Executive Summary

Change is a constant reality of our lives. In some cases, change beyond our control occurs in the world, and we have little choice but to respond. In other cases, the change is something that we wish to initiate to improve our own situation. Yet, the reality is that, in either case, change is hard. So much so that it is not uncommon for us to fail in our initial efforts to make a change. Unfortunately, though, such experiences with failed attempts at change (or lapses after a change had seemingly taken hold) can result in feelings of dread and frustration when we consider a future change, as we potentially get stuck thinking about past efforts that may have been unsuccessful and lose confidence that we’ll be successful this time. Which raises the question: when change is hard, and failure and relapses are common, what can financial advisors do to help clients overcome fear and reluctance, negative self-talk and doubt, and actually implement the action steps they need to take to achieve their goals?

In order to address the negative self-talk that can preclude clients from taking action on their financial plans, financial advisors can encourage their clients to openly share and discuss their frustrations, feelings about their past efforts at change, and the things that make them nervous about moving forward. While these conversations may be difficult to initiate, worksheet tools adapted from the Transtheoretical Model (TTM) of change can provide advisors and clients with a valuable opportunity to examine specific reasons that create frustration for the client. And by closely examining how the client’s feelings and attitudes around past efforts influence their ability to implement change, advisors can help clients understand how considering unsuccessful past efforts as lessons and planning opportunities (rather than as failures!) can be highly effective in removing negative self-talk roadblocks. By adjusting their perspective around past attempts and the opportunity for planning that they present, clients may also improve their self-image and, ultimately, build financial self-efficacy.

Advisors can also help clients by exploring the emotional significance of their goals to strengthen their commitment to change. Because understanding the emotional reasons behind a goal tends to be a much more powerful motivator than simply relying on willpower and trying to tackle goals that have little (if any) personal significance for clients. Goals that are based on the notion that they simply seem like the sensible or ‘right’ things to pursue will be much harder to commit to, in contrast to those that have personally significant reasons that bring some form of emotional satisfaction. To this end, another worksheet tool adapted from TTM offers advisors a resource to initiate conversations with clients to elucidate why pursuing their goals is personally meaningful to them and the reasons that implementing change to achieve those goals is so important on an emotional level. And this conscious understanding and contemplation of the emotional significance of goals can reveal highly compelling reasons for clients to stick to their commitment to implement change over the long run.

Ultimately, the key point is that by understanding the various roadblocks typically associated with each stage of the change process, such as negative self-talk and dread that arise in the Preparation stage, advisors can engage their clients in specifically structured discussions that help them navigate through change. Helping clients successfully move past the Preparation stage will reward financial advisors with seeing their clients through to the final Action stage, where clients will be fully prepared to finally take action to implement the changes they need to realize their financial goals!

Resolving Frustration In Preparation For Action

Making a change in our lives rarely involves just the action we take to implement the change itself. As while the moment of change – the point in time when we finally take the action step to alter our current situation – might seem fleeting, the reality is that the decision to make a change actually has a significant build-up period involving ample contemplation and planning before we reach that moment of action.

In fact, the Transtheoretical Model (TTM) of Change, first developed by James Prochaska, John Norcross, and Carlo DiClemente, finds that there are several stages that occur in the build-up period before we reach the Action stage when it’s time to finally implement change (e.g., a client taking action to bring their financial life in alignment with their financial plan). And each of these stages can face challenges that make it difficult to reach the moment of action, from the Pre-Contemplation stage (marked by either a lack of awareness that change is important, or a lack of intention to actually commit to the change) to the Contemplation stage (often marked by self-doubt and delay resulting from self-perceived incapability and lack of resources needed for the intended change), and then the Preparation stage where people may be struggling to get unstuck as they replay what didn’t go right in past attempts, which can block their energy to move forward.

When it comes to the Preparation stage, in particular, the principal hallmark displayed by individuals is negative self-talk. Individuals in this stage are often challenged by feelings of unresolved frustration and generally experience fear, shame, regret, and, in one word, dread as they contemplate another attempt at something that they fear may simply end in failure (or end in failure again, as our attempts at change are often burdened by prior failed attempts we may have already experienced in trying).

Financial advisors with clients who are struggling in the Preparation stage may (unintentionally!) be another source of internal frustration for these clients, as the very fact that the client needs their help at all (such that they hired the financial advisor!) may just serve as a reminder of the client’s past failed attempts and of what they couldn’t do on their own. This can be especially problematic with clients who might not really want to be with the financial advisor, and who only engaged in their services because either someone told them they needed to, or they just couldn’t face trying to work on the problem on their own any longer.

