Zero Balance Saving Account – Zero Balance Saving Account is the need of the hour. Zero Balance Saving Account means an account where it is not mandatory to keep balance. In these types of accounts, you can maintain zero balance and you will not be charged any penalty.

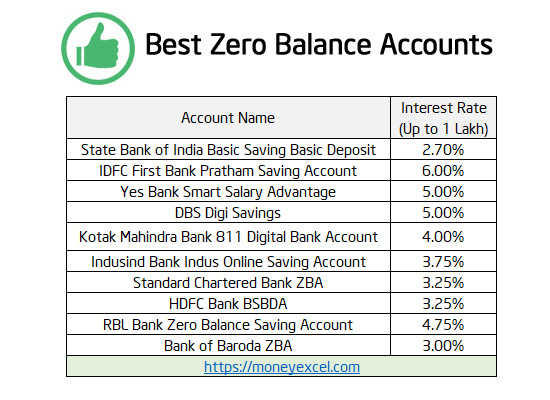

So, if you don’t want to maintain a monthly average balance (MAB) in your savings bank account, you should go for a zero balance account. You can open this account online with a click of a button. The majority of banks provide Zero Balance Saving Account. It is very difficult to identify the best bank offering this facility. To help you, here is a readymade list of 10 Best Zero Balance Saving Accounts.

What is Zero Balance Saving Account?

Zero Balance Accounts (ZBA) is an account where you can keep zero balance and enjoy the full features of saving bank account. In a normal saving bank account, you need to maintain a minimum average balance Rs.5000 – Rs.10000 per month. Minimum Average Balance is the average of all closing days in the given month. In ZBA you need not maintain a minimum average balance.

Zero Balance Saving account is suitable for spenders and not for savers. ZBA provides freedom of spending money without any restrictions.

Also Read – 10 Best Banks for opening Saving Bank Account in India

10 Best Zero Balance Saving Account

#1 State Bank of India Basic Saving Basic Deposit

State Bank of India’s most popular and leading bank. SBI provides Zero Balance Account facility by a product called as Basic Saving Basic Deposit account. This is one of the most popular products of SBI. You can open BSBD account at SBI without keeping any money in the account. You need not to pay any penalty for this. Key features and benefits details of SBI BSBD account are given below.

Features

- Interest rate – 2.7%

- Debit card facility available

- Cheque book facility up to 10 cheque leaves free in a financial year

- Single or Joint operation

- Mobile Banking

- Internet banking and Mobile Banking

- SBI Miss call facility

Pros

- Leading bank backed by the government

- Lot of features and benefits

Cons

- Interest rate is low

#2 IDFC First Bank Pratham Saving Account

IDFC First Bank Pratham Saving Account is one of the best zero balance accounts. You will be able to a higher rate of interest rate up to 6% from this account. In addition to the higher interest rate you will also get exciting benefits such as cashback, unlimited ATM withdrawal, and lot more.

Features

- Interest rate – 6%

- Facility to do unlimited ATM transactions

- Make Quick Transactions at micro ATM

- Internet and Mobile Banking Facility

- Debit card facility available

- Account opening using Aadhaar card

Pros

- Higher interest rate

- Anytime anywhere access using mobile and internet banking

Cons

- Relatively new bank

#3 Yes Bank Smart Salary Advantage

Yes Bank also offers ZBA facility. The ZBA account by Yes Bank is known as Smart Salary Advantage. This account is mostly allocated for the salary purpose. You will get facility of free unlimited NEFT and RTGS transactions via mobile or Internet.

Features

- Interest rate – 5%

- Fee Debit card with daily cash withdrawal limit up to Rs.30000

- Unlimited Transactions across Yes Bank ATM

- Free fund transfer via UPI, NEFT, IMPS

Pros

- 5 free transactions at any other bank’s ATM in India

- Accidental death cover and lost card liability protection up to 1 Lakh

- Higher rate of Interest

Cons

- Offered for Salary Account

#4 DBS digiSavings

DBS provides a facility of opening digiSavings account online with a click of a button. The entire process is paperless and very quick. Digibank is branchless. You can earn up to 5% interest on the digiSavings account. You can also enjoy cash back up to 10% via this account.

