Executive Summary

Welcome to the July 2020 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month’s edition, with special AdvisorTech consulting guests Craig Iskowitz and Kyle Van Pelt, kicks off with the news that Orion Advisor Solutions has acquired Brinker Capital for $600M to form a combined $40B TAMP, as Orion increasingly positions itself as a competitor to Envestnet with a similar portfolio-management-turned-advisor-workstation solution that in turn is becoming a distribution channel for Orion’s model marketplace and platform TAMP offering. The deal was driven by private equity firm Genstar Capital, which similarly had previously acquired the AssetMark TAMP platform in 2013 for $413M and sold it just 3 years later for $780M, though notably in this case it appears to be less about simply growing Brinker as a TAMP and more about expanding Brinker’s reach through the adoption of Orion in broker-dealer channels. The only question is whether or how many broker-dealers are actually willing and interested in changing their portfolio management and advisor desktop solution?

From there, the latest highlights also include a number of other interesting advisor technology announcements, including:

- Empower acquires Personal Capital in a deal reminiscent of Edelman Financial Engines that similarly positions Empower to end the advisor rollover bonanza by capturing plan participants with in-plan advice long before they ever retire

- Venture capital firms make big investments into Origin and BrightSide as financial planning also increasingly heats up as an employee financial wellness benefit (whose cost is validated not by the benefits of advice to the client, but the improved productivity for the business of workers with less financial stress?)

- Envestnet launches a new “Opportunities To Engage” solution to bring a Morgan Stanley “Next Best Action”-style recommendation engine to independent advisors

- New CFP Board “fiduciary tech” standards may upend historically opaque financial planning and especially insurance product illustration software

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including Mastercard acquiring account aggregation and financial API provider Finicity after losing Plaid to Visa, Apex expands its RIA custodial capabilities with a new more out-of-the-box “Extend” platform, the quiet world of advisor software surveys suddenly becomes hotly debated as inconsistent sampling methodologies show wild swings in market share, and Wealthfront announces a “New Mission” for the 2020s focused on banking as its future, effectively ending the robo-advisor movement as Betterment remains the last-robo-standing in what has turned out to be a niche solution for a subset of self-directed young investors rather than the ‘disrupt the advisor industry’ movement robo-advisors once predicted they would be.

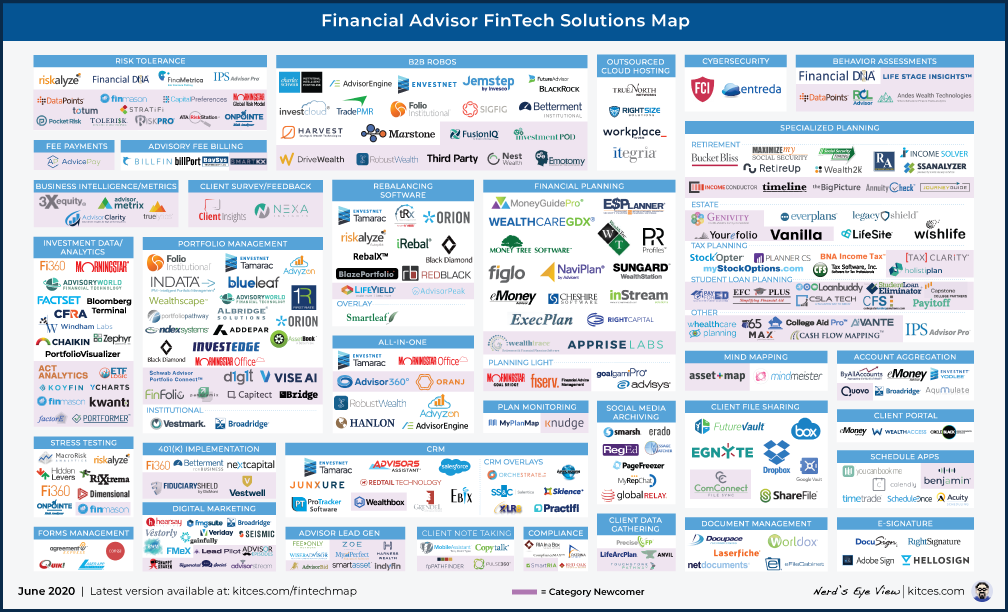

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you’re continuing to find this column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

