This post tells you multiple ways to buy Sovereign Gold Bonds online. In short time that SGB are in the market it has become quite popular and can be considered the best way to invest in Gold. This is mainly because it’s safe, secure, easy to manage, no fear of impurity and best part is you get paid 2.5% interest every year. The icing on the cake is the capital gains made are tax free in case you redeem the bond after 5 years.

You can buy the Sovereign Gold Bonds both offline and online. But buying Gold bonds online should be preferred for the following reasons:

- It’s easy. You can buy by just few mouse clicks

- the online SGB application form is very simple to fill

- No additional KYC documents need to be submitted

- & the best part you get Rs 50 discount on the price of the bond.

Where to Buy Sovereign Gold Bonds?

We list down the entities which are allowed to sell Sovereign Gold Bonds.

Sovereign Gold Bonds SBI (Nationalised banks)

There are 10 nationalised banks which sell gold bonds:

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Indian Bank

- Indian Overseas Bank

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of India

Sovereign Gold Bonds ICICI, HDFC Bank (Private banks)

There are 21 Private banks which sell gold bonds:

| Axis Bank Ltd. | HDFC Bank Ltd. | Kotak Mahindra Bank Ltd. |

| Bandhan Bank | ICICI Bank Ltd. | Lakshmi Vilas Bank Ltd. |

| Catholic Syrian Bank Ltd. | IDFC Bank Ltd. | Nainital Bank Ltd. |

| City Union Bank Ltd. | IndusInd Bank Ltd. | Ratnakar Bank Ltd. |

| Development Credit Bank Ltd. | Jammu & Kashmir Bank Ltd. | South Indian Bank Ltd. |

| Dhanlaxmi Bank Ltd. | Karnataka Bank Ltd. | Tamilnad Mercantile Bank Ltd. |

| Federal Bank Ltd. | Karur Vysya Bank Ltd. | Yes Bank Ltd. |

Foreign Banks

There are 44 Foreign banks which sell gold bonds:

| Abu Dhabi Commercial Bank Ltd. | Commonwealth Bank of Australia | Oman International Bank |

| American Express Banking Corporation | Credit Agricole Corporate and Investment Bank | Rabobank International |

| Antwerp Diamond Bank N.V | Credit Suisse A.G | Sberbank |

| Arab Bangladesh Bank Ltd.(AB Bank) | DBS Bank Ltd. | Shinhan Bank |

| Australia and New Zealand Banking Group Ltd. | Deutsche Bank | Societe Generale |

| Bank International Indonesia | Doha Bank | Sonali Bank |

| Bank of America | First Rand Bank Ltd. | Standard Chartered Bank |

| Bank of Bahrain & Kuwait B.S.C | Hongkong and Shanghai Banking Corpn. Ltd. | State Bank of Mauritius |

| Bank of Ceylon | Industrial & Commercial Bank of China | Sumitomo Mitsui Banking Corporation |

| Bank of Nova Scotia | J.P.Morgan Chase Bank N.A | The Royal Bank of Scotland N.V |

| Bank of Tokyo – Mitsubishi Ltd. | JSC – VTB Bank | UBS AG |

| Barclays Bank | Krung Thai Bank | United Overseas Bank Ltd. |

| BNP Paribas | Mashreqbank | Westpac Banking Corporation |

| China Trust Bank | Mizuho Corporate Bank Ltd. | Woori Bank |

| Citibank N.A | National Australia Bank |

Buy Sovereign Gold Bonds Post Offices

Click on the link to download the list of approved post offices for buying gold bonds. There are 810 of them.

Buy Sovereign Gold Bonds Demat Account

You can invest in Gold bonds through both National Stock Exchange of India Limited and Bombay Stock Exchange Ltd through demat accounts.

Buy Sovereign Gold Bonds Online

You can buy Sovereign Gold Bonds online on most banks through their net-banking or through demat account. We give you examples of buying online through SBI, ICICI Bank and Reliance Securities Demat Account

Everything you wanted to know about Latest Sovereign Gold Bonds

In case you have any confusion about the Sovereign Gold Bonds features, taxation, when the next issue would open, the price and any other related question, you can read all the details about the latest Sovereign Gold Bonds here.

