Executive Summary

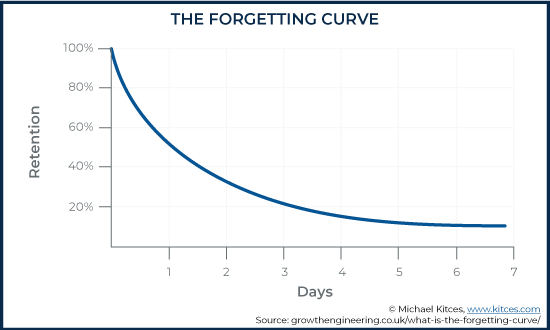

Financial advisors don’t always take their best notes when meeting with clients, as maintaining the flow of a good meeting and the rapport established through personal conversation is difficult when the advisor interrupts the rhythm of the dialogue by pausing to jot down some notes. Consequently, advisors often end out relying on hastily written fragments taken during meetings to capture (at least some of) the most important details. After the meeting, they may spend more time to reflect and expand their notes into a comprehensive account of the discussion… with the caveat that the longer they wait to complete their notes, the more they will inevitably forget (as much as 50% after a day!).

In this guest post, Michael Lecours – Co-Founder of fpPathfinder (which creates flowchart and checklist resources specifically for financial advisors), and a Financial Advisor with Ohanesian/Lecours – explores the importance of good note-taking and offers tools and suggestions that advisors can use to help them take better notes during (and after) client meetings.

Good notes documenting client meetings are important for several reasons. Most obviously, notes are reminders for both advisors and clients of the conversations and strategies discussed, as well as records of action items that need follow-up attention. Additionally, good notes help advisors and their teams stay updated with a client’s situation, allowing support staff to proactively service the client with account issues and other administrative tasks. Finally, meeting notes are essential should the advisor be accused of wrongdoing or brought to suit; a good, detailed note can be the key to a quick and easy resolution of the issue under investigation.

The best method for an advisor to use to take effective notes is highly personal and will depend on the nature of the meeting. Whether to handwrite or type notes is one consideration. As while studies have found students tend to remember lecture material better with handwritten notes (forcing them to think about material quickly as it is delivered and to summarize key points to simply keep up with the lecture) and that typing tends to be less thoughtful (as much of the information is simply transcribed verbatim), it may sometimes make more sense for advisors to type their meeting notes just to ensure the information is captured at all. Especially since comprehensive notes are generally only created after meetings anyway, when advisors can thoughtfully process what transpired with the client (though taking brief handwritten notes during the meeting still may be most appropriate). Typing notes is also more conducive for advisors to enter such notes, details, and follow-up action items directly into an advisor CRM system.

