Executive Summary

Financial advisors who want to grow their firms faster can examine a wide range of advisor marketing strategies and sales tactics. But the reality is that if an advisory firm is struggling to grow, often the problem isn’t actually a matter of better marketing; instead, it’s about developing a better client service process. Because while the most significant value proposition of a real financial advisor is ultimately to help their clients live better lives, having a consistently remarkable client service process is what allows a financial advisor to successfully elicit the positive feelings experienced by their clients, which are essential in establishing lasting trust and driving the referrals necessary to bring about growth. And simply put, the fact that an advisory firm has high retention of existing clients doesn’t mean its client service process is good enough to bring new client growth as well.

In this guest post, Angie Herbers – Chief Executive and Senior Consultant at Herbers & Company, an independent management and growth consultancy for financial advisory firms – explains how the Client Service Process is actually the key to growth, and how it consists of not only the client service experience itself, but also the Operations Experience – the behind-the-scenes activities that clients may or may not see directly, but that they can certainly feel the effects of through every interaction they have with the firm. And in order to create an exceptional client service process based on cultivating trust, there are four components that must be mastered, in the following order: 1) Understanding, 2) Control, 3) Discipline, and 4) Stability.

The first stage of trust is Understanding, and involves the advisor not just having a solid grasp on what the firm does and who it works with, but also a deep connection to and alignment with the firm’s motivation, of why it does what it does and chooses to work with the clients it has. Next comes Control, in which financial advisors decide what services they will (and will not) provide for clients, with the confidence that those services align with the firm’s (and their own) motivation and purpose. In this stage, advisors also help clients realize that they, too, have a level of control in choosing to follow the advice they are given (or not), and this autonomy serves to deepen further the trust being cultivated between client and advisor. The next stage is Discipline, in which advisors and their staff need to continually uphold all the details, big and small, of the client service process promised to clients, which, over time, create the “living client” who trusts the firm culture and process so intrinsically that they essentially mirror the actions and feelings of the firm at all times. The last stage involved in cultivating trust is Stability. For the advisor, stability represents a solid belief that, whatever transition the business may face, it will maintain the integrity it needs to continue to grow. Similarly, the client has full faith that, whatever transitions they themselves face in their lives, their advisors will provide the stability to always guide them through the experience.

Ultimately, the key point is that the client service process is the primary area where advisors should focus in order to grow their firms. And while other components like marketing, sales, and human capital are all very important, they will not mean much if the client service process is faulty. Because it is the client service process, which includes both the client service experience and the firm’s operations experience, that is most crucial in establishing positive emotions between the client and advisor, on which long-term trust and a strong, lasting client-advisor relationship are built.

Author’s note added March 19, 2020: This article was written on February 24, 2020 and it primarily focuses on advisory firm client service as it pertains to growth. Much has changed in the advisory industry in less than a month. When advisory firms are in high-crisis levels we don’t focus on growth first. We focus on stability—stability of the clients. With that, I wish to offer much hope, love and health to all advisory firms who are working through the crisis. Keep going.

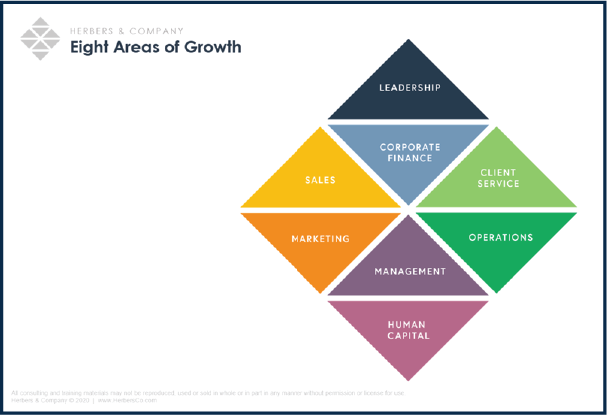

Whether you know it or not, there are eight foundational areas for every advisory firm to grow. Of those eight areas, the most important relate to client service and operations, the green areas in the figure below.

Some may look at this chart and argue that areas like human capital, corporate financial performance, or marketing should be considered prominent. Don’t get me wrong; all eight areas are important. But consider this: Without client service, you have nothing to sell. And without exceptional client service, you have nothing to grow.

