Sovereign Gold Bond were first proposed in Budget 2015 and since then has evolved in a popular investment product. The Indian’s love for gold is well known and most of the gold is imported, it led to a huge import bills. To counter this government came with the idea of Gold bonds.

What is Sovereign Gold Bond Scheme?

Sovereign Gold Bonds is a bond issued by Government of India and is denominated in grams of gold – which means 1 gold bond is equivalent to 1 gram of gold. The maturity period for these bonds in 8 years and you get the price of 1 gram of gold per bond in rupee terms in your account.

This has turned out to be a win-win product for both the government and the investors. The government is able to save a lot of gold imports while the investors have good gold investment alternative.

Latest Sovereign Gold Bond Price & Date

The latest Sovereign Gold Bond Issue – Series IV for FY 2020-21 is available for subscription from July 6 to 10, 2020.

The Sovereign Gold Bond price would be Rs 4,852 per bond. There is discount of Rs 50 per gram (i.e. Rs 4,802) to those applying online and the payment against the application is made through digital mode.

Below is the summary of SGB features:

- Sovereign Gold Bond Issue: Series IV for FY 2020-21

- Application Date: July 6 to 10, 2020

- Sovereign Gold Bond price: Rs 4,852 (Rs 4,802 if applying online)

- Date of Issue: July 14, 2020

- Interest Rate: 2.50% per annum payable every 6 months in the bank account

- Minimum Investment Limit: 1 bond

- Maximum Investment Limit: 4,000 bonds per person/HUF per financial year

- Tenure: 8 year [early exit possible from 5th year on wards interest payment dates]

- Joint Holding: Possible (the maximum limit applies to first holder only)

- Investment in the name of Minor: possible. to be made by his/her guardian

- Loan: bonds are allowed as collateral. The loan to value can be same as in case of physical gold

- Listing: The bonds would be listed on stock exchange and can be sold/bought though demat account

- Payment Mode: Demand Draft, Cheque or Electronic Payment. Cash payment can only be done up to Rs 20,000.

- Redemption Pricing: Based on previous week average price of closing price of gold of 999 purity as per India Bullion and Jewellers Association Ltd

- Where to buy? Banks, Designated Post Offices and Stock Holding Corporation of India Ltd. (directly or through agents)

- Application Form: You can download the form from RBI website or from respective banks. Also you can invest through your demat accounts.

- KYC Documents: Voter ID, Aadhaar card/PAN or TAN /Passport i.e same as for purchase of physical gold

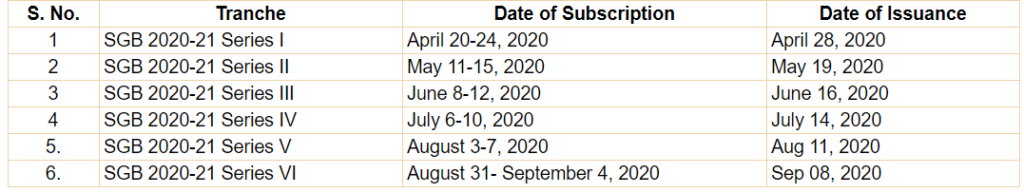

Sovereign Gold Bond 2020 Issue Dates

Following is the schedule for issue of Sovereign Gold Bonds this year:

Tax on Sovereign Gold Bond

There are three parts to Gold Bond taxation:

- The interest received is added to the income and taxed at the marginal tax slab. However there is NO TDS on the interest.

- Budget 2016 has made gains on redemption of the bond exempted from capital gains tax. This means if the subscriber redeems the bond after 5 years, no tax would be payable on the gains.

- However if the bond is sold, any gains would be considered as capital gains as in case of physical gold and taxed accordingly. If the bonds are sold with in 3 years of purchase its short term capital gains and is taxed at marginal tax rate. In case the sale is after 3 years its long term capital gains and is taxed at 20%, with indexation benefit.

23 Most common Investments and How they are Taxed in 2020?

Taxes eat a large chunk of returns that we make on investments. Keeping this in mind we have compiled list taxes applicable for most common investments in India. We cover everything from fixed deposit to stock markets to real estate.

