The Labor Department put the final touches on its ESG rule, which paradoxically doesn’t mention ESG by name, but nonetheless could curb sustainable investing within retirement plans.

It’s the latest guidance on sustainable investing from a department that has gone back and forth on its stance since 1994, despite the rising popularity of ESG investing criteria.

The rule’s proposal, issued in June, was met with fierce criticism from sustainable investing advocates and Wall Street firms, who, during the truncated public comment period, argued that it ignored research and wasn’t based on evidence that plan fiduciaries were misusing ESG.

In the final rule, the Labor Department pushed such concerns aside.

“The department does not believe that there needs to be specific evidence of fiduciary misbehavior or demonstrated injury to plans and plan participants in order to issue a regulation addressing the application of ERISA’s fiduciary duties to the issue of investing for non-pecuniary benefits,“ the rule reads.

However, the department did make some adjustments, as laid out in its fact sheet. For one, the department determined it would abandon the use of the term “ESG” within the operative text of the rule.

The “lack of a precise or generally accepted definition” of ESG made the terminology “not appropriate as a regulatory standard,” say comments published alongside the adopted rule by the department’s Employee Benefits Security Administration, which oversees and enforces ERISA. (While the term may not appear in the operative text, it’s mentioned 346 times throughout the department’s explanation of the final regulation.)

That decision came as a relief to some opponents of the regulation.

“That’s helpful, because they didn’t define ESG investing,” says Aron Szapiro, head of policy research at Morningstar, which submitted a comment letter opposing the proposal during the allotted 30-day comment period. “I don’t think anyone wants them to define ESG … The agencies just can’t move fast enough to do that sort of thing.”

The Labor Department’s adopted rule will go into effect 60 days after it is published in the Federal Register. It requires that plan fiduciaries only consider financial performance when selecting investment products and strategies in retirement plans. It also prohibits plans from using investment funds or model portfolios as a qualified default investment alternative if its objectives or goals include one or more non-pecuniary factors.

“Plan fiduciaries should never sacrifice participants’ interests in their benefits to promote other non-financial goals,” Jeanne Klinefelter Wilson, Acting Assistant Secretary of Labor for EBSA, said in a statement.

A Labor Department spokeswoman did not respond to a request for further comment.

The Labor Department said it was concerned investors would be offered funds with lower returns and higher investment risks, according to its fact sheet. The agency also warned that ESG funds may be more expensive.

The Labor Department’s rule emerged as the industry increasingly embraces ESG. Asset managers released 30 new sustainable funds into the marketplace in 2019, according to Morningstar. Sustainable open-end funds and ETFs attracted $21.3 billion in flows last year.

