A set of four new risk investors is expected to join the ongoing $600-million financing round at online food delivery company Zomato, two people in the know of the matter said, signalling continued interest in India’s internet story despite the Covid-19 crisis upending businesses across the board.

London-headquartered hedge fund Steadview Capital, South Korean Mirae Asset-Naver Asia Growth Fund, US hedge fund Luxor Capital and private equity firm Bow Wave Capital are likely to collectively pump $150 million into the company, these people said. UK’s Baillie Gifford, which had invested earlier in the round, will add more funds, a person familiar with the matter said.

Interestingly, Mirae backed Zomato’s closest competitor, Swiggy, earlier this year through another vehicle — Mirae Asset Capital Markets.

Public offer route

If these four new investors come through, Zomato would have racked up almost $575 million in all, as part of its latest fundraising efforts to fight the Naspers-backed Swiggy. Valuation for the current round has been pegged at $3 billion, as ET has reported earlier.

The Gurgaon-based company has also engaged with investment banks to kick off its initial public offering (IPO) process, sources told ET. Deepinder Goyal, cofounder and chief executive, Zomato, last month said the company was on course to go public by mid-2021.

“The investors joining the current fundraising are betting on the company tapping the public markets. While it is not being sold as a pre-IPO round, there is a clear path to an IPO that the company has drawn for itself,” said a person who is privy to the talks.

When contacted by ET, Goyal said in an emailed response, “We have no comments to offer on this.”

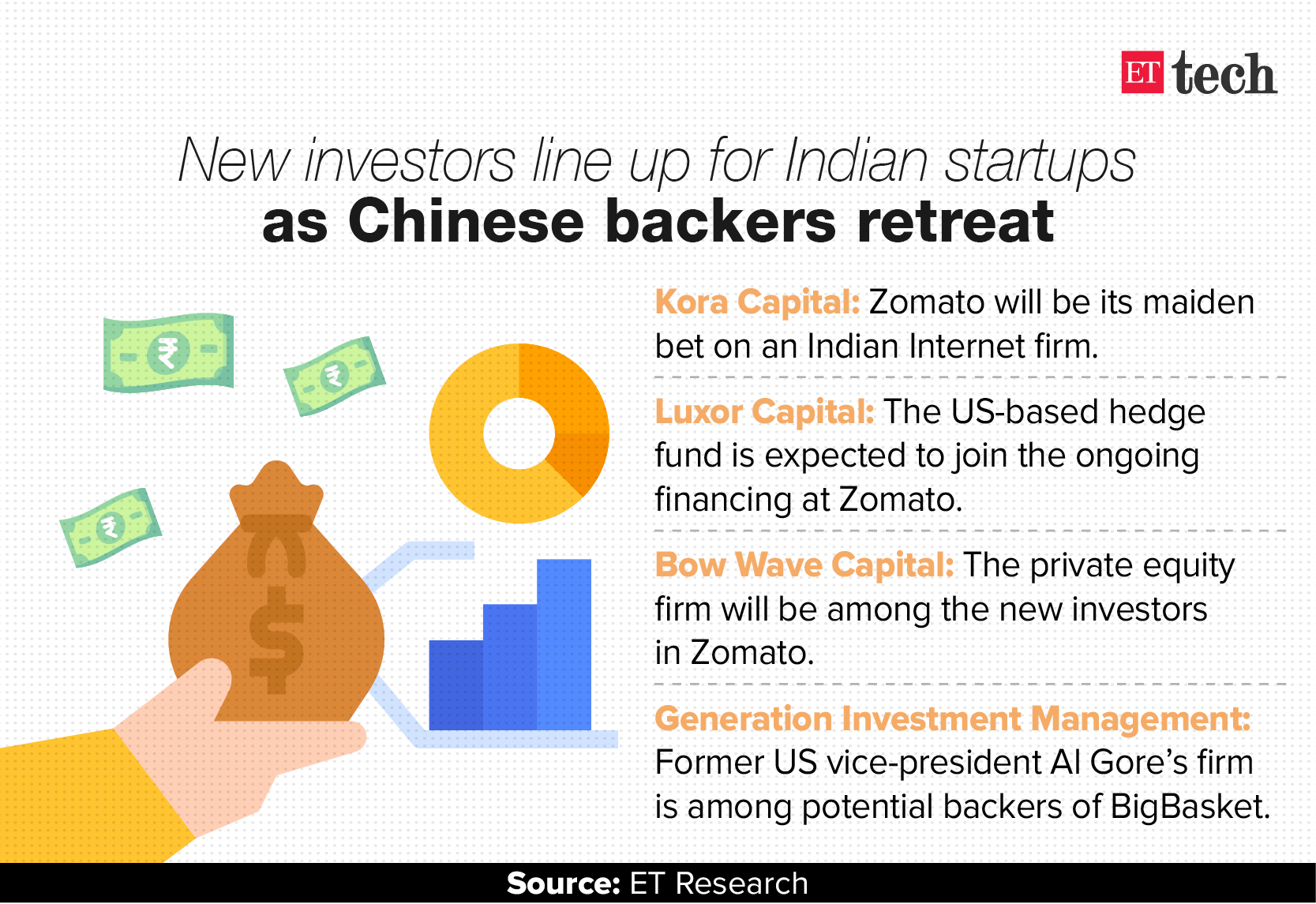

Over the last two months, Zomato has racked up fresh funds from a group of non-Chinese investors, such as Tiger Global, Kora Capital and existing backer Temasek, amid a growing wave of anti-China sentiment in India. Alibaba affiliate Ant Financial remains a key shareholder in Zomato, with a 25% holding.

Earlier this year, Ant committed to investing $150 million, but Zomato has been able to access only $50 million so far, as India tweaked its foreign direct investment (FDI) rules in April. The new policy requires regulatory approval for any investment from a country that shares a land border with India.

Over a hundred investment applications — primarily from Chinese-origin investors — are on hold or being moved between various departments and ministries as the government continues to maintain strict curbs on capital inflow from Beijing and Hong Kong.

Even as India clamps down on Chinese capital, domestic internet companies have been shoring up funds from the US, Singapore and European investors. ET reported on September 29, that e-grocer BigBasket is in talks with Singapore government’s Temasek, US-based Generation Investment Management, Fidelity and Tybourne Capital, for a $350-400 million financing round.

Sectoral trend

For Zomato, specifically, what’s worked while attracting new investors is its focus on the food delivery sector, unlike Swiggy, which has diversified into grocery delivery and other adjacent categories, two investors said on the condition of anonymity.

What’s also helped the discovery and delivery app is that it’s been able to trim its monthly burn to less than $2 million and clawed back 85% order value and 70% order volumes from pre-Covid levels.

The online food delivery industry, primarily comprising Zomato and Swiggy, saw demand cratering during the initial months of the lockdown but has registered a rebound in sales and order volumes aided by the Indian Premier League cricket tournament and festive season.

In a report released by Zomato, it said that the food delivery sector continues to grow back steadily to pre-Covid levels. “With the overall sector clocking around 85% of pre-Covid gross merchandise value up from around 75% in August. We expect food delivery in both metros and smaller cities to make a full recovery soon – and resume growing over pre-Covid levels,” Zomato had said in a September 23 blog post. GMV stands for order volumes here.

Correction: Steadview Capital has clarified that it is headquartered in London and not Hong Kong as earlier mentioned. The error is regretted.

Leave a Reply