Clearly, dealing with this level of client frustration is a tough issue. Advisors may experience their clients’ frustration in unexpected ways and not know where it is coming from – a client lashes out, seemingly out of nowhere, when you make a suggestion; they may rapid-fire shoot down your suggestions, claiming that they’ve “been there, did that, didn’t work… let’s move on to whatever’s next.”

And naturally, clients working to get past the challenges they face in this stage are having a tough time, too. Which means that while helping clients through the earlier stages of Pre-Contemplation and Contemplation focused on positive thoughts and the impact of the change on other people, aiding clients struggling in the Preparation stage is largely about healing one’s self from the damage that prolonged negative self-talk can inflict on one’s self-esteem.

While this may not be an easy process, there are resources that advisors can use to help their clients through the Preparation stage that will not just lead them to the Action stage (where clients will finally be able to implement the strategies to change) but will also give advisors an opportunity to help clients develop their own financial self-efficacy and further strengthen their working relationship with the client!

How Clients Overcome Negative Self-Talk And Frustration

One of the central goals in the Preparation stage is to help clients end the negative self-talk that can deter them from implementing change. And while it may sound simple, negative self-talk can be a hard cycle to break.

However, despite the challenges faced by clients in this stage, there are measures advisors can take to help clients perceive their progress more positively, such as by engaging them in guided learning experiences (versus through a less effective trial-and-error process, where they are set up to experience even more failure) to develop a new, positive self-image as an individual who can successfully implement change.

Curbing Negative Self-Talk Through Self-Evaluation

The first strategy in getting past the Preparation stage involves self-evaluation. This deals with reconciling the vision that an individual has of themselves today with one of themselves in the future, along with all of the versions in between. It involves emotionally attenuating negative self-talk and reconciling unrealistic expectations of the future, with the goal of showing the client that change doesn’t happen overnight; getting from ‘here’ to ‘there’ is a gradual process that will take time (hence the utility of a model that examines the Stages of Change). Accordingly, clients should understand that the initial days of taking action to implement change can often be the hardest and will occur when a person may be at their most vulnerable.

Taking time with clients to think carefully about how they can prepare for action is important to help them deal with those vulnerable moments once they begin to make progress and realize their visions of their future selves. Because pushing past the Preparation stage too quickly can result in a greater likelihood for failure without a ‘Plan B’ at the ready – when clients do not fully prepare, it is much easier for them to revert back to their old ways.

One way advisors can help clients prepare for action is to guide them through a brainstorming session to design those ‘Plan B’ backup plans. This can be helpful for clients who may feel blocked by mental hurdles to mitigate their resistance and still be successful at implementing change. With access to alternative plans that they are already familiar with, clients will have more tools at their disposal with a greater chance of bypassing their roadblocks.

Example 1: Clara, a client who wants to save more money, notices how hard it is to resist going out to her favorite (expensive!) coffee shop and to start making adjustments to her budget. She’s just not sure if she can curb her expensive coffee habit and is daunted by the steps she’d need to take to start a savings strategy.

Clara discusses her feelings with Addison, her financial advisor, who suggests that Clara can perhaps reward herself by purchasing a bag of her favorite gourmet coffee beans from the coffee shop and making her own freshly brewed cup of coffee at home. Even though the beans may be expensive, their net cost is much less than a daily cup from the coffee shop.

Clara is excited by the opportunity to spend some focused time preparing an indulgence for herself and is energized by Addison’s willingness to help her brainstorm alternate solutions. She is more motivated to move forward with adjusting other items in her budget.

Another revelation that can be gleaned through self-evaluation is to see how past ‘failures’ can actually serve as valuable learning opportunities and warning signs that help us make course corrections to better prepare for and set up rewards and ‘Plan B’s.

Example 2: As Clara, the client from the last example, reflects more carefully about what her daily routine will look like without a morning visit to her favorite coffee shop, she recalls the last time she tried to quit her coffee habit in an effort to save more.

While she was able to keep up without her daily visits for a little while and made her own instant-brew coffee in the morning, she realized that aside from missing some really good coffee, she simply missed the social experience of actually going into the coffee shop and seeing familiar faces.

