To help small businesses manage their cash flow during COVID-19, we’ve extended our short-term cash flow pilot to Xero customers with business edition plans until 31 August 2020. It represents the next wave of innovation for Xero – moving from real-time data to predicting the future. We sat down with Penny Wildash, Product Manager at Xero, to find out why forecasting is the key to business success.

Why is cash flow forecasting so important?

Cash is the lifeblood of small businesses. No matter where you are in the world, small businesses want to know the same things. How much is in my bank account? What do I owe? What do people owe me? Can I pay my bills? Am I making a profit? Answering these questions is quite often the biggest challenge they face.

Now that businesses are dealing with the economic impacts of COVID-19, it’s even more important for them to know where they stand with their finances. Our short-term cash flow feature offers the insights they need to manage their cash flow, while giving advisors an opportunity to start deeper conversations with their clients.

How did the new feature come about?

We’ve wanted to address the problem of cash flow for a long time. But it’s such a big issue, so we had to stop and think about where to begin. There are two ways to look at cash flow: a short-term view, and a long-term one. While long-term forecasting is important, there are specialist tools by our app partners that integrate with Xero and help with those longer term planning and scenarios.

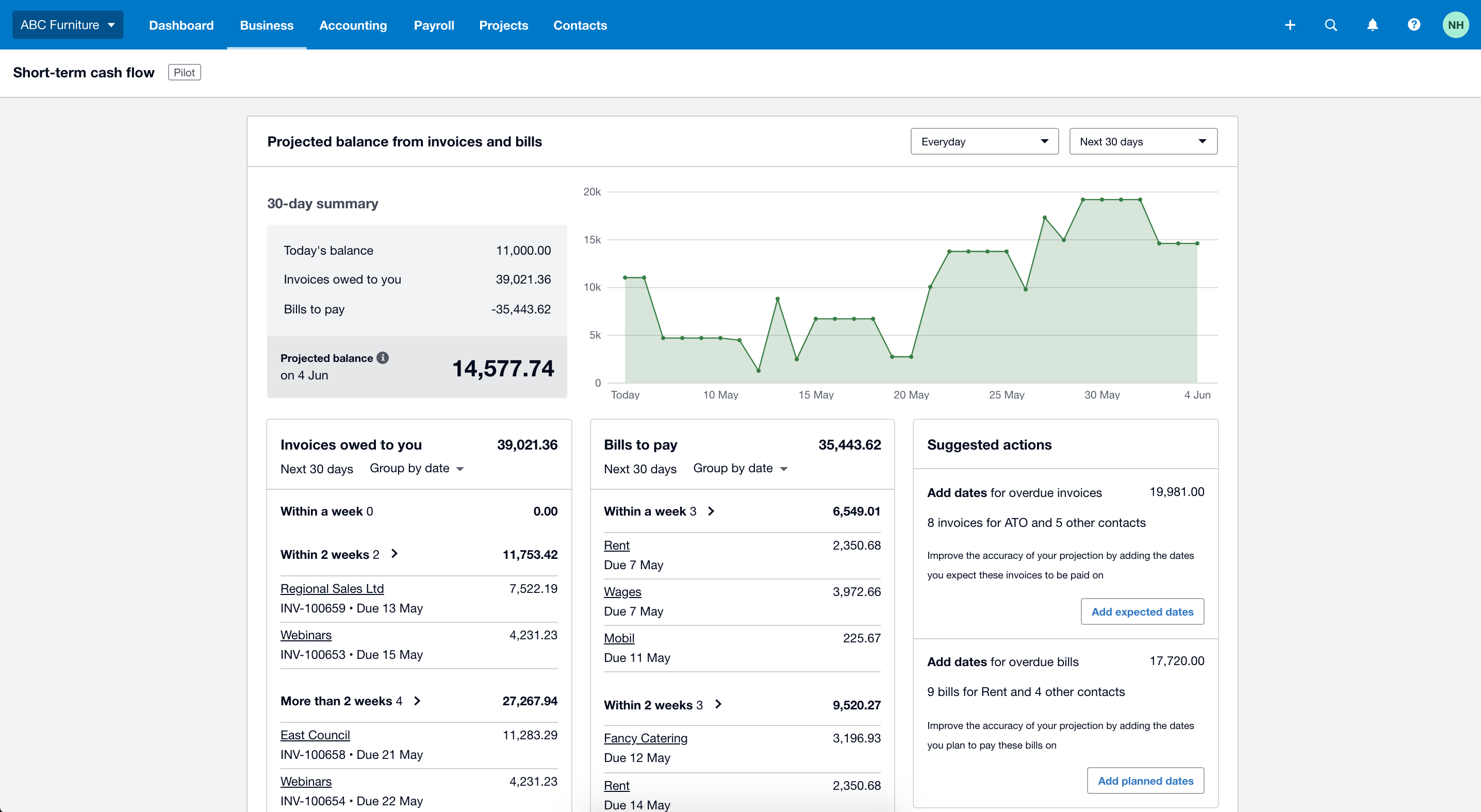

So we decided to focus on that short-term view, to help businesses manage their bank balance on a day-to-day basis. Once we had a problem to solve, we started on the discovery work. Analysing data, talking to customers, sharing concepts. We wanted to see what customers thought about our ideas. They told us it needed to be visual, real-time and offer insights to help them improve their cash flow.

How has the pilot been received?

We’ve had great feedback. People love that the feature is clean, simple and easy to understand. They really like the beautiful graphs and suggested actions, as well as the fact that it’s all within Xero. When you’re a small business owner dealing with the impact of COVID-19, you just want to go to one place to quickly get the information you need.

Accountants and bookkeepers have also found it useful as a tool to walk clients through their cash flow position and next steps. Small businesses are turning to them more than ever as they navigate COVID-19, so they really appreciate not having to pull this information together manually. It means they have more time to focus on the individual needs of their clients.

