How to Save Income Tax – a question that is often asked by my friends, family and blog readers. The problem is there are multiple sections for people to know and if they have heard about it to check if its applicable to their case or not? To help both salaried and professionals to plan their tax, we have come up with the eBook “How to Save Tax for FY 2019-20”. This is a short 43 slide power point presentation (in pdf) which covers all the tax saving sections and investments applicable for tax payers.

Download Tax Planning eBook for FY 2019-20 (AY 2020-21)

Lets have a look at the changes that happened in Income Tax laws in Budget 2019.

Budget 2019: Changes in Income Tax Rules

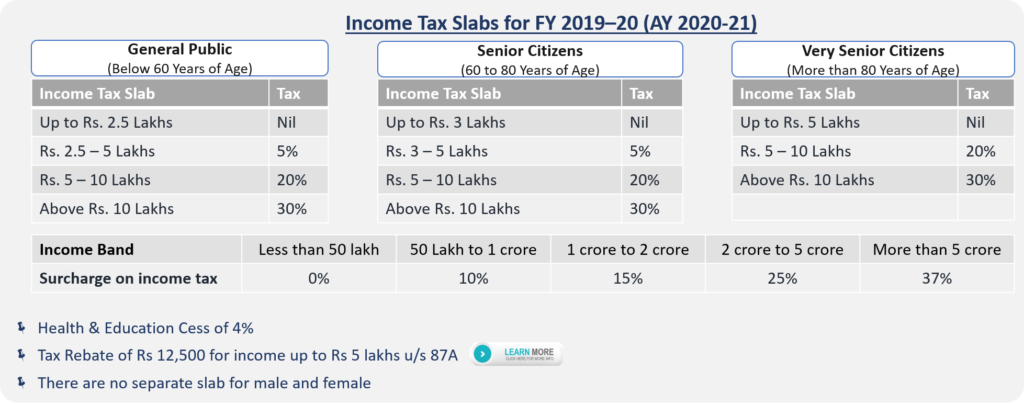

- Increased Tax Rebate u/s 87A: For individuals with net taxable income of Rs 5 lakh or less the tax rebate would be lesser of tax liability or Rs 12,500 whichever is lower

- Standard deduction for Salaried and Pensioners increased from Rs 40,000 to Rs 50,000

- Increased Tax for super-rich: Surcharge increased to 25% for income between 2 to 5 crore & to 37% for income beyond Rs 5 crores

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEA on home loans on purchase of affordable home

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEB on Auto loans on purchase of Electric vehicles

- No Tax on Notional Rental Income from Second House

- Capital gains exemption on reinvestment in two house properties: Tax payers can now buy two houses on sale of 1 house if the capital gains are less than Rs 2 crore. This benefit can be availed only once in lifetime

- TDS threshold increased from Rs 10,000 to Rs 40,000 on Bank Interest Income

For Details of changes read: 19 Key changes in Budget 2019

Mentioning Some Points I am frequently asked

1. There is NO tax benefit on Infrastructure Bonds

2. There is NO separate tax slab for Men & Women

Income Tax Slabs for FY 2019-20 (AY 2020-21)

You can download the tax planning eBook for FY 2019-20 by clicking the link below. As stated it covers all the income tax sections available for salaried and Professional tax payers:

Download Tax Planning eBook for FY 2019-20 (AY 2020-21)

I think on some platforms the above button is not clear, in that case CLICK Here to Download the Tax Planning ebook

We give a brief of all the tax saving sections below:

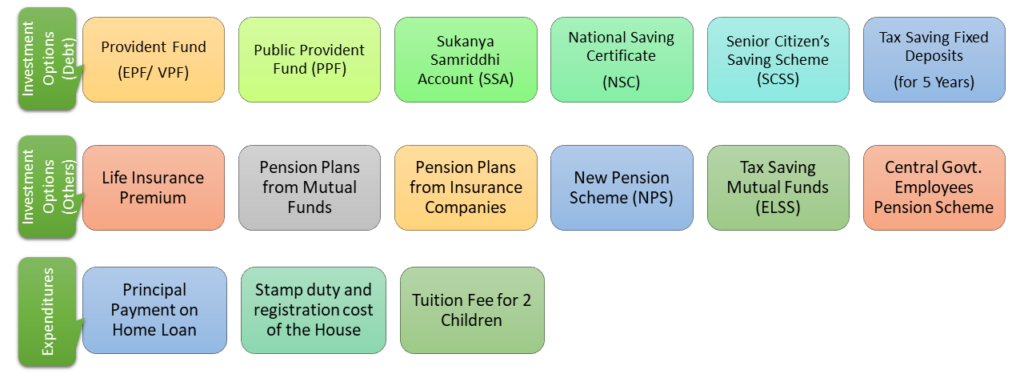

1. Section 80C/80CCC/80CCD

These 3 are the most popular sections for tax saving and have lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