Orion Acquires Brinker Capital For $600M As It Positions To Compete Against Envestnet As A Broker-Dealer TAMP? The blockbuster industry news headline this month was the announcement that Orion Advisor Solutions was acquiring $24.5B TAMP Brinker Capital for a whopping $600M (a near-record TAMP valuation of almost $25M of valuation per $1B of AUM!), which combined with Orion’s own nearly $15B Portfolio Solutions (formerly CLS Investments) platform will produce the industry’s fourth-largest TAMP (behind only AssetMark, SEI, and big-dog Envestnet with $185B on its TAMP platform) with over 1,000 employees. Notably, the deal also marks the entry of private equity firm Genstar Capital, which was previously an investor in competing TAMP AssetMark, and is also a current investor in both hybrid broker-dealer Cetera and RIA aggregator Mercer Advisors, which reportedly was the one that fostered the Orion/Brinker merger proposal (helping to explain rumors earlier this year that both Orion and Brinker were ‘on the block’), and is now an equal co-owner alongside existing Orion PE investor TA Associates (though it remains unclear whether or how much capital TA Associates actually took off the table, and whether they’ll be looking to re-deploy it elsewhere soon?). The crux of the deal appears to be ramping up Orion’s TAMP capabilities, both to achieve greater economies of scale in an increasingly price-competitive business where scale is crucial, and with experienced Brinker CEO Noreen Beaman to head the newly merged Orion/Brinker TAMP offering (in which Orion Portfolio Solutions will be rebranded to Brinker Capital). The deal may be particularly appealing for Orion, given its RIA-centric roots as a portfolio reporting solution in that channel, given Brinker’s greater depth in the broker-dealer channel (already the bulk of its 4,000 advisors on the platform) that is expected to produce rapid TAMP growth as brokers shift their value proposition to more financial planning advice and increasingly outsource portfolio implementation (which RIAs often scale their own in-house portfolio management offerings instead). Which means in practice, Orion is squarely positioning itself as a competitor to Envestnet and its platform TAMP offering – a combination of portfolio management technology tools and an ever-growing marketplace of both in-house (PMC) and third-party (marketplace) TAMP solutions – as Orion too combines together its CLS and Brinker offering into a $40B TAMP, and also announced this month an expansion of its model marketplace solutions through Orion Communities, all of which will be distributed through Orion’s portfolio management technology solutions (again akin to Envestnet). On the other hand, it’s notable that Envestnet itself wasn’t the buyer of Brinker – especially after it acquired FolioDynamix a few years ago for $195M to similarly expand its portfolio-management-plus-TAMP technology capabilities in the broker-dealer channel – raising the question of whether new CEO Bill Crager simply doesn’t have the industry-legendary acquisition appetite of former CEO Jud Bergman (who tragically passed in a car accident last year), or if Envestnet already sees its own future as going beyond TAMP distribution with its recent efforts to expand into insurance and annuities (with its Insurance Exchange) and banking and lending (with its new Credit Exchange). At the least, though, the Orion/Brinker deal both cement the increasingly inextricable link between technology and TAMP/asset management solutions, and the idea that technology doesn’t necessarily just facilitate asset management but can actually become an asset management distribution channel (it was, after all, Orion acquiring Brinker, and not the other way around!?)… and that the opportunity to distribute asset management through technology is so significant that it can help a sizable TAMP to earn a significant strategic acquisition premium on its valuation in an otherwise increasingly commoditized TAMP business. As in the end, the real key to the Orion/Brinker transaction will not simply be the ability of Brinker to distribute its asset management strategies further into the broker-dealer (or crossing over further into the RIA) channel, but whether Orion can gain market share over Envestnet’s ENV2 and Tamarac offerings to become the advisor dashboard and portfolio management platform through which Brinker can gain additional adoption?

Commonwealth’s Advisor360 Spin-Off Prepares To Ramp Up With (Insurance?) Broker-Dealer Enterprises With New Enterprise-IT CEO. For the past 20 years, the world of independent advisor technology has exploded, driven by the rise of the internet and APIs that can allow ‘any’ software to connect with any other. The significance of the rapidly expanding ecosystem of independent software solutions is that in the past, it was only the largest firms with the greatest economies of scale that could sufficiently reinvest into quality technology, while today it’s standalone providers like eMoney and MoneyGuidePro have 10s of thousands of users, far more than the largest wirehouse (or even all of them combined!), and providing independent software platforms the widest base of advisors across which they can reinvest for future. In fact, it’s the expanding reach capabilities, and the opportunity to amortize development costs over a wider base of advisors, that drove last year’s shift of broker-dealer Commonwealth to spin off its previously-proprietary advisor technology platform – dubbed Advisor360 – into a standalone offering and then begin to license it to other broker-dealers. The pivot turned heads at the time, as Commonwealth has consistently ranked at the top of User Ratings for broker-dealer technology in the T3 Advisor Tech Survey… raising questions of whether Commonwealth was spinning off its ‘secret sauce’. Yet shortly thereafter, the company announced a massive deal with MassMutual that instantly expanded Commonwealth’s base of advisors using the technology from 2,000 to 11,000+, demonstrating both the demand amongst the largest enterprise broker-dealers (and legacy insurance carriers) for a more cost-effective integrated technology platform, and Commonwealth’s opportunity to rapidly scale its offering into the new market. And now, consistent with this big-enterprise focus, Commonwealth’s now-standalone Advisor360 platform is announcing a new CEO to lead the business – Richard Napolitano, a serial entrepreneur with several successful technology exits (to the likes of Adobe and HP), and a former President of Sales for Sun Microsystems and President of EMC’s $4B software storage division. In other words, Commonwealth and Advisor360 chose not to hire a financial services industry or ‘WealthTech’ executive, but someone with deep experience in large-enterprise software solutions, a signal both of Advisor360’s growth aspirations, and what appears to be a particular focus on the largest (insurance-based?) broker-dealer enterprises (rather than the increasingly popular independent RIA channel). In addition, it’s notable that while more and more technology for broker-dealers is built to facilitate asset management distribution – from Envestnet, to the recent Orion/Brinker deal – Advisor360 is ‘simply’ positioning itself as an enterprise software solution for large enterprises, giving it an increasingly unique positioning in an otherwise crowded marketplace competing for the enterprise advisor’s dashboard (and perhaps especially appealing amongst insurance broker-dealers that are more likely to offer their own proprietary insurance and investment solutions anyway?). Ultimately, it remains to be seen whether Advisor360 can string together more big deals on the size and scale of MassMutual, given the immensely complex sales cycle and transition effort it details. But given the hire of Napolitano – and his experience in large-scale enterprise sales and deployments – Advisor360 is clearly betting that it can. Time will tell?

