At a time when advisors and clients alike are working from home, many advisors feel that their firms’ wealth management tools aren’t up to the task.

What’s more, technology headaches are prompting some advisors to consider a career move lest they lose business.

Those insights are among the findings of a new report from fintech company Broadridge Financial.

Eight-nine percent of advisors surveyed said that their desktop software and firm tools became more critical during the pandemic. And yet, 77% said they had lost business as a result of not having the appropriate technology tools to interact with clients, according to the report.

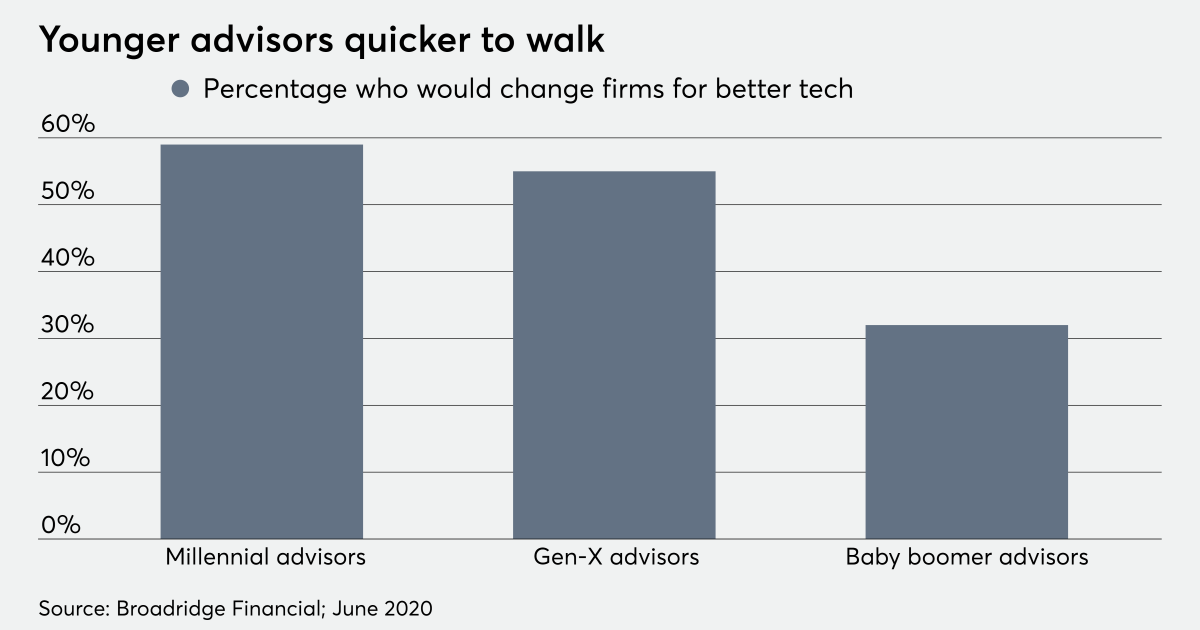

Half of financial advisors said they often think of leaving their current firm for one with better technology tools. For financial advisors under the age of 40, that figure is higher. They are 59% more likely to leave their current firm for one with better technology, according to the report. That could have a big impact on firms trying to retain and grow talent.

It’s already been a factor in recent recruiting. Raymond James brought on five new advisors in July of this year, who all cited the firm’s technology platform as a reason for their move. A four-advisor team said it left Morgan Stanley in September for Ameriprise because of the firm’s “digital capabilities.”

Firm technology could play an even more critical role in the future.

“Thirty or forty percent of advisors will retire in the next 10 years,” says Mike Alexander, president of wealth management at Broadridge. “Couple that with folks now living longer, we’re going to have more investors than advisors.”

To meet demand, firms will have to fine tune digital engagement with clients, including the myriad ways that they are able to interact and work with their advisors, he says.

Investing in that modernization can be a pain point. “This is a time where firms are under cost pressure and pressure from regulation. They need to modernize and investment dollars are being squeezed out,” Alexander says.

But, he adds, this is also an opportunity to deepen client relationships, particularly with younger investors.

Mark Elzweig, a recruiter, says technology is just one of many factors in advisors’ career decisions. “It can make an advisor really consider a firm, or rule a firm out, but it’s usually a part of the whole picture.”

The Broadridge report surveyed 254 North American RIA and wirehouse advisors in the U.S. and Canada.

Leave a Reply