SIP (Systematic Investment Plan) or Lump sum – Which is the Best way to invest in Mutual Fund? Which investment method would lead to higher returns? A question asked by almost all new investors. We help you find an answer to this eternal debate.

SIP was introduced by Franklin Templeton Mutual Fund more than 15 years back. The idea was simple you buy mutual fund units on a monthly basis for a fixed amount. When the markets are low you would be able to buy more units and on high markets, you’ll be able to buy lesser units. This not only helped in averaging the unit price over long period of time but also helped people invest in a disciplined manner every month.

SIP vs. Lump sum – The Cash flow

SIP Vs. Lump sum choice depends on the cash you have in hand. In case you have a corpus ready you might think if you should invest in one go or do a SIP. However if you do not have a lump sum corpus and have a monthly income, you obviously have NO option but to DO SIP. Also a person whose future income is uncertain, SIP is NOT the right approach for them.

Lesson: SIP suits people who have regular monthly income

SIP vs. Lump sum – Higher Returns?

Assuming that you have lump sum amount and still in two minds about – should you invest in one go or spread your investment as SIP? The underlying question being which investment option would offer higher returns?

To answer this we give you following five market situations from the year 2000 and see how SIP compares to the lump sum investment.

- Constant Declining Market

- Constant Rising Market

- Declining and then Rising Market

- Rising and then Declining Market

- Volatile Market

Here are some assumptions:

- Rs. 60,000 is invested in both lump sum and SIP and is used for buying SENSEX.

- Since the cash flow structure for the two is different, to make it comparable we assume that SIP investor puts the entire amount in a debt fund and starts systematic transfer plan (STP) to the equity fund.

- The above debt fund gives a return of 8% per annum.

Also Read: 13 Common Myths about SIP in Mutual Funds

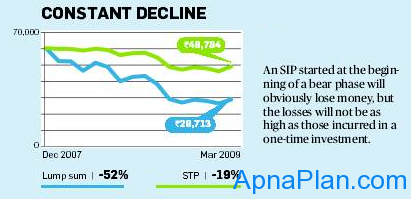

Constant Declining Market (Dec 2007 – March 2009)

SIP vs. Lump sum – Constant Declining Market

As the market is declining, you would loose money in both SIP and lump sum investment but the loss in case of SIP is lower than Lump sum investment. So SIP wins in case of Constant Declining Market.

Constant Rising Market (Jan 2005 – December 2007)

SIP vs. Lump sum – Constant Rising Market

Both kind of investment gives positive returns, but SIP would never be able to beat Lump Sum in case of Constant Rising Market. So Lump Sum wins in case of Constant Rising Market.

Also Read: How are Mutual Funds Taxed?

Declining and then Rising Market (January 2000 – November 2003)

SIP vs. Lump sum – Decline and Rise Market

SIPs yield the best results if the market falls initially and recovers subsequently. The SIP investor gains because he gets to buy more units at lower levels.

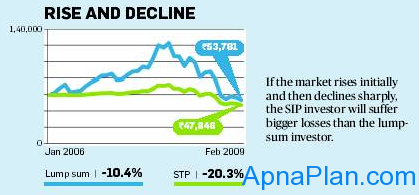

Rising and then Declining Market (January 2006 – February 2009)

SIP vs. Lump sum – Rise and Decline Market

If the market rises initially and then declines sharply, the SIP investor will suffer bigger losses than lump sum investor.

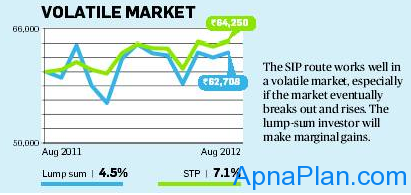

Volatile Market (August 2011 – August 2012)

SIP vs. Lump sum – Volatile Market

The SIP route works well in volatile market, especially if the market breaks out and rises. The lump sum investor would gain too but marginally.

Lesson: SIP gives better return in case of Constant Declining Market, Declining and then Rising Market and in Volatile Market (which eventually breaks out & rises). The problem is at the time of investment you don’t know which phase of market you are in. So even though we know that which kind of market SIP is better we cannot actually use that information for making investment.

Also Read: Mutual Funds to Park money for Short Time

How should you invest?

If you are salaried or have a constant income every month, you should go for SIP as that matches with your cash flows. For money you got as bonus or proceeds from existing investment or gift, you can invest in SIP or lump sum depending on your comfort level and understanding of market. If you think the market is under-valued (Low PE is one such metric) you can go with lump-sum while in over-valued market (like present situation) you might want to invest in Debt Fund and DO STP (Systematic Transfer Plan) in equity fund.

Even while regular SIP you should make occasional Lump sum investments in months/periods when there is sharp fall or market in under-valued (as analysed by you). To conclude there is NO definite winner between SIP vs. Lump sum but SIP & Lump sum investment together with some sensible market time is the way to invest!

Leave a Reply