Executive Summary

Welcome to the August 2020 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition welcomes new co-author (and AdvisorTech guru) Craig Iskowitz, and kicks off with a look at the emergence of “AdvisorTech” as a financial technology software category unto itself. As the reality is that while “FinTech” has been on the venture capital and private equity map for nearly a decade now, the focus of FinTech continues to be payments, banking, blockchain, and a number of other applications that may be of great interest for the broader financial services world and their direct-to-consumer marketplace opportunities… but little relevance to financial advisors, with our unique (and uniquely fractured) business landscape, B2B (and B2B2C) provider needs, and specialized regulatory and integration needs. And as financial advisors increasingly shift away from the distribution of financial products and into the world of financial advice itself, “WealthTech” (and its investment-centric) focus is arguably still too narrow to capture the needs of the financial advisor ecosystem. And so, it’s time to recognize AdvisorTech as a category unto itself… a subset of the broader world of FinTech, but itself a label for the broader needs of financial advisors than WealthTech, AdviceTech, or RegTech alone can capture!

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- JD Power issues the results of their annual survey, finding that more than 90% of brokers deem their technology platforms as essential, but fewer than half find their broker-dealer’s own technology solutions to be “very valuable” in their businesses!

- Envestnet integrates with FIX Flyer to expand individual bond trading capabilities for large RIAs

- Refinitiv acquires Advisor Software to expand its rebalancing and portfolio management capabilities to compete for enterprise advisor platforms

- With traditional industry conferences on hold, the AdvisorTech community self-organizes its own AdviceTech.LIVE virtual conference!

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including Knudge launching a live beta to help financial advisors support their clients to implement ongoing financial planning recommendations, MoneyGuide launches RIA Planning Analytics but may have missed the mark on supporting relationship-based ongoing financial planning, AdvicePay integrates with MoneyGuide as interest continues to grow in offering (and generating advisor revenue from) fee-for-service financial planning, Holistiplan launches new tax planning tools as advisors focus more on the risk of rising tax rates, and Smarsh launches a new archiving solution for Zoom meetings… and in the process, highlights how the more digital advisor communications become, the more compliance expects to capture, archive, and review everything advisors communicate to their clients.

