As private equity firms inject capital across wealth management, one of the largest consolidators kicked off the year with a record-breaking RIA acquisition agreement.

In its largest deal ever, Hightower is buying Bel Air Investment Advisors — a Los Angeles-based ultrahigh-net-worth practice with more than $8 billion in assets under management — from a Canadian asset manager, the firms said Jan. 4. The parties expect the deal to close in the first quarter; neither Chicago-based Hightower nor the seller, Fiera Capital, disclosed the price.

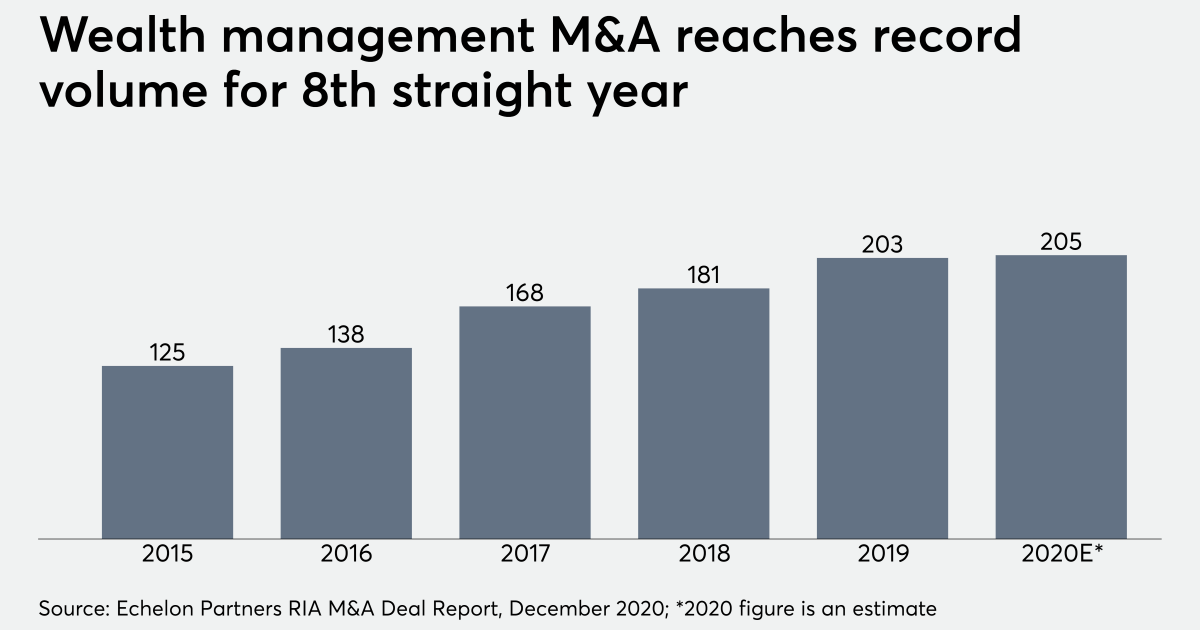

PE-backed firms like Hightower — which received $100 million for strategic investments in 2017 under its recapitalization by Thomas H. Lee Partners — have helped fuel record volumes of deals in wealth management for eight years in a row, according to investment bank and consulting firm Echelon Partners. At nine deals completed by Dec. 22, Hightower tied CI Financial for the most M&A transactions in 2020 across wealth management.

Bel Air Chairman Todd Morgan leads a group of 10 advisors, six investment managers and 27 other employees who serve clients with at least $20 million in investable assets. Bel Air has a broker-dealer, Bel Air Securities, and the firm uses Pershing as its custodian, according to its SEC Form ADV brochure.

In an interview following the announcement of the deal, Morgan and Hightower CEO Bob Oros said Bel Air would retain the same brand and custodian under the new setup. Bel Air will use Hightower’s RIA and BD after the deal closes.

“We’re very attracted to high-quality leadership teams with an orientation for growth, with next generation leaders all in place,” Oros says. “Working together, letting them do what they do so well, which is serve their clients, we felt we could be a really powerful combination.”

Montreal-based Fiera acquired Bel Air in 2013 — 16 years after Morgan co-founded the firm. His career as a broker dates back to 1970, when he started a seven-year stint at Piper Jaffray & Hopwood. Morgan later spent 20 years with Goldman Sachs before launching the indie practice. Bel Air’s founders and managers will also control an undisclosed level of equity after the deal.

“We’re looking for some rising young superstars to bring into our business,” Morgan says. “We think we found the right partner who shares the same vision.”

Morgan estimated that the practice grew by nearly two-thirds — some $3.5 billion — under Fiera’s roughly eight-year ownership, though he noted that one of Bel-Air’s teams left prior to the agreement with Hightower.

Fiera confirmed the deal in a news release that cited a combined selling amount of $81 million in Canadian dollars — roughly $63.4 million — excluding transaction costs, for the Bel-Air deal and a separate transaction for another one of its portfolio firms. Bel-Air and the other outgoing firm, Wilkinson Global Asset Management, generate about $58.1 million in combined annual revenue. About 15% of the firms’ AUM will remain sub-advised by Fiera after the deals.

“After thorough strategic review of our private wealth operations in the U.S. and in light of the evolution of our private wealth business model, we elected to divest Bel Air and WGAM, two high-quality businesses,” said Fiera CEO Jean-Guy Desjardins said in a statement. “These transactions are also a testament to our commitment to create value for our shareholders through disciplined capital allocation, which remains a key strategic priority for us.”

The parties unveiled the deal after wealth management M&A set records for quarterly volume in each of the last two periods of the year, according to Echelon’s latest deal report. Wealth managers notched 55 deals in the third quarter and at least 69 in the fourth after a lull amid the coronavirus had pushed down volume to its lowest quarterly level in nearly three years. Average AUM acquired soared by 24% in the past year to $1.8 billion, also a record, Echelon says.

2020 brought “some of the largest wealth management M&A transactions to date,” according to the firm’s preliminary fourth-quarter report. “As smaller firms shelved acquisition plans (possibly due to resource constraints and COVID-19), larger well-capitalized buyers executed banner transactions.”

Including the Bel Air deal, Hightower has acquired 14 firms since the beginning of 2019, when Oros embarked on a strategy of identifying more acquisitions and solidifying its existing ranks of RIAs. For much of its 12-year history, the firm had focused on equity partnerships with breakaway brokers and outsourced platform services under former CEO Elliot Weissbluth.

With 114 practices in 33 states as of Sept. 30, Hightower had $81.4 billion in assets under administration and $61.6 billion in AUM. The firm aims to provide scale to successful practices as “a partner to help, hopefully, grow bigger faster,” Oros says.

“Core to the Hightower model is, we want to empower business owners,” he says. “Don’t confuse that with us coming in and telling them how to run the business.”

Leave a Reply