U.S. government debt prices were lower on Tuesday in a holiday-shortened week, with mounting optimism about a coronavirus vaccine driving some risk-on sentiment from investors.

At around 2:10 a.m. ET, the yield on the benchmark 10-year Treasury note was up at 0.6916% and the yield on the 30-year Treasury bond rose to 1.4050%. Yields move inversely to prices.

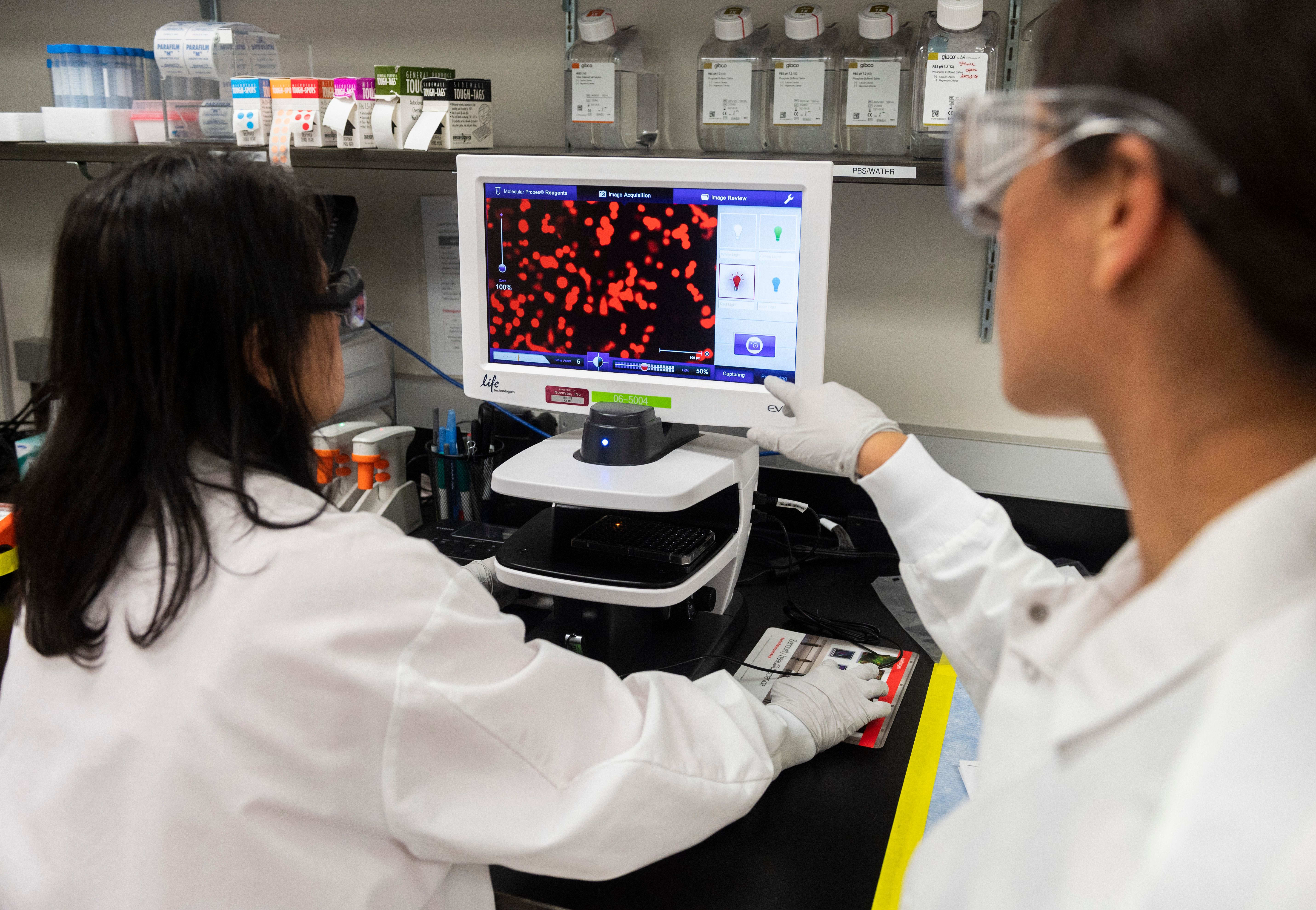

American biotech company Novavax said Monday that it had started the first human study of its experimental coronavirus vaccine, with initial results on safety and immune responses expected in July.

The news followed Moderna‘s announcement last week that all 45 patients in its vaccine trial had developed coronavirus antibodies.

As states look to tentatively reopen their economies, the U.S. has now confirmed more than 1.6 million cases of the virus, resulting in more than 98,000 deaths, according to Johns Hopkins University.

Investors will also keep an eye on a flaring of trade tensions between the U.S. and China, with disputes over blame for the coronavirus pandemic and new Hong Kong security laws threatening to derail the landmark “phase one” trade agreement signed in January.

On the data front, S&P/Case-Shiller home price readings for March are due at 9 a.m ET Tuesday, before April’s new home sales figures at 10 a.m. ET.

Auctions will be held Tuesday for $63 billion of 13-week Treasury bills, $54 billion of 26-week bills, $65 billion of 42-day bills and $44 billion of 2-year notes.

Leave a Reply