Buy Sovereign Gold Bonds SBI

Buy Sovereign Gold Bond SBI

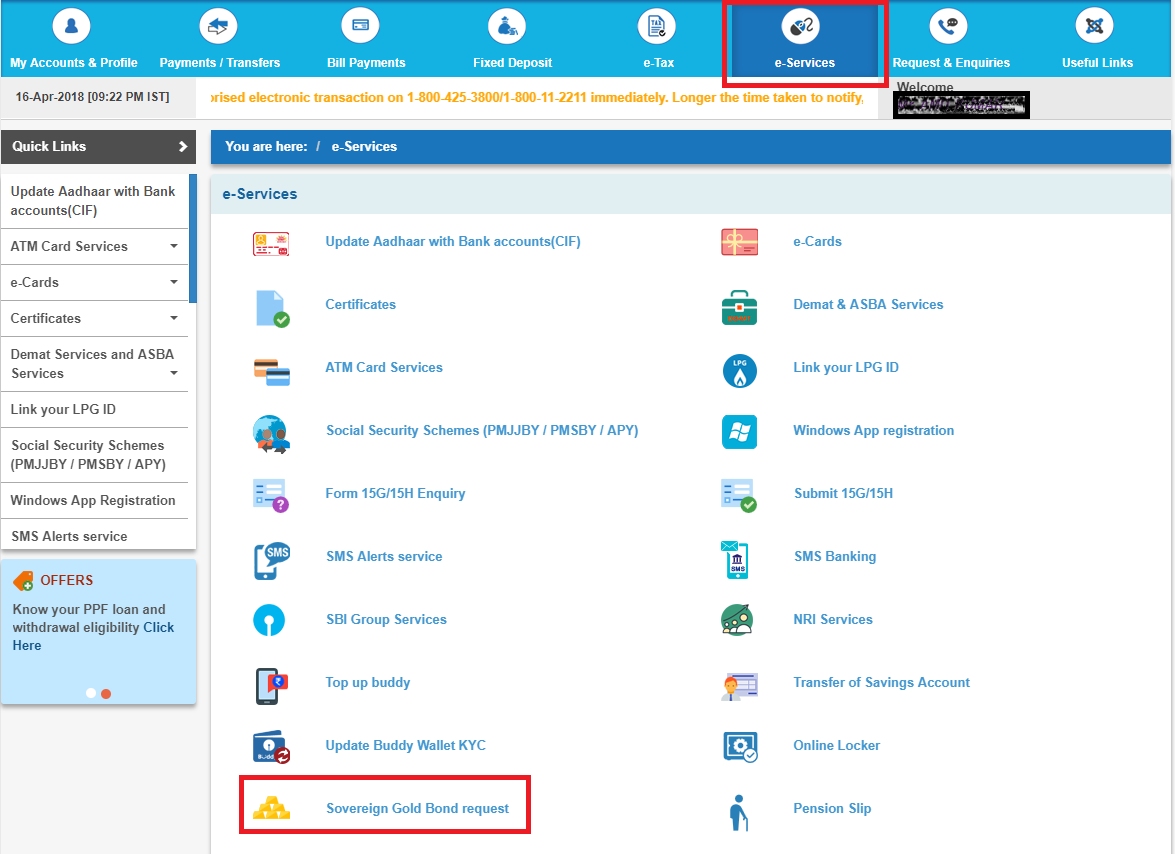

➋ Select the Menu

Go to e-Services

Click on Sovereign Gold Bonds

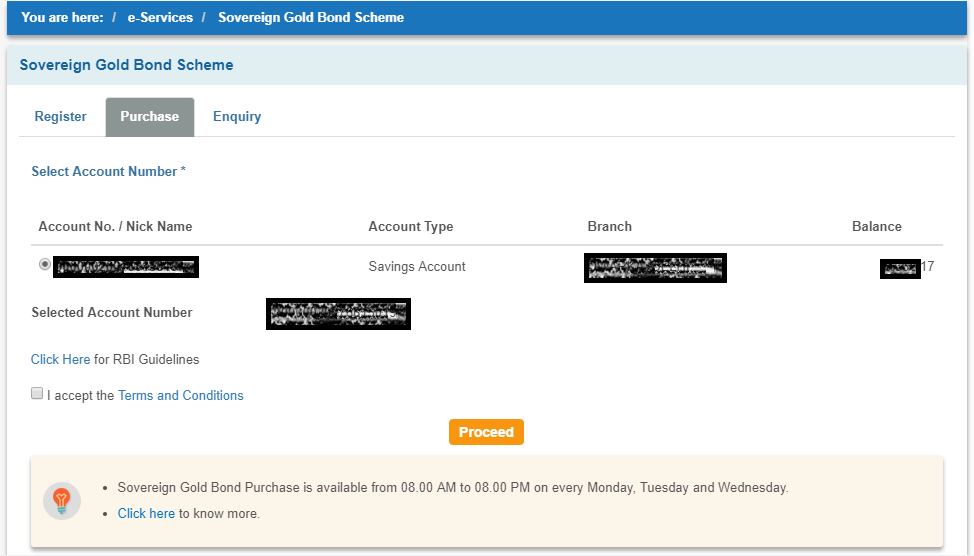

➌ Apply for Sovereign Gold Bond SBI

Apply for Sovereign Gold Bond in SBI by filling out the simple application form. It just asks for quantity you want to invest and through which account. Also in case you need the SGB in Demat form you need to enter your demat account details (DP ID & DP Client ID).

