Two companies founded by the CEO of a startup custodian are being sued by 11 former clients.

The RIA and investment management company started by Altruist CEO Jason Wenk are being accused of failing to properly supervise a barred advisor who put their funds in unregistered securities issued by another company that has been charged with fraud. The charged company is unaffiliated with Wenk.

“While we feel for any person who may have been hurt by the advisor’s actions, we were not involved in any way and expect to be fully cleared of the lawsuit,” Wenk said in a statement.

The former clients claim the rapid growth of Wenk’s firms inhibited the firms’ ability to properly supervise ex-advisor James Heafner’s purported misconduct; they claim the companies hired improperly supervised annuity salesmen to boost assets, according to the lawsuit filed in a North Carolina court.

Heafner was registered with Wenk’s RIA, Retirement Wealth Advisors, from 2014 to 2018. During that time he invested clients’ funds in annuities and managed portfolios at FormulaFolio Investments, Wenk’s investment management firm. Heafner also allegedly placed $1.7 million of client assets in unregistered securities with 13% management fees from 1 Global Capital, according to the lawsuit. 1 Global and some of its executives were charged with fraud by the SEC and the Department of Justice in 2018 and 2020, respectively.

Heafner was fired from Retirement Wealth in August 2018 for “failure to follow written policies and procedures in regard to outside business activities,” according to a note from the firm in his regulatory record.

The lawsuit levels 13 accusations, including negligent misrepresentations against Heafner, and negligent and willful or wanton supervision against Retirement Wealth and FormulaFolios.

Wenk is personally not a defendant in the lawsuit and no longer serves as CEO of the firms. He maintains the largest ownership stake in both, according to Form ADVs. He provided the following statement:

“Retirement Wealth and FormulaFolios explicitly denied requests by an independent advisor affiliated with the firm to sell certain non-registered securities as an outside business activity. This is well documented and will be presented to the court. Unfortunately, the advisor took his own actions without disclosing it to the firm and his clients were impacted. Upon learning of the advisor’s failure to comply with firm policies his registration was terminated. To my knowledge the advisor is no longer licensed or in the industry.”

Heafner’s attorney did not respond to a request for comment on the allegations. A response filed to the lawsuit says Heafner denies claims against him.

Retirement Wealth’s growth

Over the five-year period ending in 2018, Retirement Wealth grew to 189 advisors from seven, according to the lawsuit. Client assets at Retirement Wealth and FormulaFolios grew to $5 billion from $220 million in the same time.

The clients’ lawsuit takes issue with how that growth was achieved.

Their lawsuit claims growth at both companies stemmed from annuity salesmen the firms hired and who appeared unaffiliated with FormulaFolios and were not adequately supervised by either firm.

The two firms hired reps via The Impact Partnership, a marketing consulting firm that supports insurance companies and agents, according to the lawsuit. Recruits were “incentivized to solicit and recommend” clients to use FormulaFolios’ investment services, the lawsuit says.

