A legendary dealmaker’s family office is changing hands for the second time in four years, under a deal with nearly as many wrinkles as his famed leveraged buyouts.

Whitnell & Co. started as the family office of late former Beatrice Companies Chairman Donald P. Kelly before expanding to other high-net-worth and ultrahigh-net-worth clients, trusts, foundations and institutions. A hedge fund-backed firm with family office roots, Rockefeller Capital Management, is buying Oak Park, Illinois-based Whitnell from a regional bank.

Rockefeller’s global family office division is adding three teams of advisors led by Wayne Janus, Mia Erickson and Brian Henderson from Whitnell, which has 25 professional staff and $1.4 billion in client assets. Green Bay, Wisc-based Associated Banc-Corp, is selling Whitnell to Rockefeller for an undisclosed sum in a deal expected to close in March, the firms said Jan. 5.

In a statement, Rockefeller Global Family Office President Timothy O’Hara praised Whitnell’s “planning-led focus, extensive experience, scope of services” and Chicagoland location. “The Midwest is a key region for our national expansion, as our footprint continues to geographically align with where Americans build businesses and create wealth,” O’Hara said.

The deal includes a strategic partnership making the bank a mortgage lending referral partner to Rockefeller in the Midwest and establishing the bank’s trust company as one of the firm’s third-party vendors. Associated and Rockefeller also plan to work together on certain other lending and asset management services. Associated had purchased Whitnell in October 2017.

Rockefeller and the seller have “a shared appreciation of the needs and goals of our clients,” Associated CEO Philip Flynn said in a statement. “This partnership positions us to leverage our core capabilities through Rockefeller’s network of clients and relationships.”

Rockefeller Global Family Office has 22 advisors after its 2019 acquisition of Financial Clarity. The firm’s main wealth manager has 91 advisors on 41 teams, including 26 who joined the firm in 2020. The firm manages $69 billion in client assets across its organization. The seller didn’t retain any equity in Whitnell under the deal, according to Rockefeller.

Rockefeller CEO Greg Fleming and funds affiliated with Viking Global Investors formed the company out of the family office in March 2018. The Whitnell deal came two months after Rockefeller opened its first Chicago location.

“The Whitnell family services business model is an excellent match for our organization and our clients,” Fleming said in a statement. “We look forward to welcoming the Whitnell team and leveraging their expertise as we grow our Chicago market presence.”

The newly acquired firm’s name came from the surnames of investment managers Bill White and Mike Brunell, who co-founded the firm with Kelly in 1988, according to Whitnell’s website. In the most famous deal over many in his career, Kelly teamed up with Drexel Burnham Lambert and KKR on the leveraged buyout of the Beatrice food conglomerate for $6.2 billion in 1986.

“In Don Kelly one finds elements of all three types of clients we serve: business owners, executives and wealthy families. Don was, at various points in his life, all three of these,” the website says. “Don expressed his love for family by ensuring that they were secure and they continue to work closely with the financial professionals at Whitnell to this day.”

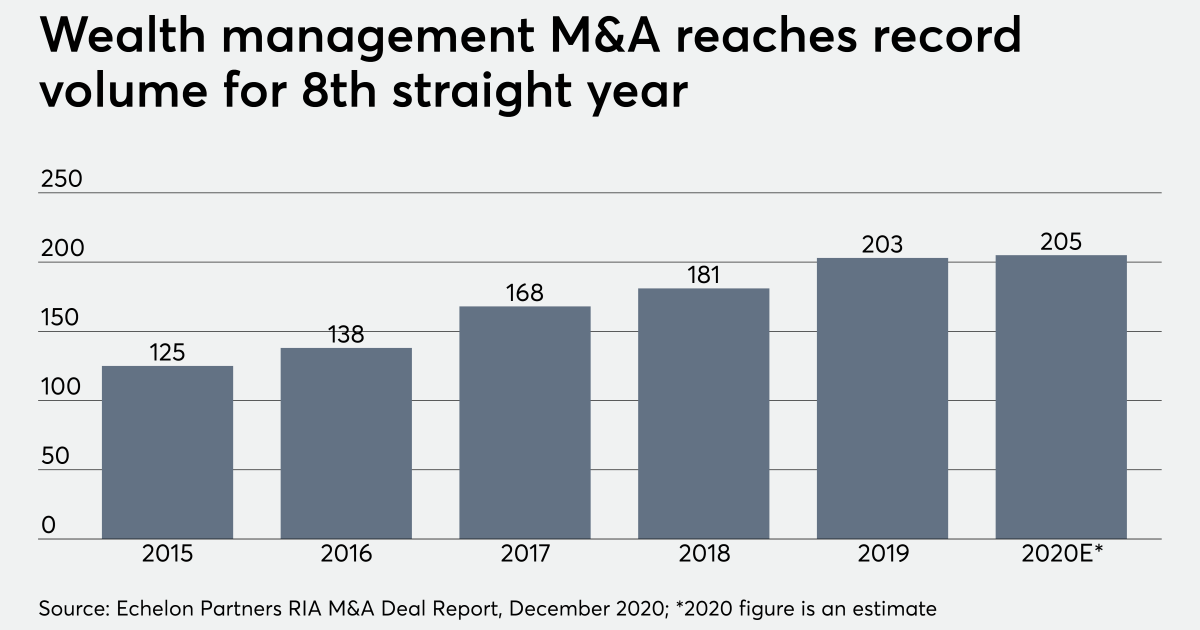

Beyond their traditional use for the wealthiest of clients, the term “family office” and similar labels are gaining momentum in wealth management, according to Carolyn Armitage, managing director of investment banking and consulting firm Echelon Partners.

“To call yourself a multi-family office is a terrific way to distinguish yourself in the marketplace,” Armitage says, adding that Rockefeller’s global family office fits well when “considering their name and their positioning” in wealth management.

Leave a Reply