Long term investment in the stock market helps in creating wealth. The stock market investors are always looking for stocks that can help them in generating long term wealth. Leading stock broking firm Motilal Oswal has conducted research and released wealth creation report. The name of report is 25th wealth creation study report. The wealth creation report contains 25 Best stocks for long term investment. The shortlisting of stocks is done by using logical shortlisting method.

In this post, we will take a look at wealth creation study report and detail of 25 long term investment stocks along with top 10 wealth creator stocks of 1995 to 2020.

25 Wealth Creation Stocks by Motilal Oswal for Next 25 Years

Approach adopted for shortlisting of long term investment stocks are given below.

Step 1 – To carryout study of 25 Wealth Creators of the last 25 years and find out common details. Findings of this study is given below.

- All the shortlisted companies were small to mid in size in the base year 1995.

- They were consumer-facing with secular business model.

- All the companies where very profitable.

- Most of the companies where market leaders in their respective business.

- The management of the companies with high integrity level and competence.

Step 2 – After studying old 25 wealth creator stocks, next step is to find out potential 25 wealth creator stocks. Logical method used by Motilal Oswal is given below.

Size – List down 150 midcaps i.e. companies ranked 101 to 250 by current market cap.

Business Model – Find out consumer-facing companies with secular business models. This means cyclical business like auto, capital goods, chemicals, oil & gas and reality needs to be eliminated.

Very Profitable – From the shortlisted companies find out profitable companies. To find out profitability look at RoE. The last five years’ average RoE should be greater than 15%.

Business Potential & Management Potential – The next is to judge shortlisted companies based on business potential and management potential. Shortlist companies that qualify both count business potential and management potential.

Market Leadership – Now from the remaining stock find out market leaders. The companies that are famous and in leadership role.

Value Migration – Find out value migration companies. The companies that create value and capable of migrating from business model that satisfy customer priority irrespective of market leadership.

Large Cap for Financials – Financial Services is quite a risky business, and here size begets size. So, in the report they have mainly resorted to large caps for financials, and roped in leader names for the portfolio.

Digital Play – Find out the companies that are involved in digital play or digital disruption.

Valuation – Valuation matters a lot but in long run it will not make sense to give lot of weightage to valuation thus it is ignored in the shortlisting process.

Based on above process following 25 stocks are shortlisted for long term investment for 25 years.

- Ajanta Pharma

- Alembic Pharma

- Astral PolyTech

- AU Small Finance

- Bajaj Finance

- Bata India

- Bayer Crop Science

- Coromandel International

- Dixon Technologies

- Dr Lal Pathlabs

- HDFC AMC

- HDFC Bank

- HDFC Life Insurance

- Honeywell Auto

- ICICI Lombard

- ICICI Securities

- Indiamart Intermesh

- Max Financial

- Mphasis

- Muthoot Finance

- P&G Health

- Page Industries

- Syngene International

- Varun Beverages

- Whirlpool India

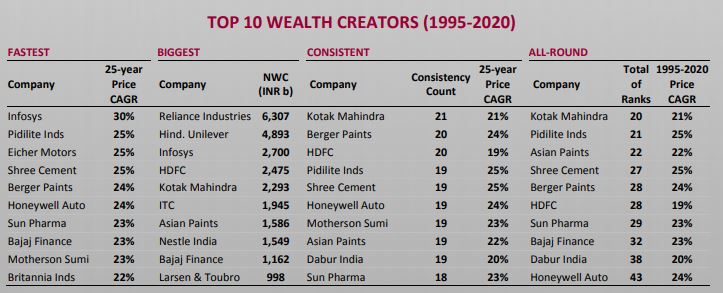

In addition to above 25 stocks for long term investment below is detail about 10 Wealth creator stocks from 1995 to 2020.

Over to you

Do you think 25 wealth creator stocks for next 25 years suggested by Motilal Oswal will give good returns in the future?

Do share your views in the comment section given below.

Leave a Reply