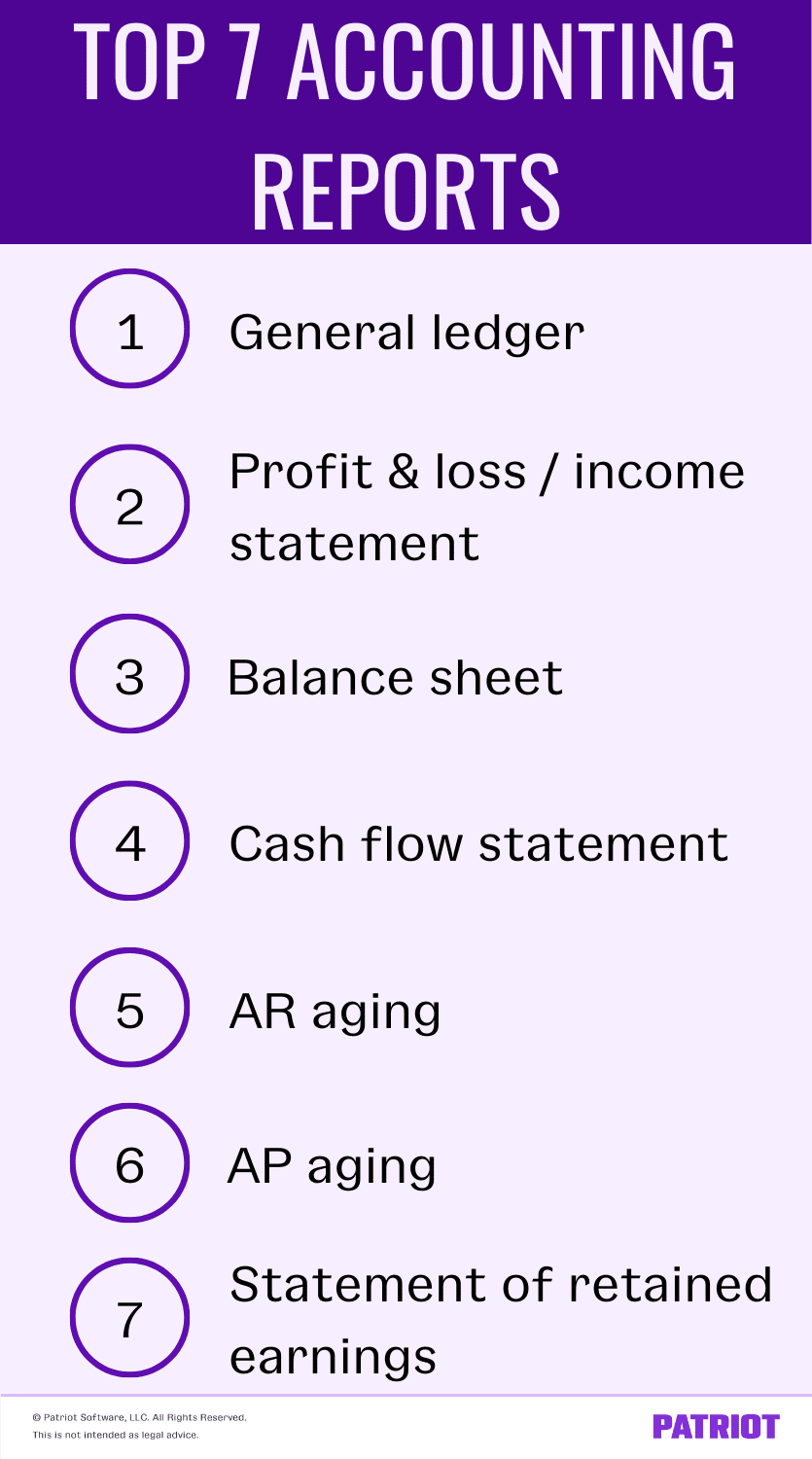

You know that running a business means tracking all of your incoming and outgoing money. So, you write it all down and track every single penny and transaction. But, how do you analyze all of that information? The answer: accounting reports. Let’s dive into the seven accounting reports you should know when running a business.

What are accounting reports?

Do you have all of your financial data gathered and ready to go? Good. That’s the basis of any accounting report you create.

