In its third recruiting grab of at least $1 billion in client assets this year, LPL Financial poached a 13-advisor enterprise from Securian Financial.

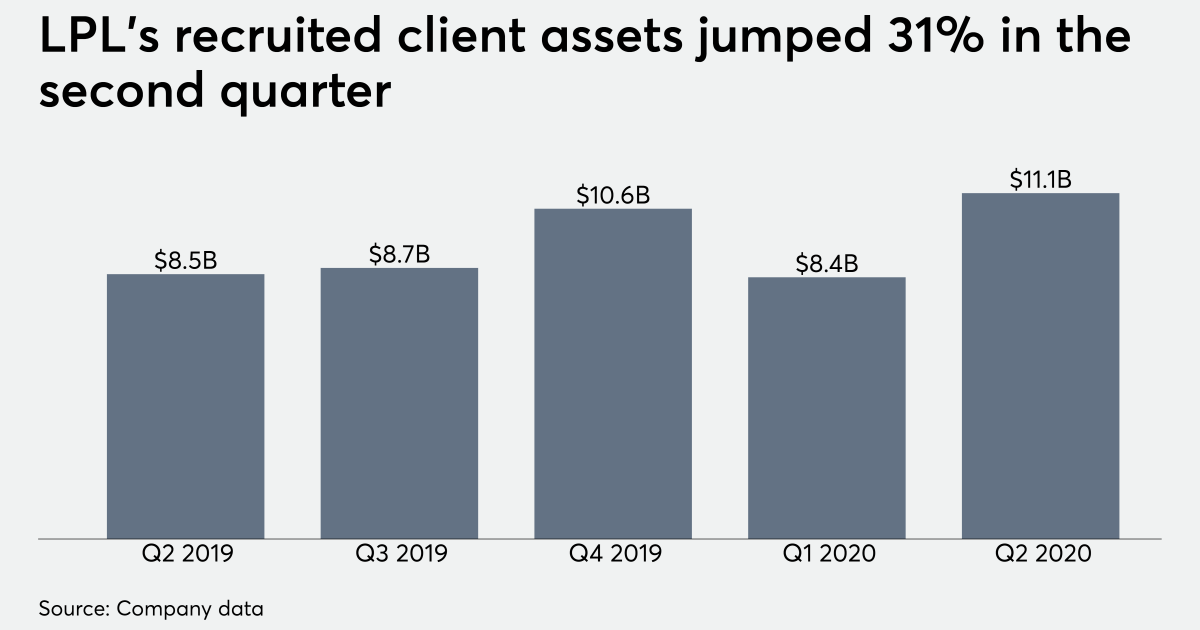

Not only has LPL attracted advisors with almost $39 billion in client assets in the last four quarters, it has also completed three of the 10 largest recruiting moves among IBDs in 2020, according to Financial Planning’s tracking of company announcements. A fourth move involving M&T Bank’s 170 advisors and $20 billion in client assets is slated for next year.

SGC Financial and Insurance Services affiliated with the nation’s largest independent broker-dealer and its corporate RIA, LPL said on Sept. 16. The San Mateo, California-based group’s 75-year-old origins date to its time as a general agency. The move came after LPL’s headcount soared by 812 financial advisors year-over-year to 16,973 in the second quarter.

SGC Financial and Insurance Services manages more than $1 billion in advisory, brokerage and retirement plan assets, according to LPL. SGC Financial’s leadership team consists of COO Cara Banchero and President Matthew Bond, an advisor who has been president for the past nine years and had been affiliated with Securian for 18 years, according to FINRA BrokerCheck.

LPL’s technology, independence and resources attracted SGC Financial, Bond said in a statement.

“LPL’s size and scale, combined with the excellent transition and onboarding support, is huge,” Bond said. “We expect this move to LPL will help us continue to thrive and expand our footprint in the Bay area, as well as look into regional opportunities.”

A spokesman for Securian didn’t immediately respond to requests for comment.

SGC Financial formally affiliated with LPL on Aug. 19. Besides office support staff, the group includes fellow advisors Robert Ostenberg, Peter Evans, Joseph Winslow, Jason Heise, Anthony DiRegolo, Justin Skelton, Aaron Moore, Steve Grochol, Chris Manzi, Patrick McAndrew, Kevin Lyle and Ed Bruzzone.

LPL’s other recruiting announcements involving an enterprise with more than $1 billion in client assets came in May, when it drew an office of supervisory jurisdictionmanaging $3 billionfrom Advisor Group’s Securities America. In August, The No. 1 IBD alsounveileda different ex-Securities America team with $800 million at the time they left the firm.

Leave a Reply