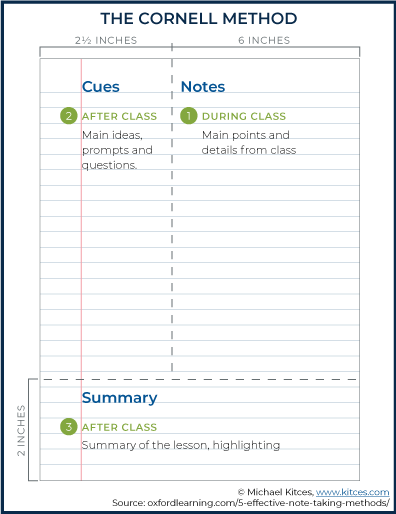

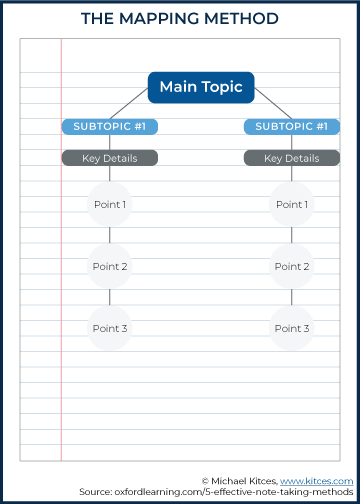

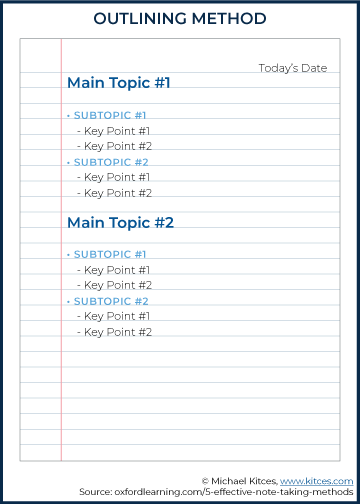

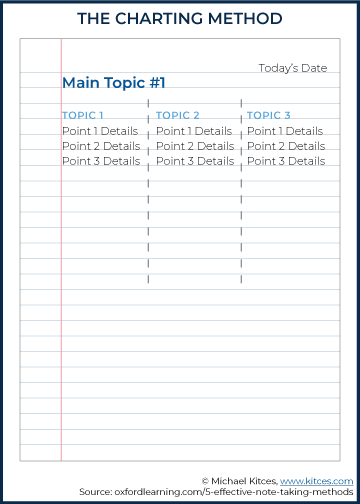

Regardless of the medium, there are several traditional frameworks for organized note-taking. Two examples include the “Cornell Method”, which divides the page into functional areas for notes during and after a meeting, with space to create an overall summary, and the “Charting Method”, which organizes main points in a columnar format (useful for discussions bouncing back and forth between a few main topics). For advisors specifically, “Guided Notes” are customized templates useful for conducting meetings in a consistent, organized fashion.

Tech tools are also available to help make note-taking easier and more efficient. Redtail has introduced note templates customized for individual clients and that prompt advisors with reminders; MobileAssistant and Copytalk are apps that transcribe recorded notes; in addition to financial planning checklists and flowhcarts, fpPathfinder now offers interactive checklists with pre-populated questions to be used as a discussion guide with clients.

Ultimately, the key point is that, even though it may be difficult for advisors to take detailed notes during meetings, they should still make time to create complete and accurate notes afterward. There are many resources available for advisors to find out what works best for them to capture important details and to transfer these notes into their CRM systems. By developing excellent note-taking skills and habits, not only will advisors reduce the possibility that important details will ever be lost, they also empower their teams to proactively provide the best client service experience with access to well-organized, detailed client information.

Why Financial Advisors Need To Have Good Note-Taking Skills

When it comes to note-taking, financial advisors often find that their notes from client meetings lack important details, but by the time they realize these gaps from the cursory notes they may have initially jotted down (having planned to fill them in more later), they also realize that they can no longer remember what those details were! As unfortunately, despite all the reasons why notes should be taken routinely and immediately after (if not during) a client meeting, it’s not always easy (or possible) to take flawless notes that capture every single detail.

In a perfect world, the advisor would add a note to the client record (ideally in a CRM or some other record management system) after each meeting, phone call, or email, to summarize the conversation. After all, if an advisor working with 100 clients interacts with each client an average of 6 times a year – through meetings, phone calls, email exchanges or at client events – that would equate to a very manageable ~600 notes per year (or a little more than two notes per workday!).

The benefits of good note-taking are clear and well-understood:

- A well-written note makes it clear who needs to follow up with what. For example, it can document the action items resulting from a meeting (such as updating income projections) or document the client’s responsibilities (such as updating a new beneficiary form for a 401(k) plan account);

- Inevitably, both the advisor and the client will forget the details of the meeting and will need to revisit the notes a year (or more) down the road to remember why the follow-up responsibilities were needed; notes can help clarify the decisions that were made and provide greater context;

- Advisors that are part of teams or with administrative/operations support, benefit through the use of note-taking as each person on the team can quickly understand a client’s situation if the client’s primary contact at the firm is unavailable. It also creates institutional knowledge as new team members join — they can review the notes to learn quickly not only the history of each particular client, but also the general manner in which the firm services their clients; and finally,

- Notes are important from a compliance standpoint. If the advisor were to be investigated for wrongdoing, a note can serve as critical documentation to help the advisor’s case.