As such, she only kept up with the home-brewed (yet mediocre) coffee routine for a month before needing to revisit the social buzz of her nearby coffee shop.

Clara remembers feeling frustrated and deflated, but Addison, her advisor, knows that Clara is in the Preparation stage and needs some encouragement to get her past the negative self-talk she engages in.

She has the following conversation with Clara:

Clara: I just can’t do it, I planned out my routine so carefully, yet I still failed.”

Addison: No, no. Your past efforts aren’t a failure at all! They just tell us that you need an emotional connection on top of the better-quality coffee you’ll be making for yourself at home. So instead of never visiting the coffee shop anymore, how would it sound if you committed to making your own coffee at home every day except for Friday – and that’s the day you visit your coffee shop? Think of it as an extra-special treat for yourself.

Clara: Oh, I like that idea. I’d get to keep some connection to the people I see every day at the coffee shop. Yet, I don’t know if that would really be enough to satisfy my need for a bit of social contact before I head into the office – my job can be pretty rough, and it’s really nice to start the day with some friendly interaction.

Addison: That makes sense and is perfectly reasonable. So maybe another option you can try, in addition to visiting the coffee shop just once a week, is to start a coffee-time video chat with a friend or family member a few mornings during the week to try to get that emotional need fulfilled along with the coffee.

Dwelling on the negative aspects that resulted from past mistakes, instead of viewing them as learning opportunities, tends to deplete willpower. And while willpower on its own may not be able to help a person solve it all, it is still helpful in implementing change. Thus, advisors can use what clients may consider ‘failures’ as useful signals to think about during the Preparation stage.

Furthermore, being able to address shame and negative self-talk, and also to be able to forgive oneself for past mistakes, can help clients more effectively explore the reasons why their goals are important to them and worth pursuing!

Exploring Commitment To Goals

The second key strategy in the Preparation stage involves exploring commitment, recognizing that it takes more than just willpower if the change is to last. For instance, research on change that involves smoking, drinking, and exercise habits shows that, while willpower alone can help individuals maintain new habits for about a year, old habits tend to creep back in shortly thereafter. As while a person can have all the facts about why a change should be made, there’s a good chance that they will likely still feel unsure of what to do to maintain the habits needed to keep the change in place.

Because when it comes to making a true and lasting commitment, an emotional connection to the goal can bring a client much closer to understanding and feeling, on an emotional level, the deeper forces that drive us and that instill in us a genuine desire to make something happen.

Additionally, it can be risky for individuals who believe that there is only one way to move forward (i.e., they have no backup plans) because if that one way ends up not working, willpower will probably be depleted rather quickly. Willpower can be valuable to help us get started, but, on its own, won’t be enough to sustain prolonged commitment to change over time.

For instance, the two statements below highlight the power and driving force behind the personally meaningful ‘why’ of an action versus just the utility and sensibility of an action.

- “I want to start saving up for a vacation so that I don’t pay for it all with a credit card and rack up more debt.”

We set up savings and do things like making cuts to our daily store-bought coffee… we save, but it is a struggle because there is no emotional connection to the reason for saving. Saving feels like a loss that we must overcome with willpower as opposed to a win that we could ride to the financial goal.

- “I want to start saving for a vacation to Disneyland with my entire family in two years. My daughter loves the princesses; she is going to flip, and so will my mom when she sees her granddaughter in a tiara!”

We set up savings, and we are proud; we tell our family and start to plan the vacation. As we do so, we get even more excited and feel more proud of our financial decisions because we are deeply and positively charged for this change. Who needs tons of willpower when you are literally giddy to see the money in your account, as you imagine the smiles of your family members?

As the above example illustrates, the solution is to help clients understand their emotional ‘why’ and to be able to answer the question, “Why does this change matter so much?” Although some of the reasons may have been reviewed during the earlier stages of change (i.e., Pre-Contemplation and Contemplation), clients can review them again here in the Preparation stage as the need arises.

Remember, it can be hard to change for ourselves, especially when the change is seen simply as the ‘logical’ thing to do – because while that may factually be true, there simply won’t be enough motivation to change and to keep up with the habits required to implement the change. Thus, we need a reason that is personally (and emotionally) significant to help bolster commitment.

Access To A Safe Environment To Discuss Roadblocks

Guiding clients through the change process involves tackling big steps around self-evaluation and exploring commitment. Understandably then, it is important for clients to have a safe environment where they will be comfortable discussing their feelings around these highly personal and potentially sensitive areas.