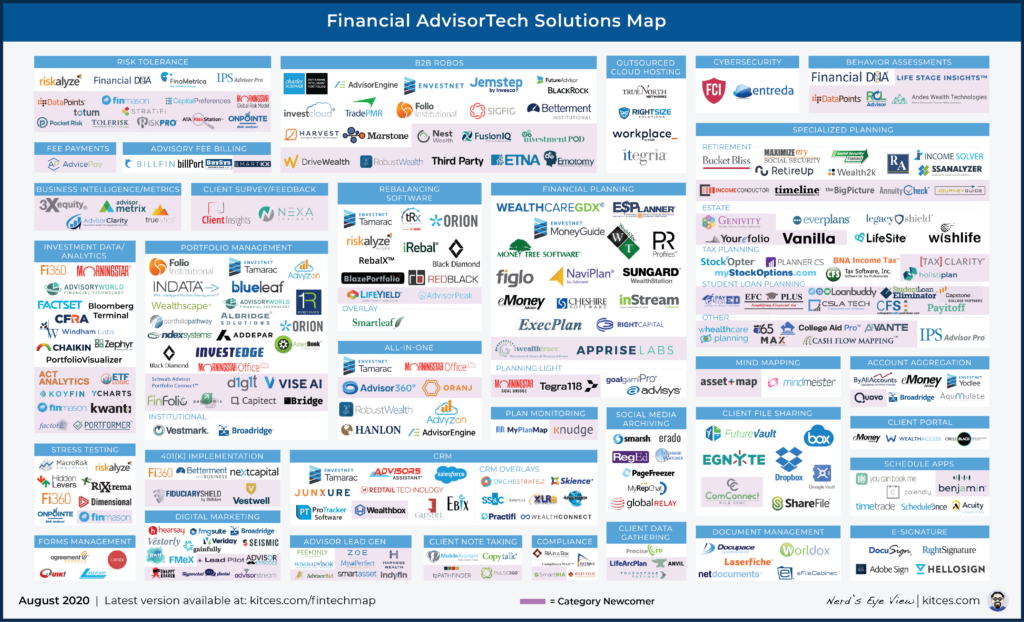

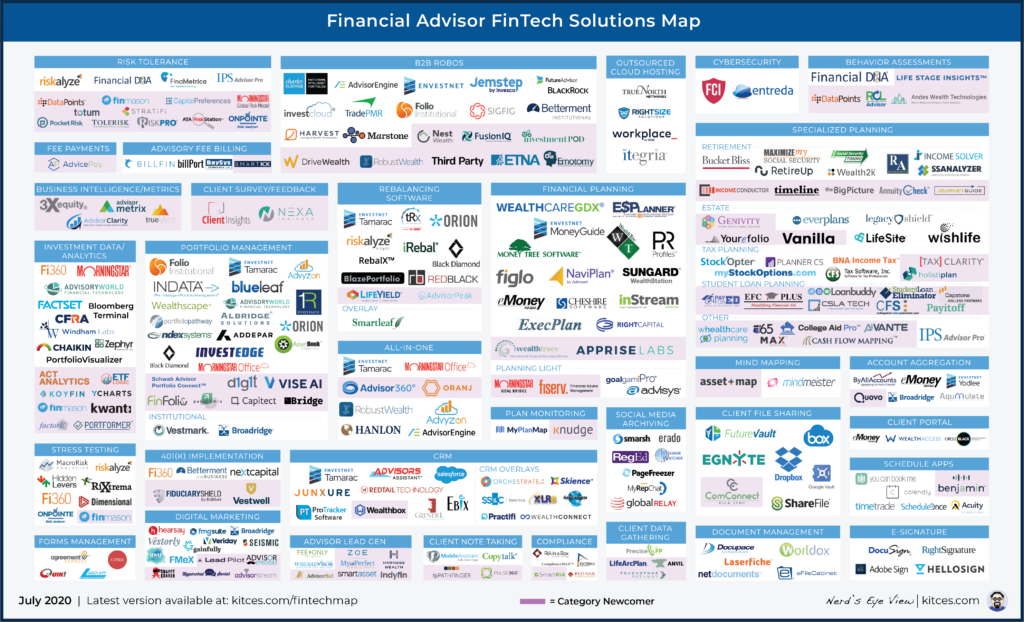

And be certain to read to the end, where we have provided an update to our popular new “Financial AdvisorTech Solutions Map” as well!

I hope you’re continuing to find this column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

AdvisorTech Emerging As A Distinct Category From FinTech or Wealth. Over the past decade, “FinTech” has become a hot category in the world of venture capital. From financial payments companies like Square and Stripe to those reforming student loans like SoFI and Commonbond to P2P lending like Prosper and Lending Club and of course the “robo-advisors” and next generation retail investing platforms like Betterment, Wealthfront, Robinhood, and Acorns, the popular FinTech business intelligence platform CB Insights now tracks more than 250 different “FinTech” companies in everything from payments to investing, payroll to banking, and more. The caveat, though, is that FinTech is largely a story of technology companies trying to draw away market share from traditional incumbents in the direct-to-consumer marketplace, and the software that financial advisors uses is almost non-existent in the broader “FinTech” ecosystem, with a handful of companies like Riskalyze and Addepar showing up in the “Financial Services” or “Wealth Management” categories (though notably, even “WealthTech” is disproportionately direct-to-consumer solutions!). To some extent, this is simply because technology company opportunities in the world of financial advisors don’t represent the same opportunity in the first place, with consumer-oriented FinTech companies like Stripe valued at $35B, Robinhood at $7.6B, SoFi at $4.8B, Credit Karma at $4B, often after just 5-10 years of building… and MoneyGuidePro last year being sold to Envestnet for “just” $500M after 20 years of growth. Yet the size of successful exits like MoneyGuidePro, along with eMoney Advisor, Orion, and more, coupled with a growing addressable market for advice-centric financial advisors, and an advisor technology ecosystem that itself is now approaching 250 companies, it’s arguably time for financial advisor technology to get its own category… which we are hereby dubbing “AdvisorTech” to specifically characterize the technology solutions that financial advisors themselves use to execute their businesses (as distinct from the broader world of FinTech that is largely focused on consumers, or to a lesser extent large financial services enterprises). In turn, within the AdvisorTech category include a subset of RegTech (regulatory/compliance) solutions, WealthTech (investment/wealth management) solutions, AdviceTech (financial planning software and specialized advice/support tool) solutions, and more. Still, the broad category of AdvisorTech itself is still distinct, both in the nature of the solutions (which are either B2B for advisor businesses, or B2B2C for advisors serving their clients), the regulatory constraints (complying with SEC, FINRA, and state regulators for advice along with investment and insurance products), the pricing economies (because advisors tend to work with affluent clients, their per-end-client revenue/customer is drastically higher than virtually all direct-to-consumer FinTech solutions), and the marketplace itself (distributing software to a highly fractured financial advisor marketplace has distinct challenges of its own). And so henceforth, it’s time to stop simply talking about FinTech – a lens that really doesn’t characterize the realities of the financial advisor needs and marketplace – and instead start talking about AdvisorTech!

