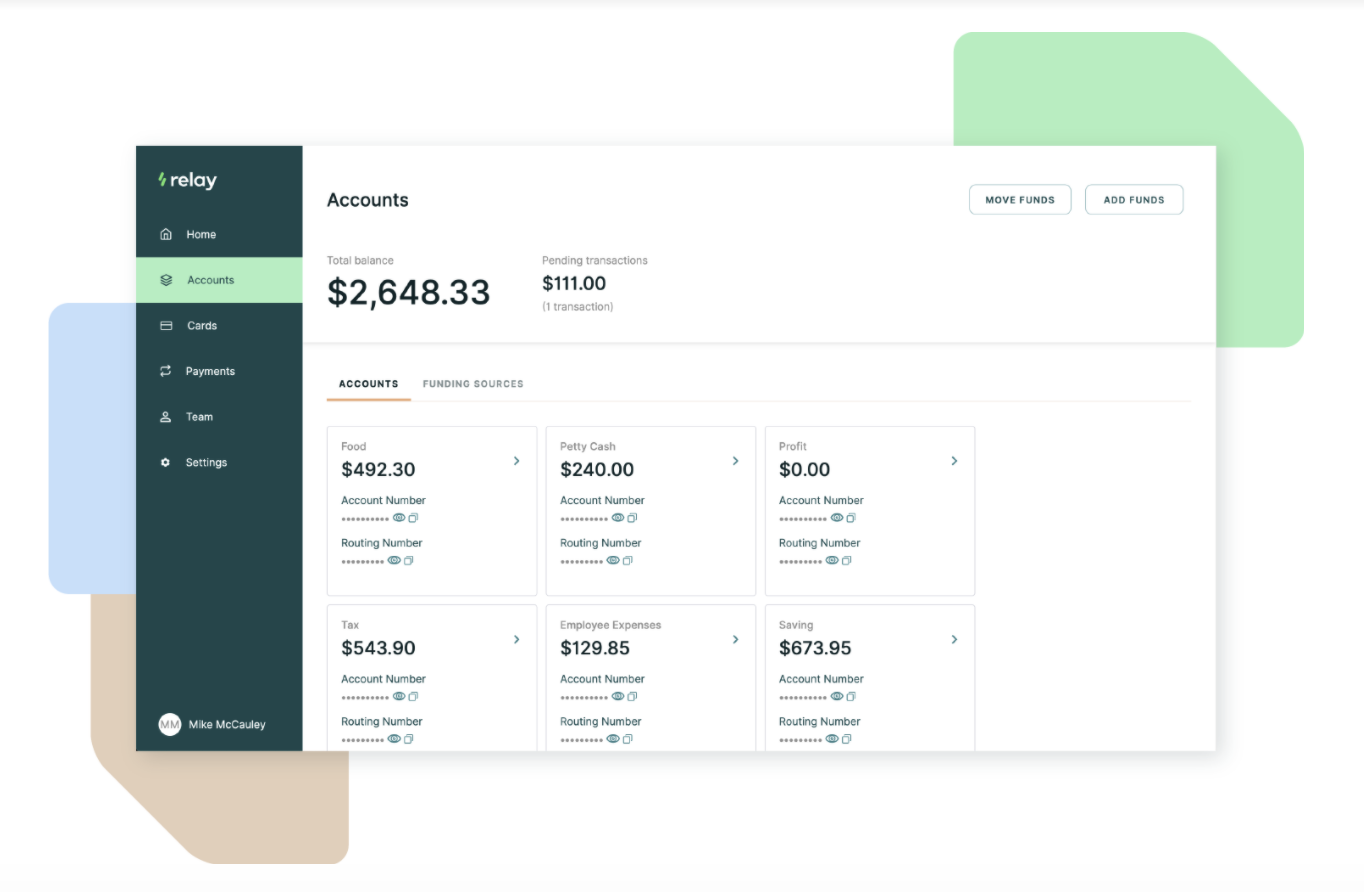

We’re thrilled to announce a new partnership with U.S.-based Relay. Built for entrepreneurs, Relay offers small business banking that is intuitive and flexible. It can be used by anyone from freelancers to 100+ person companies.

