Love the idea of starting your own business, but don’t want to deal with the hassle of finding an office space and paying rent? Then starting a business from home may be a good fit for you. Find out the pros and cons of owning a home-based business and how to start a business from home.

Is a home-based business the right fit?

Before you run off and start a business from home, you need to ask yourself, Is a home-based business the right option for me?

There are a few plus sides to starting your own small business from home. For starters, you can minimize overhead costs and say goodbye to some additional costs (e.g., renting an office space). You can also enjoy more flexibility and squeeze more into your day.

On the other hand, expansion is limited when you own a home-based business. And, your work-life balance could suffer because it can be hard to step away from your work when you’re at home.

Before starting a business from home, weigh the pros and cons. Think about if it’s really the best option for you and consider other options.

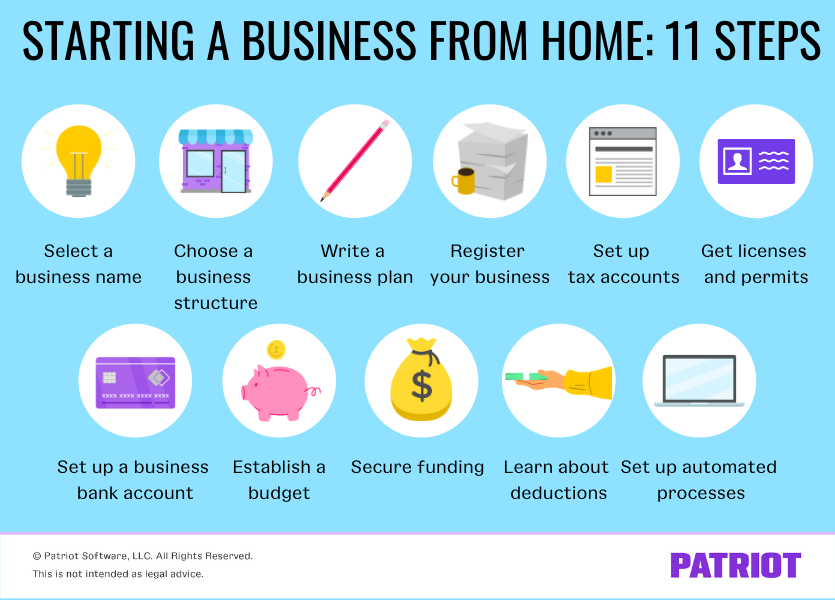

11 Steps to starting a business from home

When it comes to starting a home-based business, you have to prepare and do your research. Not to mention, you must be willing to put in a little extra legwork to get the ball rolling. Take a look-see at these steps to starting a home-based business to find out what you need to do to get your company up and running.

1. Select a business name

Behind every good business is a solid business name. If you want your home-based business to thrive, you need to select a business name that sticks the landing.

When coming up with the picture-perfect business name for your company, choose a name that’s easy to memorize and pronounce. You don’t want a name that’s difficult to spell or is too long. It should also align well with your business’s overall mission.

Do some research to make sure the business name isn’t already taken by Googling the name, running a trademark search, and looking at domain names.

Run the names you come up with by your family and friends. Ask for their honest opinions and feedback, and pay attention to what they have to say.

2. Choose a business structure

As a small business owner, there are a number of business structures to choose from. Almost too many…

Here is a list of the types of business structures:

- Sole proprietorship

- Partnership

- LLC

- Corporation

- S Corp

The business structure you choose for your home business affects how your business is taxed and the type of paperwork you must file. Before deciding on your business entity, compare and contrast your options to find which one will best suit your home-based business.

3. Write up a business plan

A major part of starting your own business, home-based or not, is whipping up a business plan. Your business plan acts as a roadmap for your small business. It can help you further understand your market, obtain funding, and set goals for the future.

Before you write up a business plan, you need to know what you’re going to offer and conduct thorough research about your market and competition. Once you have those building blocks, you can begin creating your small business plan.

Include the following sections in your plan:

- Executive summary

- Company description

- Market analysis

- Organization and management

- Service or product line

- Marketing and sales

- Funding

- Financial projections

- Appendix (e.g., additional documents)

Keep in mind that as your business grows, you need to adjust your business plan accordingly.