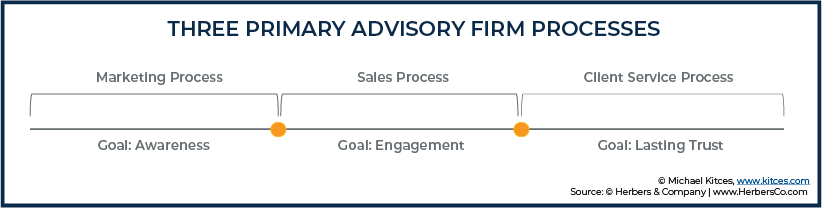

Within every advisory firm, there are three primary processes. They are the Marketing process (which builds awareness), the Sales process (which builds engagement), and the Client Service process (which builds trust).

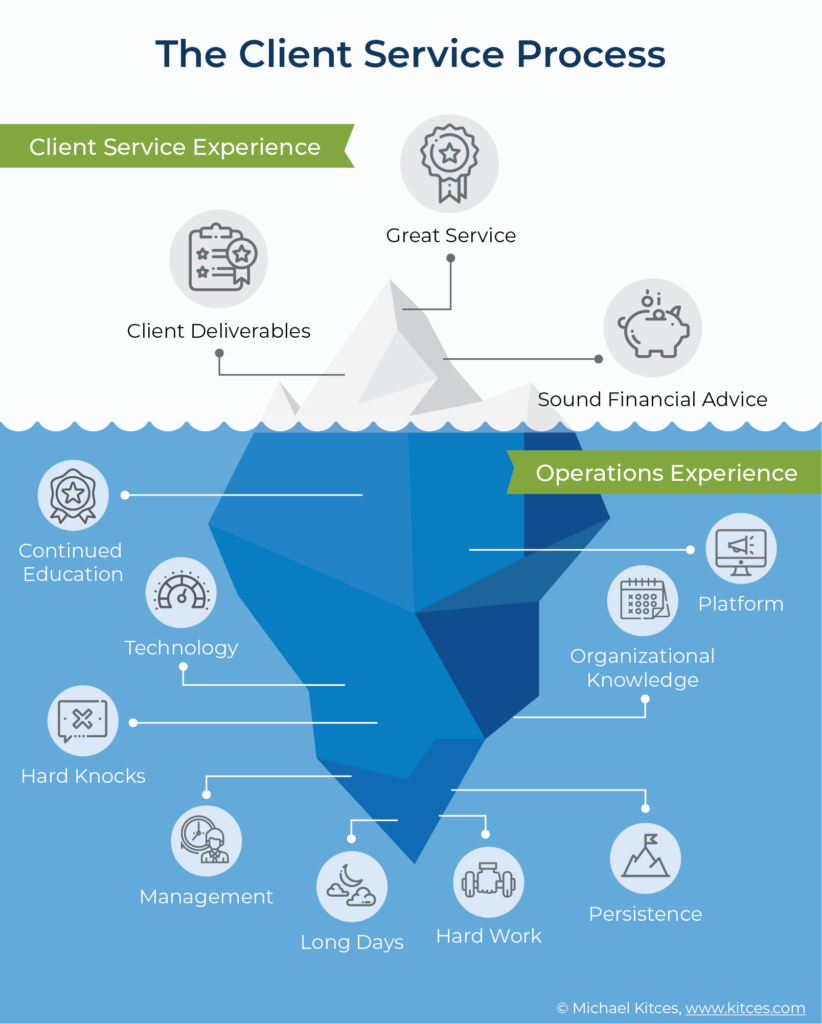

The evolution of the Sales Process is an integral part of every advisory firm, serving to engage clients and connect the Marketing Process, which brings initial awareness of the firm to clients, with the Client Service Process. An advisory firm’s Client Service Process is the sum of every interaction with and experience within your firm. It contains the client service experience, which is what clients see and feel when they interact with you. But (and this is the part most firms neglect) it also encompasses the operations experience, which is what you and your employees see and feel when serving and interacting with the client. The sum of the client service experience and the operations experience is the client service process.

