With popularity of Mutual Funds you must have heard “Mutual fund investments are subject to market risks. Please read the offer document carefully before investing“. But are only mutual fund investments have risk and other investments are risk-free?

In fact you might not realize but what you consider as “Safest” also carries some risk. This post tells you the risks that are associated with various investments and how to deal with them. This would help you think and take better decisions.

Debt – Fixed Deposit, Bonds, etc

We start with the most popular investment idea – Fixed Deposits. Most investors consider FD as Risk Free but this is NOT true. Below are the risks associated with investment in Fixed Income/Debt instruments like Fixed Deposit, Bonds, etc.

Default or Credit Risk:

The Risk: You might not get principal and interest due on time or not get back at all

Most risky investments:

- Investors who had put money in shady companies or real estate companies are still fighting to get their money back.

- Depositing money with co-operative banks is riskier than other banks. More than 165 co-operative banks have been shut down in Maharashtra alone in the past 30 years.

Also Read: Highest Interest Rate on Bank Fixed Deposits

Recent Events:

Helios and Matheson Information Technology, Jaypee Infratech, Jaiprakash Associates, Valecha Engineering, Ansal Properties, Elder Pharmaceuticals, Zenith Birla, Unitech Ltd and Rasoya Proteins are some of the BIG companies which have defaulted on their fixed deposit payments.

How to mitigate Credit Risk?

1. Always invest in fixed deposits/ bonds of high Credit rated companies. Retail investors should not risk their money with companies with ‘A’ or lower ratings.

Credit Rating & What it Means

Also Read: 7 High Rated Companies Offering more than Bank Fixed Deposits

2. Government backed investments/bonds like GOI bonds, PPF, NSC, SCSS, SSA etc are safest as far as credit risk is concerned.

3. Government backed big companies like NTPC, IOCL, etc are safe bets too.

4. Government Banks are least risky followed by large and small private banks. Co-operative banks are risky. If you bank with co-operative banks do keep limited amount with them. Only deposits up to Rs 1 lakh can is insured. Though there are ways in which you can increase this insurance.

Interest Rate Risk:

The Risk: The bond prices fall if the interest rate rises and vice-versa.

Most risky investments: Long tenure Bonds, Debt Mutual Funds (especially funds that invest in long tenure bonds)

Bonds price change with Interest Rates

Recent Events:

Long/Medium term debt funds suffered losses up to 2.2% in a single day on February 8, 2017 as there was no change announced in Monetary Policy by RBI that day. Everyone expected interest rate cut and so the bonds were trading at higher. As there was NO interest rate cut, the bonds prices fell leading to losses in debt funds.

Also Read: How are Mutual Funds Taxed?

How to mitigate Interest Rate Risk?

1. The longer the maturity duration of the bond more prone it is to the price fluctuations on interest change. So invest in bonds or mutual funds with short maturity. Usually Liquid, Ultra Short Term & Short Term Mutual funds invest in bonds with low maturity (though there are exceptions). Long term GILT mutual funds are most risky as the bond duration could be 20 to 30 years.

2. There is NO impact if you plan to hold your bonds till maturity.

Reinvestment Risk:

The Risk: The proceeds from an investment would have to be reinvested at a lower rate than the original investment

Most risky investments: Fixed Deposits, Bonds with Call option (which means the company has an option to buyback bonds before maturity)

Also Read: 13 Investments to Generate Regular Income

Recent Events:

The interest rates are cyclical – which means it goes up and comes down. The problem is it’s very difficult to predict even by experts! Right now we are seeing Bank FD interest rate in the range of 6% to 7%. In 2011 the interest rates for 5 year FD was in the range of 9% to 10%. These FDs would mature now which have to be invested in FDs with interest rates.

How to mitigate Reinvestment Risk?

1. Lock-in for long term when the interest rate is relatively higher. If you have money you can go for Fixed Deposit else open a recurring deposit.

2. Do NOT invest in bonds with Call option. They usually offer higher interest to compensate for call option.

Investment Risks and How to deal with them?

Equity:

No Fixed Returns:

The Risk: the return cannot be predicted

Most risky investments: Stocks, Equity dominant Mutual Funds

How to mitigate?

1. Most illustrations available predict equity returns from 10% to 20% based on history. The time period selected depends on their convenience. The first thing you should know you CANNOT predict returns in stocks.

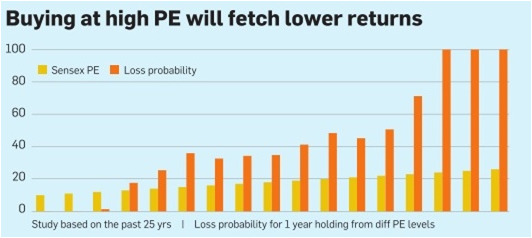

2. So the next best thing is to buy when the markets are lower priced. There are various metrics which tell that markets are trading at lower levels. The problem is they are NOT 100% accurate and there is NO guarantee that history would be repeated. But for layman it’s good to buy when PE of markets are lower than historical averages.

Buy at lower PE

3. If investing directly in stocks, stick to strong well managed companies. (However remember that No one knew about fraud happening in Satyam – one of the biggest IT companies of its time)

4. Invest through equity mutual funds or Index.

Also Read: How to Invest Direct in Mutual Funds?

5. DO NOT trust experts or schemes which promise more than 20% returns! It’s definitely fraud…

Volatility Risk:

The Risk: the price fluctuates widely

Most risky investments: Stocks, Equity dominant Mutual Funds

How to mitigate?

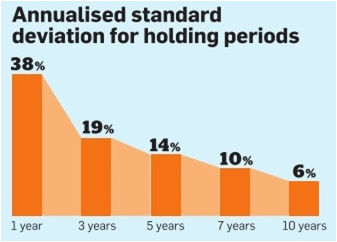

1. On certain days some stocks can fluctuate more than 20% but there are ways to overcome this. The volatility decreases as the investment tenure increases. So invest for long term.

