Once the ITR is submitted and verified by the tax payer, the department goes through every return in automated/manual fashion to check if everything was correct and matches with the data available with them. In case they find a wrong/doubtful entry or have further questions about any declared or undeclared income or deduction or exemption, they send communication to the tax payer for further verification. This is the TAX NOTICE – the most dreaded thing for tax payers.

However please note that most notices are harmless (and some times happy as its about tax refund), as they ask for some more details or inform about mismatch of your tax returns from Form 16/16A/26AS. This is the reason why we suggest to always match your ITR with Form 26AS. The important thing to know is notice is received under which section, what it means and what you need to do?

We list down the common tax notices sent and how to deal with the same.

Also Read: How are your Investments Taxed?

Tax Notice Section 143(1A)

This year many tax payers are receiving tax Notice Section 143(1A). The reason for the notice is because of discrepancy in the income or deduction mentioned in the tax return and Form 16/16A or Form 26AS. The most common reason being not including interest income in returns, not submitting investment proof for tax saving or HRA to employer and claiming the same while filing ITR among others.

Time Limit to Serve the Notice: NA

Time Limit to respond: 30 days

What to Do?

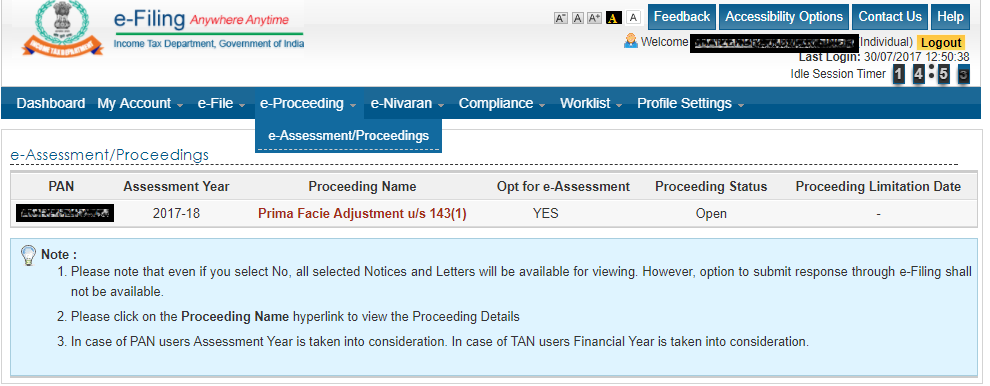

The reply to the notice can be done online. The tax payer need to login to the income tax efiling website and reply through e-Proceeding. You may need to attach the relevant proofs in the reply.

Also Read:How to Respond to Notice u/s 143(1)(a) – A detailed guide?

e-Proceeding to Reply to Notice u/s 143(1A)

Tax Notice Section 143(1)

This is more of intimation than notice about the tax return you filed. This could be of three types:

- Your Final tax assessment matches with that of assessing officer

- Tax Refund – When tax payer is eligible for tax refund as excess tax was paid / deducted

- Tax Due – Tax payer needs to pay more tax

Time Limit to Serve the Notice: Up to end of next financial year from when the return was filed. So for AY 2017-18 the notice can be served by March 31, 2019

Time Limit to respond: In case of Tax Due, the payment has to be done in next 30 days

What to Do?

In case there is full match, you need not do anything. In case of tax refund, the amount would be transferred in next few days to your bank account. For Tax due case, make tax payment in 30 days of receiving notice.

Also Read: Use Challan 280 to Pay Self Assessment Tax Online

Tax Notice Section 143(2)

This is the scrutiny notice that follows preliminary assessment of returns. This can be of 3 types depending on the severity.

- Limited purpose scrutiny: The tax department would like to clarify on a few points/numbers and so tax payer needs to verify the same.

- Complete scrutiny: In this case the tax department has found serious discrepancies and hence a detailed scrutiny is required.

- Manual scrutiny: This is hand-picked by assessment officer and can be sent only after approval from Income Tax Commissioner.

