After adding nearly 400 new advisors this year to reach nearly 16,500, LPL Financial is aiming even higher.

A multi-pronged approach of attracting and accommodating advisors will drive LPL Financial’s strategy in 2020, according to Dan Arnold, CEO of the nation’s largest independent broker-dealer.

After announcing record recruiting and organic asset growth for 2019 in LPL’s fourth quarter earnings report, Arnold detailed the firm’s strategic framework for the year ahead in a conference call with analysts.

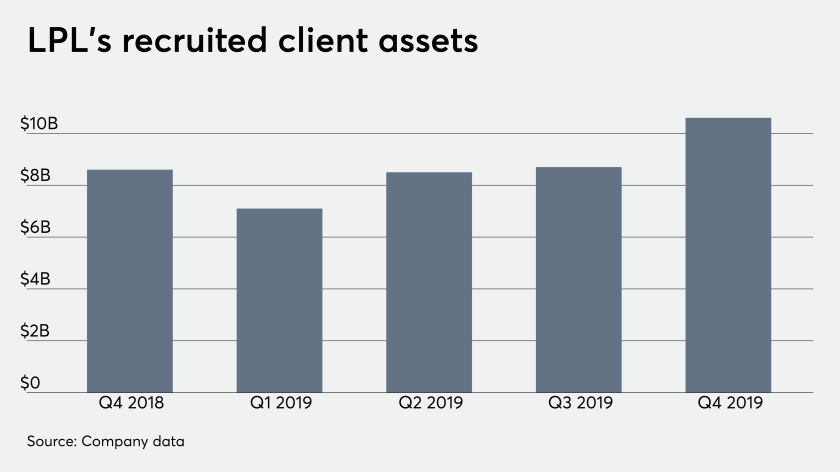

LPL will invest in business development and “differentiated capabilities” to attract new advisors, Arnold said. Those efforts resulted in a record level of $35 billion in recruited client assets last year, he noted.

The company added 355 net new advisors last year, compared to the 899 net new representatives who affiliated in from in 2018 as LPL completed the acquisition of the assets of National Planning Holdings. This past year, though, LPL made only one small acquisition of a 30-advisor BD and reeled in the vast majority of new advisors through recruiting.

New affiliation models ranging from fee-only RIA services to and a new premium employee offering for ex-wirehouse reps will be emphasized this year, Arnold said. Since introducing the wirehouse breakaway model in the third quarter, it gained commitments from its first couple of teams, Arnold said. “We are encouraged by our growing pipeline of interested advisors,” he added..

In light of the trend toward lower retail trading commissions, pricing will also be highlighted this year, Arnold said. After eliminating fees for mutual funds, LPL introduced a zero-fee ETF platform last year.

Recruiting efforts will be spearheaded by digitized workflows, lead generation and lending, Arnold told the analysts.

LPL has also been ramping up its outsourced services for the past year, deploying home-office staff to serve as a virtual CFO, CMO or administrative personnel for advisor practices. The number of subscribing advisors has reached 650, up 500 for the year, Arnold noted.

This year LPL is focusing on automating workflows where Arnold says advisors “spend approximately 80% of their time.” The company launched customer relationship management modules powered by Microsoft, Salesforce and Redtail Technology in the fourth quarter. LPL is only halfway through the initiative.

The firm ended 2019 with 16,464 advisors, an increase of 2% from 2018.Total net revenues for LPL in 2019 were $5.6 billion, an 8% rise over 2018. Net income rose 27% year-over-year to $560 million, while earnings per share soared by more than one-third to $6.78.

Leave a Reply