Advisors and brokers bracing for examinations under the SEC’s Regulation Best Interest now have tips about what’s going to show up on the test.

State regulators will be checking to see how firms have adjusted their practices with respect to conflicts of interest, sales of complex products and investor profile questionnaires, among other areas, according to Andrea Seidt, chair of a Reg BI implementation committee launched last year by the North American Securities Administrators Association.

“You know what we as state regulators care about because these are the things we’re examining,” Seidt said in an interview after NASAA released a survey of the 2018 policies of more than 2,000 broker-dealers and RIAs prior to Reg BI going into effect. “It’s structured in a way that lets them know pretty quickly in an easy read what we’re looking at.”

The organization will assess the impact of Reg BI by conducting another survey next year. The task force issued the survey a day before NASAA’s latest annual enforcement report showed why the regulators’ views carry weight. State enforcement actions reached their highest level in nine years in 2019 at 2,755, while restitution rose to a six-year high at $634 million.

Restitution plus fines or penalties added up to more than $1 billion in 2018, but last year the total was $714 million. Incarceration and probation stemming from enforcement cases also fell by 45% to 957 years.

While NASAA Enforcement Chair Joe Borg says he can’t pinpoint the reasons for yearly variations in the numbers, the gains in equity values in 2019 may have been a factor behind the higher number of actions.

“The thing about being the cops on the beat, there’s no case too small for us to look at,” Borg says. “If everyone’s making money and nobody’s thinking of losses, their guard is down.”

The enforcement actions included 202 involving promissory notes, 144 about Regulation D private offerings and 120 relating to equities. In the past five years, state regulators have ordered $3.9 billion in fines and restitution in 11,049 actions.

So far this year, state regulators have already detected 244 schemes linked to the coronavirus pandemic, the report shows.

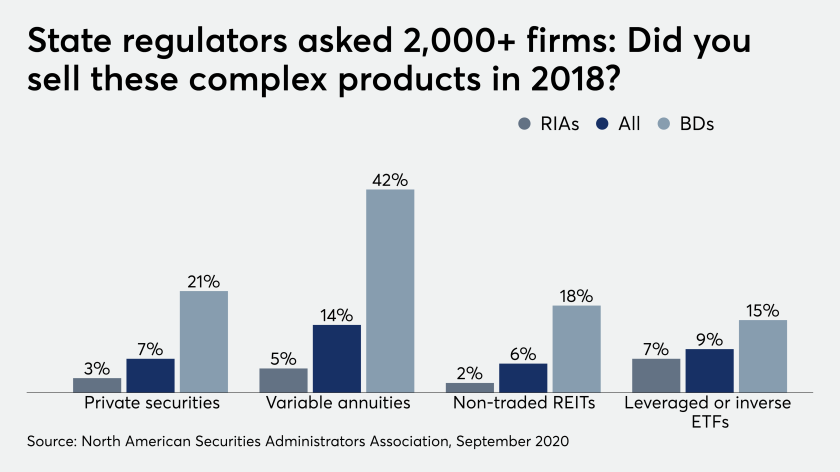

Reg BI will enhance their scrutiny of “costly, complex and risky products,” according to Seidt. The report focuses specifically on private securities, variable annuities, non-traded REITs and leveraged or inverse ETFs, which it said that 64% of firms weren’t even offering clients in 2018. Of those that did make them available, BDs did so at much higher rates than RIAs.

At least 22% of BDs and 13% of RIAs said they didn’t use any investor profile questionnaires in connection with “know-your-customer” rules, the survey shows. In terms of conflicts of interest, 41% of firms had no policies or procedures, 70% had no internal enforcement committees or officers and 76% of respondents didn’t have any “conflict registers” identifying them in detail.

Seidt has “optimistic expectations” that Reg BI will alter firms’ practices with respect to conflicts of interest, she says. The regulation will likely cause some BDs to stop selling the more complex products, according to Seidt, who also emphasized the finding on questionnaires.

“We won’t know until we go out for phase 2 to be able to quantify how those changes have played out,” she says. “I was floored that firms would not be collecting a document with basic information and they were working with retail investors.”

Leave a Reply