Deviation reduces as investment tenure goes up

2. Diversify your investment across various stocks. If you compare stock of one company fluctuates more than index.

3. Invest in Equity Mutual Funds or indexes through Systematic Investment Plan (SIP)

Real Estate:

Default Risk:

The Risk: builder fails to deliver on time or does not deliver at all

Most risky investments: Under construction properties

Recent Events:

Most properties in NOIDA, Gurgaon are running with delays of 2 to 5 years. Unitech one of the biggest builders (until few years back) has lot of under construction properties where it cannot deliver due to lack of funds.

How to mitigate?

1. Do NOT invest in under construction property.

2. Penalty clause in agreement are helpful but they are NOT implemented in spirit by real estate companies. You cannot expect company pay penalty if they do not have funds to complete the project.

Also Read: How builders use super built-up area to deceive home buyers?

Quality Risk:

The Risk: the built quality is of low quality due to cheap material or faulty workmanship.

Most risky investments: Under construction properties

Recent Events: Most New buildings have this issue

How to mitigate?

1. Do NOT invest in under construction property

2. Stick to reputed builders (this might not always help but then you have NO other option)

Gold:

Quality Risk:

The Risk: The gold has other metals mixed in it and is NOT of stated purity

Most risky investments: Physical Gold

How to mitigate?

1. If buying gold for investment invest in Sovereign Gold Bonds or ETF

Also Read: Sovereign Gold Bonds latest issues

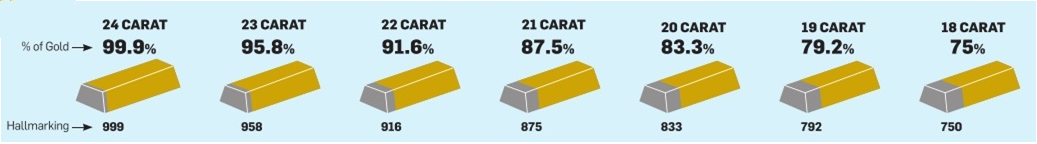

2. If buying jewelry go with hallmarked jewelry only

Gold Hallmark

Price Risk:

The Risk: Prices fall after you buy

Most risky investments: All kind of investments in Gold

How to mitigate?

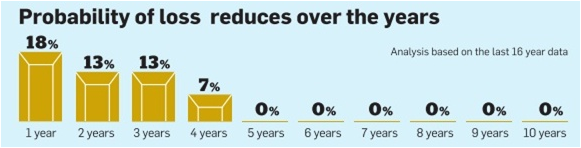

Invest for long term as Gold returns match long term inflation trends

Gold – Possibility of Loss reduces over longer term investment

Also Read: Gold Price in India – 40 Years History

Risk common to all Investments:

Liquidity Risk:

The Risk: You cannot sell or exit from the investment at right price as there are NO buyers.

Most risky investments: Bonds, Fixed Deposits (without premature withdrawal facility), Real Estate, Stocks (illiquid), Closed ended Mutual Funds, FMPs, Government schemes like PPF, SSA, NPS etc

How to mitigate?

1. Stay away from illiquid instruments or invest in them only if you are sure you would not need to sell/redeem them until maturity.

2. Some banks offer Fixed Deposits (without premature withdrawal facility) where the interest rates are just 0.1% higher than regular FDs. Stay away from without premature withdrawal facility FDs

3. Most bonds listed in stock market are NOT trade-able as there are no buyers/sellers. Invest in bonds only if you want to hold it till maturity.

Also Read: Latest Issues of NCDs

4. There are more than 5000 stocks listed on BSE but only 100 stocks are liquid. If you don’t want to get struck up invest only in liquid stocks.

5. Do NOT invest in closed ended mutual funds as there is practically NO exit before maturity.

6. Invest in FMPs only if you can remain invested till maturity.

7. Some government schemes like PPF, SSA, NPS, etc have strict pre-mature withdrawal terms. So invest in them only if you do not need money in between. These are great schemes but with limited liquidity.

Also Read: PPF – A Must Have Investment

8. You might not be able to sell your Real Estate as quickly you want. If you are lucky you can find buyers but at lower than market prices.

Regulation Risk:

The Risk: Government can change investment regulations and taxation whenever it wants and without any warning.

Most risky investments: All Investments

Recent Events:

1. Introduction of Long Term Capital Gains Tax on Stocks & Equity Mutual Funds in Budget 2018.

2. Budget 2016 made EPF withdrawal taxable. This is taken back by government after strong protest from subscribers.

3. Budget 2014 increased the investment duration Debt Fund to 3 years to qualify for Long Term Capital Gains. The problem it did not have any grandfathering clause!

4. The rules for NPS gets changed every 6 months – even after more than 10 years it seems an evolving product.

Also Read: 6 Changes in NPS Rules in 2016 & How it Impacts You?

5. The rules for all government schemes like PPF, SSA, SCSS, etc can be changed anytime.

6. Demonetization impacted Real Estate, Gold etc

How to mitigate?

You cannot really mitigate this risk but DO not take investment decisions just because of Tax benefit. The benefit may end anytime!

Foreign Investment Risk:

The Risk: The investments can get impacted due to change in regulations, political outlook or currency fluctuations of a foreign country

Also Read: How are your Investments Taxed?

Most risky investments: All Investments like Real Estate, Equities, Debt etc in a Foreign country

How to mitigate?

Diversify investment across geographies

To conclude:

In any investment returns are important but it’s even more important to know what risk comes with those returns. I hope this post would help you understand different risks and plan your investments accordingly.

Leave a Reply