Does Merrill Lynch’s New Client Engagement Workstation Show A Wirehouse Advantage For The Next Generation Of Advisor Workstations? Back in the 1980s and 1990s, technology was difficult and expensive to produce and required great economies of scale… such that the leading technology solutions were found at the largest advisor platforms (e.g., wirehouses), while the independent advisor community struggled with a lack of any technology at all beyond a series of ‘homegrown’ solutions that the early independent firms built for themselves and then sold to their peers. However, the growth of the internet, and the rise of Application Programming Interfaces (APIs), turned this dynamic upside down, as independent software providers could connect together a growing ecosystem of other independent solutions for a rapidly growing independent channel and achieve economies of scale… to the point that today, independent financial planning software platforms like MoneyGuidePro and eMoney Advisor each have almost as many financial advisor users as all the wirehouses combined, and even some of the leading ‘proprietary’ software platforms like Commonwealth have been compelled to spin off their (Advisor360) software into an independent solution to amortize its future development costs across a wider base of advisors than ‘just’ its own. However, the growth of the independent software ecosystem has not been without its challenges, in particular around the lack of consistent data standards, and an exponentially growing number of API connections that need to be made to connect “everything” with everything else… such that while anything can be connected to almost anything else, in practice most independent technology is not actually very deeply integrated with more than a select few preferred providers or key ‘hubs’. Which raises the question of whether the opportunity for superior advisor technology may now shift back to the wirehouses, whose everything-under-one-roof unity of data, combined with what is still a sizable base of 15,000+ advisors (at least for Merrill Lynch and Morgan Stanley), makes it possible to actually build the all-in-one advisor workstation that independents struggle to cobble together. A good case-in-point example is the recent launch of Merrill Lynch’s new Client Engagement Workstation (CEW), which brings together on-platform account servicing and trading tools, unified client information, and client action items and workflows, along external market data about client portfolios, into a single dashboard… and then analyzes all the data to provide Next-Best-Action-style “Insights” to spot new opportunities for client engagement (from products and solutions that Merrill offers, to planning opportunities like charitable giving strategies). In other words, while in theory independent advisor technology can make the advisor workstation of the future by weaving together an entire ecosystem of solutions, in practice, it’s hard to get everyone to play well together in the sandbox… while wirehouses that own and control all the data and development of their entire sandbox are suddenly emerging as leaders able to actually build and deliver the next generation of the advisor workstation?

Envestnet Launches “Opportunities To Engage” Recommendation Engine As Next Best Action For Independent Advisors. When robo-advisors first arrived on the scene in the early 2010s, their vision was to take all the advice that human financial advisors provide, reduce it to an algorithmic recommendations engine, and deliver those recommendations directly to consumers at a fraction of the cost (by eschewing the human financial advisor altogether). Yet the caveat is that, in practice, this robo-advisor approach effectively assumed that all financial problems can be boiled down to “problems of information” – where if consumers are just provided with the right information, they’ll immediately take the right and correct action. But in reality, just as releasing a website that says “eat less, exercise more” doesn’t solve the world’s obesity problem, providing information on the hazards of lung cancer hasn’t eliminated smoking, and having a never-ending stream of “How-To” workout videos on YouTube hasn’t put the Personal Trainer out of business, most people’s financial difficulties aren’t problems of information alone. Instead, while information is necessary (it’s hard to lose weight if you don’t know how body mechanics work, and it’s difficult to save and invest if you don’t understand how markets work), the information alone isn’t sufficient, and there’s still no substitution for the power of another human to help us think differently about what’s possible, and then hold us accountable to help us make the changes we need to make. Accordingly, the real opportunity of “robo” technology tools is not to automate the human being out of advice… but instead to augment the human being to both give better advice, and to help spot the opportunities to provide advice in the first place (which can be heavily automated in a world of account aggregation!). Accordingly, Morgan Stanley made waves two years ago when it launched its “Next Best Action” solution, where the wirehouse’s technology would monitor its immense amount of continuously flowing client data and then nudge its advisors to focus on the ‘next best action’ for a particular client, from spotting idle cash to be invested, an over-concentrated position to be trimmed, an investment that needs to be rebalanced, or some other financial planning opportunity. And now, Envestnet has announced its own version of Next Best Action for the independent advisors on its own platform, dubbed “Opportunities To Engage”, which similarly will monitor data about the advisor’s firm and their clients to spot opportunities where clients may be engaged around planning opportunities. The significance of “Opportunities To Engage” for Envestnet, though, isn’t merely the value to the advisor themselves to have software that more proactively spots planning opportunities with clients, but its ability to leverage its Yodlee acquisition as Envestnet pivots to become a ‘platform of platforms’, from its existing Exchange of third-party managers, to its new Insurance and Annuity Exchange, and its coming Credit Exchange, providing an ever-widening list of product solutions that advisors can recommend to their clients. In other words, in the future, Envestnet might not only provide nudges to advisors about planning opportunities for clients, but outright show how the client’s underperforming investment manager might be replaced by another on the Envestnet platform with better performance in a similar strategy, how a client’s insurance policy might be replaced by one from the Envestnet Insurance Exchange with lower premiums, or how a client’s mortgage could be refinanced today at a lower rate through Envestnet’s credit exchange… where Envestnet becomes the platform shelf (compensated by the product manufacturers for distribution), Opportunities To Engage is the engine to ‘spot deals’ for clients, and the advisor delivers those value-add opportunities to clients for implementation (and earns their fees with the value or cost savings the client receives in the end).

