Flipkart said its wholesale unit will acquire parent Walmart’s loss-ridden cash-and-carry business in India, Best Price, marking a consolidation of the American major’s entire retail portfolio in the country.

The deal, announced on Thursday, clears the decks for Flipkart to expand its business-to-business vertical and take the fight to rivals Amazon and Reliance JioMart in the race to woo the legions of small retailers across the country.

Bengaluru-headquartered Flipkart– which was acquired by Walmart for $ 16 billion in 2018– will launch its wholesale unit next month with categories like fashion and grocery. This will pit the ecommerce giant against a slew of rivals from JioMart and Amazon B2B to business commerce enabler Udaan and German retail giant Metro Cash & Carry.

“With the launch of Flipkart Wholesale, we will now extend our capabilities across technology, logistics, and finance to small businesses across the country. The acquisition of Walmart India..will strengthen our position to address the needs of kiranas and MSMEs uniquely,” said Kalyan Krishnamurthy, Chief Executive Officer, Flipkart Group. The company declined to share financial details of the transaction saying only that Walmart India employees will move to the Flipkart Group.

ET reported in its January 13 edition that Walmart had let go of nearly 100 senior executives including vice presidents across sourcing, agri-business, and the fast-moving consumer goods (FMCG) divisions. The report said the downsizing was a precursor to a sale or consolidation of the unit with Flipkart.

Analysts are of the view that the move by Walmart to consolidate the retail units will boost Flipkart’s ambitions in grocery retailing.

“This is in line with Flipkart’s plan to go aggressive in grocery and use the customers and assets created by Walmart to prepare for the upcoming battle with Jio and Amazon,” said Forrester Research’s Satish Meena.

Bentonville-headquartered Walmart has been long scouting for a viable and competitive business model for the Best Price brand that consists of a network of 28 stores and ecommerce operations. The accumulated losses for Walmart India stood at Rs 2,181 crore until March 2019. In fiscal 2019, the company reported revenue of Rs 4,095 crore on a loss of Rs 172 crore.

In contrast, Metro AG posted a 10% growth in net sales at Rs 6,755 crore during the year ended September 2019 according to its global annual report that also said the Indian unit has been profitable since the last two years.

Speaking to ET, Walmart India CEO Sameer Aggarwal said the combination “allows us to grow much faster and become bigger.” The Best Price operation will continue to run as it is, he said, while clarifying that “In terms of legal structure, currently Walmart India is a separate entity within the Flipkart Group.” Aggarwal will remain with the company during the transition and will then move to a different role within Walmart.

Adarsh Menon, senior vice-president at Flipkart, who leads the B2B initiative said Flipkart Wholesale “will draw on the merchandising experience of Walmart India, strong relationship with brands, and the twelve-plus years of operating Best Price,”