Providing a safe environment is crucial, as these processes are prerequisites for the internal work needed to implement change, which can leave the client feeling quite vulnerable. Advisors are key here – while the client ultimately does the self-evaluation and exploration, the advisor can set and hold an appropriate space for this to happen.

Finding the space and time for clients does not have to be a difficult thing to do, though. It can be as simple as honoring the time allotted to the client and showing a genuine interest in exploring their ‘Plan B’s. Essentially, clients should know that the Preparation stage (not just the Action stage) is very important and that their advisor wants to make time for this valuable step.

Example 3: Addison is a financial advisor meeting with her client, Cliff. She recognizes that he has been struggling with implementing his financial plan and wants to explore ways to help him through the Preparation stage before encouraging him to take any action.

Cliff: I know. I am sorry. Here I am again, just wanting to talk through ideas and draw out plans. I am sure you are a bit tired of that and ready for me to pull the trigger.

Addison: I do want you to pull the trigger – eventually. We will get there, but first, I want to explore some possible scenarios. I value planning as a part of this process, and scenario planning is my jam. I actually really like this stuff.

I also really value being able to learn about your experiences, perceptions, and ideas. We want to get the best plan in place that we can, and this way, we also know that even if our first plan doesn’t work, we have many other options we can try.

This is not a waste of time for you and me – this is preparation, and preparation is important!

Another important consideration when creating a safe space is the financial advisor’s role as a supportive guide, not just a professional who can lecture the client about the technical aspects of financial planning. Each step of the Preparation stage, including the development of multiple scenario plans, is an opportunity for the advisor to emphasize to the client that there is no certainty that a particular outcome will result, only that they can be sure that they can rely on the advisor to be there to help them successfully implement their plan.

Example 4: Addison and Cliff, from the previous example, have continued their conversation about Cliff’s financial plan. They have come up with a potential solution that Cliff thinks he can implement.

Addison: I really like this idea that we have come up with; I think it will work. Yet, before we just jump in, let’s talk for a moment about the potential pitfalls that are still out there.

Cliff: Okay, I know from the last time I tried to do this that I got stuck…

Addison: Yes, so now let’s think through that and how we can build a safety net around that scenario.

In the above example, the advisor is helping the client to formalize a workable solution to the question, “What if?”. While the initial strategy may not work, it is much easier to take action after carefully considering the circumstances and knowing that you have thought through backup plans. Encouraging clients to analyze and plan around potential scenarios by discussing the issues on the table will ultimately help them develop their own financial self-efficacy.

Clients can benefit from this style of emotional attenuation, where the advisor walks them through hypothetical scenarios, good and bad, discussing emotions, what-if planning, and how the client thinks and feels about different outcomes.

Example 5: Addison and her client Clara, from the previous example, have continued their conversation about Clara’s savings goals. They have worked through many ways that Clara can save.

In today’s meeting, Clara is expressing stress – and even some fear – about keeping these changes going. Addison decides to do a little emotional attenuation with Clara to help Clara move past the fears of “What if?” to the realization of, “If this, then that…”.

Clara: I worry about keeping all of this going, you know? I have worked hard to get here, but I feel like I am still walking on eggshells with all of these new practices in play.

Addison: Thank you for sharing with me how you are feeling. It is very important that you share with me so we can work to resolve or address these issues. So correct me if I am wrong, but it seems like you are worried – and maybe even a bit stressed – about a potential, unforeseen lapse. Is that right?

Clara: Yes, we have prepared and have all these plans, and things are going okay… but what if something we didn’t plan for happens?

Addison: That’s a great point, Clara. Let’s walk through some of the “What if” possibilities and then turn them into “If that, then this…” solutions. We might not know what will happen, but we can still prepare for how we might deal with possible outcomes. Tell me, is there any particular plan that we have in place that gives you a lot of mental peace or clarity?

Clara: Yes, actually. When we discussed what to do if I had a friend or family member ask me for money… you said I could call you and you would help run interference. Knowing that I am able to reach out to you immediately when these unknowns come up really helps me.

Addison: Great example, and that’s a great action plan! You see, you’ve got this under more control than you realize. You can totally call me if something pops up that we had not previously considered, and we can walk through it together.

