E-commerce firms in India, including leaders Amazon and Flipkart, will take a major hit if sales of non-essential items continue to be restricted and the lockdown is prolonged, industry executives and analysts said.

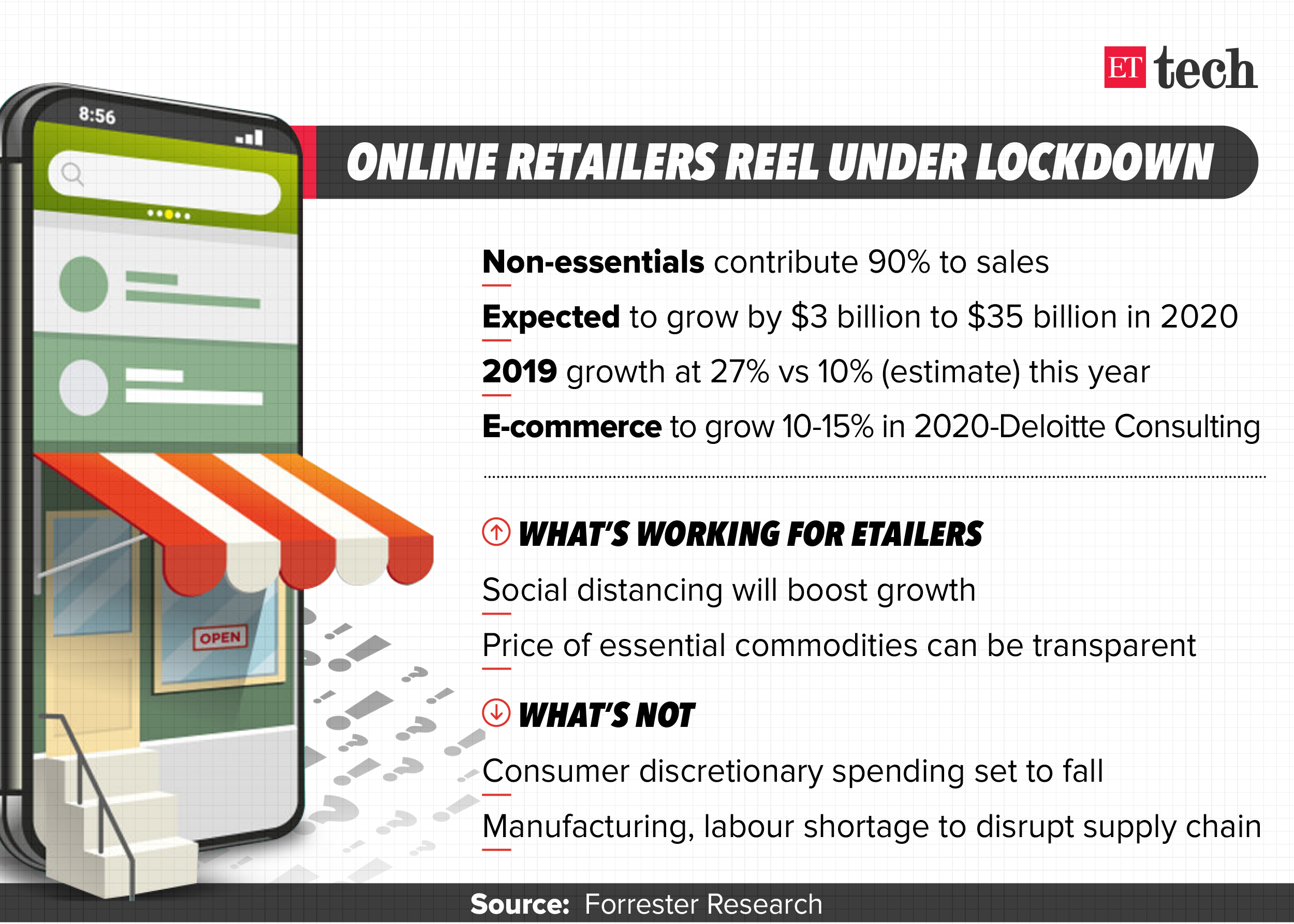

Smartphones, electronics, furniture, large appliances, among others, have been categorised as non-essential items in the current situation, but contribute more than 90% of sales at these etailers, according to Forrester Research.

The ecommerce sector cumulatively clocked sales of $32 billion last year. “The economic impact of these three weeks itself will take about three months to recover,” said a partner at a growth-stage investment firm requesting anonymity.

“The strict lockdown is a bad signal for investors, businesses and people globally, especially in the technology space, on the continued risks attached to doing business in India,” he added. Some rules may quickly need to be relaxed for businesses to breathe easy, he said.

If the online channel is opened up gradually, ecommerce firms will have to closely work with manufacturers, importers, the labour ministry, and ecosystem players to ensure that orders are fulfilled. They will also have to fix supply chain gaps by forging partnerships with neighbourhood stores, offline retailers and last-mile businesses.

This is no mean task. Already, the top two ecommerce firms in the country by Gross Merchandise Value (GMV), Amazon and Flipkart, as well as several other niche e-tailers, including Lenskart, FirstCry and Nykaa, have seen sales slump, simply because most or all of their products are termed non-essential goods right now.

“There will be limited demand for non-essential goods due to the impact on jobs and income… but there might be an uptick in demand during Diwali,” said Satish Meena, an analyst at Forrester Research.

If the sector opens up for business fully soon, Meena estimates that the e-commerce industry would grow 9-10% this year to touch $35 billion, although the rate of growth itself will be sharply lower from the 27% it clocked last year.

Analysts said they expect the growth to come on the back of consumers getting accustomed to shopping online as they maintain social distancing even after the lockdown is lifted. Sale of essential goods, helped by the ongoing 21-day lockdown and probably some more, will grow by about 3%, Meena said.

Earlier this week, industry body Internet and Mobile Association of India urged the government to allow ecommerce companies to resume operations completely, since they are best placed to follow social distancing guidelines by delivering products at doorsteps.

This comes after industry tracker Counterpoint Research cut India’s 2020 smartphone production forecast by 7-8% from the 300 million units predicted earlier. It also warned that the demand for smartphones is unlikely to pick up anytime soon.

To be sure, even categories where ecommerce companies operate unhindered, such as grocery and pharma delivery players like BigBasket, Grofers, 1MG and Pharmeasy, have largely missed order and delivery timelines, mainly as a result of acute labour shortages and capacity issues.

Hindustan Unilever, the country’s biggest consumer goods firm, said earlier this week that average daily sales and factory output had tumbled to about 40% of its usual run rate, hurt by lack of labourers and transport disruptions. To counter such a scenario, Flipkart group CEO Kalyan Krishnamurthy told employees during a recent townhall that the company will actively forge more ecosystem partnerships since this would be a critical enabler for growth.

Leave a Reply