When you Submit the form you get an acknowledgement about the investment. You are done!

Buy Sovereign Gold Bond ICICI Bank

Follow the following steps:

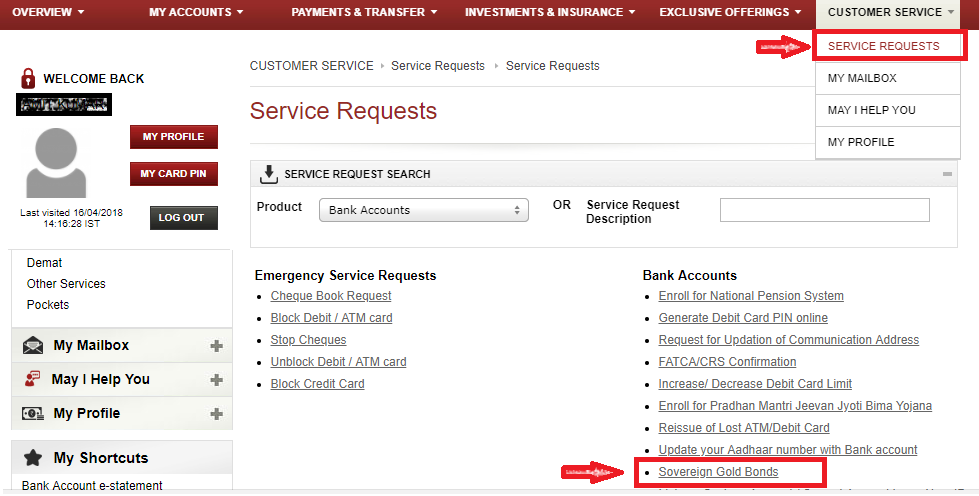

Step 1: Login to ICICI Net banking

Step 2: Go to Customer Service >> Service Requests

Step 3: Click on Sovereign Gold Bonds

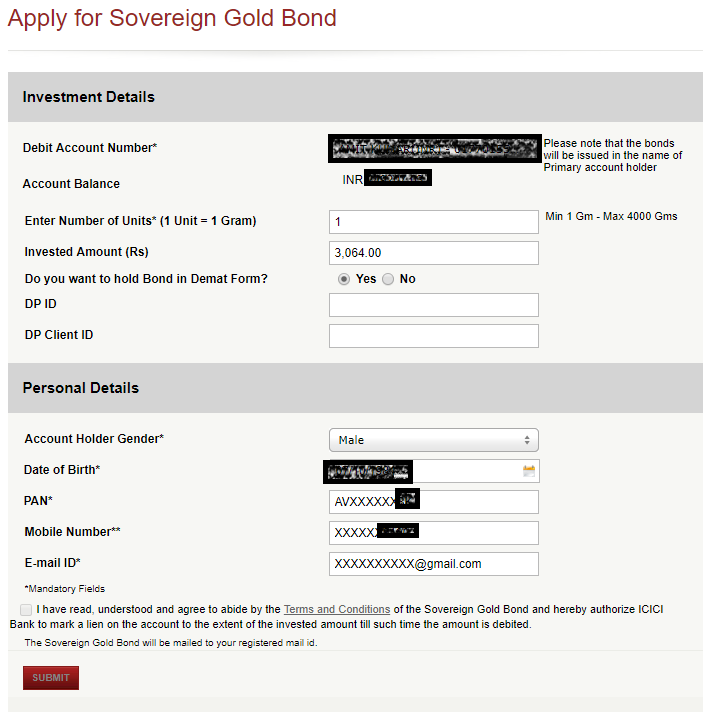

Step 4: Apply for Sovereign Gold Bond in ICICI Bank by filling out the simple application form. It just asks for quantity you want to invest and through which account. Also in case you need the SGB in Demat form you need to enter your demat account details (DP ID & DP Client ID).

When you Submit the form you get an acknowledgement about the investment. You are done!

Do you Know about Hidden Charges in Banks?

Do you know you pay a few thousand rupees every year to hidden charges of banks. This could range from more known fines for not maintaining minimum balance amount to lesser know POSDEC charge of ICICI Bank. There could be charges for ATM usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and what you can do about it?