Your accounting reports are financial statements you use to make well-informed business decisions. Reports can include financial information, like revenue, expenses, and cost of goods sold. And, they give you important information about the health of your books and business.

So, which reports should you be keeping on your radar? Check out seven accounting reports you should know like the back of your hand.

1. General ledger

The general ledger is the foundation of your books that sorts and summarizes all transactions. In the general ledger, use debits and credits to show a balance between your accounts. Unbalanced credits and debits impact the financial statements and give inaccurate accounting reports.

Parts of a general ledger

The general ledger consists of every account you need in your books. The most common accounts include:

Your general ledger also includes any subaccounts you may have, such as accounts receivable, accounts payable, product sales, rent or mortgage payments, etc.

What you can use the general ledger for

Use your general ledger report as the basis for your accounting reports and financial statements. The general ledger can also help you:

- Prepare for an audit

- Organize business transactions

- Apply for and receive business loans

- Report real financial data

- Balance your books

2. Profit and loss statement

The profit and loss (P&L) statement, also known as the income statement, shows all revenue and expenses for a period. An income statement is one of the three main types of financial statements.

Why is a statement showing income and expenses so important? Well, the income statement subtracts your expenses from your income to let you know if you have a profit or loss.

Parts of a profit and loss statement

The profit and loss statement is one of the most common accounting reports in your arsenal. And, it can include a lot of different pieces. The main parts of a profit and loss statement include:

What you can use a profit and loss statement for

Your income statements help you quickly identify problem areas so you can resolve any issues before they snowball. You can also use your profit and loss statement to:

- See if you’re turning a profit

- Plan budgets

- Evaluate the success of budgets

- Adjust expenses

- Make important financial decisions (e.g., determine if you should apply for a business loan)

3. Balance sheet

The balance sheet is another one of the three main financial statements. But, it’s very different from an income statement. While your income statement tells you how much you’re spending or earning, the balance sheet lets you and other parties (e.g., lenders) determine the stability of your finances.

Parts of a balance sheet

Your accounting balance sheet has three main components:

Assets are items of value that you own that you can turn into cash (e.g., company vehicles).

Liabilities are what you owe to others, such as businesses, the government, other people, or organizations. For example, unpaid invoices are a liability.

Equity is your value of ownership in the business. Calculate your equity by subtracting your total liabilities from your total assets.

What you can use a balance sheet for

The balance sheet shows a complete picture of your company’s financial well-being at a moment in time using assets, liabilities, and equity. On a balance sheet, your total liabilities and equity must be equal to your assets. If your balance sheet doesn’t balance, you may have made an accounting error.

The balance sheet can also show you:

- If your spending is too much

- The effectiveness of your pricing strategy

- If your marketing strategy is working in your favor

External parties might also request to see your balance sheet to determine if they want to work with you. Lenders may ask for your balance sheet when you apply for a business loan. Investors need financial data to determine if your business is in good standing. And, potential suppliers may ask for your balance sheet to determine if your business is stable enough to supply goods to.

You can use balance sheets from different periods to create a comparative balance sheet. The comparative balance sheet compares your financial position over different periods to determine changes or trends.

You can also break your balance sheet down into a classified balance sheet. With a classified balance sheet, you can see each individual subcategory under the accounts in the balance sheet. And, the subcategories can show you if you are overspending or underspending.

4. Cash flow statement

The cash flow statement, or statement of cash flows, is the third main financial statement. The statement shows the amount of cash coming into or leaving your business during a set period of time.

A cash flow statement can show two things:

- Positive cash flow: You earn more money than you spend

- Negative cash flow: You spend more money than you earn

While the cash flow statement shows the inflow and outflow of cash to your business, it does not give a complete and accurate picture of profitability. Why? Because you do not include any credit in the cash flow statement.

For example, you might show you brought in more cash than you spent (positive cash flow), but you have invoices that total more than the cash you have on hand (negative cash flow). Or, you might have a negative cash flow because customers have unpaid invoices. If you create your cash flow statement before you receive money from customers or pay vendors, your report may not be completely accurate.

