More than a month after Ritholtz Wealth Management took a barrage of criticism for taking federal aid aimed at small businesses, new data shows more than a thousand advisory firms took advantage of the government program. Among them: Carson Group, Dynasty Financial Partners and Steward Partners.

The information on Paycheck Protection Program loans of $150,000 or more — released by the Small Business Administration on Monday — shows how widespread participation in the federal government program was earlier this year.

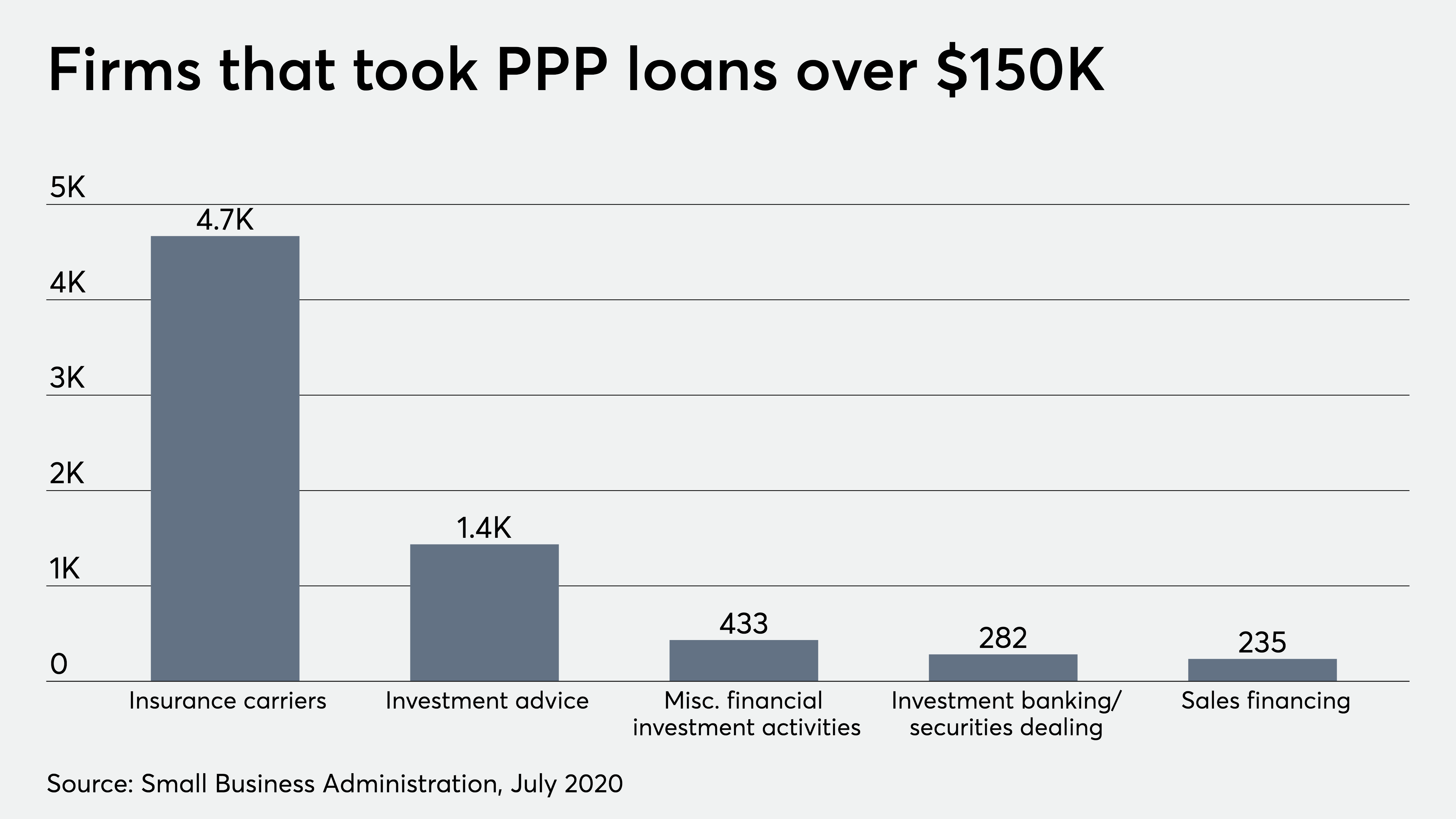

While there are 1,436 firms identified in the database as investment advisory firms, the number of wealth management firms that received PPP loans is likely higher. For instance, RIAs including Atlanta-based SignatureFD or the $6 billion Morgan Stanley breakaway team, Americana Partners, are labeled as investment banking/securities dealing or sales financing companies.

Another dataset nuance: it only provides ranges for loan amounts. Carson Group, for example, received a loan of between $2 million and $5 million. Steward Partners got between $5 and $10 million. Representatives for both firms — which reported retaining 235 and 233 jobs, respectively — were unavailable for immediate comment.

Dynasty Financial, which services RIAs and breakaway advisors, says it received $1.3 million in a “prudent” move intended to protect its employees’ paychecks and not be compelled to lay off or furlough staff (the dataset shows the company reported 69 jobs were retained). The firm’s revenue is tied to advisory fees, which are correlated to equity markets, the company says, adding it experienced a “meaningful revenue drop” in the second quarter.

“At the time in March when Dynasty submitted its application, the U.S. equity markets had fallen nearly 30%, liquidity in the capital markets was a concern, and advisors’ near-term willingness to consider independence was in question as advisors were not moving firms given demands in client service,” a company spokeswoman says in a statement.

The company says it consulted with SBA experts and discussed its application with clients. It may not keep the money. “Dynasty is continuing to evaluate inside of program guidelines whether to return the funds with interest, maintain funding as a loan to be paid back at the end of the term, or seek forgiveness as per the applicable guidelines,” the company says.

The Small Business Administration oversees the program, but banks and lenders make the loans. “All PPP loans are subject to SBA review and all loans over $2 million will automatically be reviewed,” according to the agency.

Approximately $130 billion of the $670 billion set aside by the government for the program remain available.

The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent and utilities (due to likely high subscription, at least 60% of the forgiven amount must have been used for payroll).

Some advisors questioned the ethics of financial services firms accepting the funds when the federal aid program first went live. While commission-based firms unable to sell products during the pandemic could avoid layoffs with a loan, other advisors simply looking to ease a profit pinch could take money away from other small businesses that need a loan to survive, Jeffrey Levine, a Financial Planning contributor and director of advanced planning with Buckingham Strategic Wealth, said in April. Buckingham Strategic Wealth did not take out a PPP loan.

“If there is X number of cookies in the cookie jar and everyone is hungry but others are a lot hungrier than others, who gets to take the first bite?” Levine told Financial Planning. “If you’re an advisor and you’re thinking you need to go out of business because you see a 20% decline in the market, you probably didn’t have a viable business to begin with.”

Gil Baumgarten, president of Segment Wealth Management, returned the $103,000 loan his firm received, citing uncertainty around forgiveness and worry that accepting the loan would expose his firm to increased SEC scrutiny.

“I’m in the honorability business requiring spectacular degrees of trust and an unwavering moral compass; would a new or existing wealthy client view this as right and just? Do I lose my voice when I complain in the future about less government being better than more?” Baumgarten wrote in Financial Planning in May. “Given my personal answers to these questions, I determined that whatever the final treatment of these monies, it just was not enough value for me to walk through this moral minefield.”

Leave a Reply