Buy Sovereign Gold Bonds Demat (Reliance Securities)

Follow the following steps:

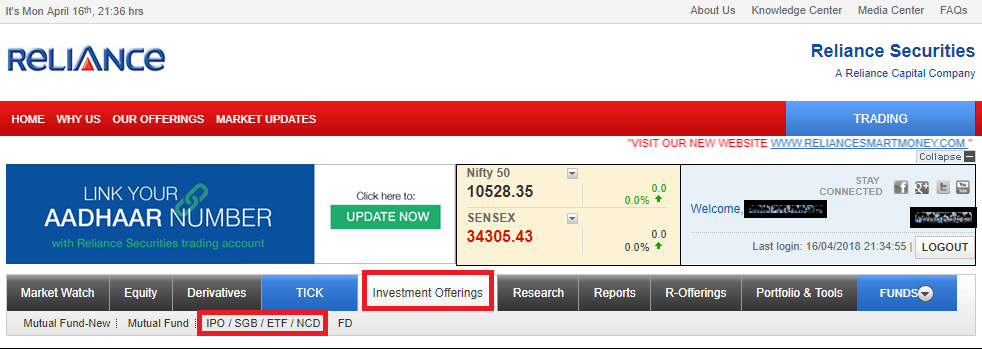

Step 1: Login to Reliance Securities Account

Step 2: Go to Investment Offerings >> IPO/SGB/ETF/NCD

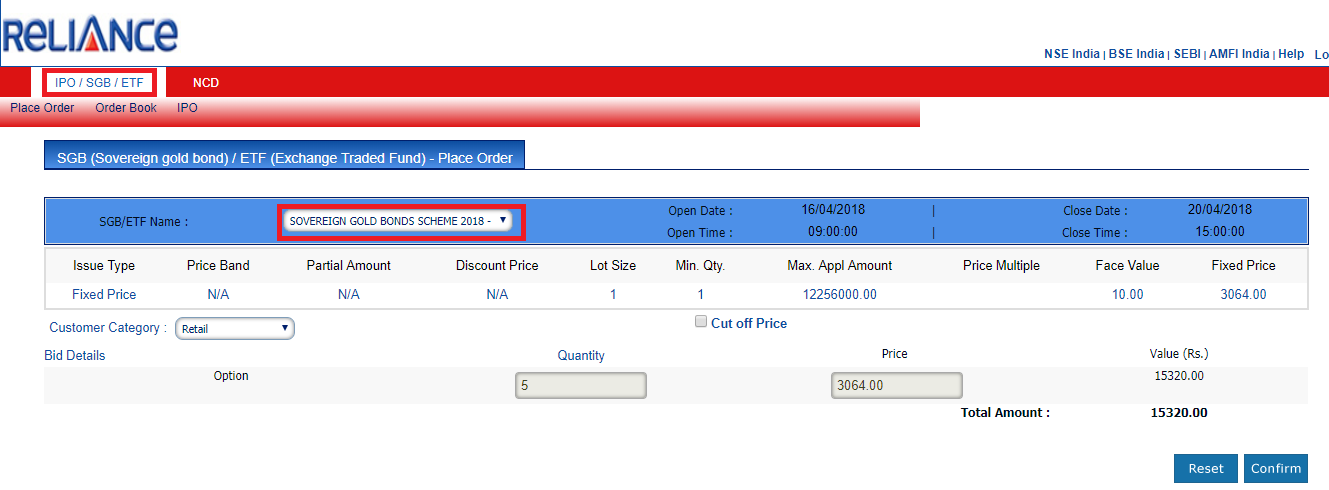

Step 3: Fill the Form by picking Sovereign Gold Bonds Scheme from drop down

You are done!

Sovereign Gold Bond Application Forms (offline)

There are 6 forms related to Sovereign Gold Bonds. You can click on each to download the same.

Buy Sovereign Gold Bond FAQs

✅How to Invest in Sovereign Gold Bond?

You can invest in Sovereign Gold Bonds online or offline. All government banks like SBI, private banks like ICICI, HDFC, Axis and foreign banks like Citibank, HSBC, etc sell Sovereign Gold Bond bond both online and offline. You can also invest though Post Office and demat account.

✅Should I buy Sovereign Gold Bond Online or Offline?

You can buy Sovereign Gold Bond either online or through physical application form. We recommend online buying because:

– It’s easy. You can buy by just few mouse clicks

– the online SGB application form is very simple to fill

– No additional KYC documents need to be submitted

– & the best part you get Rs 50 discount on the price of the bond.

✅Do I need Demat Account to buy Sovereign Gold Bond?

Sovereign Gold Bond can be bought without demat account in physical form.

✅Can NRIs invest in Sovereign Gold Bond?

No NRIs cannot invest in Sovereign Gold Bonds. Its only open to resident Indians and their HUFs.

✅Does Sovereign Gold Bond give tax benefit?

✅Can I buy Sovereign Gold Bond through Demat Account like Zerodha?

Yes almost all Demat account providers including Zerodha have option to purchase SGB. You can look here for more details.

Leave a Reply