Clara: Great, thank you. Just knowing you are okay with that, that I might call to talk about something stressing me out… it means a lot because I just really struggle with doing these things alone. Knowing you’re there for me gives me a lot of peace of mind.

We can’t predict the future, but we can move through it with greater ease – whatever it ends up being – if we know we have a plan and the assurance that we will be emotionally capable of handling what might come up. Emotional attenuation helps to reduce stress, as clients are reassured that they have the advisor to guide them through whatever may come up.

Clients can also be encouraged by the alternate solutions available, knowing that an outcome won’t necessarily be disastrous if it doesn’t go perfectly as initially planned because of the alternate solutions that are accessible. Ultimately, advisors can play a pivotal role by using emotional attenuation to help clients realize change through rational – and emotionally motivated! – decision-making processes.

Being able to see oneself as capable of successfully implementing change – and not as a failure – is a huge accomplishment. And while being able to view unsuccessful past attempts as learning opportunities full of important signals about behavior is vital, it is often easier said than done. As individuals, we are often our own biggest critics, and when we give ourselves critical feedback for long enough, it can be hard to imagine what may seem like a futile situation any other way.

Financial advisors know it probably doesn’t help the client all that much to simply tell them, “You can do it”, and “I believe in you”, without actually delving into the emotional challenges the client may be struggling against. However, these messages may seem overly easy for the advisor to deliver because the challenge isn’t really on the advisor; the client is the one who needs to make the change. But approaching this personal and potentially vulnerable terrain to explore with the client can feel awkward; it can be a difficult conversation for the advisor to initiate.

As such, using worksheet exercises can be a convenient bridge for the advisor to work more closely together with the client, at the same time helping them explore the deeper issues required to do the hard internal work of getting past the Preparation stage to move into the Action stage.

Fortunately, though, advisors don’t have to just try to figure out the right words to say to engage in such client conversations. In practice, worksheets that are explored with a client can help advisors create a structure to the conversation, take clients through a process of seeing how they talk to themselves about change and past attempts, and guide clients into making meaningful commitments that they will be able to stick to.

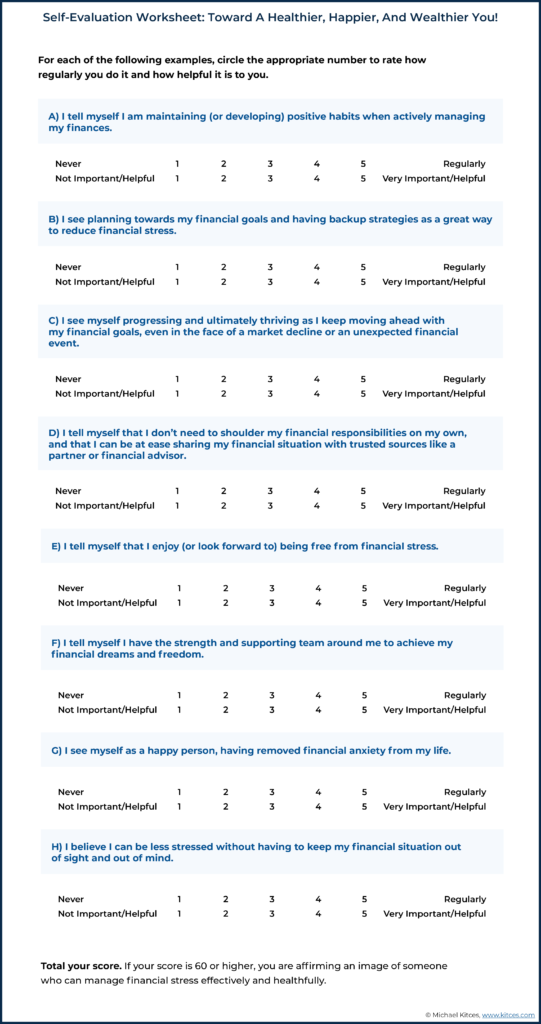

Self-Evaluation – Helping Clients Implement Change

In order to constructively assess a client’s self-talk toward their financial goals, it is helpful to examine the messaging on two dimensions. First, it is important to identify the actual message the client is giving (or isn’t giving) to themselves, and second, whether or not the message they convey to themselves is actually helpful.

Moreover, the advisor doesn’t have to worry about trying to convince the client that they are or are not ready. Nor do they need to convince the client that they are good enough (or smart enough, or whatever enough) to implement this change.

