Over the last few months, here at Xero we’ve been working with many accounting firms wanting to move their practice tools online so they can work remotely. Whilst there was a lot of enthusiasm there was also fear of the unknown – how do we make the change? Who is there to help us?

After talking with our friends at BGL, we realised their customers were facing similar challenges and we thought what better way to help them make the transition than to host an event about embracing positive change.

We invited change management experts Adaptive Change Mindset to provide their insights and tips and we heard the experiences of accounting firms who have moved from desktop to online. Here are some of the key takeaways.

1. Having the right people in place for implementation

Speaking with an account manager to learn about cloud tools before considering the implementation process can be extremely valuable for the transition journey. Xero’s free partner program is available for accountants and bookkeepers who would like more resources and checklists on what to think about when moving to cloud tools.

“Having the right people for implementation is important,” Kristen Lovett, founder and CEO of KLAS Business + Accounting, said during the event. “We got in touch with Naomi, (our Xero Partner Consultant) and she came in and helped us do a little rebuild. Anyone going across to cloud, speak with the Xero team first to ensure that the system will implement what you want and in the best way so that there will be as little disruption to the implementation process.”

2. Getting your staff on-board with the changes

Being transparent and engaging with your staff with changes can make the implementation a lot more seamless. Not only will your staff have great ideas for the change process, but they will also be more resilient and enthusiastic about changes if they see how the goals impact them. Going digital will reduce time staff spend on certain manual tasks and frees up time to do work they enjoy.

“Change is hard for people and causes stress from a physiological and psychological perspective,” said Leisa Hart, co-founder and CEO of Adaptive Change Mindset. She suggests that constructive conversations with staff will reduce stress and allow employees to better approach change, neurologically and physiologically. “When we have expectations about what’s happening, [our brains] thrive on a level of certainty.”

“We sat down with our staff and went through with them what we were doing and why we were doing it,” said Alastair Scanlon, Partner at Scanlon Richardson Financial Group.

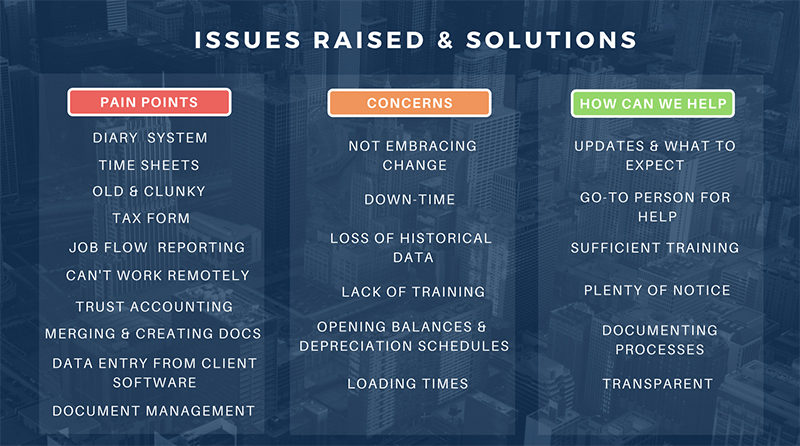

“We surveyed our staff on what they felt about the business including pain points and what they did not like about the existing software. We asked what they were concerned about with the implementation process and what we could do for them to make it easier for them going forward.”

“We showed them an ecosystem to show how everything crosses over and show what they needed to know to operate the system properly. We gave staff an idea of which tools were replacing what and gave them a rough timeline of implementation”

3. Reaching out to firms who have experienced change implementation

Change implementation will be a learning curve, but there are plenty of firms that have experienced the process and are happy to share their expertise and learnings. Reaching out to these firms can take the pressure off and ensure you are well-equipped for the process.

“I became that person, asking a lot of questions at accounting events, asking about changeovers for businesses,” said Kristen Lovett. “They can tell you how things really worked for them. Nowadays, there are a lot of accounting chat groups. There is a lot of camaraderie and community [of people willing to help].”

“Reach out to an account manager,” added Alastair. “There were two other firms who were going through the same thing at the same time. Lauren [our account manager] was absolutely fantastic getting the three firms together. We had a few dinners and coffees together before Covid-19. I was pleasantly surprised with the engagement of those firms. They were more than happy to tell us what they have been doing, what went wrong and what they would have done differently. Reach out to someone like you or the Xero team.”

If you’re an accountant and would like to know more about changing your desktop practice management tools to Xero, reach out to your Xero Account Manager or register for one of our conversion plans. We also have this handy guide How to change your practice management software.

Don’t have a Xero Account Manager? Sign up to our complimentary Xero Partner Program.

Leave a Reply