Rakesh Jhunjhunwala is an Indian investor and trader. Jhunjhunwala is the 38th richest person in India. The net worth of Jhunjhunwala is $3.2 billion. He is an undisputed king of Dalal Street. By profession, he is a trader and chartered accountant.

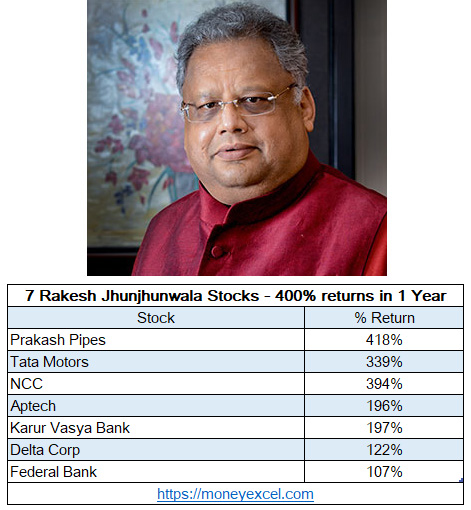

Big bull Rakesh Jhunjhunwala has invested money in multiple Indian stocks. His portfolio is a mix of stock from various categories including finance, retail, pharma, technology etc. His investments and stock portfolio is closely tracked by his fans and followers. He is earning big money from the stock market. Many stocks of the RJ portfolio have generated 100% returns in 1 Year. I have compiled a list of 7 multibagger stocks of Rakesh Jhunjhunwala in 2020-21.

7 Rakesh Jhunjhunwala Stocks – Up to 400% returns in 1 Year

#1 Aptech

Aptech is education and training company. Aptech is pioneer in non-formal education and training business. Jhunjhunwala is holding this stock since 2005 and increasing holding gradually. As of now Aptech is 49% owned by Jhunjhunwala and his family. The stock of Aptech has generated magnificent returns last year. The stock of Aptech was trading at Rs.80 in March 2020. Aptech is trading at Rs.237 in Feb 2021. In past year Aptech has generated 196% CAGR return last year.

#2 Karur Vasya bank

Karur Vasya Bank is scheduled commercial bank in India. Rakesh Jhunjhunwala purchased massive stock of Karur Vasya Bank way back in 1993. Karur Vasya Bank was penny stock at that time. The stock of Karur Vasya Bank has generated massive returns last year. KVB stock rose to almost twice and generated 197% CAGR returns in FY 2020-21.

#3 Federal Bank

Federal Bank is another Indian private sector scheduled commercial bank in jhunjhunwala’s portfolio. He is holing this stock since long. This stock is trading stock by Jhunjhunwala. He has booked profit in this stock multiple times. The Federal Bank stock has given 107% returns to Jhunjhunwala in FY 2020-21.

#4 NCC

Nagarjuna Construction company (NCC) is infrastructure company. Jhunjhunwala couple is owning 7.83 Cr shares of NCC. Jhunjhunwala has increased stake in NCC stock many times. The stock price of NCC was Rs.18 in March 2020. NCC is now trading at price of Rs.89. This means NCC has given 394% CAGR return last year.

#5 Prakash Pipes

Prakash pipes is small cap company operating in plastic sector. Rakesh Jhunjhunwala is holding stock of Prakash pipes since incorporation of company 2017. The financial of Prakash pipes is strong. This stock has generated highest returns for the Jhunjhunwala in FY 2020-21. The CAGR returns of Prakash pipes is 418% in 2020-21.

#6 Delta Corp

Delta Corp is an Indian gaming and hospitality company. Jhunjhunwala is holding Delta Corp stock since 2016. It is India’s only listed company engaged in casino gaming. Despite of slowdown in hospitality industry, the stock of Delta Corp has generated 122% returns for the investors in 2020-21.

#7 Tata Motors

Tata Motors is an Indian multinational automotive manufacturing company. The stock of Tata Motors was purchased by Rakesh jhunjhunwala in September 2020. The stock of Tata motors has risen over five times in last one year. This means 1 Lakh invested in Tata motors last year would have turned out to be 5 Lakhs by now.

Stock Market Lessons from Rakesh Jhunjhunwala Stocks

Buy for Long term

The first stock market lessons from Rakesh Jhunjhunwala is buy stock for the long term. He always says that invest in businesses and not companies. Look at the fundamentals of stock while investing in the stock. Most of the stocks where Jhunjhunwala has invested money are fundamentally strong and long term bet.

Invest in small cap stock

The second important stock market lesson is investing in small cap stock that have potential to grow in the future. The stock of Karur Vasya bank, Aptech and Prakash pipes are example of small cap stock where jhunjhunwala has invested his money.

Investment and Trading both are important

The third important lesson is Investment and trading both are important in the stock market. Federal bank and Tata motors are stock example where Jhunjhunwala has done investment as well as trading for earning money.

Consistency

Consistency is utmost important in the stock market. You should invest in good stock consistently and hold investment with lot of patience. Example of stock where jhunjhunwala has increase stake consistently are Aptech, Karur Vasya Bank and NCC.

Over to You

Do you own any of the stock given above?

Do you think Jhunjhunwala stock given above will give better performance in the future?

Share your feedback and views in the comment section given below.

Leave a Reply