- Employee/ Voluntary Provident Fund (EPF/VPF)

- PPF (Public Provident fund)

- Sukanya Samriddhi Account

- National Saving Certificate (NSC)

- Senior Citizen’s Saving Scheme (SCSS)

- 5 years Tax Saving Fixed Deposit in banks/post offices

- Life Insurance Premium

- Pension Plans from Life Insurance or Mutual Funds

- NPS

- Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

- Central Government Employee Pension Scheme

- Principal Payment on Home Loan

- Stamp Duty and registration of the House

- Tuition Fee for 2 children

We have done a comprehensive analysis of all the above available options and you can choose which is the best for you.

Know More: Which is the Best Tax Saving Investments for you u/s 80C?

Tax Saving Investment Option under Section 80C/ 80CCC/ 80CCD

2. Section 80CCD(1B) – Investment in NPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. This is continued this year too. We have done a complete analysis which you can read by clicking the link below.

Invest or Not: Should you Invest Rs 50,000 in NPS to Save Tax u/s 80CCD (1B)?

3. Payment of interest on Home Loan (Section 24)

The interest paid up to Rs 2 lakhs on home loan for self-occupied or rented home is exempted u/s 24. Earlier there was NO limit on interest deduction on rented property. Budget 2017 has changed this and now the tax exemption limit for interest paid on home loan is Rs 2 lakhs, irrespective of it being self-occupied or rented. However for rented homes any loss in excess of Rs 2 lakhs can be carried forward for up to 7 years.

Also Read: Should you Invest in Capital Gain Bonds to Save Taxes?

4. Payment of Interest on Education Loan (Section 80E)

The entire interest paid (without any upper limit) on education loan in a financial year is eligible for deduction u/s 80E. However there is no deduction on principal paid for the Education Loan.

The loan should be for education of self, spouse or children only and should be taken for pursuing full time courses only. The loan has to be taken necessarily from approved charitable trust or a financial institution only.

The deduction is applicable for the year you start paying your interest and seven more years immediately after the initial year. So in all you can claim education loan deduction for maximum eight years.

More details @ Tax benefit on Education Loan

5. Medical insurance for Self and Parents (Section 80D)

Premium paid for Mediclaim/ Health Insurance for Self, Spouse, Children and Parents qualify for deduction u/s 80D. You can claim maximum deduction of Rs 25,000 in case you are below 60 years of age and Rs 50,000 above 60 years of age.

An additional deduction of Rs 25,000 can be claimed for buying health insurance for your parents (Rs 50,000 in case of either parents being senior citizens). This deduction can be claimed irrespective of parents being dependent on you or not. However this benefit is not available for buying health insurance for in-laws.

HUFs can also claim this deduction for premium paid for insuring the health of any member of the HUF.

To avail deduction the premium should be paid in any mode other than cash. Budget 2013 had introduced deduction of Rs 5,000 (with in the Rs 25,000/30,000 limit) is also allowed for preventive health checkup for Self, Spouse, dependent Children and Parents. Its continued to this year too.

More Details @ Tax Benefit on Health Insurance u/s 80D

6. Treatment of Serious disease (Section 80DDB)

Cost incurred for treatment of certain disease for self and dependents gets deduction for Income tax. For senior citizens the deduction amount is up to Rs 1,00,000; while for all others its Rs 40,000. Dependent can be parents, spouse, children or siblings. They should be wholly dependent on you.

To claim the tax exemption you need a certificate from specialist from Government Hospital as proof for the ailment and the treatment. In case the expenses have been reimbursed by the insurance companies or your employer, this deduction cannot be claimed.In case of partial reimbursement, the balance amount can be claimed as deduction

Diseases Covered:

- Neurological Diseases

- Parkinson’s Disease

- Malignant Cancers

- AIDS

- Chronic Renal failure

- Hemophilia

- Thalassaemia

Also Read: 23 most common Investments and how they are Taxed? [updated for Budget 2019]

8. Physically Disabled Tax payer (Section 80U)

Tax Payer can claim deduction u/s 80U in case he suffers from certain disabilities or diseases. The deduction is Rs 75,000 in case of normal disability (40% or more disability) and Rs 1.25 Lakh for severe disability (80% or more disability)

A certificate from neurologist or Civil Surgeon or Chief Medical Officer of Government Hospital would be required as proof for the ailment.

