FINRA is examining brokers who received a loan through the Paycheck Protection Program, a federal government program intended to provide relief to small businesses impacted by the coronavirus pandemic.

In a letter obtained by Financial Planning, the regulator’s National Cause and Financial Crimes Detection Programs says the purpose of the examination is to determine whether the PPP loans violate federal securities laws or FINRA rules. The recipient’s name and broker-dealer affiliation were redacted.

A FINRA spokesperson confirmed that the letter came from the regulator and clarified that it is not a Targeted Examination Letter.

“FINRA is proactively looking at registered representatives that obtained loans through undisclosed outside business activities,” the spokesperson said in an email. They declined to comment on which rule violations the regulator is concerned about, or how many advisors are being examined.

While undisclosed outside business activities would violate FINRA rules, Max Schatzow, an attorney with Stark & Stark who represents a firm that received a copy of the letter sent to an affiliated advisor, says it seems like the regulator is trying to determine whether or not the individual should have taken a loan in the first place.

The letter asks for extensive information on why the advisor applied for a loan, how funds were received and used, and all compensation received since Oct.1, 2019.

“There are no rules, statutes or regulations saying an advisor cannot apply for a government-sponsored loan, whether it’s forgivable or not,” Schatzow says. “I just think it’s a crazy waste of FINRA’s resources spending their time and energy basically doing the job of a criminal investigation or enforcement arm of a government regulator.”

The federal government set aside $670 billion in April for small businesses that were impacted by nationwide lockdown orders during the pandemic

Given the sense of panic during the spring, some companies may have taken loans out under the name of a parent company to keep it off the books of a FINRA-regulated broker-dealer entity, says Stephen Murphy, managing director of Foreside Financial Group, which provides governance, risk management and compliance technology to advisors. The first-come, first-served roll out of the funding also sparked a rush to apply for the loans.

“Decisions weren’t always well-documented, applications were sometimes read with bleary eyes, and upon retrospect, perhaps different interpretations might be made now,” Murphy says.

If funds weren’t used exclusively on employee payroll, FINRA could be concerned that the firm is violating FINRA rule 2010, which requires businesses to be run in an equitable and honorable manner, Murphy adds. Or if the firm really needed the loan to avoid going out of business, it could be violating FINRA’s capital requirements.

“Were the firms using these PPP loans to cover prior misdeeds? Did firms seize on this opportunity to pay themselves as a bonus rather than putting it back into the company?” asks Murphy. ”I think it goes back to the notion of ethically running your firm.”

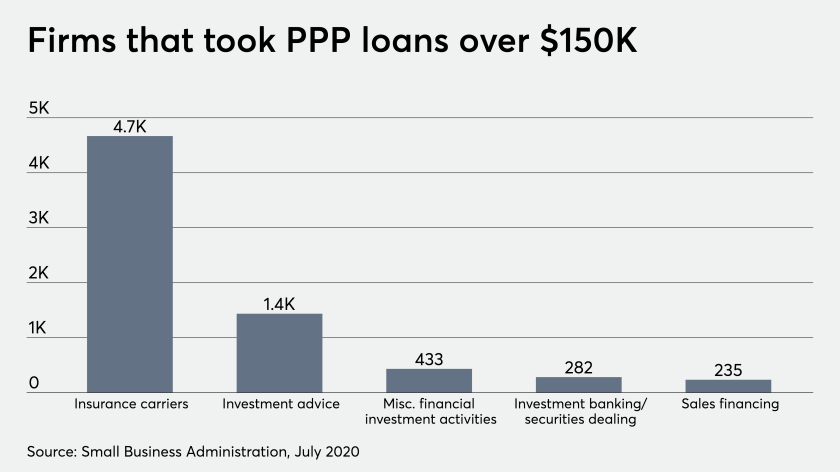

According to data released by the Small Business Association, which administered the loans, more than 1,400 wealth management firms received loans of at least $150,000.

Sanctuary Wealth Group, a broker-dealer that received between $1 million and $2 million from the federal program, has not received a letter from FINRA, according to a spokesperson.

American Portfolios, Kovack Financial and Geneos Wealth Management, all broker-dealers that received PPP loans, did not respond to a request for comment.

Other firms have dealt internally with employees who have abused the coronavirus relief program. In September, JPMorgan Chase found evidence of employee and customer wrongdoing involving PPP loans, and Wells Fargo fired more than 100 employees in October who improperly collected funds.

However, it’s not FINRA’s job to go after these cases, Schatzow says.

“FINRA should really be focused on protecting investors and making sure financial institutions are secure,” he says. “This just seems like it’s way out of left field.”

Leave a Reply