After Years Of Limited Success With Front-End Partnerships, Apex Builds Its Own To Extend Into The RIA Custody Business. Apex Clearing has been trying to establish a beachhead in the world of wealth management for years. As while they have been very successful with digitally native startups getting off the ground – they were the back-end for the early stage launches of Betterment, Wealthfront, and Robinhood – Apex has struggled with those digital startups leaving (as Betterment, Wealthfront, and Robinhood all left and built their own back-ends) at the very point that they started to reach a size and scale that would have been ‘very interesting’ wealth management opportunity to Apex. At the same time, Apex has struggled to gain traction in the independent RIA wealth management channel, initially trying to gain distribution through partnerships with so-called “B2B robo-advisors” that offered a front-end advisor and client experience to pair with Apex’s back-end custody and clearing APIs (e.g., Investcloud, Harvest Savings & Wealth [nee Trizic], AdvisorEngine, and Envestnet/FolioDynamix), as these ‘digital wealth’ platforms just haven’t picked up steam either (largely because advisors don’t seem to want to pay for an independent front-end workstation platform, and instead simply expect their RIA custodians to provide such tools as part of their own interface). And so… enter Apex Extend, where Apex has built its own front-end advisor interface to share directly to (enterprise) financial advisory firms and institutions. As while Apex has always offered a modern API-driven custody solution, the APIs were a bit complex to build to, and in practice seem to have deterred larger organizations from building these solutions directly with Apex. After all, digital advice solutions have at least historically been associated with small accounts, which means when considering those solutions, enterprises are extremely cost-conscious. After plugging in Apex custody fees, and a digital advice provider’s fees, the math didn’t pencil to be profitable enough for the expected effort. Which Apex aims to solve with Extend, providing a more out-of-the-box solution that (enterprise) financial services firms can white label. Thus now, a large fund manager – or even a sizable RIA or hybrid broker-dealer – can go to market with a digital advice offering built entirely on Apex technology, but still leveraging their brand. In addition, it wouldn’t be surprising to see a few press releases come out in the near future where Apex partners with non-financial institutions to launch digital wealth products using Extend (e.g., “robo-advisors” attached to other types of tech companies that have significant reach but would need a purely out-of-the-box robo solution, echoing the calls years ago of whether a player like Amazon or even Snapchat might someday enter the robo-advisor space?). From the advisor perspective, though, the real question is whether Apex Extend can position Apex more competitively in the ‘traditional’ RIA custodial business that is seeing record numbers of advisors at least “exploring new options” after Morgan Stanley acquired E*Trade and Schwab announced the acquisition of TD Ameritrade, particularly for mid-to-large-sized RIAs (or larger hybrid broker-dealers?) that have some tech savvy and want an RIA custodian that will be more flexible in integrating directly to their own proprietary tech stack.

Financial Planning Delivered Through Employer Channels Heats Up As Origin Raises $12M and BrightSide Raises $35M. As with any product or service, consumers will only pay for financial planning advice when they perceive enough value in that advice to be worth the cost. In the world of individual financial planning, this has led to a growing focus on figuring out best to explain the value of financial planning and justify its cost, and what advisors need to do to deliver more value to their particular target clientele. But “provide enough value in financial advice to justify the cost of that advice” isn’t the only business model to validate the cost of financial advice; instead, because financial problems have real-world costs, from relationships (financial problems are the leading cause of relationship stress and divorce) to health (a physical manifestation money-induced stress) to productivity (as financial problems distract employees in the workplace), solving one of those indirect costs of financial distress can also generate a “Return On Investment” that makes it worthwhile to pay for financial planning. In fact, one recent study estimated that in the aggregate, almost 50% of the U.S. workforce is experiencing financial stress, leading to nearly $500B in lost productivity for employers, and other research has found that financial stress can be costing employers $1,900/employee to as much as $4,000 per employee in lost productivity through both financial distractions during the workday or outright employee absenteeism. Which means, in turn, that there’s an economic opportunity in the workplace to deliver financial advice to employees, simply to enhance the business’ worker productivity (not to mention the actual value of the advice to the end employees themselves). Accordingly, in the past month, several new startups have raised significant venture and Series A rounds seeking to work with employers to deliver financial planning as the workplace as an employee benefit validated by the employer productivity benefits, including Origin (which makes financial planning advice available to employees for a flat $6/month/employee in a ‘pre-paid legal’ style model), and also Brightside (which not only provides advice, but is seeking to make more direct financial wellness enhancements, such as creating a system to route money directly from an employee’s paycheck to their otherwise-unsecured loans in exchange for negotiation a lower interest rate on the lower because it’s now ‘secured’ by the employee’s paycheck). In fact, Brightside has even attracted the attention of the vaunted venture capital firm a16z, which led its recent $35M Series A round (and signals the VC view that financial planning is now deemed to be a Big Business opportunity in the workplace channel). Notably, though, the recent initiatives from Origin and Brightside appear to be substantively different than others like Edelman Financial Engines or the recent Empower Personal Capital, in that they’re not necessarily about adding human financial advice overlaying a plan participant’s 401(k) balance, but a more holistic (and likely more household-cash-flow-based) style of personal financial advice (recognizing that for most Gen X and Gen Y workers today, their primary financial challenges are not tied to their investment accounts and their balance sheet, but their cash flow and household spending). Still, though, to the extent that comprehensive financial planners have historically focused primarily on the top 10% of households or so, employer workplace financial planning has a real opportunity to expand financial advice to groups that in the past have had limited access to professional advisors, while simultaneously being able to justify its value with a different kind of (employee, not end-client) value justification that could make it more economical to service such clients in the first place?

