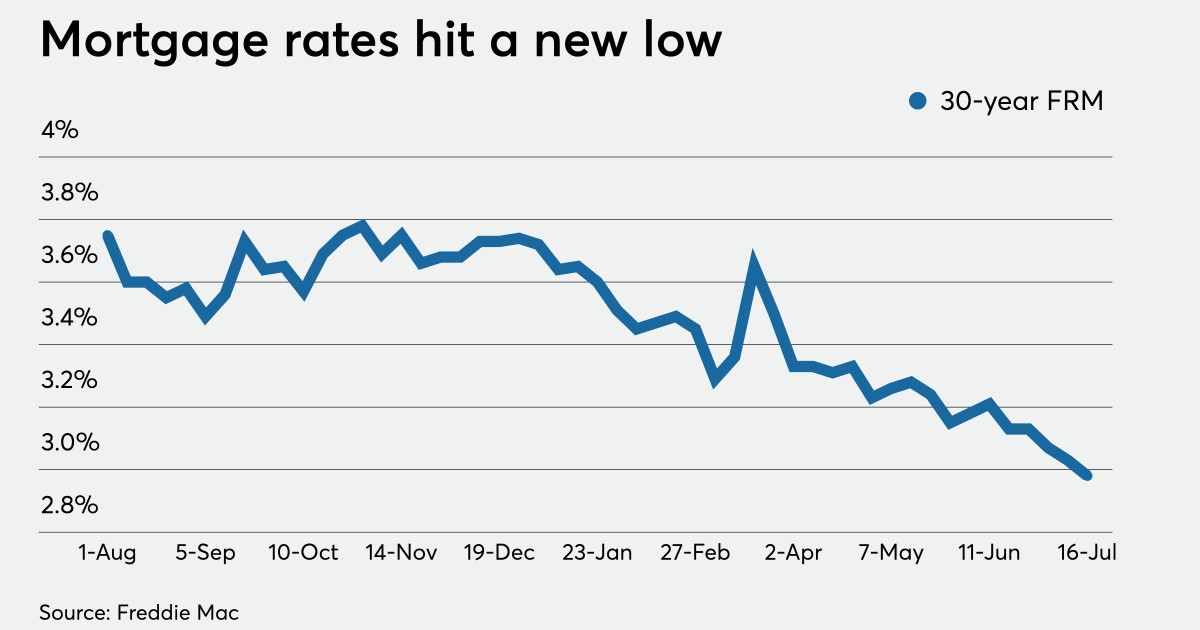

Over the last three months, home mortgage rates have managed to achieve five (!) all-time lows. Currently, Freddie Mac, which buys mortgages from banks, reports an average 3.13% rate on 30-year fixed-rate mortgages, and there is a chance that we could see rates below 3% between now and the end of August.

You should consider seizing this moment to reach out to your clients who could benefit from refinancing, or possibly even grandparents who may be looking to help grandchildren get into a first home.

Even if they elect not to pursue the lower rates, they’ll thank you for giving them the opportunity. And for those who do opt to move forward, you’ll be in the position of helping them potentially save significant dollars, both in monthly cash flow and in interest paid over time. And let’s face it: the current economic environment makes it a good idea to economize wherever possible.

The above chart illustrates the remarkable downward trend in mortgages over the past year. Compare these rates to 18% fixed-rates back in the early 1980s, or 5% as recently as 18 months ago. Nobody knows what will happen next week or next month, much less through the end of the year. But it’s clear that today’s 3% rate is pretty extraordinary.

Do you have clients who should be refinancing their home loans or pursuing a new loan? That depends on several factors, including their current mortgage rate and how long they expect to own their house. But it may be worth exploring, sooner rather than later. If you don’t have a professional, experienced loan advisor in your network, now is the time to get one. And then, as appropriate, encourage your clients to get in touch to find out more.

Leave a Reply