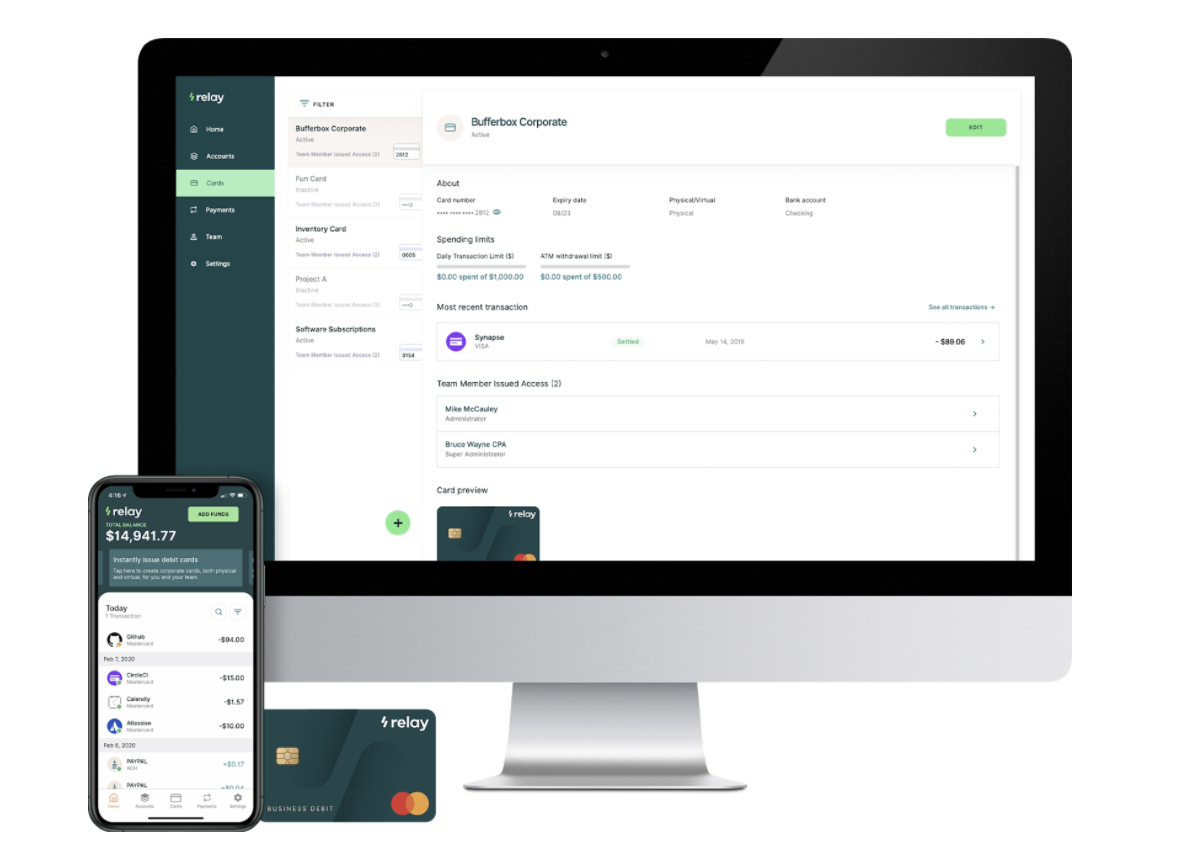

Small businesses and their advisors can register for Relay online and experience beautiful banking on web, iOS and Android devices. Relay also offers a user permission model that ensures small business owners and their accountant or bookkeepers have appropriate access to the financial data. This access enables them to gain insights into their business that’s most important to them.

That’s why Xero Platinum Partner, Joshua Lance of Lance CPA Group, has selected Relay as their business bank account of choice. “With Relay, it’s finally easy to collaborate with our clients on their banking. Between the direct feed with Xero and having access to our clients’ banking data, we save up to an hour a month per client. Using Relay gives us reliable bank feeds, access to bank statements and it accelerates reconciliation. It’s made life super easy for our practice”.

How does Relay work with Xero?

- Relay customers connect to Xero, via the bank feeds API. This connection can be initiated from inside Xero or Relay. Enriched transaction data is synced to Xero every three hours, giving customers real-time visibility of their cash flow.

- Relay and Xero customers can automate their payables by integrating the two. Relay imports unpaid bills from Xero for payment in Relay.

- Xero customers can now operate their businesses using their Relay bank account. The enriched transaction data in Relay is reliably piped into Xero.

Adding the Relay integration to Xero’s comprehensive list of global bank feed APIs is another win for small business owners and their advisors. Once business owners connect their Relay transaction accounts, they can receive real-time data directly in their accounting ledger. This helps reduce time spent reconciling transactions while increasing data accuracy.

The integration with Relay speaks to the success of the Xero bank feeds API. It enables banks, fintechs and financial institutions from all over the world to give small business customers faster access to financial data from directly within Xero. Through the Xero bank feeds API, financial institutions can continue to evolve and improve time-to-market for direct integrations by gaining access to consistent developer platforms to better serve their customers.

The ability to connect small business platforms via the API to both startup and major financial institutions showcases Xero’s ability to connect small businesses to hundreds of sources – all from a single platform.

Our Relay integration joins the growing list of connections Xero has with more than 200 financial institutions globally. These connections include Wells Fargo, BBVA and Capital One in the U.S., and CIBC in Canada.

Leave a Reply