Empower Retirement Mimics Financial Engines By Acquiring Personal Capital For $1B To Bring Human Advice To 401(k) Plans. Recordkeeping and other qualified retirement plan services have been under intense competitive pressure over the past decade, with a combination of new technology pressuring outdated back-office systems, and a growing spate of 401(k) fiduciary lawsuits that have put recordkeeper pricing and cost structures under a microscope, leading to a giant wave of consolidation as even the biggest players try to get bigger and achieve better economies of scale. Thus was the journey of Empower Retirement itself, born of a 2014 merger of the recordkeeping services of Great West Financial, JP Morgan Chase, and Putnam Investments, that is now the second-largest retirement services provider with $656B of assets under administration for 9.7M workers across nearly 40,000 workplace retirement plans. Yet the challenge is that while more size with better economies of scale, plus better technology to improve efficiencies, may over time help recordkeepers to stay competitive, it nonetheless remains a brutally challenging environment with ongoing fee compression pressure as far as the eye can see. Which helps to explain why this week, Empower Retirement announced the acquisition of Personal Capital, an independent RIA with $12B of AUM that was often dubbed a ‘robo-advisor’ but in practice was a human-based advisory firm that had simply built its own proprietary technology to serve clients efficiently. The distinction that Personal Capital was not a robo-advisor is important, because it practice it didn’t charge robo-advisor fees, either, and in fact was able to grow to $12B of AUM charging ‘human advisor’ fees that started at 0.89% (or more than 3X the going rate of robo-advisors) for a more holistic advice offering. In other words, Personal Capital proved out that there is at least a subset of consumers that will pay for human advice far above what technology alone can provide… a lesson for robo-advisors that it seems Empower hopes to implement in the 401(k) channel to similarly expand their own revenue and margins with a (human) advice offering for a subset of their plan participants. In fact, in the end, arguably Personal Capital’s greatest success was not merely its ability to deliver human advice leveraged with technology – which virtually any and every human-based RIA does today with a wide range of AdvisorTech solutions – but instead its ability to distribute its Personal Financial Management (PFM) tools to consumers for free and turn them into clients. As in practice, Personal Capital’s primary marketing channel for its 22,000+ clients and $12B of AUM was the 2.5M people (with $771B of assets being tracked) that used their free software, an effective conversion rate of about 1% of users and 1.5% of tracked assets. Which in the context of Empower’s existing user base, means the potential for Personal Capital to be deployed as “financial wellness” technology that upsells Empower’s defined contribution plan participants… which at similar conversion rates, could produce another $10B+ of AUM for Empower (or even more when considering the potential to bring in outside non-Empower assets), and may help to justify the otherwise eye-popping valuation of $1B on ‘just’ a $12B AUM (which would amount to approximately 10X revenue, drastically higher than the 2X revenue valuation typically applied to the RIA model). Furthermore, the ability to offer an ‘in-plan’ 401(k) human advice offering also reduces the risk that plan assets roll out when those plan participants retire – or at least, if they do roll over, it’s simply to an IRA still managed by their same Empower-Personal Capital human financial advisor. In other words, similar to the Edelman Financial Engines deal back in 2018, the Empower/Personal Capital deal is another example of retirement plan providers rolling out a human advice offering to its plan participants, both as a way to sell a higher-value, higher-priced, and higher-margin advice service to an increasingly commoditized retirement recordkeeping business, and also to retain (and prevent the roll-out) of retirement plan assets at retirement. As a result, the Empower/Personal Capital deal isn’t just notable in the context of the competitive environment amongst 401(k) plans (with others like Fidelity similarly rolling out more and more advice services to their 401(k) plan participants)… the growing trend could also signal a growing risk to independent advisors that the 30-year bonanza of building businesses through 401(k) rollovers may soon be coming to an end, as the previously-unadvised 401(k) plan participant of the future may already have a multi-year existing relationship with a human financial advisor who can retain provide retirement advice to retain their business long before they ever hit the radar screen as a prospect for an independent advisor in the first place!

