After months of speculation and daily talks with interested buyers, Orion Advisor Services isn’t being sold after all.

TA Associates, Orion’s private equity owner since 2015, is instead partnering with Genstar Capital to reinvest in Orion and merge it with Brinker Capital, an investment management company serving advisors at insurance firms and independent broker-dealers.

With 5,500 financial advisors, $25.3 billion in assets under management and expertise in behavioral finance and high-net-worth investors, Brinker gives Orion firepower to take on even the biggest turnkey asset management platforms.

The deal will also help Orion give more ammunition to independent advisors to meet modern client demands, says Brinker Capital CEO Noreen Beaman. In this case, the combination of Brinkers’ investing and Orion’s technology can help RIAs keep pace with new technology from wirehouses and consumer-facing startups.

There’s a race to “become the next Envestnet in terms of market size and scope,” says Rob Foregger, executive vice president of NextCapital. “Between some of the custodians and other wealth tech platforms, it’s an all-out race to get big and get as much scale as possible.”

Orion CEO Eric Clarke says he admires a lot about the competition, but sees an opportunity to build an alternative tailored to independent fiduciary advisors, which is “the fastest growing segment in financial services right now.”

You’ve got to have scale in order to compete in this space.

The company has had success in the RIA market. Since launching in 1999 as a provider of portfolio accounting software, Orion now provides more than 2,000 firms, mostly RIAs, with a platform that includes a client portal, automated rebalancing, marketing and financial planning.

Orion acquired turnkey asset management capabilities in 2018 with the purchase of FTJ FundChoice. After combining Brinker Capital with its existing investment management service, CLS Investments, Orion will have a $40 billion AUM on its TAMP.

“From a strategic perspective, this gives a lot of scale for us to compete with the biggest and best providers,” Clarke says. “You’ve got to have scale in order to compete in this space.”

While Clarke didn’t name specific competitors, Envestnet is the 800-pound gorilla of TAMPs. Data from Tiburon Researchers shows Envestnet leading in terms of institutional clients, financial advisor clients, number of accounts and assets.

Envestnet supports more than 100,000 advisors and has $185 billion AUM on its TAMP, according to company spokesperson.

“Orion and Brinker are both well-respected firms in the industry,” says the spokesperson. “Brinker has been a long-standing partner and investment strategist available on the Envestnet platform. Combined, we feel they compete with us on select portions of our business.”

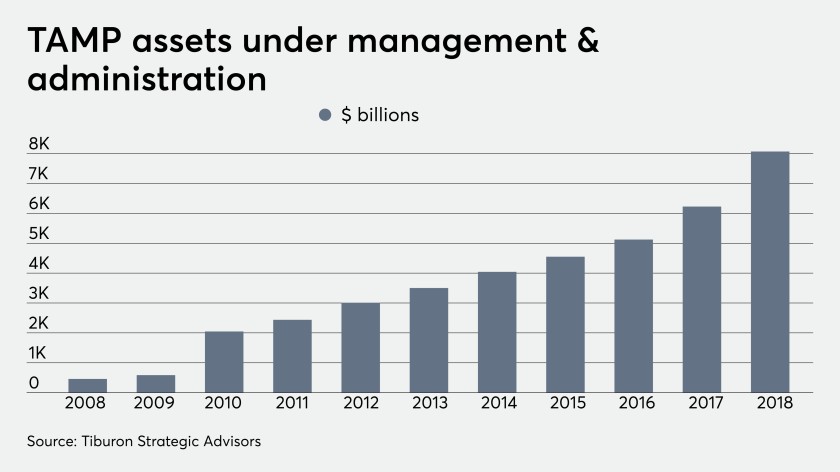

There may be plenty of room for everyone to grow as outsourcing increases in popularity among financial advisors. TAMPs collectively had $8.1 trillion in assets under management and administration in 2018, up from just $2 billion in 1995, according to Tiburon.

The researcher expects that number to reach $13 trillion by 2024.

“There is continued growth in popularity of TAMPs as advisors seek to focus their attention and value proposition on client service and financial planning,” says Robert Norris, managing principal with consulting firm Capco’s wealth and asset management practice.

With that in mind, Orion’s strategy is “very much in line with the direction of the industry,” Norris says.

Despite consolidation throughout the advisor fintech industry, independent advisors are getting more choices to meet modern client demands, says Beaman.

“The biggest disrupter is the investors and their expectations for how they want to be served,” Beaman says. “Thirty years ago, nobody wanted to put money into [the independent advisor] space. The fact that the money is slowing [demonstrates] the need for advice.”

An interesting common denominator between all three firms is BlackRock. Eric Clarke pushed in 2018 to make BlackRock’s Aladdin risk management technology available to RIAs through Orion. In November 2018, BlackRock acquired a 4.9% stake in Envestnet.

Last month, Brinker Capital announced it would start using the institutional version of the software, Aladdin Wealth. Rather than give it to advisors, Brinker is using it for in-house investment management, Beaman says.

Also interesting is the inclusion of Genstar Capital, which already has a TAMP, AssetMark, in its portfolios, as well as advisory firms like Cetera and Mercer Advisors. Two Genstar executives, managing director Tony Salewski and principal Sid Ramakrishnan, will join Orion’s board.

“I fundamentally believe that we need to earn every business opportunity, regardless of affiliation,” Clarkse says when asked about the potential to work with Genstar’s other wealth management properties.

With wirehouses investing heavily in new technology startups like Personal Capital getting bought by traditional financial institutions, independent firms need to improve how clients engage with advisors digitally, Clarke says. “Getting this kind of technology into advisors’ hands is absolutely critical for their future success..

Leave a Reply