This worksheet is meant to help people slow down and think about very personal and potentially sensitive ideas; some clients may feel uncomfortable about or dislike what they discover. This is because we don’t often understand ourselves very well – not because we’re dumb, but because we don’t generally spend much time reflecting on our values, priorities, and fears.

As such, after clients answer the worksheet questions, it is important to spend some time with them to review their answers and discuss their scores constructively in an environment where they will feel safe to have a candid discussion.

If the client scores highly on the worksheet and everything is looking good, that’s great! However, advisors can still talk more about what is working for the client by discussing and giving feedback on the statements they have just reviewed. Ask them which statements stood out most to them and ask them to state why they did. Getting clients to describe the positive things about themselves, the things that matter most to them, and what really makes them proud will help to bolster the next step in the Preparation stage – making a commitment to change.

When clients do not score very high or uncover that they have a lot of negative self-talk, it can feel scary for advisors, who may ask themselves, “What do I do? What can I say to fix this or make the negativity go away? How do I make the client feel better?” These situations can be very vulnerable moments for clients because it isn’t fun to recognize and acknowledge that we are not very nice to ourselves, especially in front of someone else.

Change ultimately comes from the inside, and this worksheet is meant to help clients understand what they need to do to bring about their desired change – while initiating conversations that explore a client’s emotions can be awkward and uncomfortable, a simple conversation can introduce the worksheet and emphasize to clients how it may help them think about ways to view past experiences as lessons instead of failures.

Example 5: Addison is meeting with her client, Cliff, and wants to explore the feelings of dread and frustration that Cliff seems to be having around saving more. However, she isn’t used to discussing emotions and feelings with Cliff, and isn’t sure how to broach the subject. However, she thinks using the Self-Evaluation Worksheet can be a good way to start the conversation.

Cliff: I hear you. I do. It’s important to me to save more; we have even identified where that additional savings can come from. I just do not know if I can. I have tried to save before, and it just does not work. I am mad when I do it, and I am mad when I don’t do it.

Addison: Thank you for providing me with that insight into your thoughts and feelings; I truly appreciate it when you share this sort of information with me. If I may, just to ensure I understand what you are saying, would it be fair to say you are feeling a lot of dread about attempting to save once again?

Cliff: Yeah, that would be one way to put it. I know what happened in the past, and I totally dread having to go back through any of that, or worse.

Addison: Change is hard and, in many ways, what can make it even harder is remembering all of those past attempts and how we treat ourselves related to those attempts. Fortunately, but also perhaps, unfortunately, the dread we experience when we do this is completely normal. This is a common emotion to feel when we are undertaking change.

Cliff: Yeah, it is like the closer I get to pulling this trigger, the more I want to prepare. But then, the more I do that, the more I am reminded of what didn’t go well. I am just stuck. I don’t know how not to see that stuff and let it hold me back.

Addison: Well, here is where the ‘fortunately’ comes in with respect to dread. There is actually a lot of research that points out that how we talk to ourselves about change can actually impact how easy it is for us to accept that change. To this end, our firm has a worksheet that we can use to take a look at self-talk.

If you are interested in going through it, we can give it a try to gain a deeper understanding of how you are and how your self-talk plays a role in your financial goals. It might feel a little awkward, but having done it myself, I can tell you that it can be enlightening. Are you open to giving it a try?

While these conversations may seem daunting to some advisors who aren’t accustomed to them, it is important to recognize that the support that advisors can bring to their clients by creating a space for open, candid, and uninterrupted discussion and by reiterating to the client that they are safe to express themselves freely with you.

This can be done in a few very simple ways, which include the following:

- Advisors can always stop and remind clients that being here today, in the office, is a positive sign that change is already taking place.

If the client is now in the Preparation stage and has worked through the first stage of change, Pre-Contemplation, with you, remind them of their progress. Even though no observable action may have yet taken place, there probably has been a lot of mental and emotional work that the client has done, and that matters tremendously. That mental and emotional work is often pivotal in creating the structural foundation upon which new habits must be built, and these are essential to bringing about lasting change.

- Explain the stages of the Transtheoretical Model (TTM) of change that the client has worked (and is working) through. Describing each step of the change process in an active and thoughtful way creates a greater likelihood that change, this time, will happen. Understanding that the Preparation stage is just one stage of several – and that the client is doing it right now – can matter a lot.