Mastercard Acquires Finicity After Losing Plaid To Visa As Account Aggregation Shifts From Wealth Management To Big Banking. The blockbuster FinTech news back in February was the announcement that Visa was acquiring Plaid for a cool $5.3B, with an eye to turning the company’s account aggregation and financial APIs away from ‘just’ reporting on a household’s financial situation and into actual triggers for financial transactions (e.g., using account aggregation comparisons to identify opportunities to actually open a new bank account or credit card with better rates, and processing the account opening itself). For Visa, the acquisition arguably marks a turning point both for account aggregation FinTech, and for Visa itself to pivot into a new world of “Open Banking” with financial-API-driven client acquisition; for Mastercard, though, the Plaid deal can be simply summed up as “the one that got away”. Accordingly – and with all due respect to Finicity, and the remarkable business that they built – it appears that after Mastercard lost the bidding war for Plaid, and could not be stuck holding the bag forever, they scooped up Finicity (which competes with Plaid in the world of account aggregation and financial APIs) for a billion dollars to keep pace with Visa. Yet notably, the sky-high valuations (the word on the street is that Mastercard paid 50x sales for Finicity, just as Visa did for Plaid) of these account aggregation and financial API deals come from the broader applications to financial services. To some extent, there’s simply the value of the data itself – harvesting the data from Finicity is valuable, and so is the ability to get even deeper competitive insight into Visa volume through Finicity’s lens as well. And while $1B is an eye-popping number, it is a fraction of Mastercard’s quarterly EBIDTA, for which in return, they get a ton of upside, moving from ‘just’ being a clear leader in the payment processing space to Finicity allowing them to participate in the upside of other markets such as: banking and Investing (only about 5% penetrated by companies like Finicity and Plaid, but a $650M total addressable market serving clients like Robinhood, Betterment, Coinbase and Acorns); Lending (a $1B market that is only about 2% penetrated serving clients like LendingClub, EarnIn, Quicken and Navient); the next wave of payments (companies like Venmo, Square, Stripe and Transferwise have only penetrated about 3% of this space); Personal Financial Management (Mastercard now has the opportunity to participate in the penetration beyond 4% of a $350M market with companies like Credit Karma and Clarity Money); and a $200M business services market (competing with the likes of Intuit, Gusto and other payroll services). And of course, the international market opportunities abound as well. From the financial advisor perspective – who are traditionally more focused on asset management and investment accounts – the reality is that the banking and money movement revolution (embodied by the Mastercard/Finicity deal) may soon begin to spill over into the advisory space as well. For instance, the deal is also a nod towards the rise of companies like AdvicePay, and RightPay from Right Capital, bringing automation to the process of billing advice fees that must come from bank accounts or credit cards instead of investment accounts, and both representing bets on a future that more and more advice will be delivered via a transaction that can be done via a bank account or a credit card (and it’s pretty hard to process a payment today that doesn’t touch Mastercard or Visa’s credit card products). And may also simply bode well for the potential of being able to move money more quickly from one account to another (e.g., the client that wants to open an investment account and might soon be able to transfer the cash from their existing bank account ‘immediately’ and easily from their smartphone, akin to apps like Venmo that may enable a new wave of ‘robo-advisor’ automation tools for advisors?).

Original Robo-Advisor Wealthfront Completes Pivot Away From Robo Advice With New (Banking-Based) Mission. When robo-advisors first arrived on the scene in the early 2010s, the mantra was that “human advisors are expensive and charge ‘an arm and a leg’”, while technology (that they built) can design and implement the same portfolio for a fraction of the cost… and assuming that consumers would then virally flock to their lower cost alternative. Yet in practice, as robo-advisors quickly discovered, human financial advisors already use technology to largely automate portfolio implementation and rebalancing (we call it rebalancing software and have had it since 2005!), and the bulk of what financial advisors are paid is actually to find and get those clients in the first place… as asking a consumer to transfer their life savings to manage is not an “if you build it they will come” solution. In other words, the real reason financial advisors struggle to charge lower fees or serve a wider range of clientele isn’t the cost to create and implement portfolios for clients, but the client acquisition cost to market and get those clients in the first place (an average of $3,119 per client according to the latest Kitces Research study!), and robo-advisors had brought an operational efficiency knife to a client acquisition gunfight. The end result was that in the years that followed, most robo-advisors were wound down, sold, or pivoted away to the B2B channels, with only the early originals – Betterment, and Wealthfront – remaining in the race. And even amongst those players, Wealthfront’s growth has slowed in recent years, crossing $10B and then $11B of AUM in 2018, but climbing to only $13.5B today (nearly 2 years later), with the rest of its growth to more than $20B of total assets on platform coming from a new banking offering with high-yield cash (that separately pulled in nearly $10B+ for Wealthfront in just 2019 alone!). Accordingly, last year Wealthfront began to pivot away from investment management as its primary product focus, and towards a new initiative dubbed “Self-Driving Money”, where its technology will help consumers automate the process of directing their money to wherever it would be best suited (e.g., automating the process of saving, managing bill paying and spotting expenses to trim, etc.), and acquiring the technology and financial planning team from Grove to accelerate the transition. And now, Wealthfront has “officially” announced its New Mission to disrupt banking – no longer financial advice – through its Self-Driving Money solution to make it easier for consumer to manage all their finances. From the perspective of the robo-advisor trend, Wealthfront’s pivot arguably marks the end of an era, where the only remaining pure robo-advisor play of a decade ago is Betterment, that has finally reached cash flow breakeven and is growing but arguably only as a ‘niche’ solution (the one player left standing) and not a mainstream disruption. And ironically, perhaps Wealthfront’s greatest investment management legacy as a robo-advisor will be the one it never fully capitalized on – not democratizing investment management through technology, but democratizing Direct Indexing, which until Wealthfront was limited to only a subset of ultra-HNW solutions like Parametric’s Custom Core, but now is becoming an increasingly mainstream solution viewed as the ‘next big thing’ to disrupt mutual funds and ETFs (even though Wealthfront showed it was possible but didn’t succeed in distributing the solution disruptively). Still, though, to the extent that financial advisors themselves are arguably overly focused on the “balance sheet” (e.g., household assets, and investable assets in particular) while the average person is more likely to need advice about their cash flow and household expenditures, Wealthfront’s pivot is even more on target to the opportunity of truly expanding financial advice and guidance to underserved consumers (or at least, automating away the unnecessary and unproductive choices through Self-Driving Money!). And most financial advisors themselves would likely agree that the traditional banking industry is sorely in need of some disruption as well. In the meantime, though… may the robo-advisor movement Rest In Peace.