Yet in practice, financial advisors tend to do a rather poor job documenting their client interactions (and sometimes even neglect it altogether). In FPA’s 2014 Trends in Client Communication, the results of an advisor survey found that 33% of respondents put written notes in client files and 41% added notes in a CRM. Surprisingly, 80% of advisor-respondents indicated that they used a CRM, which supports that a significant number of advisors are in fact using a CRM but still not documenting their client interactions (there in the CRM, or at all).

Many academic studies have examined note-taking and the problems commonly faced by note-takers. The primary reason why handwritten note-taking is difficult is because it is hard to keep up with the pace of verbal delivery. As while people tend to speak about 120-180 words per minute, a 1999 study revealed that note-taking students can type approximately 33 words per minute and can write long-hand at only 22 words per minute. The problem of keeping up is compounded by the fact that most advisors are expected to lead the meeting, take notes, and ask questions. The brain can only handle so much.

Consequently, not only is it hard to capture all of the information, but trying to parse out which information is worth capturing (when it’s not possible to takes notes on all of it) just further amplifies the note-taking challenge. For instance, Educational Psychology Professor Kenneth Kiewra in his 2018 report for the nonprofit learning and education organization IDEA examined note-taking and learning trends of students in college, and found that on average, students recorded only one third of all important ideas.

Of course, if an advisor’s meeting notes were to miss two thirds of all important information discussed with a client, the advisor may not get much value later when they review the notes a year or so later. Especially since as concepts become more complex (which they tend to do in a financial planning meeting!) with increased levels of auxiliary details, the notes captured from those meetings will, accordingly, tend to miss more and more of those details. And many of those subtle details are what make a note especially valuable.

Furthermore, one study reviewed in Kiewra’s IDEA report found that 61% of notes contained some kind of inaccuracy. And most of those inaccuracies involved numbers. And as advisors know, if the data to begin with are bad, any financial planning analyses based on that data will be unreliable. In other words, garbage in, garbage out!

What advisors are faced with, then, is a series of obstacles that must be overcome as they develop a workable process to manage their note-taking systems.

The Ideal Structure Of (Good) Client Meeting Notes

Successful note-taking is more than just creating a transcript of the meeting. Successful note-taking requires a structure, framework and tools to make it an effective resource to rely on in the future. As stated earlier, not all of the important concepts are captured in notes. For advisors, a lot of the subtle yet important context and emotions are omitted from notes.

Fortunately, though, while advisors may have difficulty finding enough time to capture all of the details from their client meetings (such as emotional elements, personal nuances, etc.), there are methods they can use to take notes that are more effective in the time that they do have.

The following sections can help provide more context around what a note really is, how it can become a more effective tool for an advisor, and some methods that may be useful for advisors to take more impactful notes.

The Anatomy Of A Client Meeting Note – Process and Product

There are two components of a note that serve as valuable tools for the advisor: the process and the product.

The first part, the process of actually taking notes during (or after) a meeting, is useful because it focuses the advisor’s attention on what is being said (or what was said). It also helps with better retention of the knowledge, as the simple act of writing the information down will help the advisor retain that information.

The second part is the product – the written or digital note that can be referenced in the future. Academic research tends to agree the true benefit of the note is that it can be referred to at a later date, versus just the memory enhancement process of writing the note in the first place.

Timing Of Advisor Note-Taking For Client Meetings

One of the primary obstacles advisors are faced with is simply finding the time to record details from meetings. Taking notes while meeting with a client is not always convenient, as clients will often expect their advisor’s full attention, and stopping to record notes during a meeting can disrupt the flow of the discussion. Often, advisors can only manage to record their notes after meetings to capture the most important details.

Accordingly, the interval between the time information was learned during a meeting, and the time it was committed in writing (or captured in the advisor’s CRM system) is critical. Documenting notes quickly (either during the meeting, if possible, or right after the meeting) is ideal, and ensures that important details are not missed.

The longer one waits to document meeting details, the more information will be lost. This is known as the “Forgetting Curve”, which illustrates the speed at which people forget details.