Parts of a cash flow statement

A cash flow statement typically has three parts:

- Operations: The money you receive from customers and spend to operate your business. The operations section shows if you are generating enough revenue from sales to cover your expenses

- Investing: The buying or selling of long-term assets, such as stocks or property. You may spend money on an investment (e.g., mortgage) or earn money on the sale (e.g., selling stocks)

- Financing: The inflow or outflow of cash resulting from debts, loans, or dividends. Negative cash flow in this section indicates you are paying off debt

What you can you a cash flow statement for

Use the cash flow statement to determine if your income and expenses are in sync. A negative cash flow shows you may need to increase sales or reduce costs. Positive cash flow indicates that your business is bringing in more than you spend.

Investors may ask to see your cash flow statement to determine if investing in your business is worth the risk. If you earn enough cash to pay off expenses, you may be a good risk. Vendors may also ask to see the report to make sure you have the funds to pay for goods or services.

5. Accounts receivable aging

If you use the accrual method of accounting, you use an accounts receivable (AR) aging report. The AR aging report shows all money owed to your business. Use the report to keep track of and manage all lines of credit you extend to your customers.

The accounts receivable report details how much money customers owe to your business. Do you send invoices to customers after providing a good or service? If so, record the money owed to your business in your AR. All of the receivables on the aging report represent outstanding invoices.

Parts of an AR aging report

Generally, the report is broken up into a few intervals:

- 1 – 30 days (due immediately)

- 31 – 60 days

- 61 – 90 days

- 91+ days

The AR aging report also includes the following categories:

- Customer name

- Total balance for each customer

- Current amount

- Days past due (e.g., 31 – 60 days)

- Totals for each column

What you can use an AR aging report for

Why is the accounts receivable aging report so important? The report shows you how much money your customers owe you and how long it’s been an outstanding balance. Knowing this information allows you to stay on top of collections, forecast cash flow, and estimate bad debt. And, you can see which customers owe you money so you can send payment reminders and contact late payers.

6. Accounts payable aging

The flip side to accounts receivable aging is the accounts payable (AP) aging report. Rather than showing the money owed to you by your customers, the AP aging report details how much your business owes to others. As with accounts receivable aging, only use the accounts payable aging report if you use accrual accounting.

Your AP aging report shows invoices you need to pay. Only record invoices in your payables report when a vendor extends credit to you. Do not enter in payments that you pay immediately to a vendor.

For example, you purchase supplies from a vendor on credit. You agree to pay $500 four weeks from the date of delivery, and the vendor issues you an invoice. Record the invoice information in your books as soon as you receive the invoice.

Parts of an AP aging report

Like an AR aging report, you can break the AP aging report into intervals:

- Current (0 – 30 days old)

- 1 – 30 days past due

- 31 – 60 days past due

- 61 – 90 days past due

- Over 90 days past due

Your AP aging report includes:

- Vendor names

- How much you owe to each vendor

- Amount of time you have owed debts

- Whether any payments are past due

What you can use an AP aging report for

You can use the information in your AP aging report to:

- Manage cash flow

- Make decisions about which debt to pay first

- Plan future expenses

- Build your business budget

- Avoid missing payments

7. Statement of retained earnings

The statement of retained earnings lists your business’s retained earnings at the end of a reporting period. So, what are retained earnings? Retained earnings are business profits you can use for investing or paying liabilities. The statement of retained earnings is also commonly known as the statement of owner’s equity, equity statement, or statement of shareholders’ equity.

Parts of a statement of retained earnings

There are three pieces of information you need to know for the statement of retained earnings:

- Beginning retained earnings

- Net income

- Dividends paid

Use the following formula to calculate and set up your statement of earnings:

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends Paid

Use your balance sheet or the previous statement of retained earnings to locate your beginning retained earnings for the period. Gather your net income information from your income statement. Use either your income statement or your general ledger to determine the dividends paid.

What you can use the statement of retained earnings for

You can use your statement of retained earnings to track your retained earnings and seek outside financing. Create a statement of retained earnings every accounting period to determine if your business increased or decreased retained earnings between periods.

Positive retained earnings show you have the funds to invest in your business (e.g., purchase new equipment) or pay off debt. Negative retained earnings show a deficit.

Are your accounting reports taking too much time out of your day? Patriot’s accounting software makes it easy to enter your information, run reports, and get back to your day. If you’re digging through spreadsheets and filing cabinets, then our online accounting software is for you. Try it free for 30 days!

This is not intended as legal advice; for more information, please click here.

Leave a Reply