Sovereign Gold Bond Calculator

A lot of people are confused on the way interest is calculated on Sovereign Gold Bonds. Just to reiterate these gold bonds pay interest of 2.5% every 6 months directly to the bank account. This interest is decided on the purchase price and not on the market price of the bond. Here is an example

Amit bought 1 Gold Bond for Rs 4,400 and is holding till maturity. At maturity the price of the gold bond is Rs 6,000. Below is how his cash flow would look like:

- Bought 1 Gold Bond (January 1, 2020): Rs 4,400

- Interest Received every 6 months till maturity: Rs 55 (2.5% of 4,400/2)

- As the maturity period is 8 years, he would receive total of Rs 880 as interest (Rs 55 * 16 times).

- On Maturity as the gold price has increased to Rs 6,000 per bond, he would get Rs 6,000 in his bank account.

| 01-Jan-20 | 01-Jul-20 | 01-Jan-21 | 01-Jul-21 | Every 6 months | 01-Jan-27 | 01-Jul-27 | 31-Dec-27 | Return (XIRR) |

| -4400 | 55 | 55 | 55 | 55 | 55 | 55 | 6000 + 55 | 6.18% |

If you do calculation using XIRR function in Excel (proxy of Sovereign Gold Bond Calculator), you would get 6.18% returns on this investment.

Sovereign Gold Bond Benefits

There are multiple ways you can invest in gold. You can do it by buying physical gold bars, invest in jewellery, through mutual funds, ETFs, etc. However, from gold investment perspective (& not consumption) Sovereign Gold Bond is the most preferred method because of following reasons:

- You get interest of 2.5% every year on your gold

- You need not worry about the purity of gold

- You have no worry about storage

- The buying and selling is easy – you can do it all online from comforts of your home

- In case you need to exit in emergency, you can resell it through stock market

- There is no capital gains tax on gains you make (if you redeem the bonds on maturity)

How to buy Sovereign Gold Bond?

You can buy Sovereign Gold Bond online through almost all government, private & foreign banks or demat accounts. In case you are not comfortable online you can visit banks, post office or buy through agents by filling up a simple form. You would need any of the following for KYC: Voter ID, Aadhaar card/PAN or TAN /Passport i.e same as for purchase of physical gold.

How to buy Sovereign Gold Bond?

In case you are confused on how to buy Sovereign Gold Bond – we have done a detailed post on the same. We have step by step instructions on buying gold bonds through SBI, ICICI Bank and Reliance Money Demat. You can also get the list of all banks and post offices where these bonds are available. You should Invest through Online internet banking or demat account as its convenient and you also get a discount of Rs 50 on bond price.

Should you Buy Sovereign Gold Bond?

Invest in sovereign Gold bonds only if you wanted to invest in gold or need gold for marriage etc in next 5 to 8 years. These bonds are efficient way of gold investment as you need not worry about purity; there is no loss of making charges and no tension about safety and storage. Additionally you get 2.5% interest every year. However you should NOT invest aggressively in gold as it would at best give inflation equivalent returns. Also remember exiting this bond mid-way through selling them on stock market might be difficult!

Sovereign Gold Bond FAQs

✅Is SGB good investment?

If you compare various ways that you can invest in gold like buying physical gold, ETFs, gold mutual funds, SGB is clearly the best way to invest in gold. But you should first decide if gold is the right investment for you. This may also be a good option to invest if you plan to buy gold jewellery after 5 to 8 years for marriage of gifts.

✅What is the advantage of Sovereign Gold Bond?

Sovereign Gold Bond have several advantages over traditional form of investment in gold. It pays you interest every year, the gains made are tax free. You need not worry about the purity and storage. And to top it all you can buy and sell SGB right from your home.

✅Can I buy gold bond on SBI?

✅Are Sovereign Gold Bond tax free?

The capital gains made on Sovereign Gold Bond are tax free if its redeemed after 5 years. But in case it’s sold in secondary market (through stock exchange) you have to pay relevant capital gains tax.

Also, the interest received every year is taxed as per the income tax slab.

✅Can NRIs buy Sovereign Gold Bond?

NRIs are not eligible to invest in Sovereign Gold Bonds.

✅Can I buy Sovereign Gold Bond anytime?

Theoretically yes. All the Sovereign Gold Bonds issued till date are listed on stock exchanges. You can buy them through your Demat Account. The problem is trading volume is very low. You may not be able to get the right price or the right quantity through stock exchanges. My recommendation is as these SGB are open for subscription every month, buy from there.

✅Is demat account required for Sovereign Gold Bond?

Sovereign Gold Bonds can be bought in both demat and physical form. So demat account is not necessary for buying Sovereign Gold Bond.

Leave a Reply