Of course, they’re also giving us really valuable feedback about what we need to improve. We’ve had a few people saying ‘well, if you’re telling me what I should do with my business, I need to understand how you’re calculating that’. So we’re working on making our calculations more transparent. But overall, they trust Xero and know we’ll build a really high-quality feature.

What’s the role of AI in cash flow forecasting?

Machine learning and AI are such broad terms, but they do play an important role in what we’re building now and the kinds of capabilities we want to build in the future. Next month, we’ll be releasing the first version of cash predictions to a small group of customers. It uses advanced statistical models that look for repeating patterns in an organisation’s weekly and monthly transaction history.

We’ve tested a few different ways of surfacing predictions, but what we’ve learned is that customers only want us to predict the predictable. They don’t want us to create predictions based on one-off things from the past. So we need to make sure we’re only showing things they can reasonably expect to happen, such as payroll and repeating invoices and bills. Of course, every business is different. Lots of small predictions may be helpful for some, but noisy and irrelevant for others.

We’re entering uncharted territory, really. Our approach is to be conservative in our predictions and iterate from there. But the team is already exploring more advanced machine learning methods to improve the predictions we’re making in the initial pilot, so we can expand on the suggested actions and give small businesses better visibility of their cash flow.

What do you value most about this work?

I have close friends that run small businesses and a partner who works in the travel industry, so I’ve seen first hand how COVID-19 has impacted lives and led to great personal tragedy for so many around the world. I think it’s important that we all look at what we’re doing and pivot our approach – whether it’s to keep our business going or support those who are struggling.

I know our team is really passionate about supporting our customers in whatever way we can during this extremely stressful time. And while it’s still early days for cash flow forecasting, we’re moving as fast as we can, because we know it’s going to positively impact someone’s life. It’s not just code and statistics. It’s someone’s ability to pay the bills and put food on the table.

Leave a Reply