![]()

And, its primary goal is to create lasting, unbreakable trust. And if done well, you create a whole lot of great ‘feelings’ (think: experiences) for you, your clients, and your employees that make up your culture, which fuels growth.

Here’s the problem: your client service experience can absolutely operate with a bad operations experience, and the reverse is also true. But your firm cannot boost its growth potential unless both are working together, in tandem, one building on the strength and consistency of the other.

Many advisory firms (and consultants) attempt to solve growth problems with more marketing, never considering that the client service experience and/or the operations experience is broken.

But if you aren’t getting a whole lot of referrals and/or you want to grow faster, you must look where you don’t want to go. And often, client service and operations are the places many advisory firm leaders don’t want to look first and may even want to avoid. They believe their client service and operations experiences are great; after all, they aren’t losing many clients.

However, the truth of the matter is that most growth problems (and opportunities) for advisory firms are deeply rooted in client service and operations issues. Without a truly exceptional client service process, the firm is not very referable in the first place. And even good marketing just breaks its implied brand promise if it can’t deliver a good client service experience when new clients do come on board. Which means if the real issue is client service, more marketing won’t and can’t solve the growth problem, no matter how bad you want it and/or believe you can grow out of the problem.

I know, you have great client service, so you say. But riddle me this, if it’s so good, then why aren’t more of your clients talking about you, inundating you with tons of referrals? Why do you need marketing at all?

I’ll give you a secret; there is a trick most high-growth advisory firms know. While clients can see and feel the client service experience because they are part of the process, they also ‘feel’, without seeing, the operations experience. In other words, you can have the best client service experience, journey, map, guidebooks, technology, or whatever. Still, if your operations experience isn’t great, your clients ‘feel’ the impact of your business not operating well.

When something doesn’t ‘feel’ good to a client, whether they can identify it or not, you have a major problem. This is because those feelings drive their level of trust with you. And if their level of trust is not maximized, they will not refer their trusted friends to your business.

While feelings can rarely be seen and are most often only expressed, it’s highly possible you may not even know when clients are unhappy at all. And in all my work with advisory firms, it’s even harder to capture client feelings about your firm in a client satisfaction survey, because, well, feelings are not permanent. The clients may not be feeling the discomfort of a less-than-ideal service experience at the moment they’re filling out a client survey, and therefore don’t reflect the negativity. But it’s still keeping them from more actively referring the advisor.

That’s not to say client surveys aren’t important, but let’s be clear – people don’t always have the words to express what they’re feeling, especially within the confines of a survey that has to ‘guess’ upfront the right questions to ask to even try to elicit that feedback.

Therefore, the most straightforward thing you can rely on is simply the client’s actual behaviors over time. And if their behavior is not sending referrals, it’s the first sign of a problem.

This all leads to the question: how do you create exceptional service? Well, you must first build or rebuild trust with your clients before you can grow at your maximum level. Why? Because growth happens only when trust exists. And there is no trust deeper than when someone has no fear in expressing their feelings to you.

And, as you build more trust with your clients, they build more trust and certainty in referring others to you. If you focus on cultivating the feelings associated with trust, you will grow. If you focus on ‘stuff’ first – technology, new tools, guidebooks, processes, marketing or whatever – you are leaving a lot of growth out there for someone else to capture.

The secret to high-growth is when firms focus more on cultivating ‘feelings’ first because they know, true growth begins with clients behaviors. To do that, you must first understand the four feelings of trust: Understanding, Control, Discipline, and Stability. In that order. And to begin, you, yes you, must be understanding, controlled, disciplined, and stable yourself! Because, well, feelings transfer… that’s simply human nature. And, until you get your feelings of trust sorted out, no one will follow.

The Evolution of Trust

Let’s dig into each component separately, to see how they come together and build on one another to create an exceptional client service process, keeping in mind that you are first going to cultivate these ‘feelings’ within your firm so they can be transferred to the client, through you and your employees within your culture.

Understanding

Building an exceptional client service process, and generating true trust with a client, begins with a focus on you and your behaviors – your firm culture. To do this, you must know who you are and why your firm exists.

This part of the process requires knowing your mission and your firm structure. Your mission statement will establish your firm’s purpose – generally, all advisory firm mission statements answer the question: “What do we do?”