Imagine losing 50% of the details from a meeting if notes were entered the next day! Important details are forgotten as quickly as 20 minutes after they are learned. So while the advisor may retain the major to-do items and some of the big updates, they may also inevitably forget the subtle yet critically important details, like family updates or other personal notes that help them build a close working relationship with the client. Especially if the advisor has multiple meetings in a day, and only tries to capture the relevant notes after all the meetings have occurred… which makes it hard not only to remember all the key details, but which pertained to which client meeting!

The Ideal Length Of A Note

There is no clear answer to how long a note should be as it depends on many variables. Paul Axtell, author of Meetings Matter, suggests that one page of notes will suffice for most meetings. This is corroborated by a survey conducted by Nuance (the makers of Dragon Speech Recognition) which found that 48% of financial service professionals surveyed take one full page of notes for each conversation.

Practically speaking, this guideline is just that – a guideline – and will be subject to variation based on the nature of the meeting. Whereas a full page of notes will probably not be necessary for a five-minute conversation about routine matters or simple planning concepts, a meeting to discuss retirement planning may require more than one page of notes. Alternatively, one page of meeting notes may be the perfect length to capture all of the pertinent details from a routine, hour-long client meeting intended to revisit a client’s financial plan and review any personal updates since the client’s last meeting.

Analog Vs Digital Note-Taking

While there is much debate over the benefits of writing notes by hand with pen and paper vs typing them on a computer keyboard, the general consensus is that handwritten notes are preferred because it forces the note-taker to paraphrase and summarize the important details, as opposed to a more verbatim typed dictation of what the speaker said. This phenomenon of ‘accidental dictation’ can happen more often when typing notes since people tend to type a lot faster than they write (making it easier to simply transcribe what was said, instead of thinking about and processing what was said to condense it in hand-written format).

One study, conducted by Professors Pam Mueller and Daniel Oppenheimer, sought to shed light on the debate between handwritten notes versus typed notes. The researchers looked to see what was better: a shorter, paraphrased note written by hand; or a longer, more detailed typed note. The results consistently found that people who took handwritten notes during a talk could recall information better than someone who typed their notes, which the researchers believe is because the typed notes tended to be more of a transcription of the talk rather than a summary of the key points delivered by the speaker.

On the other hand, while this study supports the benefits of handwritten notes for memory recall, financial advisors are not expected to recall the details of client meetings from memory, but rather through the notes (and ideally accessed from a CRM). Thus, the ramifications of this study may suggest the opposite for financial advisors, as a typed note can include more information than a handwritten note while taking the same amount of time (and perhaps even save more time if typed directly into a CRM).

Ultimately, a financial advisor will need to assess whether taking notes during a client meeting is even feasible, as while it may be appropriate to jot a few notes on a notepad during the conversation, it may come across as rude or dismissive (or just plain odd) for an advisor to type notes into a computer as if to dictate what their client is saying (while also still trying to have a conversation with them).

Which means in practice, handwritten notes may still be the preferred method for advisors to use during a meeting, not for the sake of learning and processing the information but simply for the interpersonal dynamics of note-taking during a client conversation. Taking handwritten or typed notes after a meeting, though, may be equally effective, as both methods can involve the same level of thoughtful recollection needed to record the key points gleaned from the meeting. (Though in the case of post-meeting notes, it’s crucial to do so immediately after the meeting, given the steepness of the forgetting curve as time passes!)

Frameworks Of Client Meeting Note-Taking

The idea of completing one page of notes for each client meeting can seem daunting for some advisors who have yet to develop a post-meeting routine. In this context, a note-taking framework can be helpful to provide overall structure to the note-taking process, and guide the advisor to ensure that notes are being taken on all the important areas.

Four note-taking methods that are commonly used by students for classroom note-taking are described below; financial advisors may benefit from using or adapting any of the following styles to take more effective notes during (and after) client meetings.

Cornell Method

The Cornell Method of note-taking consists of two parts. First, notes are taken during the meeting in the upper right portion of the page. Then after the meeting, the note-taker (i.e., the advisor) can identify and list the major points and issues (to serve as a cue) in the upper left portion of the page. The bottom portion of the page is also completed after the meeting, which includes a brief summary of the meeting.