- Focus on the things that are going right. Even if many of the Self-Evaluation worksheet scores are low, some scores will still be higher. Focus on those higher scores and the statements that the client says are helpful. Ask more questions about these and explore what is important and potentially motivating for the client.

- Try asking additional scaling questions to increase conversations around positive change. Scaling questions, generally, are specifically designed to elicit discussion about change and to help clients recognize change in themselves. Advisors can pause while reviewing any one of the statements in the worksheet (which are also scales in and of themselves) and simply ask something like, “I noticed on this statement, you rated yourself ‘Nearly Never’. Why is your answer ‘Nearly Never’, and not ‘Never’?”. The conversation that ensues may reveal important information – not just to the advisor but to the client as well – around key aspects of what the client values and why they may feel blocked.

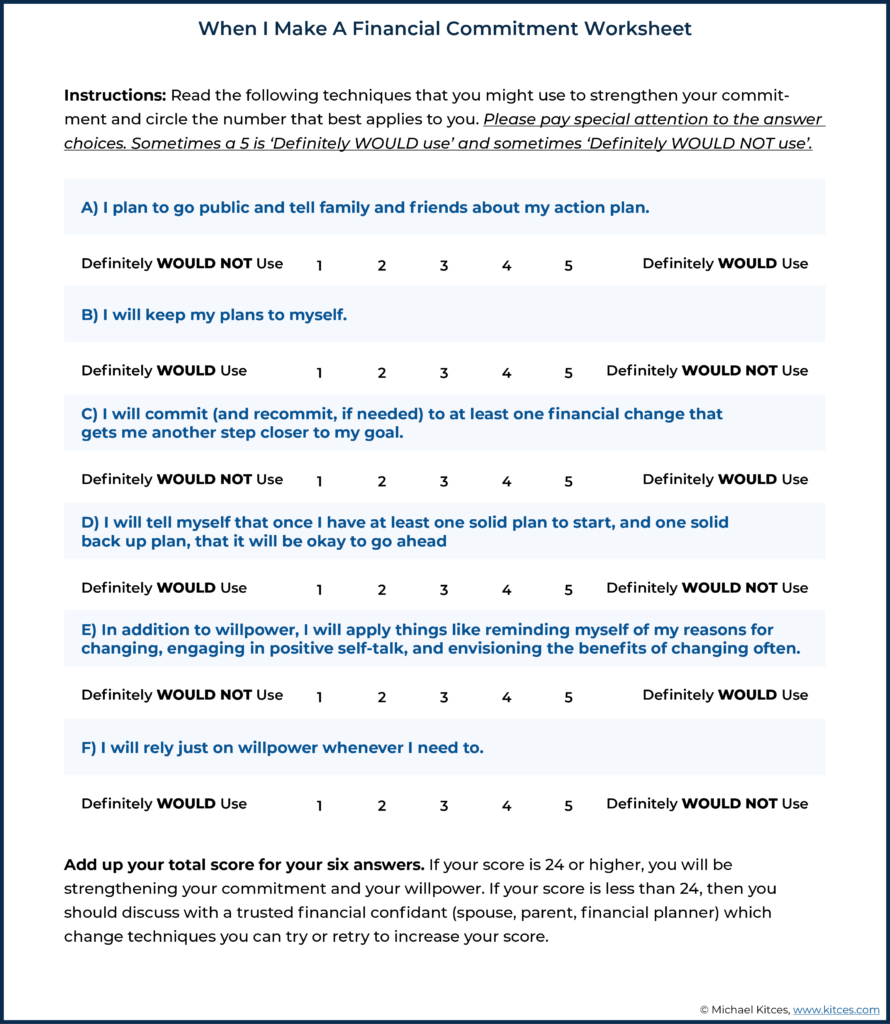

Commitment – Identifying Emotional Connections To Goals

Once advisors address negative self-talk and create a safe environment for these conversations to take place, they can then begin helping clients in the Preparation stage address their issues around dread by encouraging them to find deeper reasons (i.e., involving their emotional brain) to make a commitment.

Accordingly, the Financial Commitment Worksheet is intended to help clients contemplate their commitment style. Letting the client review the worksheet, discussing their results, and giving them the opportunity and guidance to reflect on very personal insights is the main objective.

Through these discussions, advisors can learn what commitment really looks like for a client and better understand the things that excite them (or that don’t).

