Nearly three months after taking over as Cetera Financial Group’s head recruiting executive, John Pierce says the firm is “being ultra-competitive” when recruiting advisors.

“We’re increasing our deals for higher quality advisors that have larger percentages of advisory business,” Pierce said in his first interview with Financial Planning after moving to Cetera following tenures with Stifel and Ameriprise.

The five firm, 8,700-representative IBD has recruited more than 150 financial advisors this year, according to Pierce, who declined to provide any additional metrics. Cetera hasn’t provided the number of recruits it added in 2019, beyond noting that incoming advisors brought a record $100 million in gross dealer concessions. It added around 800 in each of the prior two years.

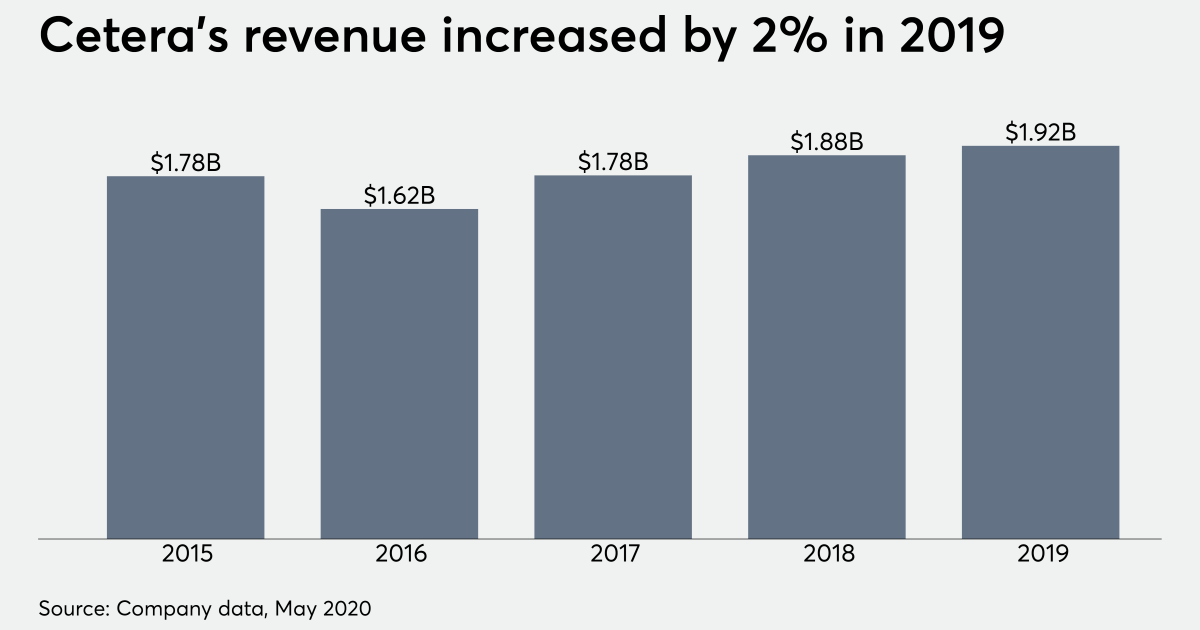

Like other IBDs, the private equity-backed network is also absorbing the impact of lower revenue tied to interest rates that have plummeted during the coronavirus. In a recent periodic review of Cetera’s parent firm by Moody’s Investors Service, the rating agency cited its “weak profitability and debt servicing capacity” but also its “strong franchise” and advisor base.

To Pierce, the current economic conditions resemble those when there were “all of the big moves” by advisors between 2008 and 2010 amid the financial crisis. Independence looks much more attractive to wirehouse and other employee advisors who are working remotely using much of their own infrastructure, the veteran recruiting executive says.

“The fundamental question most advisors are asking themselves is ‘Why am I paying 50, 60, 70% for bloated overhead when I can be independent?’” he says. “People have woken up to the fact that they’ve been forced to be independent, and then the next logical step is ‘OK, how do we do that?’”

The network’s two largest recent recruits have come from a fellow IBD. In early September, Cetera Advisors poached a multi-generational family practice from Advisor Group’s Securities Service Network with $100 million in client assets. The week before, Cetera Advisors recruited another team from the same IBD with three advisors and $275 million in client assets.

“In evaluating the evolution of our firm, opportunities for cost savings and more robust technology for our clients were top considerations,” Thomas Nestlehut, advisor and principal of Chicago-area practice Nestlehut Financial Services, said in a statement.

Cetera faces substantial competition in an IBD channel that’s always fighting for recruits and among full RIAs. The SEC’s Regulation Best Interest may prompt RIA advisors to think twice about dropping BD registrations and staying away from IBDs, Pierce says.

“You’re going to see an increase in enforcement, you’re going to see an increase in legal actions,” he says. “This notion that, ‘Let’s just go pure RIA on my own is a panacea,’ is dangerous.”

Leave a Reply