This method combines in-meeting and after-meeting note-taking. It incorporates a technique called spaced repetition, which helps the advisor retain the information on their own since they have a second chance to review the material. The summary section also leaves room for the advisor to summarize the nature of the advisor-client interaction itself (i.e., the non-verbal aspects of the meeting) in addition to summarizing the discussed elements of the meeting.

One downfall of this approach is that it does not easily fit within a CRM’s blank note field. Some additional steps may need to be added to the note-taking process depending on how information needs to be added to the advisor’s CRM system to address this issue. (While some CRM systems can accommodate handwritten notes included as attachments to client entries, these notes typically are not searchable.)

Mapping Method

The Mapping Method is a variant on mind mapping, and may be particularly useful for visual learners. The format consists of main topics with a series of branching subtopics that connect back to the main topic. From there, additional bullet points could be added to support each sub topic.

Notice how this approach provides cues to help capture subordinate details, which many note-takers struggle with. The result is a series of observations connected by lines that will create a clear connection of concepts with a visual element.

The drawback to this approach is similar to the drawback associated with the Cornell Method. The format does not easily fit within the traditional advisor CRM’s note field, and is probably more difficult to adapt for advisors than the Cornell Method.

Outlining Method

The Outlining Method is probably the most common method utilized in note-taking. It consists main topics and subtopics (perhaps items on an agenda), with subordinate details added below each subtopic.

One of the clear benefits of this approach (at least compared to the previous two frameworks) is how it can easily be adapted and incorporated into a CRM. This method works very well in meetings that have a structured, organized agenda prepared in advance of the meeting.

One of the notable disadvantages of this approach is how rigidly the information must be organized. This format may be fine during a formal academic lecture that flows in a logically sequenced progression, but a meeting with a client may involve a lot of jumping around from one topic to another, since so many topics become intertwined, making it more difficult to fit the free-flowing conversation to a typical outline (where it’s not clear in advance how many key points there will be in a subtopic as the conversation bounces around, making it difficult to space the outline appropriately).

Charting Method

The final framework often used by students in the classroom is the Charting Method. This framework consists of several columns, one for each topic (or agenda item). This allows plenty of space reserved for each topic, and can be adapted for advisors to accommodate the inevitable topic-jumping that happens in client meetings (as it would simply mean switching columns as the new points continue to be added to the bottom of each).

Guided Notes: Customized Templates For Use In Routine Client Meetings

Another way to look at note-taking is to utilize a “Guided Note” approach. Guided Notes organize note-taking in a structured and templated way, helping the advisor to systematically review specific points of discussion during the meeting, and is a good option when meetings consistently cover (at least roughly) the same agenda.

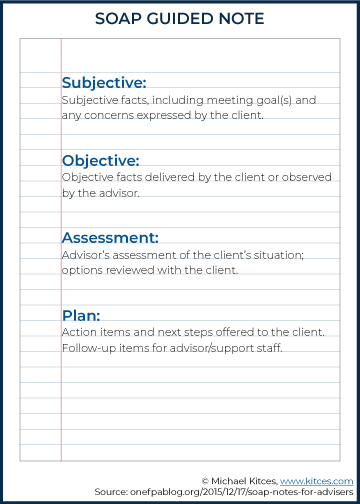

Guided Notes can be developed for an advisor’s specific needs, but there are some interesting examples that are already being used among financial advisors.

Originally coming out of the medical profession are “SOAP” note, which stands for Subjective, Objective, Assessment, and Plan. These customized guided notes provide a universal structure allowing medical professionals to concisely communicate amongst each other about mutual patients in a standardized format of key areas.

SOAP notes can be adapted to use for financial advisors as follows:

- Subjective: Name of the client, their goal(s) for the meeting, or the issue they need to address;

- Objective: Everything that was reviewed with the client along with the advisor’s observations (e.g., performance of account, cash flow, taxation issues, etc.);

- Assessment: A summary of any recommendations made by the advisor and the rationale for those recommendations; and

- Plan: The final section that includes action items and next steps.