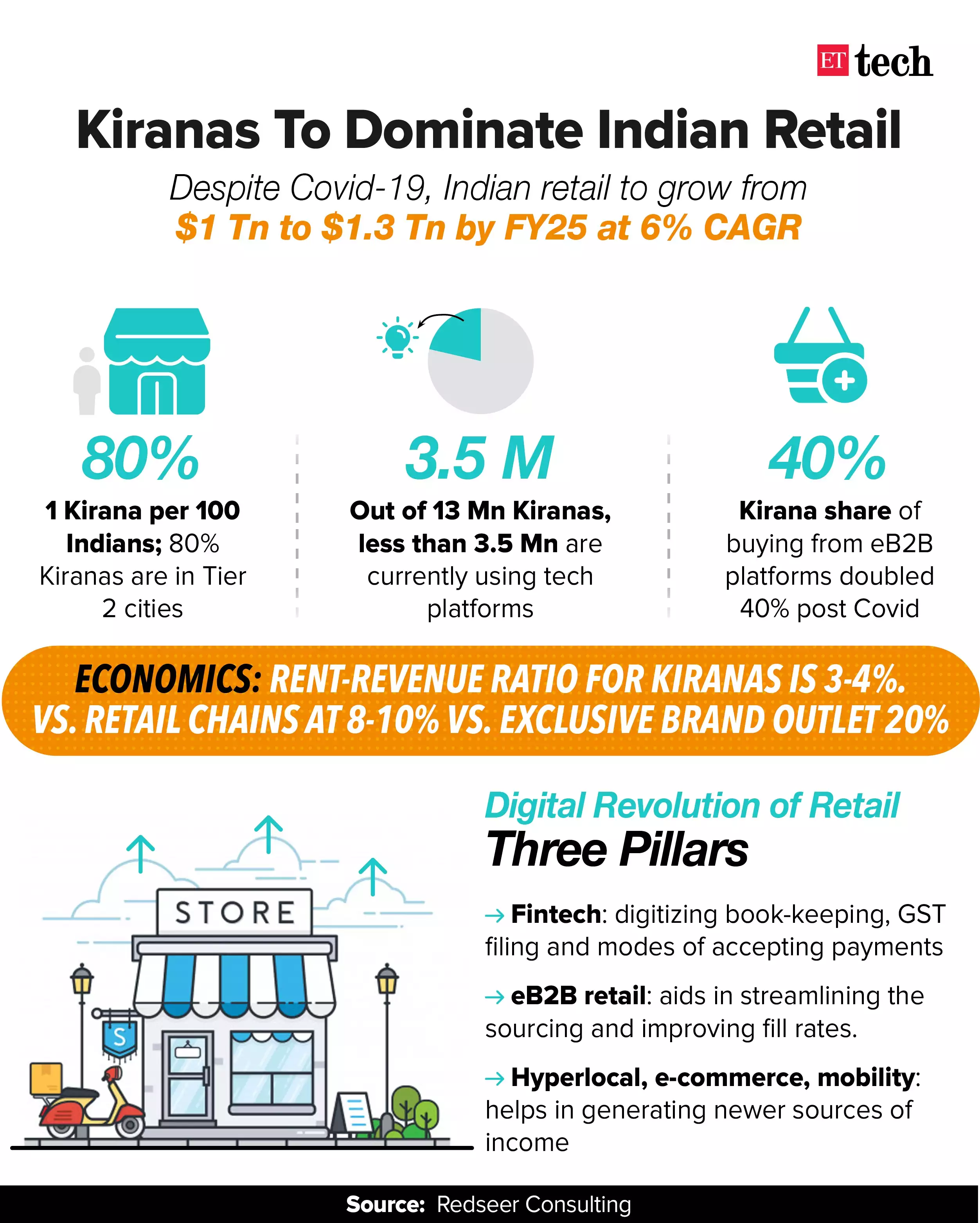

With Covid-19 accelerating the willingness of small businesses to adopt technology for expansion, it has opened up a new market for ecommerce players. According to a report by Redseer Consulting, three out of four mom-and-pop stores have no exposure to technology platforms for any service including payments or procurement.

Forrester’s Meena said, “Given the structure of our market, small merchants and kirana shops remain the top priority for (ecommerce) players.”

Since early this year, Flipkart has been ramping up its manufacturer engagements, and supply chain capabilities in the run-up to the launch. The company is already piloting FMCG retail to kirana (mom and pop corner stores) in the Delhi NCR region.

“We think the catchment around Delhi NCR is a representative market for other parts of the country as well, to test and learn and then use as a model to scale up,” said Menon.

Menon said Flipkart Wholesale will continue to onboard other brands and manufacturers on the platform. “We might have Best Price as one of the anchor stores on the B2B platform, but the objective of the marketplace is to provide as much selection as possible,” Menon said.

Earlier this month, Walmart Inc led a $1.2 billion investment in Flipkart Group, valuing the company at $24.9 billion, about 19% higher than when it sold a majority stake to the US retail behemoth.

Leave a Reply