The slump in annuity sales stemming from low interest rates hasn’t extended to some products designed for protection and a little bit of upside during economic turmoil.

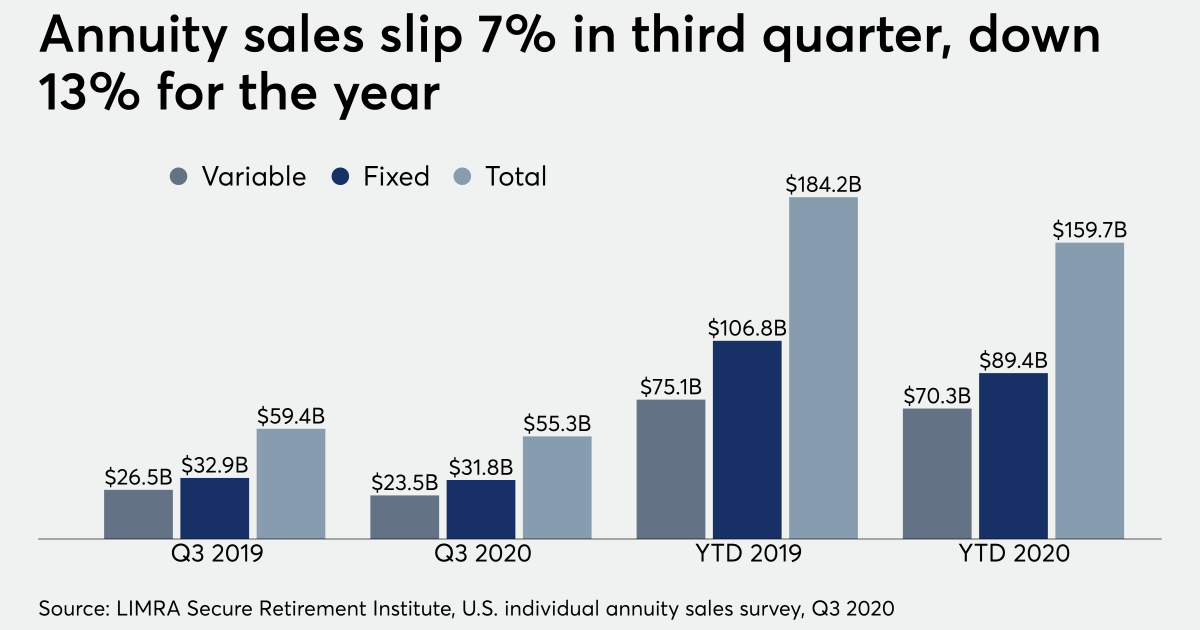

Fixed-rate deferred annuities such as multi-year guaranteed annuity products, as well as registered index-linked annuities — also known as structured or buffered variable annuities — are moving at higher volumes than last year. Overall, though, sales fell 7% year-over-year in the third quarter to $55.3 billion, according to the LIMRA Secure Retirement Institute.

Sales have tumbled by more than 20% year-to-date across each of the fixed product lines besides fixed-rate deferred annuities. In variable annuities, traditional products have also seen double-digit declines in sales. At the same time, RILA sales have surged by a quarter to $15.7 billion in the first nine months of 2020.

“Economic conditions are very favorable for RILA products, providing investors downside protection with greater growth potential,” Todd Giesing, SRI’s senior annuity research director, said in a statement. He notes that accumulation-focused products are driving the sales, which is marked by 30% higher volumes from the previous quarter in all distribution channels.

Banks in particular fueled the momentum around fixed-rate deferred products, according to Giesing. With branches opening up slowly after closures earlier in the year, fixed-rate deferred sales soared by 60% year-over-year to $15.8 billion in the third quarter. The bank channel was responsible for 41% of the sales, a substantially larger share than the year-ago period.

In fact, sales of all products rebounded from the previous quarter, according to Sheryl Moore, the CEO of annuity research firm Wink. Still, with the exception of the double-digit increases among MYGAs and structured VAs, Moore points out that sales of most of the other products are more than 10% behind their pace at this time last year.

Jackson National Life Insurance led issuers in overall sales, with a market share of 8.4% and the seventh consecutive quarter of Jackson’s Perspective II product being the most popular on the market. Sammons Financial Companies — with a market share of 12.4% for fixed-rate deferred products and 16.5% for MYGAs — took second place. The rest of the top five issuers included AIG, Lincoln Financial Group and Athene.

Among MYGA products, the MassMutual Stable Voyage 3-Year drew the largest sales. Three of the top 10 MYGA issuers boosted their sales by more than 1,000% in the quarter, Moore said in an emailed statement.

“It is very telling how consumers’ demand for guarantees continues to be emphasized through the sales of MYGA products,” Moore says.

Leave a Reply