Tegra118 Acquires RetireUp’s Financial Planning And Insurance Optimization Tools. Will A Second Bite At The Planning Software Apple Finally Deliver The Ultimate Holistic Wealth Experience? Insurance broker-dealers have struggled for years with bifurcated user experiences between wealth and insurance products. Advisors complain that they must navigate two completely different account opening processes while clients wonder why their portals don’t display both investments and insurance products. Envestnet has a twelve-month head start building out this functionality after snapping up PIEtech’s MoneyGuide for $500 million, which has robust insurance planning functionality that we expect to be combined with their Insurance Exchange launched last year to connect carriers directly to advisors. The first acquisition for Tegra118 hits the wire just four months after private-equity firm Motive Partners finalized its purchase of 60% of Fiserv’s investment services unit and relaunched it as a standalone company. Motive paid a premium, shelling out $510 million for their share of the business, yet they have quickly opened their wallets to show that they understand the new entity will need additional firepower to remain competitive. The RetireUp deal comes exactly ten years after Tegra118’s previous acquisition of a financial planning software vendor AdviceAmerica, which brought them robust planning tools and a decent proposal generation system, but suffered from a lack of investment from Fiserv corporate and eventually fell behind the competition as their user interface grew stale. However, Tegra118 was successful at integrating AdviceAmerica into their enterprise managed accounts platform, making it one of the few on the market that could deliver a centralized model management infrastructure that a broker-dealer home office could use to automatically deliver internal models to their advisors and maintain consistent investment strategies at scale. Their platform’s scalability has long been at the core of Tegra118’s value proposition and drove their success in both the broker-dealer space (10 of the top 12) and asset management (10 largest firms), but the one segment that Tegra118 has not been able to break into is insurance broker-dealers. A four-way battle has developed to provide wealth systems to insurance firms between pure technology players like Tegra118, enterprise TAMP vendors like Envestnet (Advisor Group), broker-dealer developed platforms like LPL Financial’s ClientWorks (which power’s Equitable’s wealth infrastructure) and Advisor360 (which is licensed by MassMutual and recently spun off from Commonwealth Financial) and RIA custodians like Pershing and Fidelity (used by Lincoln Financial). This is where RetireUp could be the key, since they have a unique digital account opening capability that is integrated with dozens of insurance carriers and can pre-fill the myriad of forms and electronically deliver them to the correct providers. RetireUp, which is based in Libertyville, IL, closed a deal to become part of LPL Financial’s Vendor Affinity Program last October and has spent the past few years bolstering its product offerings with its own acquisition of RepPro, a smart forms and digital business execution platform, and has steadily built out their line of annuity products from a range of providers. If Tegra118 can combine RetireUp’s insurance onboarding workflow with their existing managed accounts process, it could deliver a unified experience that insurance broker-dealers would be very excited to see. But with Tegra118 under pressure to integrate RetireUp’s tools into their enterprise workflow as well as market their new brand and grow their revenue enough to show promise of a future return for Motive and operate in a post-COVID environment where enterprise firms might delay large scale conversions, can they convince any of the top insurance broker-dealers to seriously consider their new offering?