In my experience, advisory firm mission statements are rarely different from one another. In general, most firms exist to ‘help clients live a better life.’ But what most mission statements don’t do is talk about feelings; why do you do what you do? If you answer the ‘why’ properly, you will be stating a feeling. This goes beyond, ‘peace of mind’ ‘better life’, etc.

The best mission statements say things like, ‘we bring joy to clients by removing their financial stress’. In this example, ‘joy’ is the feeling. Most advisory firms have mission statements, but many don’t have any feelings associated with them, which is often why they aren’t effective. Everything within your client service process must tie back to the mission. In other words, if your mission is to bring joy but the firm is putting resources towards some part of its offering that isn’t bringing your clients joy, should you be doing it?

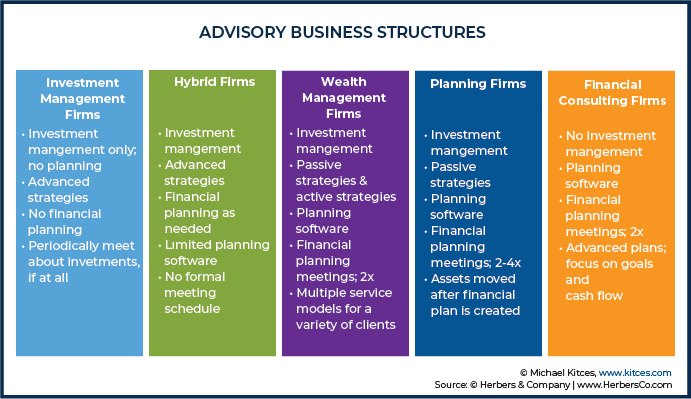

Second, to take understanding deeper, you must identify your firm structure. This is where many advisory firms and their leaders get tripped up. In fact, most advisors I talk to don’t even recognize that there are different advisory firm structures at all; they think of an advisory firm in the ‘old’ style of wealth management where they simply do everything for clients… but that’s not the case anymore. And/or they utter the words solo, silo, or ensemble.

There are five major types of advisory firms now, and despite what you read about certain types of firms, all these types are successful: Investment Management Firms, Hybrid Firms, Wealth Management Firms, Planning Firms, and Financial Consulting Firms.

As you can see from the graphic, each type of advisory firm has a different set of services to offer clients, and consequently, a different client focus, and also different pricing models. For you to build an exceptional client service process, you must first decide where you are going to place your focus. What services are you best at (and wanting) to provide? In other words, what type of advisory firm are you, really?

I will let you ponder this for a minute and, while you do, heed this advice: in today’s fast-moving advisory industry, you need to know exactly where you sit on the line between an investment management firm (far left) and a financial consulting firm (far right). Your answer will inform who you are. And to serve clients well, you must know exactly what you will and will not do, under a structure and mission you and everyone else in your firm understands.

If you don’t, you’ll never truly earn your clients’ trust. This is because if you don’t know who you are, clients and employees won’t know how to tell their friends what makes you different than any other firm out there. Thus, in not understanding you, they will never know how to talk about you.

Control

Once you know your mission and firm type, you can then begin to zero in on the next step to trust, which is control. When you move from understanding to control, you begin to zero in on the type of client you want to work with – because your mission and firm type will influence the types of clients who will benefit most from what you focus on doing.

While some consulting firms will have you identify a niche or target market at this point, we’ve found this is not the most important step… yet. To gain trust through controlling the type of client you work with, it’s ideal to make a complete list of the ‘feelings’ great clients show you as you are providing them your service.

In other words, which would you rather have: a client who is appreciative or a client who is critical? What if the appreciative client was outside of your niche, and the critical client was within your target?

Niche and target client aside, my guess is your client service process can serve, hopefully profitability, either of those clients. But, even if they weren’t within your niche or target, I’m guessing you’d still pick the appreciative client over the critical one. Once you begin focusing on the type of clients you want to service based on the feeling they give you while serving them, you enter true independence.

To say it bluntly, you stop putting up with a lot of crap from clients who might otherwise fit. Now you know who really belongs in your culture, and now you can focus on serving them without all the conflict.