Time Limit to Serve the Notice: Up to 6 months from the end of financial year from when the return was filed. So for AY 2017-18 the notice can be served by September 30, 2018

Time Limit to respond: As per the Notice

Also Read: How to file Revised Income Tax return?

What to Do?

Collect all documents related to your income, expenditure and investment details for the year and meet with the Assessment Officer as stated in the letter. You can also send your representative if required. In case you do not respond to notice or not meet the assessment officer following actions can be taken:

- The officer can calculate tax liability as he seems fit, which may lead to additional tax liability

- Penalty of Rs 10,000 for each failure under Section 271(1)(b) and/or

- Prosecution under Section 276D, which may extend up to one year with or without fine

Also Read: 25 Tax Free Incomes & Investments in India

Tax Notice Section 139(9)

Notice under Section 139(9) is sent if the ITR was defective. This can mainly be because of following reasons:

- Used the wrong ITR Form

- If the ITR was filed without paying full tax

- If the refund was claimed for TDS for which the corresponding income was not mentioned in ITR

- Mismatch in the name on the ITR & PAN

This is just an indicative list.

Time Limit to Serve the Notice: NA

Time Limit to respond: 15 days. Extension possible by writing to your assessing officer

What to Do?

In case you do not respond the return filed is considered invalid. The tax payer needs to download the correct ITR Form and select the option `In response to a notice under Section 139(9) where the original return filed was a defective return.’ Quote the reference number and acknowledgement number and fill the ITR form with rectifications as required.

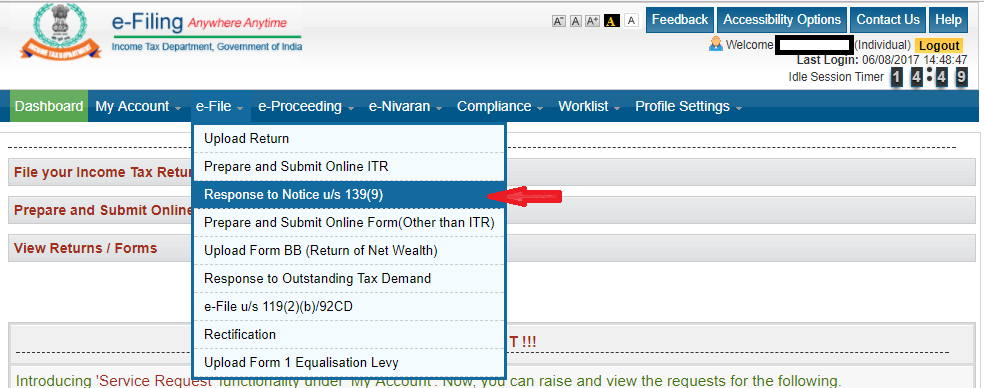

Then login to the income tax efiling website and Select e-file >>`e-file in response to notice us 139(9)’ and upload it using the password in the notice.

Respond to Tax Notice – Section 139(9)

Tax Notice Section 148

Tax payers receive this notice if any income has not been disclosed and has escaped assessment.

Time Limit to Serve the Notice: If the income is less than Rs 1 Lakh, the notice has to be sent within 4 years from the end of assessment year and within 6 years if the income is more than Rs 1 Lakh. So for income concerning FY 2016-17 (AY 2017-18), the notice can be sent up to March 2024.

Time Limit to respond: 30 days or as specified in notice

What to Do?

The tax payer needs to file the return of the assessment year as asked by the assessing officer.

Download: Ultimate Tax Saving ebook with tax calculator FY 2018-19

Tax Notice Section 234(F)

This is the new section introduced in Budget 2017 and applicable from assessment year of 2018-19. According to this the tax payer would have to pay a fine of Rs 5,000 if the tax return is not filed by due date. In case the tax return is not filed even by December 31, the penalty would increase to Rs 10,000. However for income up to Rs 5 Lakh the fine would not exceed Rs 1,000.

Time Limit to Serve the Notice: NA

Time Limit to respond: NA

What to Do?

From next year file your returns on time!

We hope a brief review of all tax notices would help you to be better prepared in case you receive it. Do not panic and consult an expert in case of any issues!

Leave a Reply