My firm’s director of Institutional Asset Management did a great Fortune column looking at the tendency of different asset classes to rise or fall concurrently with weakness or strength in the US dollar…

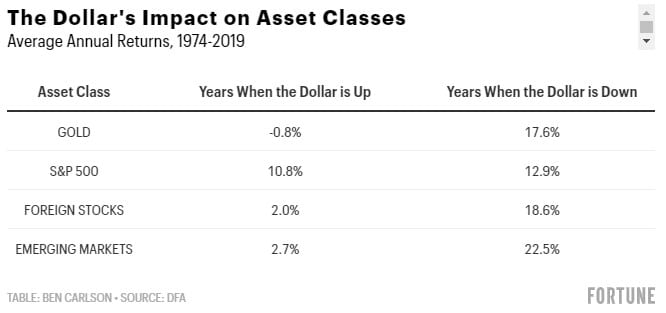

When the dollar is up, gold, foreign developed, and emerging-market stocks tend to perform poorly. And when the dollar is down, gold, foreign developed, and emerging-market stocks tend to perform admirably.

In years of dollar weakness, foreign stocks have risen 85% of the time, gold is up 80% of the time, and emerging markets have advanced 65% of the time.

On the other hand, in years of dollar strength, foreign stocks are up just 62% of the time, gold is only up 42% of the time, and emerging markets rose just 50% of the time.

Here’s my Chart o’ the Week from Ben:

Read the whole thing:

Which Investments Benefit From a Weaker Dollar? (A Wealth Of Common Sense)

Leave a Reply