Will The Real Advisor Software Survey For Market Share Please Stand Up? The world of financial advisors is incredibly fractured, with 50,000 advisors amongst the four major wirehouses, but then nearly 150,000 more scattered amongst 3,800+ broker-dealers (from independents to regionals to insurance broker-dealer subsidiaries), not to mention more than 30,000 SEC- and state-registered investment advisers, and countless more advisors working for insurance companies. The end result is that not only is it remarkably difficult just to count how many “financial advisors” there actually are (especially in a world of multi-licensed insurance agents with broker-dealer affiliates who are also dually-registered as investment advisers), but it’s even harder to understand the trends of advisor technology adoption when there are so many different advisors across so many different channels (and spanning mega enterprises to solo entrepreneurs). Over the years, a number of “Advisor Tech Software Surveys” have emerged, the longest-standing of which is the Financial Planning magazine annual Tech Survey. However, as a result of what appears to be a declining focus in putting resources towards the survey, this year Financial Planning’s survey reached a problematically low nadir of just 225 advisors (down from 350 in 2019 and over 3,000 a decade ago), and in turn was split across so many channels that the entire survey included only 29 standalone independent RIAs, 9 wirehouse advisors, while (over-)sampling nearly 50 advisors in banks and credit unions; in fact, fewer than 125 of the advisors had any affiliation to a traditional wirehouse, broker-dealer, or RIA (the rest in banks, insurance companies, or the 15% in an ambiguous “Other” category)… raising serious questions about whether the survey is representative of much of anything, and being called out by advisor tech guru Joel Bruckenstein for bizarre results like an indication that MoneyGuidePro’s market share crashed from 65% to 7% in the past year (the year that Envestnet bought it for half a billion dollars, which, if actually true, would be a multi-hundred-million-dollar writedown for Envestnet!). In fact, Bruckenstein several years ago created his own “T3 Advisor Technology Survey” after breaking away from the Financial Planning survey. Yet while the T3 survey draws from a far wider sample – literally thousands in the latest 2020 survey – it too still struggles with inconsistent sampling through the historical use of an “open” survey link that software companies themselves help to distribute (which increases the sample size, but also effectively turns the representation of market share into a “turn out the vote” exercise for the tech vendors, that in turn has occasionally led to wild swings in T3’s market share data, such as where Redtail’s market share leaped from 19% in 2018 to 57% in 2019). In turn, other providers in recent years have begun to develop their own surveys, from RIA In A Box’s survey of its 1,600+ advisors (a healthy sampling, but almost exclusively of small-to-mid-sized RIAs that themselves are only a fraction of the total advisor landscape), to the Investment News Advisor Tech Survey (which in 2019 also surveyed ‘just’ 272 advisory firms). Arguably when it comes to advisor software ratings – i.e., do advisors like their software – T3’s multi-thousand advisor response rate at least gives a solid base of feedback about what software advisors like the most. Still, though, with various advisor software surveys showing 10% – 20% swings in market share (and sometimes more) from year to year or from one software survey to the next – almost all of which is a result of their own dissimilar or internally inconsistent sampling methodologies – it remains remarkably difficult to answer the simple question: which advisor technology tools are actually growing, or shrinking, their market share?

Will The CFP Board’s New Fiduciary Standards For Advisor Technology Kill Black Box Insurance Product Illustrations? If there’s one thing that computers are good at, it’s crunching numbers; as while the industry debate continues about whether or how much financial advice will be delivered in the future by ‘robots’ versus humans, the calculations that underlie such advice has long since transitioned to the digital realm, with more and more financial advisors relying on third-party financial planning software or at least leveraging Excel for their financial planning projections, and relatively few ever still pulling out their trusty HP-12C calculators. Similarly, when it comes to evaluating financial products – particularly the complex ones like life insurance – product illustrations have long been the domain of software that produces the illustrations and models their underlying ‘moving parts’. Of course, the caveat is that even when software does the number-crunching “work”, the financial advisor is still expected to know and understand what the software has produced in the course of using that software output to make a recommendation. And in its latest update to the Standards of Conduct and Code of Ethics, the CFP Board is now requiring CFP professionals to fully understand their technology as one of the 15 Key Duties of being a CFP Fiduciary, including that the CFP Professional “must exercise reasonable care and judgment when selecting, using, or recommending any software, digital advice tool, or other technology while providing Professional Services to a Client”, “must have a reasonable basis for believing that the technology produces reliable, objective, and appropriate outcomes”, and most importantly “must have a reasonable level of understanding of the assumptions and outcomes of the technology employed”. In other words, it will no longer be permissible for CFP professionals to simply accept “black box” software output without some evaluation of its reliability and objectivity, and without understanding the assumptions being used and how the output is produced. Notably, this doesn’t necessarily mean that advisors must independently deconstruct and re-calculate software output. Though it may someday stoke the creation of a third-party provider who can put its stamp on technology vendors for their “reliable, objective, and appropriate outcomes” to give advisors their requisite “reasonable basis” beyond just taking the vendor’s word. And it does create more of a challenge when it comes to the software used for product illustrations, particularly in areas like permanent life insurance that do have a series of complex and often-not-fully-disclosed underlying assumptions that, arguably, CFP professionals cannot meet by just taking the illustration output and presenting it to a client (especially since an illustration by the company trying to sell the product doesn’t necessarily meet the objectivity requirement, either!). In fact, in recent years even regulators themselves have acknowledged that life insurance illustrations are so inconsistent that they shouldn’t be used for comparison purposes in the first place, arguably making it even more difficult for CFP professionals to rely on such software output with clients under the CFP Board’s new standards (and especially if the details of the underlying assumptions aren’t fully disclosed). All of which ultimately raises the question: will the CFP Board’s new Technology Standards force changes to life insurance product illustrations, and more generally to any financial planning software or other projection tool, that doesn’t fully and completely disclose its underlying assumptions and calculation engine for advisors to evaluate for themselves?

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Can Orion take on Envestnet, or is its technology-plus-TAMP solution already too deeply seated into the broker-dealer community? Will Empower be able to leverage Personal Capital to capture 401(k) rollovers long before retirement while plan participants are still employees? Will Origin and BrightSide be able to scale financial planning as an employee wellness benefit? Can Apex gain market share amongst independent RIAs with a new more out-of-the-box custodial solution? Could the new CFP Board Advisor Tech standards create newfound pressure on financial planning software and especially insurance product illustrations to be more transparent about their assumptions and calculations?

Disclosure: Michael Kitces is a co-founder of AdvicePay, which was mentioned in this article.

Special thanks to Kyle Van Pelt, who wrote the section on Mastercard/Finicity section and also on Apex, and to Craig Iskowitz who wrote the Tegra118/RetireUp section. You can connect with Kyle via LinkedIn (or follow him on Twitter at @KyleVanPelt), and with Craig on LinkedIn (or on Twitter at @craigiskowitz).

Leave a Reply