Unlike many airlines, cruise ships, movie theaters and other industries, fintech feels like it was created for this moment in history.

After all, helping people access financial services whenever and wherever they want is a core principle of financial technology startups. It’s no wonder that as many industries have struggled to adapt to work-from-home orders, fintech has thrived.

People stuck at home have used their newfound free time to explore investing, leading to historic rise in new accounts and activity on mobile trading apps. When markets dropped and investors looked to help, investors turned to robo-advisors for help.

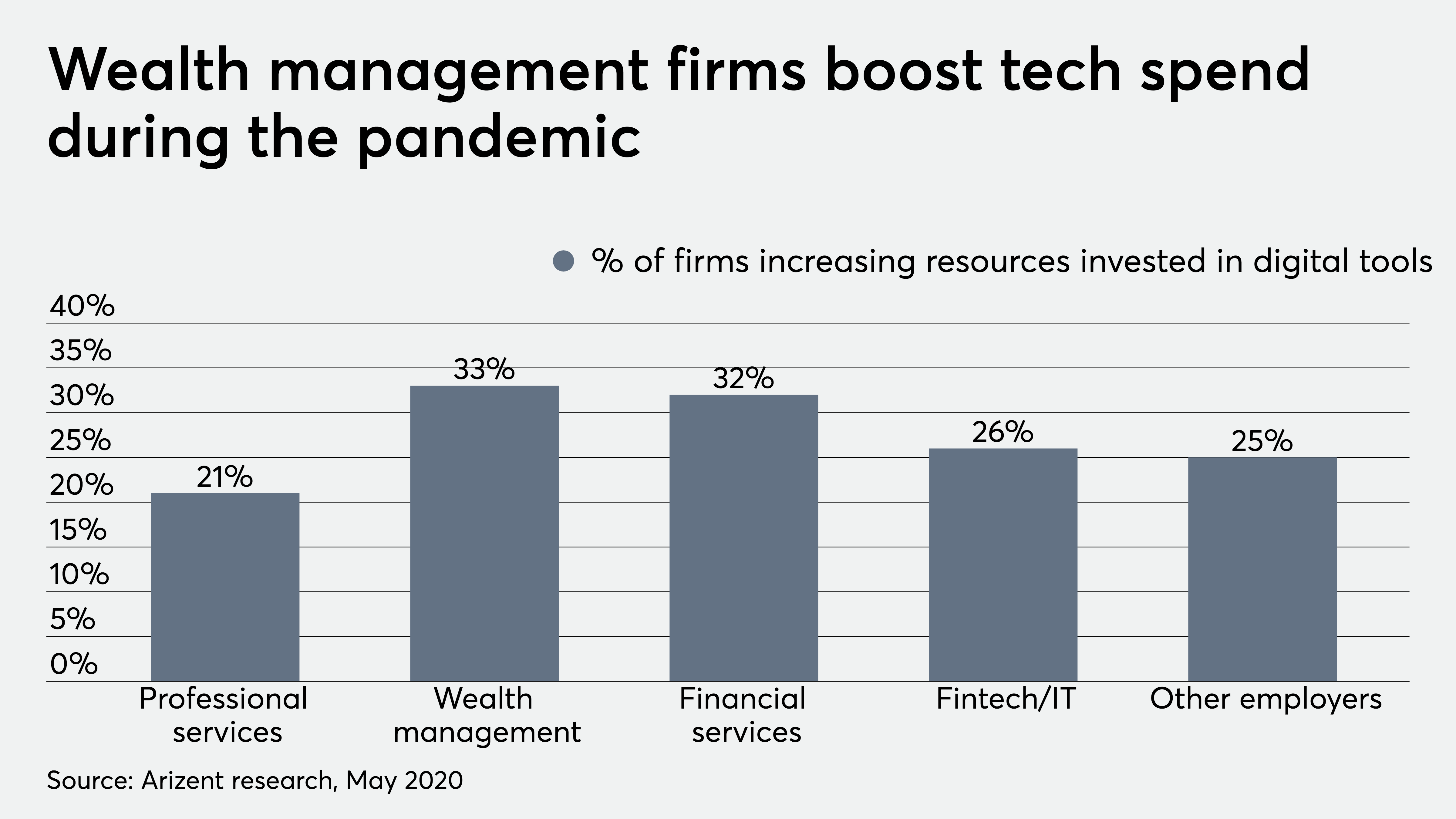

And it’s not just the startups. Online client engagement has soared, with firms saying technology adoption rates have accelerated by five years. The long-predicted “digital wealth transformation” is no longer coming. It’s here.

All of it is influencing funding. After a dip in early 2020, private equity and venture capital have resumed flowing into the industry at a pre-pandemic pace, while ongoing consolidation is opening new opportunities for fintechs to expand market share.

And as nationwide protests brought racial inequality into focus, both traditional financial institutions and digital startups are examining the role technology can plan in democratizing access to financial planning and helping traditionally underserved communities build wealth.

With that backdrop, Financial Planning is combining the INVEST and INVEST West conferences this year to bring the wealth management industry’s most innovative minds together for one entirely digital event. This is your destination to learn, contribute and connect as the entire community looks to shape the future of WealthTech.

You’ll explore the deep structural changes required for sustainable growth in a maturing market, compare the leading concepts and designs for customer and advisor experiences, and examine digital strategies driving the industry’s transformation.

Here’s a preview of some of we have planned:

The Present and Future of Digital Engagement

2020 has been a year of turmoil and challenge, but also of rapid adaptation and learning. The industry has seen a number of immediate shifts in how clients are engaging digitally and foresees far-reaching implications coming out of this period of disruption. This session will include data and insights from Cynthia Loh, Charles Schwab’s vice president of digital advice, and Alois Pirker, research director of Aite Group, on a pivotal year for behavioral change and a vision for moving toward a post-pandemic world.

From #InvestTech to #AdviceTech: Innovation in Advice-Centric Technology Ecosystems

This session will focus on how the shift from investment-centric value propositions to advice-centric models is driving changes in wealth advisors’ technology and integration needs. We’ll cover the critical role of data in an “AdviceTech” ecosystem, as advisors require usable insights to personalize advice and recommendations. This session will also include insight around the adoption best practices from Toussaint Bailey, CEO and principal of Enso Wealth; Dana Anspach, founder & CEO of Sensible Money; Ankur Vyas, head of wealth omni channel at Truist; Jon Stevenson, head of wealth management at MoneyLion; and Gavin Spitzner, president of Wealth Consulting Partners.

Retirement Tech Reset: What Are the Opportunities & Developments That Are Moving the Needle?

The “Retirement Reset” is real and the current environment has prompted us to look at the intersection of retirement and technology with fresh eyes. How can technology help investors evaluate progress against their current retirement goals and identify adjustments that need to be made? Retirement technology platforms and tools abound but how should they be used in the unprecedented moment we find ourselves in? Have turbulent markets overhyped the role that technology can play in retirement, or made it even more relevant? Steve Gresham, managing principal of the Execution Project; Ainslie Simmonds, EVP and global head of digital at PIMCO; Fahd Rachidy, founder and CEO of ABAKA; and Brooke Worden, president of the Rudin Group, will unpack these questions and more and give us all a view into retirement’s next chapter.

Leave a Reply