Disabilities Covered

- Blindness and Vision problems

- Leprosy-cured

- Hearing impairment

- Locomotor disability

- Mental retardation or illness

- Autism

- Cerebral Palsy

Also Read: How to Calculate Income Tax? – explained with example

9. Physically Disabled Dependent (Section 80DD)

In case you have dependent who is differently abled, you can claim deduction for expenses on his maintenance and medical treatment up to Rs 75,000 or actual expenditure incurred, whichever is lesser. The limit is Rs 1.25 Lakh for severe disability conditions i.e. 80% or more of the disabilities. Dependent can be parents, spouse, children or siblings. Also the dependent should not have claimed any deduction for self disability u/s 80DDB.

To claim the tax benefit you would need disability certificate issued by state or central government medical board.

You can also claim tax exemption on premiums paid for life insurance policy (in tax payers’ name) where the disabled person is the beneficiary. In case the disabled dependent expires before the tax payer, the policy amount is returned back and treated as income for the year and is fully taxable.

40% or more of following Disability is considered for purpose of tax exemption

- Blindness and Vision problems

- Leprosy-cured

- Hearing impairment

- Locomotor disability

- Mental retardation or illness

- Autism

- Cerebral Palsy

10. Donations to Charitable Institutions (Section 80G)

The government encourages us to donate to Charitable Organizations by providing tax deduction for the same u/s 80G. Some donations are exempted for 100% of the amount donated while for others its 50% of the donated amount. Also for most donations, the maximum exemption you can claim is limited to 10% of your gross annual income. Please note that only donations made in cash or cheque are eligible for deduction. Donations in kind like giving clothes, food, etc is not covered for tax exemption.

How to Claim Sec 80G Deduction?

- A signed & stamped receipt issued by the Charitable Institution for your donation is must

- The receipt should have the registration number issued by Income Tax Dept printed on it

- Your name on the receipt should match with that on PAN Number

- Also the amount donated should be mentioned both in number and words

Also Read: 25 Tax Free Incomes & Investments in India

11. Donations for Scientific Research (Section 80GGA)

100% tax deduction is allowed for donation to the following for scientific research u/s 80GGC

- To a scientific research association or University, college or other institution for undertaking of scientific research

- To a University, college or other institution to be used for research in social science or statistical research

- To an association or institution, undertaking of any programme of rural development

- To a public sector company or a local authority or to an association or institution approved by the National Committee, for carrying out any eligible project or scheme

- To the National Urban Poverty Eradication Fund set up

Also Read: How you Loose Money in FD?

12. Donations to Political Parties (Section 80GGC)

100% tax deduction is allowed for donation to a political party registered under section 29A of the Representation of the People Act, 1951 u/s 80GGC.

Download Tax Planning eBook for FY 2019-20 (AY 2020-21)

13. House Rent in case HRA is not part of Salary (Section 80GG)

In case, you do not receive HRA (House Rent Allowance) as a salary component, you can still claim house rent deduction u/s 80GG. Tax Payer may be either salaried/pensioner or self-employed.

To avail this you need to satisfy the following conditions:

- The rent paid should be more than10% of the income

- No one in the family including spouse, minor children or self should own a house in the city you are living. If you own a house in different city, you have to consider rental income on the same

The House Rent deduction is lower of the 3 numbers:

- Rs. 5,000 per month [changed from Rs 2,000 to Rs 5,000 in Budget 2016]

- 25% of annual income

- (Rent Paid – 10% of Annual Income)

You need to fill form no 10BA along with the tax return form

More details @ Claim Tax Benefit for Rent Paid u/s 80GG

Along with the tax saving sections and investments for both salaried and business, it also has details about all the common salary components and their tax treatment. This section can help you to plan your salary components in case your company offers such facility.

We hope that this eBook “How to Save Tax for FY 2019-20?” (in pdf format) would help you in understanding, planning and saving taxes.

Please give us your feedback and help us improve!

Leave a Reply