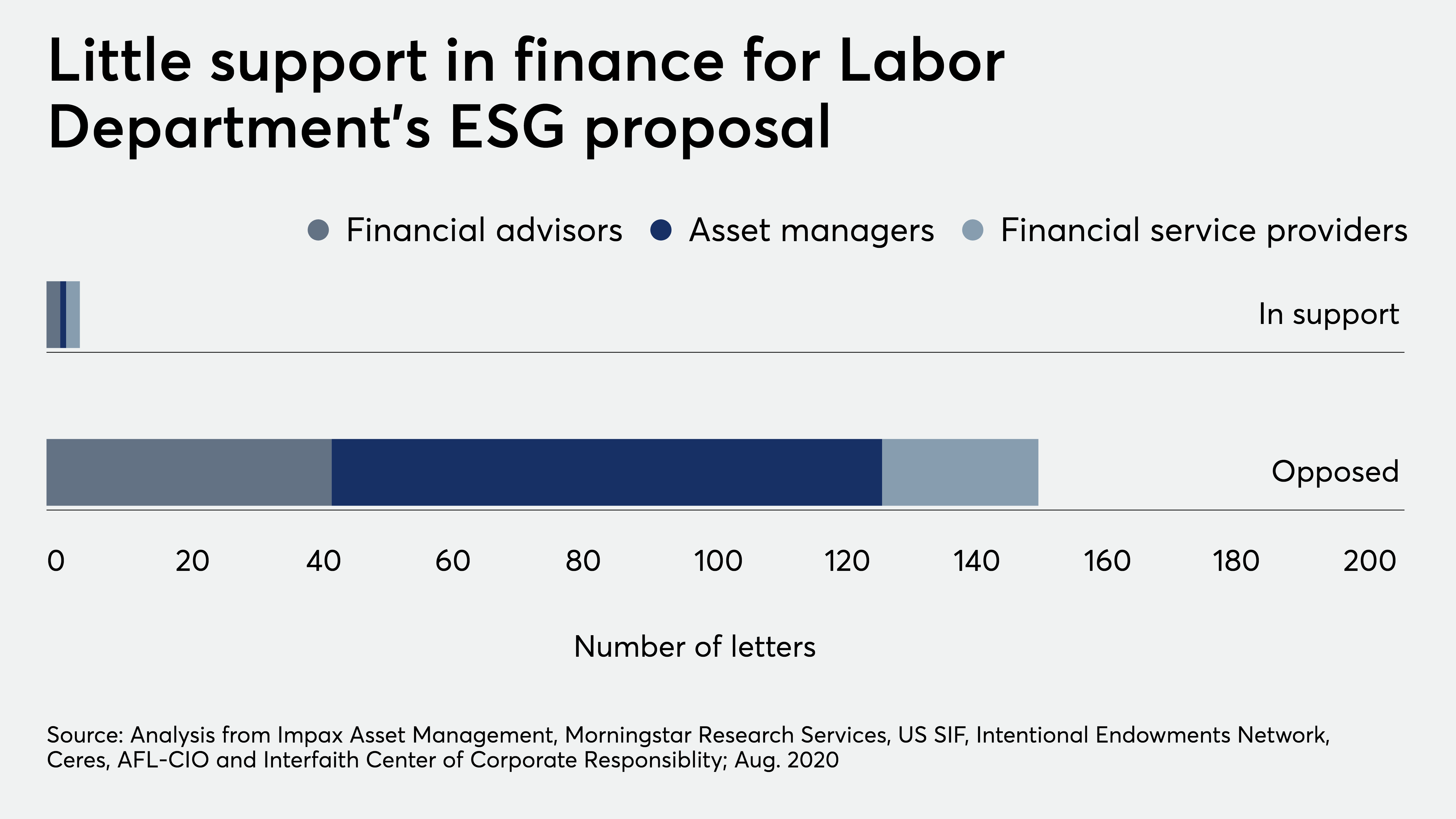

The 30-day comment period for the rule proposal withdrew more than 8,700 comment letters and petition submissions — more than 95% of which opposed the rule, according to an analysis conducted by six investor organizations and industry firms.

Unsurprisingly, environmental organizations were critical of the proposal. The proposal also garnered opposition from insurance companies, asset managers, financial advisors and consumer advocate organizations alike.

“This rule is a solution in search of a problem,” Andres Vinelli, vice president of economic policy at the Center for American Progress, said in a statement the day the rule was adopted. “The rule is not backed by relevant evidence and in fact only adds extra burdens onto fiduciaries that consider ESG factors—burdens that are notably not imposed on investments in risky fossil fuel firms.

The Labor Department has gone back and forth on its stance of sustainable investing via interpretive bulletins, going back as early as 1994, although it has maintained that plan fiduciaries aren’t to sacrifice investment returns. In 2015, during Phyllis Borzi’s appointment as assistant secretary for the EBSA, the Labor Department specified that ESG factors can impact returns and may be incorporated in an investment assessment.

The new rule takes a more critical approach, according to Szapiro. “Especially in the preamble, this regulation is just much more skeptical.”

Labor Secretary Eugene Scalia criticized ESG investing in a Wall Street Journal opinion article, published simultaneously with the rule proposal in June.

The sentiment has been echoed at the SEC whose Office of Compliance Inspections and Examinations said it would review the accuracy and adequacy of RIA disclosures in “new types or emerging investment strategies,” such as ESG, according to OCIE’s 2020 examination report.

SEC Commissioner Hester Peirce has criticized ESG rating agencies and questioned whether such a wide array of issues can be reduced to a “single, standardizable score.”

“The ESG tent seems to house a shifting set of trendy issues of the day, many of which are not material to investors, even if they are the subject of popular discourse,” Peirce said in remarks to the American Enterprise Institute last year.

Some state pension funds have reconsidered the cost of tying their investments to social activism, according to theWall Street Journal.

Meanwhile, investors and some of the largest asset managers are bullish on ESG. Clients are increasingly referring their friends and families to wealth management firms incorporating social strategies in their investments, according to J.D. Power research.

How will the new rule impact the industry?

“We’re all trying to figure this out,” Morningstar’s Szapiro says.

Leave a Reply