92% Of Brokers Say AdvisorTech Is Crucial But Less Than Half Say Their B/D’s Tech Is Very Valuable … OUCH! “Groundhog Day” is here again. Advisors at broker-dealers have long complained about the technology they are provided, often citing compliance-imposed limitations and lack of integrations. And here we are again, with J.D. Power’s 2020 U.S. Financial Advisor Satisfaction Study laying bare the unhappiness of most advisors with the tools they’re provided by their broker-dealer. Sadly, the lack of satisfaction continues in spite of increased spending on technology, as broker-dealers shelled out a record 3.7% of revenue on technology in 2020, a 15% increase over 2018. LPL Financial, the largest independent broker-dealer, spent $150 million on technology in 2019 after allocating an extra $15 million to their budget. Yet while firms are investing heavily, it seems many have been missing the mark on delivering an end-to-end that meets their advisors’ needs. In fact, just 48% of advisors say the core technologies of their firm are ‘very valuable’ according to JD Power’s. That must change for platforms that want to win the talent war, since technology has become more of a differentiator than either investment products or payouts (which have mostly equalized and homogenized across broker-dealers), and the total headcount of brokers has been slowly decreasing for two decades (which means broker-dealers need to attract ‘new’ advisors away from their competitors by being superior in at least some aspect). Today, advisors switching platforms are expecting features like single sign-on, e-signature, fully digitized account opening, mobile friendly websites, and client portals with account aggregation… and that the client data flows cleanly amongst them. Considering that the JD Power study also found 19% of wirehouse advisors intend on leaving their firms within the next two years, every broker-dealer worth their salt will need to pump up their offerings if they expect to have any chance of attracting part of this cohort (and their clients’ assets). The irony, though, is that notwithstanding all the spending and regardless of size or profitability, virtually all wealth management firms continue to struggle with a lack of integration between their technology tools, as well as a lack of automation throughout advisor workflows. When it comes to integration, currently just 21% of advisors surveyed in both the employee and independent channels say their tech platform is “completely integrated”. These two issues are correlated; automated workflows require seamless flow of accurate data, which is impossible without deep integration across the tech stack. Firms without automated workflows and integrated user experiences will score lower on advisor satisfaction. It’s a vicious cycle. Only Commonwealth Financial and Edward Jones made it into the top satisfaction tier, which they have owned for the past decade, while nine out of the fifteen firms surveyed saw their average satisfaction levels drop. And it’s not a coincidence that the top two have focused on differentiating their advisor experiences through their technology platforms. Edward Jones said it’s spending $500 million on a digital acceleration strategy to modernize and simplify all of their capabilities. Commonwealth went so far as to build their own custom wealth platform called Advisor360 which they licensed to MassMutual in 2019 before spinning it off into a standalone fintech vendor in April 2019 (to help offset the mounting $35,000 annual cost per advisor and amortize their development costs over a wider base). Most broker-dealers wind up as a hodgepodge of software tools — a few advisors say they need something, and it magically appears on the platform to keep them happy. I’ve referred to this as the “appification” of advisor desktops, which look like an iPhone screen covered with icons that have little to no integration with each other or the firm’s core platform. And it will probably get worse before it gets better, as advisors’ reliance on technology to manage all aspects of their practice has been growing for many years, but has accelerated considerably during the COVID-19 crisis. This means that a higher percentage of advisors will be accessing more parts of their firm’s technology stack that probably never had that level of sustained usage before, which could result in more calls to the help desk, more bug reports (and possibly outages) if services are overloaded. All of which has a negative impact on advisor satisfaction and loyalty especially, among those that are younger and more tech-savvy. Among employees under 40, those who were highly satisfied with their technology were 82% more likely to stay with their firm and 76% more likely to recommend their firm to other advisors. But broker-dealers can’t be everything to everyone, and need to get clear on who their ideal advisor profile is first… which then makes it easier to create an end-to-end advisor experience (A/X) without having it turn into a free-for-all to add applications to their tech stack (instead adding only what’s relevant for their ideal advisor persona). Increasing advisor satisfaction with technology should drive up advisor efficiency as well as retention, both directly impact the bottom line, which means technology has likely never had a better ROI for broker-dealers to invest into. Will COVID finally force the changes necessary so we don’t hear the same old story in the JD Power survey again next year?

Will Redtail and Riskalyze Merge As Brian McLaughlin Joins The Board Of Riskalyze? It’s common for company boards to have regular turnover to bring fresh faces and new ideas, but some faces generate more buzz than others. Riskalyze, the risk-profiling turned multi-functioned-advisor-technology Swiss-Army-Knife-platform, announced this month that Brian McLaughlin was joining their board (while two other long-time members departed). Notably, McLaughlin co-founded Redtail Technology, the leading CRM provider for advisors that reports over 40,000 firms and 120,000 users. Riskalyze’s board sees the departure of Andy Swan, co-founder of LikeFolio (a company that uses social media to develop insights into consumer behavior) and Ryan Shanks (the co-founder and CEO of advisor recruiting company FA Match), who were both on the board from 2014 to 2020. There’s been a long history of collaboration and cooperation between the leaders of Riskalyze and Redtail, both of which are located in Sacramento, which over the years has led to the two CEOs traveling together (when we used to travel), and even pranking one another’s offices. But in a recent video, Klein and McLaughlin discussed how a 2013 integration with Redtail was instrumental in getting Riskalyze onto advisors’ radars. Building integrations with many of the leading advisor software tools was a big part of Riskalyze’s path to success, as they methodically built out an impressive inventory of 100+ connections to other vendors turning them into the most popular advisor tool for measuring risk tolerance. Other vendors like eMoney Advisor and Money Guide had blazed the integration trail, but these were mainly one-way data transfers between applications. Klein’s firm took a different approach by embedding its Risk Score Speed Limit right into every user interface that they linked up with. That put their risk tolerance component of the advice value chain front and center on every advisor desktop and became a part of every client onboarding process. Over the last six years, Riskalyze has expanded way beyond the original risk concept, though, adding lite financial planning, portfolio analytics, a model marketplace (another revenue stream that could be a gateway to becoming a TAMP), proposal generation (which puts them in direct competition with Morningstar Advisor Workstation), basic portfolio management (which was a huge step for them and a requirement to offer an end-to-end platform that could start their climb up the value chain to compete with Orion Advisor Tech and Envestnet), trading and order management. The board announcement sparked a surge in rumors about a possible merger between the two tech vendors, but Klein was quick to shoot this down. The idea of a Redtail/Riskalyze merger is not totally crazy, though, considering that with all of the components that Klein has built out, the only missing piece left is CRM. And with both companies already based in Sacramento – thus the natural personal relationship of their CEOs – a merger would be geographically easy to implement. Either way, McLaughlin brings a unique perspective, since he not only has access to a large pool of advisors (many of whom are not Riskalyze customers), he also has a strong technology background (having written a lot of the underlying code for Redtail and staying involved in development efforts), and Redtail has mastered the process of selling into large broker-dealer enterprises (where Riskalyze historically lagged) like few others in AdvisorTech. Even without a merger, crossing selling opportunities and/or deeper partnerships and integrations between the two platforms are likely on the horizon, as Riskalyze looks to expand their already dominant market share in their category (almost 30% according to last year’s T3 Advisor Software Survey) and Redtail fights off new entrants into the RIA space like Wealthbox and Salesforce FSC. Regardless of whether McLaughlin stays for two years or six, his insights, industry experience, and technical know-how will benefit Klein and his team now that they have him locked up for at least quarterly brainstorming sessions. Riskalyze has grown from a niche product without a category, to making their own category and dominating it, we’ll see how much value a close friend and industry leader can add to an already hyper-successful company. Though it’s still hard not to wonder if the news is a prelude to a merger!