Features

- Interest rate – 5%

- Paperless and quick account opening with Aadhaar card

- Free 24×7 fund transfer UPI, IMPS, NEFT & RTGS

- Debit card facility available

- Cashback facility for online shopping

- Mobile app available for doing transaction

Pros

- Paperless and Signature less process of account opening

- Competitive interest rates

- Higher security by automated authentication

Cons

- Branchless and digital bank difficult to get support

#5 Kotak Mahindra Bank 811 Digital Bank Account

Kotak Mahindra is a leading bank that provides the facility of opening ZBA with a video call. ZBA account of Kotak is also known as digital bank account. You will get the facility of the virtual debit card along with this account.

Features

- Interest rate – 4%

- Instant account opening online

- Virtual Debit card for online shopping

- Auto sweep facility for earning higher interest

- Scan and pay facility

- Mobile Banking App

Pros

- Video KYC facility for opening account

- Virtual debit card with low risk

Cons

- You cannot open Joint account

- Rate of interest is low

#6 Indusind Bank Indus Online Saving Account

Indusind provide saving bank account called as Indus Easy Saving Account. This account is also known as basic saving bank deposit account. You will get free ATM card and provide banking with convenience.

Features

- Interest rate – 3.75%

- Free account opening

- Free ATM card

- Internet banking and Mobile banking

- Video chat with bank

Pros

- Omni present banking facility

- Free NEFT / RTGS / IMPS transactions on online channels

Cons

- Lower rate of interest

#7 Standard Chartered Bank ZBA

Standard Chartered Bank also offers ZBA. You need not to maintain any average balance for using this account. You can get ATM debit card facility. All your basic banking requirements are addressed by this account.

Features

- Interest rate – 3.25%

- Free Debit Card

- Unlimited ATM withdrawals

- Free cheque book facility

- Internet and mobile banking facility

- Free NEFT / RTGS transactions

- Fee cash deposit, cash withdrawal, DD and PO

Pros

- Unlimited free ATM transactions are about at SC and other bank ATM

- Get free monthly account statements and free passbook

Cons

- Low interest rate

#8 HDFC Bank BSBDA

HDFC bank also provide zero balance account. HDFC ZBA account is also known as BSBDA. HDFC is private sector bank and provide plethora of benefits on ZBA saving account.

Features

- Interest rate – 3.25%

- Free passbook facility for all individual account holders

- Free Debit card facility

- Free lifetime BillPay, InstaQuery facility, email statements

- Net banking, mobile banking and SMS banking

#9 RBL Bank Zero Balance Saving Account

RBL bank provide basic saving account facility. You can earn 4.75% interest on the balance amount. RBL basic saving account is value for money as it provides multiple benefits details are given below.

Features

- Interest rate – 4.75%

- Rupay Debit card with withdrawal limit of Rs.50000

- Unlimited free transaction at RBL ATM

- Two free cheque books per annum

- Mobile Banking, Internet Banking and Phone Banking

#10 Bank of Baroda ZBA

Bank of Baroda is one of the leading and strongest public sector bank. BOB provide Baroda Advantage saving account that is suitable for most of the people. You can enjoy amazing features on the saving bank account offered by BOB.

Features

- Interest rate – 3%

- Passbook and cheque book facility

- Debit card mobile banking and internet banking facility

- Unlimited ATM withdrawal facility

Over to you

Zero Balance Account is a very good financial product that will help you in difficult times. You have to keep certain important features in mind while selecting ZBA such as interest rate, charges etc.

I have tried a few zero balance saving account and found that SBI & RBL is the best. I hope I have covered all the best ZERO Balance Accounts. If any of the accounts is missed please let me know via comment section.

I request you to appreciate my efforts of shortlisting Best ZBA account by sharing this post on Facebook and Twitter.

Leave a Reply