If you’ve taken out a business loan or line of credit, you’re aware that interest accrues on the borrowed amount. But, do you know how to record accrued interest in your books?

Recording interest allocates interest expenses to the appropriate accounts in your books. That way, you can stay organized and better manage your accounting books.

About accrued interest

Loans and lines of credit accrue interest, which is a percentage on the principal amount of the loan or line of credit. The interest is a “fee” applied so that the lender can profit off extending the loan or credit. Whether you are the lender or the borrower, you must record accrued interest in your books.

Accrued interest is interest that’s accumulated but not yet been paid. Because it’s accrued and not yet paid, it can be a payable (if you’re the borrower) or receivable (if you’re the lender).

When you accrue interest as a lender or borrower, you create a journal entry to reflect the interest amount that accrued during an accounting period.

You also record it on your business income statement and balance sheet. So, how do you record accrued interest on these two financial statements?

For borrowers, accrued interest is:

- An expense on the income statement

- A current liability on the balance sheet

For lenders, accrued interest is:

- Revenue on the income statement

- A current asset on the balance sheet

How to record accrued interest in your books

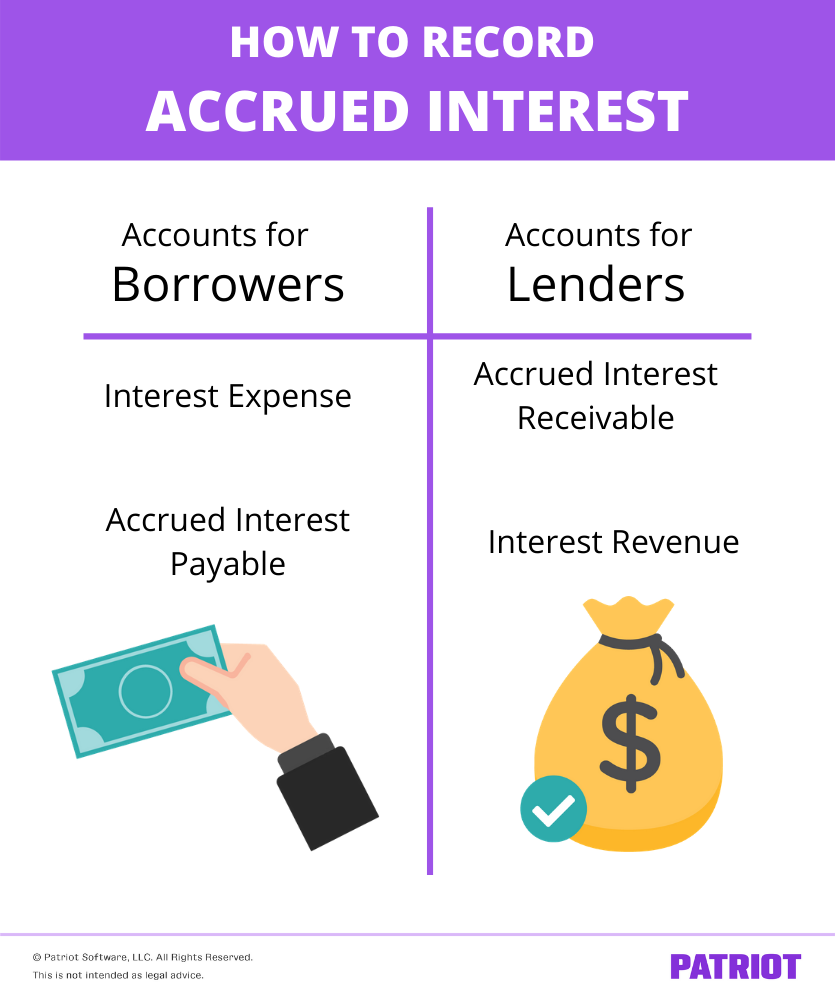

How you create an accrued interest journal entry depends on whether you’re the borrower or lender.

If you’re the borrower, you’ll work the following accounts:

- Interest Expense account

- Accrued Interest Payable account

If you’re the lender (e.g., extending credit), you’ll work with these accounts:

- Accrued Interest Receivable account

- Interest Revenue account

Read on to learn how to calculate the accrued interest during a period. Then, find out how to set up the journal entry for borrowers and lenders and see examples for both.

Calculating accrued interest during a period

To calculate accrued interest, you need to know three things:

- Interest rate (percentage)

- Time period (number of days the interest accrued over)

- Loan or credit amount

Once you know these three pieces of information, you can plug them into the accrued interest formula:

Accrued Interest = [Interest Rate X (Time Period / 365)] X Loan Amount

Example

Let’s look at a $10,000 loan with 5% interest. You want to find out the accrued interest over 20 days.

[5% X (20 / 365)] X $10,000 = $27.40

The accrued interest during this time period is $27.40. This would be the amount you would record in your books.

Borrower’s guide on how to record interest payable

When you take out a loan or line of credit, you owe interest. You must record the expense and owed interest in your books.

To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account. This increases your expense and payable accounts.

Take a look at how to record interest expense journal entry:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Interest Expense | X | ||

| Accrued Interest Payable | X |

Example

Let’s say you are responsible for paying the $27.40 accrued interest from the previous example. Your journal entry would increase your Interest Expense account through a $27.40 debit and increase your Accrued Interest Payable account through a $27.40 credit.

Take a look at how your journal entry would look:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Interest Expense | 27.40 | ||

| Accrued Interest Payable | 27.40 |

Lender’s guide on how to record interest receivable

If you extend credit to a customer or issue a loan, you receive interest payments. You must record the revenue you’re owed in your books.

To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue account. This increases your receivable and revenue accounts.

Here’s how the journal entry would look:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Accrued Interest Receivable | X | ||

| Interest Revenue | X |

Example

Now, let’s say your customer owes you $27.40 in accrued interest. Your journal entry should increase your Interest Expense account through a debit of $27.40 and increase your Accrued Interest Payable account through a credit of $27.40.

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Accrued Interest Receivable | 27.40 | ||

| Interest Revenue | 27.40 |

Looking for an easier way to manage your accounting books? Give Patriot’s accounting software a try! Our patent-pending cash-to-accrual toggle gives you the power to run reports using either modified cash or accrual accounting. Try it for free today!

Leave a Reply