4. Register your business

Find the perfect name for your business? Great! Now you need to register the name with your state.

Generally, the state you operate in and your business structure determine how you must register your business name. In some cases, like with corporations, you register your name when filing documents to form the business.

You may also need to file for a “doing business as” name (DBA name). A DBA is different from the legal name of your company. Your DBA is the name the public sees on advertisements, signs, and your storefront. Every state and county has different rules for registering a DBA name.

Reach out to your state to learn more about registering your business’s legal name and DBA.

5. Set up tax accounts

Like any other business owner, you need to pay taxes on your company’s income and report it to the government.

Depending on your business and where you operate, you may need to apply for:

- Federal tax ID number

- Employer Identification Number (EIN)

- Business tax ID number (e.g., permits)

- State tax ID number

- Local tax ID number

Check with the IRS, your state, and your locality to find out what tax identification numbers you must get for your home-based business.

6. Get licenses and permits, if applicable

Depending on where your home-based business is located, you may need to get some business licenses and permits.

Permits and licenses allow you to operate in your locality and perform certain functions, like collecting sales tax from customers. Types of licenses and permits you may need to obtain include:

- Business license

- Sales tax permit

- Resale permit

- Professional licenses (e.g., doctors, lawyers, etc.)

You must apply for and obtain the proper business licenses and permits to legally operate your business. Check with your state and locality to find out what permits and licenses you need to get for your home-based company.

7. Set up a business bank account

If one thing does not go together like PB&J, it’s your personal and business expenses. That being said … when you start a company, create a separate bank account for business.

Combining your business and personal expenses may not seem like a bad idea at first, but it can lead to plenty of problems down the road. Mixing funds can make your accounting records disorganized, giving you an inaccurate snapshot of your finances and causing you to overspend.

You generally need to provide your name, SSN, business name, DBA name, Employer Identification Number (EIN), and business license to create a separate bank account for business. To set up a business bank account, follow these steps:

- Select a banking institution

- Prepare your documents

- Open the account in person or online

- Double-check that your information is accurate

8. Establish a budget

Creating a business budget is oh-so important, especially when you’re first starting out. Your business budget can help you forecast cash flow, spot financial problems, and track your progress and goals.

When establishing your home-based business budget, think about the following types of expenses:

- Utilities

- Supplies

- Office furniture

- Equipment

- Marketing

Of course, these costs can vary from business to business. Lay out exactly what costs you plan on having and create a budget from there.

9. Secure funding

Just like any other type of small business, you likely need to secure funding to help your business get off the ground.

A perk of starting a small business from home is that you can eliminate some of the costs associated with opening a brick-and-mortar store. But, that doesn’t mean you dodge all startup expenses.

To help with said expenses, you can do one (or some) of the following:

- Get a business credit card

- Receive a loan from your bank

- Apply for an SBA loan

- Borrow funds from friends and family

- Seek help from investors

- Use some of your personal savings

10. Learn about deductions

If you use part of your home for business, you may be able to take advantage of the home office tax deduction.

With the home office deduction, you can claim the portion of your home that is used for business and reduce your tax liability. The deduction can help you cover costs associated with your home office, such as mortgage interest, rent, insurance, and utilities.

You can claim the home office deduction if:

- You use the space regularly and exclusively for business AND

- The space is the principal place of your business

“Home” can be a house, an apartment, a condo, a mobile home, a boat, or a similar property that you own or rent. Free-standing buildings, like unattached garages or barns, can count as home offices, too.

Contact the IRS for more rules about claiming the home office tax deduction.

11. Set up automated processes

If you want your home-based business to succeed, keeping your finances in order and your books up-to-date is a must.

To help streamline your accounting processes and keep your books organized, consider investing in accounting software. Software can help you track income and expenses and take a few tasks off of your plate. You can also do your accounting by hand or hire a bookkeeper to handle your transactions.

You may also consider automating other tasks, such as paying bills, emailing customers, and posting on social media.

Starting a business from home? Congratulations! Now it’s time to start tracking your income and expenses. Patriot’s online accounting software makes it a breeze to record your transactions and keep your books in order. Try it for free today!

This is not intended as legal advice; for more information, please click here.

Leave a Reply