Refinitiv Acquires Advisor Software To Compete As An Enterprise Advisor Platform But Can They Differentiate In A Crowded Marketplace? The Refinitiv brand was launched in 2018 after private equity firm Blackstone purchased Thomson Reuters Corp’s Financial and Risk unit. Blackstone immediately started building a top-flight executive team for their new wealth management division by hiring former Foliodynamix co-founder and CEO Joe Mrak last July, who then brought on Charles Smith as head of digital wealth management solutions this March (previously a managing director in Ernst&Young’s Wealth and Asset Management practice for eight years). After coming onboard, Mrak must have realized that while Refinitiv had industry-leading market data and portfolio analytics tools, there was a huge gap in fee-based investment advisory systems, starting with model management, portfolio rebalancing, trading, reporting, and billing. Accordingly, while it’s been overshadowed by the flurry of high profile AdvisorTech M&A activity this year that included Orion Advisor buying Brinker Capital and Empower swallowing up Personal Capital, Refinitiv has been quietly filling their basket with some ‘finely aged’ technology vendors that check off some key boxes on their shopping list to build out their wealth management ecosystem. In March, they snapped up Scivantage, which provided them with a self-directed investor trading portal called Wealthsqope (renamed as Refinitiv Digital Investor, and fitting well with a lot of Refinitiv’s key clients like US Bank, Bank of the West, and USAA, that also used the BETA self-cleared platform) and the Maxit cost basis product and outsourcing platform (which counts Broadridge and Sungard as clients). And now Refinitiv’s has made its latest acquisition: Advisor Software. Founded by Andrew Rudd in 1995 (who was a co-founder and chairman of risk management systems and services provider Barra, which itself was acquired by MSCI in 2004), the eponymously named Advisor Software started out with a portfolio rebalancing engine and added digital onboarding, proposal generation, and lite financial planning over the years, but never built out enough functionality to be considered a complete end-to-end solution. And while arguably more competitive in the narrower category of rebalancing software, Advisor Software never implemented an effective sales and marketing strategy to reach the market share level where they could compete with other standalone rebalancing tools like Total Rebalance Expert (bought by Morningstar in 2015), iRebal (bought by TD Ameritrade in 2007) or RedBlack Software (bought by Invesco in 2019), and haven’t been included in reviews of top portfolio rebalancing products. Still, though, Advisor Software did manage to stay in business for 25 years, which is an accomplishment and a testament that their rebalancing software was up to par (just not with a sizable client base). Under Refinitiv, and with Advisor Software’s decent portfolio rebalancing and onboarding solution as the central component, Mrak needs to make sure it can scale up to support the average Refinitiv client, which includes 3 of 4 wirehouses and many of the biggest broker-dealers and banks. Mrak will also likely be on the lookout for additional acquisitions to fill out the missing pieces of his wealth management platform, including performance reporting, a client portal, and fee billing, all of which will need to be tightly integrated into the new platform (which is no easy feat, even with Mrak’s extensive experience combining disparate technology solutions from his time at Foliodynamix, and after their acquisition by Envestnet in 2017). Ultimately, it looks like Refinitiv’s goal is to build out an enterprise-level advisory platform to compete with the likes of Advisor360, Charles River, Envestnet, Tegra118, and Vestmark. But considering the additional competition in the space, they will need a more compelling value proposition than ‘just’ integration to their market data, portfolio analytics, and self-directed investor tools to convince broker-dealers, banks, and other large firms to consider the cost and pain of switching out one of their core technology platforms.

MoneyGuidePro Integrates With AdvicePay As More Advisors Start To Charge For Financial Plans. In the early days of financial planning nearly 50 years ago, “financial advisors” were almost entirely insurance or investment salespeople, who discovered the superiority of a more “needs-based” consultative selling approach of understanding a customer’s pain points and then selling them whatever they needed to fill that gap (as contrasted with the prior approach of simply trying to sell the features and benefits of one specific product to anyone and everyone you met). Not to mention, of course, the additional value that’s created for the client by going through the financial planning process itself and receiving their financial plan. Yet because the roots of financial planning are in a ‘consultative needs-based selling’ approach, historically most financial advisors have either given away the financial plan for free (because they were compensated for the subsequent implementation) or at best charged a nominal financial planning fee as a loss leader. Over time, the growing expertise of financial advisors and a growing confidence in charging standalone financial planning fees has led to more financial advisors charging for their financial plans… with the caveat that it’s been difficult to scale such ‘fee-for-service’ advisory firms, as eventually the friction of paying and the time-consuming nature of collecting and processes physical paper checks becomes a significant blocking point (especially relative to the now-largely-technology-driven-automation of collecting AUM fees or remitting product commissions). Thus the significance of AdvicePay arriving on the scene in 2017, which facilitates a technology-driven collection of financial planning fees (via credit card or bank ACH), along with the ability to automate billing for financial planning on a recurring basis (e.g., annual retainer or monthly subscription fees). Yet the reality is that most financial advisors and their clients don’t necessarily want another website to have to remember to log in to… such that this month, Envestnet’s MoneyGuide financial planning software announced an integration with AdvicePay that will allow advisors to log into AdvicePay directly from MoneyGuidePro (without going through a separate website), noting the increasing interest amongst MoneyGuide’s own advisor base to charge financial planning fees. Though notably, the MoneyGuide/AdvicePay integration currently only supports an advisor login, while in the end, it’s likely that advisors will want to facilitate clients being able to log into AdvicePay through their financial planning portal (to actually pay their financial planning fees directly from the planning software) to further reduce the friction of paying for financial advice.

