With 265 million internet users, rural India is not only catching up with cities in terms of the sheer number of netizens, it is also mirroring the time spent, frequency, share of female users and mode of access with its urban cousin.

And, while internet usage might look similar on the surface, the activities which urban and rural users engage in online are different, according to data and insights by leading research firm Kantar, which were exclusively with ET.

Moreover, while urban India is close to reaching saturation levels with around 60% of the population having access to the internet, the headroom for growth in rural areas remains massive, Kantar said.

This could skew the way online companies and developers view India as a market.

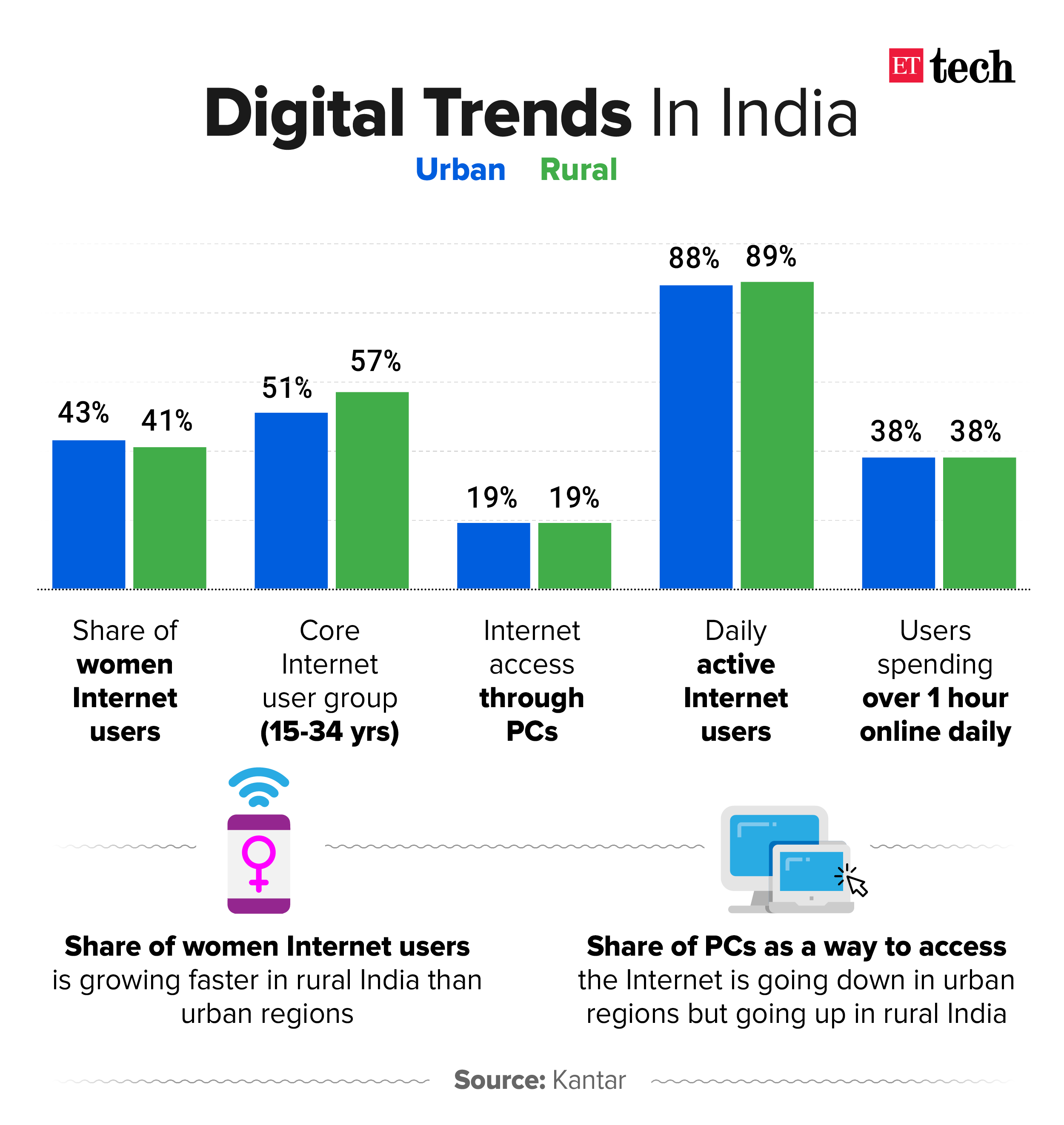

Women now make up 41% of internet users in rural India, compared to 43% in urban regions. The number of daily active users in rural India is 89%, versus 88% for cities and towns, with close to 40% of users in both regions spending over one hour accessing the internet daily.

Internet access through personal computers stands at 19% for both.

The only slight difference in demographic shows up while analysing the share of users between the ages of 15 and 34, which Kantar calls the ‘core internet user group’.

This makes up 57% in rural regions and 51% in urban regions, signalling that various age groups in the urban populace are using the internet more.

“There is not much difference in the demographic or the overall usage and duration as well. But the moment we look at the usages, there’s a significant difference. So, basically what this means is that, there are fewer activities that rural users are doing, but they’re doing it for a longer period of time,” said Biswapriya Bhattacharjee, executive vice president of the insights division at Kantar.