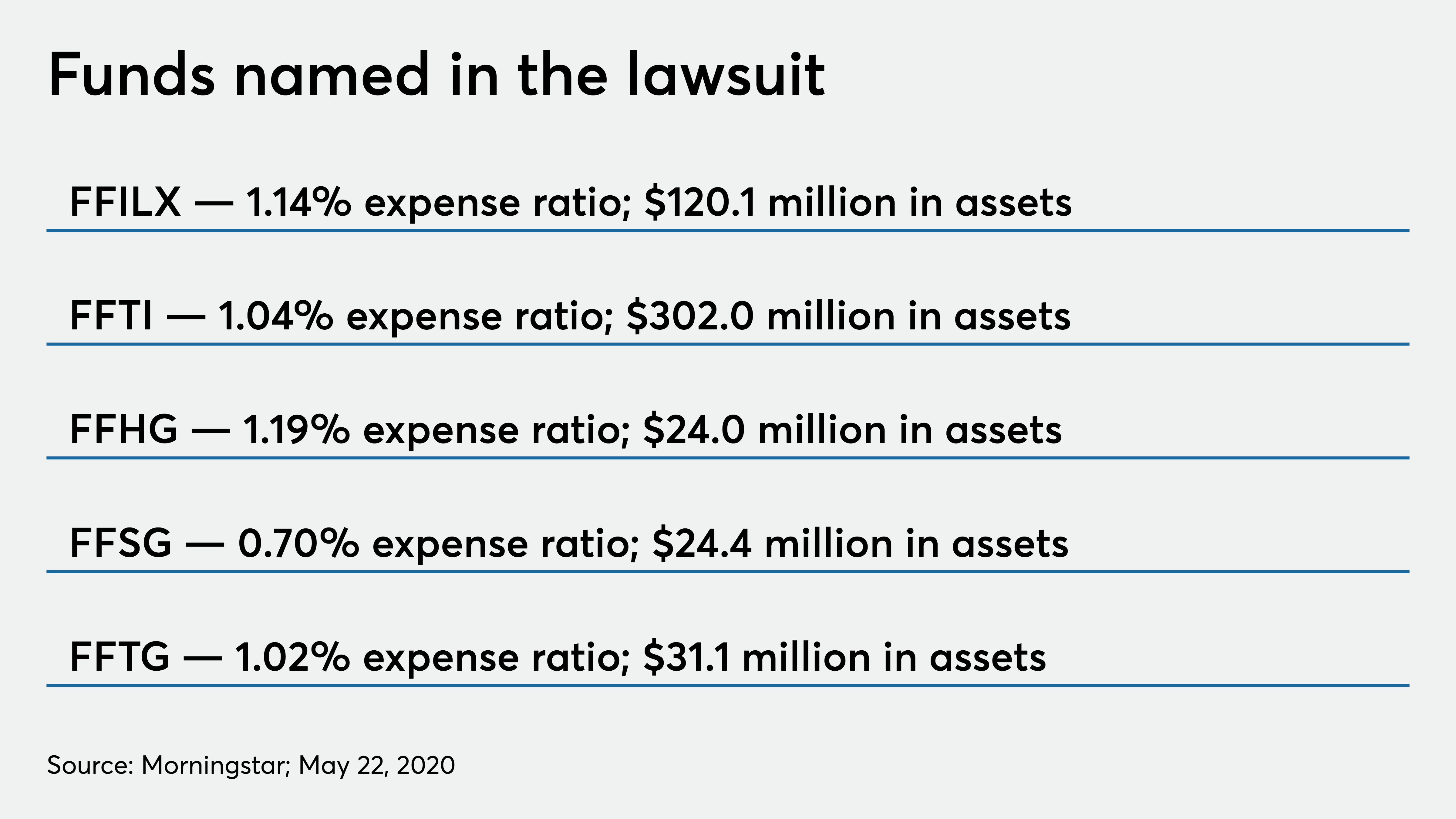

The reps’ recommendations boosted FormulaFolios’ assets, in part because it uses proprietary funds in portfolios it manages, according to the lawsuit. (Wenk is one of two portfolio managers of the funds, according to prospectuses.)

The firms chose to “not supervise IARs denoted as independent contractors, as required,” which allegedly helped them grow more quickly, the lawsuit claims.

Heafner also allegedly recommended clients invest in FormulaFolio managed accounts, the lawsuit says.

“Mr. Heafner told me [FormulaFolios] earned about 7%-8% and never lost money,” one of the former clients wrote in an affidavit filed with the case.

Clients say they didn’t know Heafner had any relationship with FormulaFolios, other than that he advised on their accounts, according to client affidavits attached to the lawsuit.

The former clients claim in affidavits that they were rushed through paperwork that was not explained to them. Many didn’t recall signing a FormulaFolios investment agreement.

One client, who requested paperwork when he closed his FormulaFolio accounts around the end of 2018, says he later realized much of it was filled out in different color ink.