Holistiplan Rolls Out ‘Solve For Max’ As Income Harvesting Strategies Gain Focus Ahead Of Potential Tax Rate Increases. The traditional approach to tax planning is fairly straightforward: defer, defer, defer, avoid, avoid, avoid. As no one wants to pay taxes any sooner than they have to (both psychologically and mathematically, thanks to the time value of money)… and ideally, it’s nice to avoid paying taxes altogether (albeit often not feasible to do so). The caveat, though, is that in a world with progressive tax brackets – higher tax rates on higher income levels – there can actually be such thing as being “too good” at tax deferral, pushing so much income out into the future that when it eventually comes time to withdraw/liquidate, there’s no way to do so without being launched into even higher tax brackets than what were available in the first place (and potentially more-than-overwhelming the time value of tax deferral). As a result, while it’s certainly a positive to defer taxes for those who tax rates are already high, for those in lower tax brackets, it’s often better to accelerate the income and harvest the gains (as opposed to the traditional tax-deferral approach of deferring gains and harvesting losses)… at least to the extent that income can be harvested at those lower rates before moving into higher tax brackets today. Which means it’s crucial to know exactly how much income can be harvested at current tax rates for any particular client before moving into higher tax brackets… a matter that is made more complex by a wide range of phase-ins and phase-outs that can further alter the marginal tax bracket beyond just the thresholds of income tax brackets alone, from the phase-in of taxation on Social Security benefits, the phase-out of medical expense deductions and the AMT exemption and the Qualified Business Income deduction, the impact of Medicare Part B and Part D surcharges on retirees, and more. And sadly, most financial planning software is not actually precise enough in its tax calculations to actually show this as a part of the financial plan itself… giving birth to more specialized independent tools like Holistiplan, which this month announced a new “Solve For Max” feature that will help advisors figure out exactly what the marginal tax rate is that their clients are subject to (given all the various phase-ins and phase-outs), and identify the ‘Max’ amount of income that can be Roth-converted or (potentially 0%) capital gains that can be harvested to fill up the current tax bracket at favorable rates. Because in the end, it’s hard to show the tangible value of financial planning… but there are few ways more straightforward to do so than being able to show clients hard-dollar tax savings by harvesting their income at currently-favorable (and potentially 0%) rates… at least for those that are in and can currently take advantage of low tax rates. Which may only become more of a focus as recent economic stimulus in light of the coronavirus pandemic has amplified deficits and is making clients (and their advisors) increasingly anxious – especially given presidential candidate Biden’s recent tax plan proposal – that now may be the best time to harvest income at current tax rates in anticipation of the potential that tax burdens ‘must’ rise in the future?

Knudge Launches Beta Version Of Client Task Management System For Financial Planning Recommendation To-Dos. When financial planning was primarily used as a tool to validate the client’s need for a product (that the financial advisor was selling), the process came to a close fairly quickly as the advisor implemented the recommended product. But in the modern more ongoing-relationship-oriented approach to financial planning – not to mention an approach that is often far more comprehensive and entails far more action items to implement than can be done quickly after the initial plan presentation meeting – the reality is that financial plans can take months or even years to implement, and it may be incumbent on the advisor to break down financial planning goals into smaller tasks and then help clients to prioritize them on an ongoing basis just to be able to complete them in the first place (as no client can implement a list of 10-20+ financial planning recommendations all at once!). The end result is that outside of a select number of hourly financial advisors, financial planning is looking less and less like a singular advice engagement – provide the information and get the recommendations to implement – and more like an ongoing form of “project management” or even Agile Planning approach where clients are guided in an iterative process to select the next milestones, take the steps over a finite time period to accomplish those milestones, and then meet again to select the next milestones going forward. All of which creates a need – and highlights a substantial gap – for tools that advisors can use to manage, keep track of, and collaborate with clients on, that ongoing list of financial planning “to-dos”. Which is where Knudge comes in. Designed by a financial advisor for his own needs and now being sold to other advisors (akin to so many other ‘homegrown’ AdvisorTech software solutions that have been built over the years, from Orion to Redtail to iRebal and more), Knudge is essentially a “to-do” management tool that advisors use with their clients, to help clients keep track of their financial planning to-dos (i.e., recommended action items of the financial advisor), and help to automate the process of nudging (“knudging”) clients to complete their outstanding financial planning tasks (in a collaborative portal where advisors can support the process). More generally, tools like Knudge help financial advisors actually fulfill the concept of being not just dispensers of expert wisdom but “accountability partners” that help clients actually follow through on the financial planning changes they wish to make in their lives. Perhaps the biggest caveat to Knudge, though, is that advisors have historically managed both tasks and client communication from within their advisor CRM and steer clients to a client portal – not yet another separate third-party tool – raising the question of whether or to what extent Knudge can integrate or embed itself into advisor CRM and financial planning software systems, or make a compelling case for why advisors should have a separate login and yet another (task management) portal for clients to log in to (or risk being replaced by financial planning software providers like RightCapital that are increasingly building such features into their own client portals). Though ultimately, the need for a solution is clearly present, and some advisors already report using generalist task management systems like Trello to help clients manage their financial planning to-dos… for which Knudge is now offering a Live Beta of a long-overdue industry-specific solution.