Another example of a guided note comes from Dan Sullivan of Strategic Coach, who has long advocated the D.O.S Conversation. This conversation starts with the advisor asking the prospect or client the following question: “If we were meeting here three years from today – and you were to look back over those three years to today – what has to have happened during that period, both personally and professionally, for you to feel happy about your progress?”

The question (along with some probing follow-up questions) is designed to uncover the client’s Dangers, Opportunities, and Strengths (hence the D.O.S. conversation). The question can understandably elicit a wide range of responses from the client; to assist with that, Strategic Coach has developed the D.O.S. Conversation Workbook to help capture the answers. Each worksheet is broken into three sections (one for Dangers, one for Opportunities, and one for Strengths). It is a guided note framework tailored around that question.

Ultimately, a Guided Note approach puts in place a strong framework to create a consistent and repeatable process in dealing with client meetings and interactions. It can provide a stronger, more detailed framework than some of the traditional note-taking methods described earlier. The drawback is that time and effort are needed to craft an appropriate guided note structure in the first place (though the SOAP notes or D.O.S. frameworks above may be a helpful starting point).

Technology Can Make Note-Taking Easier For Financial Advisors

There are a lot of tools that can assist with improving the note-taking process for financial advisors. As while the CRM will always be the backbone of any note-taking process, the tools to consider are the ones that can help tease out the important details from the client, capture those details in some way, and ultimately (as well as easily!) log them appropriately into a CRM.

For advisors who want to stick with handwritten notes, Livescribe may be of interest. It offers a ‘smart pen’ that can digitize handwritten notes, which are converted to searchable text that can be synced with many other apps, although it still does not appear to easily integrate with typical advisor CRMs.

Looking more specifically within the financial services industry are several tools to assist financial advisors. Some examples include:

Redtail Note Templates – This recently launched feature allows the advisor to add guided notes that can be customized for particular clients. It can provide prompts to nudge the advisor to make notes (either during or after the meeting) and help remind the advisor to inquire about certain areas of importance (such as updates on the family or children, health updates, tax impact, cashflow, emotions, etc.). These guided notes can help prompt those important but quickly forgotten details.

MobileAssistant – A mobile app that works as a dictation tool by allowing advisors to speak their notes into their smartphone or other recording device, and then send the voice recordings to trained transcriptionists who type up a note to capture the recording and then link the transcribed note to the appropriate contact in the advisor’s CRM. What makes this app particularly interesting is that the transcriptionists are specifically trained to recognize and understand key terminology used by financial advisors.

Copytalk – Another transcription service, similar to MobileAssistant, except a phone number can be dialed (as opposed to recording locally on the advisor’s smartphone), which then records the conversation to be transcribed.

fpPathfinder Interactive Checklists – From the makers of checklists and flowcharts for financial advisors comes a new interactive version of their checklists that can be accessed online. Interactive checklists offer a series of guided notes consisting of probing questions that an advisor can ask a client on a particular issue (such as a checklist for a client whose spouse just passed away). In addition, fpPathfinder has partnered with Redtail to integrate into their CRM. This means that advisors are two to three clicks away from pulling up important checklists and probing questions from within Redtail and one click away from sending a completed checklist-note to the appropriate client record.

The integration of tech tools can potentially make it easier for advisors to integrate notes into their CRM systems, and will allow help advisors to address issues in a systematic and repeatable way.

Advisors have several options available to them that can help them elevate their note-taking skills, including a wide range of different note-taking frameworks (like the Cornell Method or a guided note), and software/technology tools to aid in the note-taking process (such as Redtail CRM’s new note template feature, MobileAssistant and Copytalk’s transcription services, and fpPathfinder’s new Interactive Checklist offering).

Better notes will ultimately create a better client experience, since clients will not have to repeat the same planning issues and concerns in subsequent meetings, and small details captured one day that could be very important in the future (such as a passing comment about a previous marriage). But the benefits of exemplary note-taking go beyond client experience. Notes can improve team communication and make the practice more efficient. Most importantly, good note-taking can facilitate an exceptional client experience by empowering members of the firm with current and relevant knowledge about the client, enabling proactive and highly personalized client outreach and servicing.

Leave a Reply