“The only handwriting in them that is mine is my signatures,” he says in an affidavit attached to the lawsuit. “Even the dates are not in my handwriting.”

Retirement Wealth and FormulaFolios are attempting to compel the lawsuit into arbitration, according to a court filing.

“Plaintiffs agreed to arbitrate, and now they must do so,” the firms’ filing says.

Wenk was CEO of Retirement Wealth and FormulaFolios during the four-year period ending in 2018, according to ADVs filed with the lawsuit. While he is still the largest shareholder of both companies, he no longer runs them, according to current ADVs.

1 Global connection

Heafner was terminated from Retirement Wealth in August 2018, according to FINRA BrokerCheck. A week prior, the SEC charged 1 Global Capital and its then-CEO, Carl Ruderman — the former owner of Playgirl Magazine — for allegedly defrauding at least 3,400 investors.

“1 Global used a network of barred brokers, registered and unregistered investment advisors, and other sales agents — to whom they paid millions in commissions — to offer and sell unregistered securities,” the SEC complaint against the firm and CEO reads.

Heafner was allegedly one of those investment advisors and earned commissions on 1 Global investments, according to the lawsuit.

He allegedly depicted the investments to clients as low-risk, according to one-page financial plans given to then-clients and attached to the lawsuit.

The plaintiffs say Retirement Wealth Advisors and FormulaFolios were responsible for monitoring Heafner.

Heafner “consistently exhibited red flags of gross incompetence” when giving clients investment advice and sometimes took months to reinvest funds from liquidated investments, the lawsuit says.

“We disagree strongly with the claims and assertions set forth in the amended complaint and are confident we will be vindicated when this matter ultimately is resolved,” wrote Danielle Tyler, Chief Compliance Officer of Retirement Wealth and FormulaFolios in a statement to Financial Planning, and declined to comment further on pending litigation.

‘I always did my best for my clients’

In a letter to clients written after 1 Global Capital filed for bankruptcy as well as his termination, Heafner said he had always acted in their best interest. He compared his current situation to that of Capt. Chesley “Sully” Sullenberger, who successfully ditched a damaged plane in a river, saving all 155 people aboard.

“I felt a close connection with Sully because, like Sully, I always did my best for my clients, and like Sully I am being accused of making the wrong call by clients, authorities and attorneys for recommending 1 Global Capital,” Heafner wrote in the letter dated February 28, 2019, and attached to the lawsuit. “Like Sully, I face losing my licenses, my career, and my wealth.”

In July 2019, FINRA barred Heafner from the industry for refusing to appear for testimony about unapproved outside business activity at Taylor Capital Management, a broker-dealer with which he had also been registered. He ceased being registered with Taylor Capital in January 2018, according to FINRA BrokerCheck.

At the end of 2019, a FINRA arbitration panel ordered Heafner and Taylor Capital to pay five of his former clients a total of over $869,000 in damages plus costs for alleged violations of federal securities laws and other misconduct, according to the award. FINRA cancelled Taylor Capital’s license in October 2019, according to BrokerCheck. In January, arbitrators ordered Heafner pay $60,000 plus 5% annual interest to another client for allegedly unsuitable investment recommendations and other misconduct.

A FINRA spokeswoman did not return a request for comment.

Wenk recently launched Altruist, a tech-driven custodian for financial advisors. He told Financial Planning in October he wants to boost transparency in the independent channel with his new company. It raised $8.5 million in a Series A funding round in November led by Venrock, according to Altruist.

Wenk says that FormulaFolio funds are not offered on the Altruist platform.

“FormulaFolios is not a money manager on the Altruist platform and there is no affiliation between the companies,” he said in a statement. “There is no incentive for any advisor using Altruist to use any funds or ETFs from any company.”

Correction: A previous version of this article listed FFIOX and FFILX as separate funds. They are two share classes of the same mutual fund. The graphic headline has been corrected to show the funds are not Jason Wenk’s proprietary funds.

Leave a Reply