Two ex-Morgan Stanley financial advisors whose team managed $2 billion in client assets joined an LPL-affiliated firm, making it the second largest recruiting move this year in the independent broker-dealer sector.

Advisors John Gallagher and Mark Levin of Marlton, New Jersey-based Maverick Partners Wealth Management affiliated with LPL Financial as their IBD and Gladstone Financial Resources Group as their office of supervisory jurisdiction, the firms said Nov. 16.

Gladstone is the largest LPL enterprise that uses the firm’s corporate RIA. The firm has annual revenue of roughly $150 million, about 670 advisors, and $24 billion in client assets. Maverick Partners represents the largest wirehouse breakaway team unveiled by any IBD in 2020, according toFinancial Planning’stracking of company recruiting announcements.

“To make this move now, during a global pandemic and in the midst of market uncertainties, was a huge, carefully calculated decision,” Gallagher said in a statement. He added that the move enables the newly independent practice to be “a business that is our own, where we can be fiduciaries and keep our clients’ best interests at the forefront of everything we do.”

A spokeswoman for Morgan Stanley declined to comment on their departure.

Gallagher and Levin became business partners in 2013, and they formally affiliated with LPL on Nov. 12, according to FINRA BrokerCheck. Gallagher had spent 11 years with Morgan Stanley after three years with Smith Barney, 18 with Legg Mason and three more starting out his career at Janney Montgomery Scott. Levin had been with Morgan Stanley since 1996.

Their new OSJ became one of LPL’s largest in May, when Gladstone Wealth Group merged with Financial Resources Group Investment Services. After the deal, Gladstone retained ownership of its hybrid RIA and the entity’s parent, Gladstone Wealth Partners, according to LPL. Gallagher and Levin had known Gladstone CEO Rick Frick at Morgan Stanley.

“Their move to independence represents the continuing trend of successful, high-net-worth teams gaining independence to have more control over how they run their businesses and how they serve their clients,” Frick said in a statement.

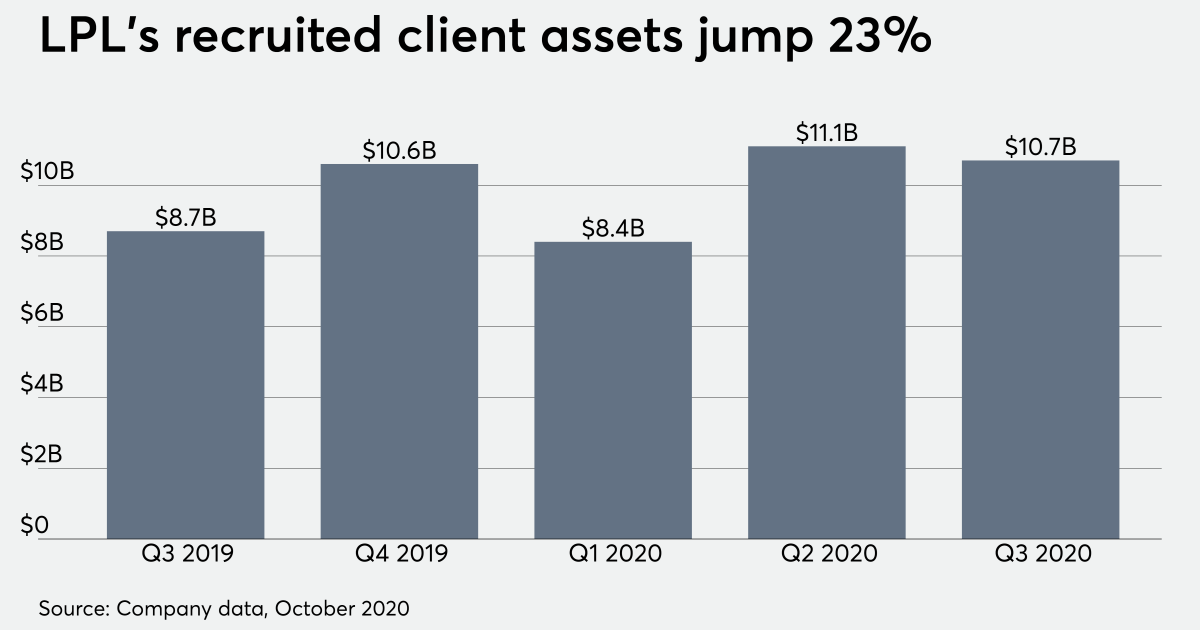

LPL’s recruited client assets in the past 12 months have amounted to more than $40 billion, according to the firm’s third-quarter earnings. The firm has also notched the largest recruiting move announced this year in the IBD sector, as well as two major bank-channel poaches for 2021 that are likely to be the largest of next year.

Though recruiting efforts were disrupted earlier this year due to the coronavirus pandemic, advisor moves have since picked up. Earlier this month, a former UBS team that managed $1.8 billion joined an RIA founded by a former colleague.

Leave a Reply