Once you’ve determined the type of client you want to work with – based not just on the financial or specialization metrics they may bring to the table, but also the feelings they inject into your firm, you then build services around them to fit their specific financial need. Here’s the thing, though; while listing out your ideal client is based on the feelings you want to cultivate, building a list of services is also about services you want to provide.

So many advisory firm leaders build a menu of services for clients that they ‘think’ the client wants, for fear of losing the client they already have or the fear of not getting more. In doing so, they end up with a firm where there is no boundary around provided services, plus a whole team of people who don’t understand where the service line is between ‘enough’ and ‘too much’ (which can eventually lead to overstaffing and undermine the profitability of the firm).

To begin, make a list of all the things you will not do, which do not give you the feeling of control and boundaries that you’ve been missing for years. If done this way, what remains will be a collection of what you will provide, and most importantly, a lot of extra time to focus on growing your firm.

For advisory firms, Control is about determining and choosing who will be served and how. This phase of building trust is not just about the firm gaining control, though; it is also about your clients and how you help them gain more control over their finances. You do this by showing them that ‘real’ control is who and what advice they choose to let in.

Discipline

The discipline phase of trust-building is where most all trust fails. Many advisors know what they should do, but it is only by doing these things consistently and well each time that deep trust will be cultivated over time. Unfortunately, few advisors manage to get the small details right consistently enough to achieve lasting trust that cultivates client referrals.

Discipline always comes with a process. And to put this into practice, you must take the time to put your client service experience into a repeatable process, in writing, and consistently do all the things you’ve said you are going to do, year after year, coordinated by your operations experience. It’s never good enough for you to stick to a client service process some of the time; you have to create the exact same process with every client you serve, every time you interact with them.

When you consistently do what you say you’re going to do for someone, trust begins to grow exponentially. This is because, as trust compounds, growth in your firm does as well. Today, these consistent, planned, and processed interactions result in what we, at Herbers & Company, call the “living client.”

The living client is one who mirrors your words, actions, and feelings to others outside of your firm because each time you interact with a client, they trust the process you are taking them through. And they trust it because you show them the process, and then deliver on those words. Consistency in words and actions takes a disciplined, documented process that you can duplicate every time, and that can also be easily transferred and trained to your employees.

Stability

And finally, the last feeling of trust is Stability. How do we define stability? For our purposes, it is a state of knowing that if you go through a transition phase in your business – whatever that transition may be – that you have the ability to walk stably through it to the other side and continue to grow.

For your clients, stability is knowing that you will guide them safely through to the other side of any transition they experience, including market changes – both the ups and the downs. Transitions can be negative, such as the death of someone important to them or an unwanted divorce, or they can be positive, such as a long-awaited retirement.

A consistent client service process opens your firm to providing higher quality service to all clients – all clients! When a client has a transition moment, especially an unplanned one, a consistent process enables you to determine more easily if you are the best one to help them or if you need to bring in or recommend other professionals to help you. This all creates an interdependent support system for the client… and interdependence is the goal.

Stability is having enough experience to know what you do well and having the confidence to ask for help in times when you need it most.

In times of crisis, stability is the phase you rely on the most. And, if you are able to walk a client and your business safely through any crisis you endure, clients will trust you for a very long time.

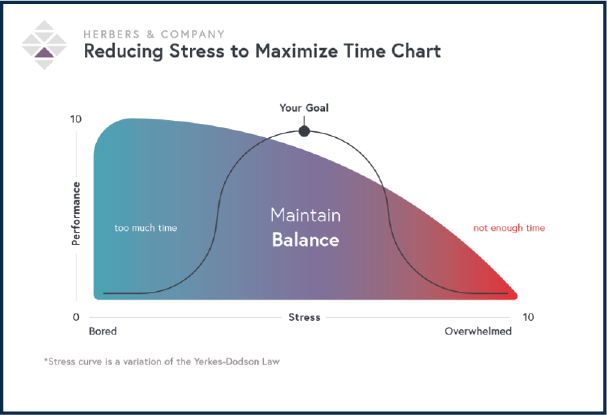

How Stress Impacts Trust

Now that you know the four components of trust, and the steps you need to take to cultivate its feelings, let’s talk about stress. I think the following story is important to share.