— knudge (@Knudge) July 13, 2020

Smarsh Launches Archiving For Zoom Meetings As Compliance Turns Rising Digital Communication Into Increased Advisor Surveillance? Financial advisors have long had a fundamental obligation to not be misleading to their clients, as embodied by both the ‘Fair Dealing’ rules under FINRA and the anti-fraud provisions of Rule 206(4) of the Investment Advisers Act, with a particular focus on how financial advisors advertise their services (and their promised results for clients). The end result of these regulations is a significant compliance focus on financial advisor advertising (which generally must be pre-reviewed and approved before public use), as well as an obligation for compliance departments to supervise ongoing client communications (which typically are post-reviewed to at least identify questionable communication that may indicate current or future problem behaviors). Of course, the caveat to the compliance review of advisor communication is that compliance can’t review what it can’t capture to review in the first place, such that, in practice, compliance oversight has been largely relegated to a focus on advertising itself (as those materials are published and therefore can be reviewed before publication), and email communication (which can be captured electronically), but not ongoing phone calls (which aren’t feasible to capture and record except amongst the largest financial services firms that record calls “for quality assurance purposes”), and especially not in-person meetings with clients and prospects (where it’s not practical and typically not comfortable for clients to bring recording devices into the room). But now in a pandemic-driven digital world, where advisor-client communication is increasingly happening via a recordable medium – Zoom – compliance departments are stepping up their expectations of compliance recording, archiving, and review. Which led this month to the announcement that compliance archiving provider Smarsh has rolled out a solution where advisory firms can record, archive, and – thanks to a contemporaneous transcript that is created – review what advisors are actually saying to clients in their client meetings. On the one hand, the fact that video meeting archiving can be largely automated, and in particular that Smarsh automatically attached a transcription service that allows compliance to quickly search large volumes of meeting transcripts for relevant (i.e., concerning) keywords – is a very positive compliance adaptation in the midst of a fast-moving shift in how advisors and clients (and prospects) communicate. On the other hand, though, the shift indirectly highlights how, the more advisor communication shifts to digital tools, it is automatically being surveilled, just as the reduction in phone calls and uptick in email 20 years ago led to the rise of email archiving systems. The good news of this shift is that it creates the potential to more readily ‘weed out’ bad apples, who have long since conducted the bulk of their business via phone calls and in-person meetings precisely because they were harder for compliance to oversee (but now impossible in a archived-Zoom-call-centric world). The bad news, though, is an increasingly ‘big brother’ feeling of constant compliance oversight and pressure that can increase advisor anxiety and self-consciousness in a detrimental manner (as even those who are doing nothing wrong may still feel the pressure of knowing compliance may, after the fact, scrutinize every word that was said in the moment). Still, though, to the extent that the limiting factor to compliance oversight has always been the limitations on recording in the first place, it seems increasingly inevitable that the more digital financial advice becomes, the more it will be recorded and subject to compliance scrutiny… for worse or for better?

Envestnet Deepens Flyer Integration To Improve Tamarac’s Fixed-Income Trading For Large RIAs. Even though most advisors invest their clients’ assets in a combination of equities, mutual funds, and ETFs, there is still a need by many RIAs to purchase individual bonds for different client situations and economic environments. Particularly given that, while it may seem that interest rates may never rise again, eventually they will, and buying and holding individual bonds to maturity has long been a popular strategy for a rising interest rate environment. Not to mention other individual-bond-based strategies valuable for long-term planning, from using Series I Bonds as a hedge against future inflation, to building your own low-cost equity-indexed annuity or structured note by pairing bonds with equity index options. However, most smaller RIAs lack the asset flows to justify a dedicated fixed income trader with specialized trading software, so they usually manage their bond strategies in Excel and trade through their custodian’s website. But this requires significant manual effort, introduces inefficiencies into middle and back office processes, and bifurcates portfolio management between how bonds are managed versus the clients’ equities, mutual funds, and ETFs. Which in turn helps to explain why smaller advisory firms tend to use fixed income ETFs and mutual funds, instead of going to the trouble of buying individual bonds in the first place. But RIAs using Envestnet’s Tamarac platform will now have access to advanced fixed-income trade processing via Flyer’s Co-Pilot order management system (OMS), which is now available for all Tamarac clients with deeper integration that should provide a more comprehensive, seamless, and advanced advisor trading experience. Flyer provides trading tools, connectivity, and infrastructure for wealth management and capital markets, and has become the gold standard for integrated order management software and order routing through their Flyer Trading Network that provides connectivity to dozens of trading venues such as broker-dealers, ECNs, and custodians. Other vendors that have integrated Flyer Co-Pilot include Orion Advisor Tech, Riskalyze and Morningstar. Envestnet first launched access to Flyer’s OMS back in April 2019, but without support for fixed income. It was not surprising when this was announced, considering that Envestnet already used Flyer Co-Pilot OMS for their own internal trading desk (that drives their TAMP business). The updated client-facing Flyer version enables Tamarac users to trade individual bonds alongside equity and mutual fund orders, without having to leave the system, which is a huge benefit for trading and operational efficiency. Notably, there are other options available for RIAs to purchase individual bonds such as fixed income SMA managers, as well as outsourced services like Bond Navigator. However, purchasing the bonds directly provides more control and customization of portfolios for specific client needs, such as bond ladders to reduce credit risk and increase diversification. The new Tamarac-Flyer integration include aggregating and blocking of fixed-income orders into the Flyer staging blotter, which replaces the Excel sheets and should enable increased visibility while orders are being filled and better pricing for larger orders. In addition, it will support for characteristic-based orders by CUSIP, which allows advisors to define the parameters of the bonds they would like to buy (i.e. rating, duration, maturity) and the system will identify securities that match (whereas characteristic-based fixed income orders is normally only available on enterprise-level wealth management platforms like Vestmark and Charles River or specialized fixed income trading systems). Thus, the new Envestnet/Flyer tie-up should be a tremendous benefit to RIAs that currently trade (or would like trade) large numbers of bonds. And the market opportunity is big for Envestnet, given that their Tamarac platform already has about 40% market share of RIAs with more than $1 billion AUM, as well as a third of firms in the $500 million to $1 billion range. Since larger firms are more likely to include individual bonds in their client portfolios, adding sophisticated order management capabilities for fixed income securities could help Envestnet increase their lock on this valuable and fast-growing market… in addition to perhaps enticing some smaller RIAs that haven’t historically traded individual bonds to begin doing so.

