The Covid-19 pandemic is bringing about a transformation in the payment habits of Indian consumers similar to what was seen during the ban on high-value currency notes in 2016, according to a new report by RedSeer Consulting.

Digital payment volumes across channels such as the Unified Payments Interface (UPI), wallets and cards are set to shoot up by an additional 6 percentage points over the next two years against a base scenario without the virus outbreak, it said.

The report – titled Indian Mobile Payments: 5x growth — predicts that digital payment volumes would grow at a Compounded Annual Growth Rate of 37% to Rs 4,067 lakh crore by financial year 2022.

Without the pandemic, the sector would have registered a 31% CAGR, it said. As of financial year 2020, according to the report, the total value of digital payments across various channels stood at Rs 2,152 trillion.

The trend similarly is set to play out over the longer term.

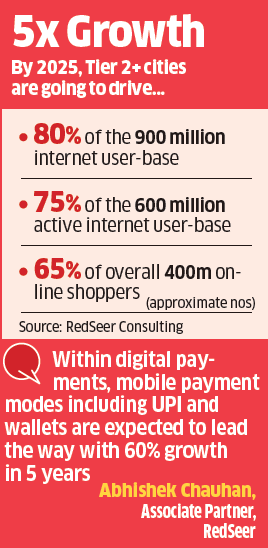

India’s digital payments sector, which would have reached Rs 6,464 trillion by financial year 2025 at a CAGR of 25%, is now set to register a growth rate of 27% to reach Rs 7,092 trillion in volumes in five years, led largely by increased adoption in mobile-based payments.

The report notes that the last time India witnessed such a shift towards digital payments was during demonetisation.

“Demonetisation of November 2016 acted as a trigger point in India’s digital payments story when the ‘common man’ had his first interaction with cashless payments,” said Anil Kumar, founder and CEO of RedSeer. “The outbreak of Covid-19 has brought about another major turning point in this journey.”

Early trends indicate that the adoption is happening most rapidly among consumers in smaller towns, both on the merchant and consumer payment side.

Early trends indicate that the adoption is happening most rapidly among consumers in smaller towns, both on the merchant and consumer payment side.

According to the report, digital transformation in smaller towns would be on the back of increased access to smartphones and high speed internet, as well as low-cost merchant payment acceptance technologies such as QR codes and Near Field Communication point-of-sale (POS) devices.

Industry executives also shares similar views.

According Vishwas Patel, the chairman of industry group Payment Council of India, smaller towns such as Guwahati, Bhubaneswar, Dehradun and Imphal are witnessing one of the sharpest growths in digital payments, both in terms of volume and new users.

“A large number of new consumers in these areas have switched to digital and contactless payments since they provide a safe and hygienic alternative to cash transactions,” said Patel who is also the CEO of CC Avenues – a payment gateway.

Meanwhile, merchant payments solutions such as QR codes and contactless card payments are also witnessing adoption and is likely to drive growth, according to the report.

The payment to merchant (P2M) category of digital payments is expected to grow at more than 50% CAGR until fiscal year 2025.

Moreover, according to a survey of 1,000 merchants conducted by RedSeer, shop owners believe that nearly half of all digital payments at their stores are set to be through mobile based payment modes such as UPI and wallets.

Before the pandemic, the share of e-payment at shops was mostly dominated by card-based transactions, according to the survey results.

“In terms of profitable business model, integrated play is significantly important for players. Standalone businesses will find it hard to sustain in the market due to limited monetization potential, and low customer retention,” Abhishek Chauhan, Associate Partner at the firm added citing examples of market leaders such as Google, Paytm and PhonePe.

The report also noted that the spend categories which will see the most digital payments include loan repayments, SIPs and bill payments in high value transactions and transit payments, tickets and QR codes in low value categories.

Leave a Reply