In the market meltdown of 2008, Herbers & Company (then named Angie Herbers Inc.) witnessed some interesting behaviors of some of our financial advisory firm owners and leaders (i.e., our clients) that hurt their growth going into and coming out of hard times. There is no other time in the history of my consulting career that I learned more about growing an advisory firm than I did in the five years from 2008 to 2012 as I was consulting through the crisis, watching, and researching through the hard times, alongside our clients.

During this period, Herbers & Company, by necessity, moved to an ‘open innovation’ research platform. In other words, we would buy specific research data points from our consulting competitors (they were happy to take our money back then) and sponsor research at universities to deliver much-needed innovation to our client firms to grow. We did this so our clients could capitalize on the growth in the bear market. Doing this has turned out to be the best decision I have ever made because today, many of the firms we worked with back then are the largest firms in the country. But also, much of the proven growth systems Herbers & Company have today is based on the research we bought from others, which would have taken us years to research ourselves.

One research project we sponsored was conducted on stress, at the Kansas State University Financial Planning Research Center (which conducts clinical research on factors that affect advisors and clients in the advisory industry). The research was conducted by Dr. John Grable and Dr. Sonya Britt in a series of tests with real clients and real advisors, both wired to gauge their physiological stress levels. The conclusions are outlined in several resources, including the November 2012 cover story in Investment Advisor magazine called, “Stress Fracture” that I wrote.

But the best illustration of the this research and pivotal research that came after 2012 is found in the 2017 book “Communication Essentials for Financial Planners” by Dr. John Grable and Dr. Joseph Goetz, which I highly recommend as the top book for every financial advisor to read.

With this research and knowledge, we’ve learned that an advisory firm culture that demonstrates high stress levels, the stress that exists amongst financial advisors and their firm’s leadership transfers to clients. Let me repeat that: your stress transfers to your clients! In other words, if you are stressed out about your business growth, your business performance, and/or high or low market cycles, it’s likely you are transferring this stress onto your client relationships. And if they ‘feel’ you are stressed out, do you think they are going to send you more business or trust you when times get bad?

Therefore, it’s not surprising that the number one killer of trust, and thus, client service, is stress, which is usually created by a lack of stability, and often the symptom is poor time management. While you can have the best client service process, you alone and/or any advisor in your firm can tear down your culture if you are coming to work stressed out all the time. If stress exists in your culture, because you are putting pressure on growth, financial performance, or whatever, there is nothing—nothing—that can improve your growth until you remove the stress.

To remove the stress, you must remove your expectations on financial performance and run your firm with prudent corporate financial systems. Most stress in businesses comes because leaders make revenue or profit goals for their businesses, for themselves, or for their financial advisors to perform and achieve. Regardless of whether those goals are realistic or unrealistic, the act of doing so inevitably creates unnecessary performance anxiety and stress at levels that hurt clients and your ability to grow. And furthermore, what happens to those goals, expectations, and cultural morale when the market slides and it becomes highly likely that those goals cannot be achieved? The answer? You set your entire culture, and yourself, up to fail.

Ask yourself: On a scale of 1-10, what is my stress level? What is my financial advisor’s stress level? What is my culture stress level? If your level is over five consistently throughout the day, week or month, your growth problem is not any process—marketing, sales, or client service—it’s likely expectations you’ve put upon yourself and others.

Removing the stress is something only you can do! And to do that begins with a new vision to take it full circle.

You Have Trust. Now What?

Creating a client service process built on trust requires that you work through the four components of trust described above and ensure that high levels of stress stay out of your culture. Once you’ve done that, you can then document and script the entire client service process.

The action and the scripting of your process outline your messaging and firm positioning so that everyone in your firm can follow the same steps and deliver it with confidence. In fact, once you follow these steps, your firm’s messaging is solved as well, which is great news because it means you are 80% of the way through the Marketing process, too. This is because you can articulate who you are and tell your story in a repeatable and consistent manner that cultivates great feelings in clients leading to lasting trust.

By doing so, you communicate your value through repetition, and the best way to generate new clients is through word of mouth marketing. Which now begs the question: What is good marketing? The answer is simple: It’s good communication. Trust begins with great communication. As you communicate what clients should expect, they will develop deeper trust as they begin to experience those expectations being met.

Leave a Reply