MoneyGuidePro Launches Firm-Wide Analytics For (Relationship-Based) RIAs… With Transactional Clients? As financial advisors grow their client bases over time, it inevitably becomes difficult to keep track of all the clients and their individual needs and situations. On the one hand, this has led to the growth of advisor CRM systems to help capture all the relevant client information and ongoing client interactions. On the other hand, it’s now beginning to lead to the rise of tools that aim to analyze an advisor’s client base and identify new planning needs and opportunities (e.g., Morgan Stanley’s Next Best Action, Envestnet’s “Opportunities to Engage”, etc.). And at a minimum, there’s a growing interest in advisor data analytics that help keep track of it all and monitor ongoing trends – not in the context of “Big Data” analytics (as individual financial advisors don’t really have enough clients to have ‘big data’ problems), but more along the lines of the ‘small data’ insights of trends within their particular base of (dozens or a few hundred) clients. In this context, it’s notable that Envestnet MoneyGuide recently announced the launch of Planning Analytics, with the goal of providing data insights and analytics on an RIA’s client base within MoneyGuidePro or MoneyGuideElite. As contrasted with Envestnet’s existing Analytics platform, which is primarily for larger enterprises and reports on their portfolio an investment trends, the new RIA Planning Analytics tool targets solo and ensemble RIAs, capturing financial-planning-based rollup data like client ages, household income, and total assets – displayed into histograms that show how the advisor’s clientele are distributed – as well as type of client (employed vs retired, business owner vs employee), how many have actually received financial plans, when they received their last financial plan, and how many clients are pursuing various goals (tying in with MoneyGuide’s goals-based planning process that starts with a strong focus on upfront goal selection). The appeal of such tools is that it can help to highlight planning opportunities (e.g., how many clients are approaching retirement and don’t have a retiree health care goal, or how many clients have young children but haven’t implemented any life insurance), or simply clients that are due for a financial planning update (e.g., those who haven’t had a ‘new’ plan in MoneyGuide for the past X years). Yet the irony is that in the process, MoneyGuide is effectively highlighting how focused it has become on typically-transactionally-oriented brokers over more relationship-based RIAs that tend to service clients in an ongoing financial planning relationship in the place. After all, advisors who are working with clients on a holistic basis would ostensibly already know their clients with young children need life insurance, and to the extent that was previously recommended and not implemented, it’s an issue of nudging (or Knudging) the client to follow through and implement… not a matter of MoneyGuide providing a list of clients the advisor impliedly ‘missed’ in providing such advice in the first place? And advisors working with prospective retirees nearing retirement would ostensibly already be meeting with clients on an ongoing basis and having a discussion about pre- and post-retiree healthcare needs and costs… not need a reminder from MoneyGuide of which clients failed to ever create a goal that covers health care in retirement in the first place? And in general, advisors who are getting paid on an ongoing basis for financial planning advice tend to be doing financial planning on an ongoing basis (e.g., an ongoing monthly or quarterly client service calendar)… and presumably wouldn’t need a reminder of which clients had been paying financial planning fees for years and hadn’t gotten a plan update in years (such that MoneyGuide’s Planning Analytics will now remind them). As the reality is that it’s the more transactional broker that has historically accumulated several hundred clients (more than any one advisor could possibly keep track of on their own), may have large base of clients who haven’t been seen in years, and doesn’t necessarily do (nor is necessarily incentivized to do) comprehensive financial plans for every client in the first place. Which means, in essence, that MoneyGuide has built a feature for financial planning for RIAs that increasingly do ongoing financial planning with the lens of more transactional brokers who don’t (and thus need the features that Envestnet is now offering). To be fair, there is a non-trivial subset of RIAs that historically have been investment-management focused, and have only done financial planning for some of their clients some of the time – and will likely find real benefit in Envestnet’s RIA Planning Analytics. Yet the irony remains that while MoneyGuide simply tries to ‘remind’ financial planners which of their clients have ‘missing’ goals or haven’t received a plan update in years, it’s now the startups like Knudge and competitors like RightCapital – and not the market-share incumbents like MoneyGuide – that are creating the most relevant tools for the leading edge of financial advisors that are actually doing financial planning with their clients on an ongoing basis and want tools to help their clients actually change their financial behaviors for the better?