According to the research firm, rural users, on average, perform about 32% fewer activities than their urban counterparts on the internet.

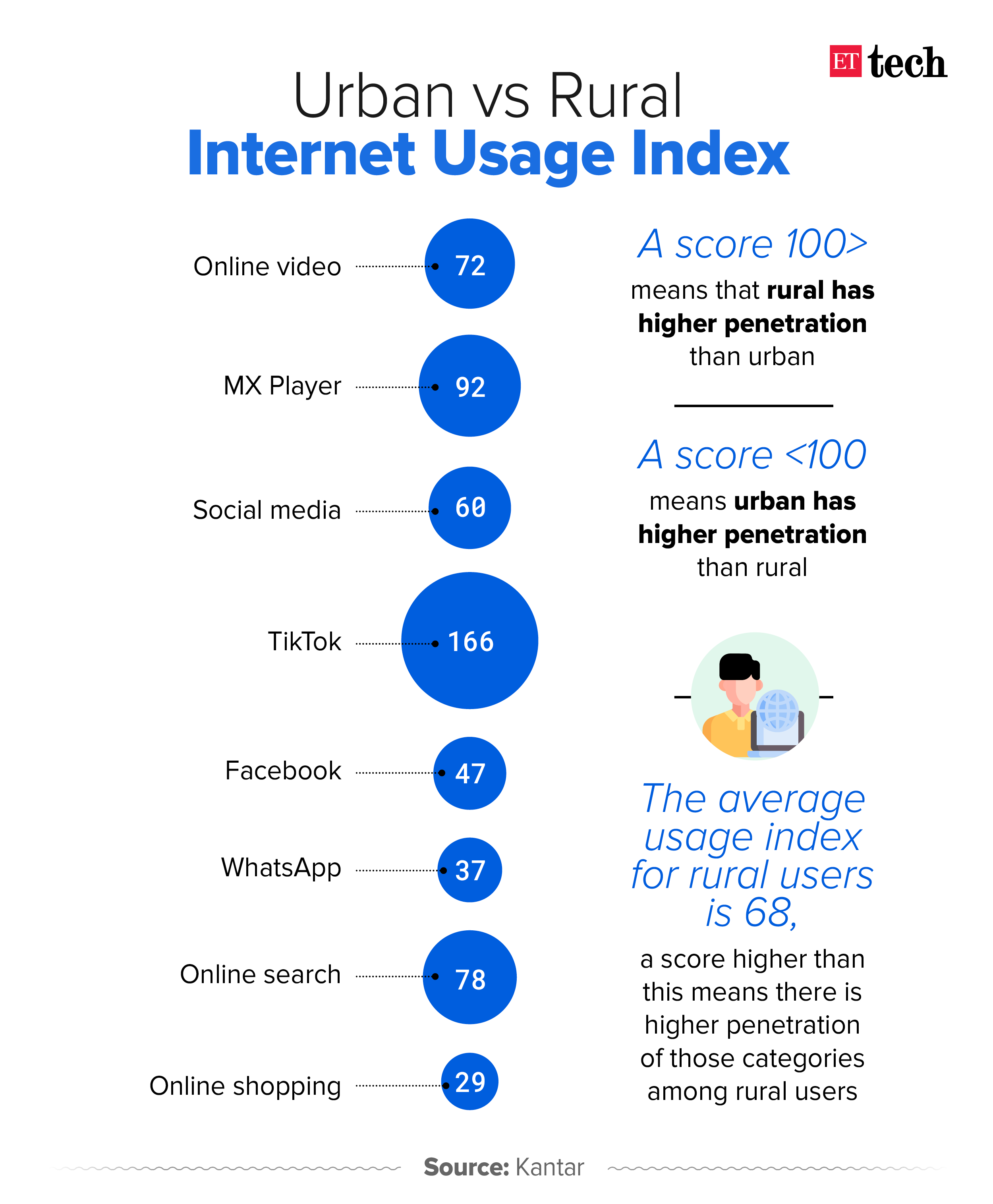

However, when it comes to activities such as watching online videos and online search, rural users cross the average usage index, meaning they are doing more of this than other activities such as using social media.

While urban users consume more video content online, apps such as MX Player* and Jio TV see almost equal reach in urban and rural India.

The biggest surprise, however, is social media, where the overall lower adoption of Facebook and WhatsApp in rural India keeps the usage index at just 60, but TikTok scores 166.

Typically, scores higher than 100 mean the reach in rural areas is higher than in urban regions, and vice versa.

The usage index for Facebook in rural India is just 47, while for WhatsApp, it is even lower at 37. The least penetrated category in rural areas is online shopping, which gets a usage index of just 29.

“Rural is all about entertainment and social media,” added Bhattacharjee. “Shopping is much more of a higher order function. It’s not that rural users are not shopping online, it’s just that the penetration is much lower than for urban users.”

(Illustration and graphics by Rahul Awasthi)

*Disclosure: MX Player is owned by Times Internet that also owns ETtech

Leave a Reply