The goal of the conversation arising from this worksheet is to understand what a client intends to do and how they view commitment. Furthermore, it provides an opportunity for the advisor to reiterate that they are there for the client, that change can be positive, and that it is okay to share that positivity with others.

Understandably, simply giving clients this worksheet to review and fill out can feel awkward or unnatural; it may not even be a strategy the client (and advisor!) would be open to or comfortable with. If this is the case, advisors might instead consider using this worksheet as their own checklist for a conversation that they themselves drive.

For instance, instead of asking the client to review and answer the worksheet questions, advisors can structure a conversation to introduce issues around commitment and discuss the ideas presented in the worksheet statements, which could go something like the following:

Advisor: Another way to deal with the dread we may feel when we think about our financial plan is to consider what excites us about making a commitment.

Client: What do you mean? I mean…I do want to make this change. So, I guess I am excited about it… is that what you mean?

Advisor: Well, not quite. However, you make a really interesting point about commitment. Basically, sometimes we ‘know’ that something might be the right or sensible thing to do, but we don’t get excited about it. For example, if we implemented this plan, would you be excited about sharing your commitment publicly? Do you plan to tell your friends or family about the action you are planning?

[the advisor starts out by addressing worksheet statements A and B, around sharing the action plan with family and friends]

Client: Hmmm… well. Hmm. I don’t really feel that excited about sharing the details about what I’m planning to do, but I might tell people, once things are going well, what I am saving for.

Advisor: Great, so then tell me. When you have been excited about a change or a commitment outside of finances, what did you do to share, if anything, about that commitment?

Client: Yeah, I mean… my wedding. I wanted to shout it from the rooftop, and it felt great to share that dream and those emotions with others.

Advisor: That is a wonderful example! Do you think there is a way to think about your financial goal in that same way?

Client: Yeah, I get it now. I think I would share my financial goals because I can totally see some of my family members being proud of me and want to celebrate with me the changes I’m making.

Advisor: Here’s another idea. Let’s explore that comment you just made about waiting until things are going right before you say anything. What would recommitting to a goal or a change look like for you?

[the advisor encourages further exploration around what the client has said by using statement C from the worksheet, probing into their thoughts around commitment and recommitment]

Client: Hmm…yeah, like…I don’t really want to recommit; I want this to work, and saying that I’m going to ‘recommit’ just feels like a fancy way to say that I’ve failed before and I’m going to try again.

Advisor: I hear you expressing some dread and fear over plan A not going well and thinking that you need to go back to the Preparation stage ‘drawing board’. Is that correct?

Client: Yeah. I don’t want to fail again. This is why I am working with you this time.

Advisor: Thank you for sharing that. It is a big step that we are working on together. That being said, I want to reassure you that while I can’t assure you that our plan will work, I can assure you that I will be there to help you plan from here on out and that we’ll figure out new strategies to try if we need to. Starting down this path, we will be in a new place, we will learn new things, and we can implement them into a recommitment strategy, if necessary.

Client: I do appreciate that; it does help to see any change as a positive change because we can always re-evaluate. And truly, that re-evaluating is the only plan we can be assured of…

Advisor: Re-committing isn’t a bad thing; it is actually good. And although it can be hard to do in the moment – I am not saying that things will never feel disappointing – you will not be alone, and we can learn so much and create new and better opportunities moving forward…

The advisor can steer the conversation further by continuing down the list of worksheet questions, working all (or just some) of the issues into the discussion simply as a way to encourage the client to think about commitment and what might work (or not work) for them.

Because when we make emotional connections to goals and the idea of change, we are often more eager to celebrate and share those commitments. Helping the client recognize unique reasons that really energize them and taking the time to dig deep to identify the most important reasons for targeting financial goals can create strong, lasting commitments.

Ultimately, the Preparation stage is about helping clients confront dread, which commonly emanates in response to failure as frustration and negative self-talk. Simply put, clients dread failure, and by focusing on the dread associated with failure, clients can end up getting stuck in the Preparation stage and have difficulty progressing to the Action stage.

Yet, by creating a safe space to talk through dread, fears, and failures, advisors can begin to help clients address and shift negative mindsets that may have been roadblocks to implementing change.

Furthermore, by activating a conscious, deliberate thought process to examine negative self-talk and feelings around commitment, advisors will help their clients discover why their goals are personally important in ways they may never have thought of before. Which can lead clients through successfully navigating past the Preparation stage and readying them to tackle the next stage of change: the Action stage!

Leave a Reply