Will FinTech Efficiencies From 4U And Virtual Outsourcing Via FLX Transform Asset Management Distribution To Advisors? Over the past decade, the rise of the internet and its ability to connect data, tools, and even people across large distances, has spawned both a boom in advisor productivity (reducing the need for operational staff overhead) and a rise in advisor outsourcing solutions, creating a veritable ‘golden age’ for solo and independent financial advisors who can now accomplish with some AdvisorTech tools and outsourcing assistance what might have once required a (costly) 2-3 full-time staff members. The end result is that, despite the prognostications that small advisory firms are ‘doomed’ if they don’t grow huge to gain economies of scale, in practice solo advisory firms are surviving and even thriving (even as the big also get bigger). The same cannot be said, however, when it comes to asset managers themselves, that are facing a similar dispersion where the big firms are getting bigger and the small are stuck small… but without the same kinds of technology and outsourcing efficiencies that can allow small asset managers to remain as competitive as small advisors have. But now, some new startups are looking to change that. The first is the 4U Platform, which is aiming to solve the common challenge of asset managers that struggle to get their marketing materials approved by enterprise advisor platforms (which get an onslaught of marketing materials to review on a constant basis and inevitably end out prioritizing existing and large partners over smaller asset managers) by creating a centralized platform that can both review marketing materials (done once for all their partner firms instead of separately at each enterprise!) and then use their 4U Engage platform to distribute that (now-pre-approved) material to advisors to use with their clients. And the second is FLX Distribution, which is aiming to connect (small) asset managers with independent distribution and sales teams that can provide part-time outsourced support services to firms that can’t necessarily afford to hire their own teams (or at least want to be part of a community of other small asset managers looking to share ideas for marketing and sales distribution). In other words, just as AdvisorTech platforms have created centralized efficiencies for a large base of small independent advisory firms (e.g., no more individual-firm-level downloads and reconciliations when one centralized portfolio performance reporting system can do it once for all their firms!) and the landscape for outsourced support from paraplanners to virtual assistants has grown, so too is a similar wave now coming to smaller independent asset managers trying to reach financial advisors efficiently. Ultimately, it remains to be seen whether 4U and FLX Distribution in particular will succeed or not. But the essence of what they’re building – shared support systems and one-to-many technology efficiencies that serve a large base of small firms in need – is likely here to stay. Which is a plus not only for asset managers themselves, but the independent advisors they serve who benefit from the competition between asset managers in getting more and better solutions for their clients!

With Advisor Conferences On Hold, AdvsorTech Companies Take Control Of Their Own Destiny As Asset Map Announces Online AdvisorTech Event AdviceTech.Live! As Obi Wan Kenobi said to Darth Vader in Star Wars, “Strike me down and I’ll become more powerful than you could possibly imagine.” Seeing how COVID-19 has killed all live conferences for the near future, the looming question has become whether virtual events are just a temporary substitute, or could take their place in the longer term? All of the big industry conferences have been postponed until 2021, including AdvisorTech specialties like T3 Enterprise, while other large conferences have transferred to a virtual format, such as Charles Schwab’s IMPACT and LPL’ Focus. To fill the void, Adam Holt, CEO of Asset-Map (a provider of visual planning software), decided to create AdviceTech.Live, a new online-only AdvisorTech event, scheduled for August 27, as a new way for vendors, advisors, and wealth management firms to connect effectively in an online environment. As a result, rather than a heavy content focus (though there will be sessions), the event has been designed to maximize engagement by encouraging and facilitating interactions between attendees. Consequently, rather than re-purposing a video calling app to broadcast the panels, AdviceTech.Live will be hosted using technology from Bizzabo, a platform specifically designed for large online events with many resources to make online events seamless and allow for more direct interaction between participants. Each vendor will be manning a ‘virtual booth’ where they will be able to speak directly to interested participants and answer live questions. More generally, the conference is designed as a showcase of the best advisor-facing technologies, and will have five panels running throughout the day, each representing a different product category: CRM, financial planning, portfolio management, marketing, and a special category called practice multipliers. Vendors will have short sessions to present their product, followed by a moderated discussion of industry trends, allowing advisors to get a view of the companies and products side by side. In addition, one of the goals of this conference is to raise awareness of diversity issues in the fintech field, by both bringing a wide range of moderators and speakers from different backgrounds to share their knowledge and experience, and donating 50% of all sales (with tickets priced at $70) to the CFP Board Center for Financial Planning Diversity Initiatives. But in the end, the event is also simply coming about because a pool of marketing dollars that was earmarked for live conferences is now searching for channels that can deliver vendor messaging to groups of quality leads, which if it attracts a strong advisor attendance will quickly make events like AdviceTech.Live a vital outlet for technology firms. If this inaugural conference is as big a success as the organizers expect (which, in full disclosure, co-author of this column, Craig Iskowitz, is on the advisory board!), Holt intends for it to become an annual event, and could even mark the first appearance of an all-virtual event on the 2021 list of the Best Conferences for Financial Advisors! For those who are interested, AdviceTech.Live will take place online on August 27, 2020, from 10:30am until 5:00pm EST, and tickets can be purchased online.

In the meantime, we’ve updated the latest version of our Financial AdvisorTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new AdvisorTech innovation!

So what do you think? Will advisors attend an AdvisorTech event self-organized by the tech vendors themselves (and cut traditional conferences out of the sponsorship business)? Can Refinitiv take on the likes of Tegra118 and Vestmark in the enterprise platform marketplace with their Advisor Software acquisition? Is Riskalyze angling for a merger with Redtail CRM by inviting Brian McLaughlin to its board? And will the pressures of the work-from-home environment finally stir broker-dealers to make the reinvestments necessary to get at least a majority of their advisors to actually like their broker-dealer technology platforms?

Disclosure: Michael Kitces is a co-founder of AdvicePay, which was mentioned in this article.

Leave a Reply