Google Pay, Paytm and PhonePe are trusted and most popular payment apps across India. People are using these apps for transferring money and doing daily transactions like mobile recharge, grocery purchase, and bill payments. There are dozens of payment apps available in the Indian market out of all Google Pay, Paytm and PhonePe are leading the race.

I am a regular user of Google Pay and Paytm for making payments. I have rarely used other apps for doing transactions. In this post, I will be sharing my personal experience with Google Pay, Paytm, and PhonePe apps. I will also share key features and compare them. The purpose is to help you in deciding which payment app is best for doing daily transactions – Google Pay or Paytm

What is Mobile Payment App?

Mobile Payment app means Mobile Wallet. Payment Apps allows you to link your bank accounts or credit cards with a mobile app. You can make payment directly from the app without the need for your credit card, debit card, or other cheks. You can make use of a mobile payment app for money transfer, payments, mobile recharge, DTH recharge, shopping, etc. You can also save money in the mobile wallet up to a certain limit.

Google Pay

Google Pay (G Pay or Tez) is mobile wallet and online payment system by Google. You can send money to friends, pay bills, recharge phone and do lot more using Google Pay. In short, Google pay converts your mobile to personal banking system. You can transfer money as well as make bill payments with a click of a button.

Also Read – 7 Ways to Earn Free Paytm Cash in 2020

Key Features of Google Pay

Pay to anyone – You can pay money to anyone. You just need UPI ID or bank details of person receiving money. The money can be transferred to UPI ID. It is not mandatory to have Google Pay app for receiver.

Bill payment – You can make utility bill payment like gas bill, energy bill, mobile bill, DTH using this app. You just need to link your biller once with this app.

No Additional KYC – This app works with your existing bank account. This means you need not to worry about additional KYC process.

Get Rewards – This app is famous for cashback and rewards. You will get e-scratch card one making transactions using this app. The rewards will directly get credited to your bank account.

More Secure – The Google Pay app is trusted and most secure app. Every transaction is secured via UPI PIN. You can lock your device using finger print or face lock. This app also provide protection from fraud detection and hacking.

Multilanguage support – This app supports major Indian languages like Hindi, English, Gujarati, Marathi, Tamil and Telugu. Due to Multilanguage support it gives better user experience to the end user.

Nearby Store Feature – You can search nearby store using this app. This app also provides information about business hours, nearby grocery store, availability of essential goods etc.

Paytm

Paytm is mobile wallet cum payments bank. You can scan QR code and make payment within seconds using this app. You can use bank account linked with your mobile number in this app. Paytm mobile app is widely used for money transfer, bill payment, mobile recharge, shopping etc.

Key Features of Paytm

Money transfer – You can do money transfer from wallet to wallet or from your bank account to any other bank account without any charge. You just need UPI id for making payment.

Bill Payment – Paytm app can be used for bill payment, online recharge, water bill, gas bill and electricity bills. You can get various offers and assured cashback while making payment using Paytm.

KYC – KYC is mandatory for transferring money from one account to other. KYC is mandatory for using Paytm. It is one-time process where you need to show your Aadhaar and other identity proofs.

Rewards – Paytm is famous for providing rewards. You will get cashback as reward in this app. It is provided at the time of bill payment or recharge. Additionally, you will also get deals and discount vouchers for using this app.

Multi Language Support – Paytm supports multiple languages. Overall 11 languages are supported in Paytm including Hindi, Gujarati and Marathi.

QR code – QR code generation and payment using QR code is one of the top feature of Paytm. You can scan QR code and make payment just by entering amount.

Google Pay or Paytm – Which one is best? – Comparison

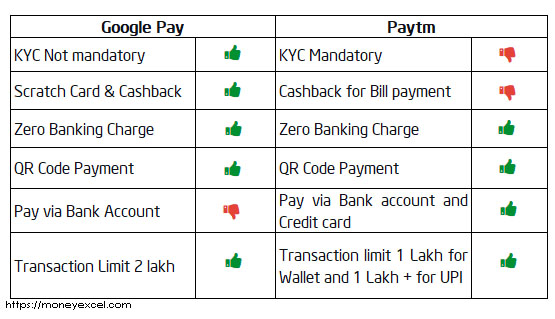

Google Pay and Paytm both are equally good mobile payment wallet. However, when we actually make comparison Google pay wins over Paytm. Key feature comparison table is given below.

Looking at key feature comparison and usage Google Pay is clear cut winner over Paytm.

Over to you

Which Mobile wallet you use for making a payment? Google Pay or Paytm? Do share your views and experience in the comment section given below.

Leave a Reply