If you are reading this, chances are you have received SMS from DOPBNK and wondering who has sent this? What does this mean? Which bank has sent it? What should you do and if you should be worried?

DOPBNK Fullform

The Full form of DOPBank is “Department of Post Bank”. This essentially means Indian Post Payments Bank (IPBB) which was established in 2017 by Department of Postal Services. Indirectly this means the IPBB is owned by Government of India.

What is DOPBNK? Which bank sends the SMS?

As you can see the entity DOPBNK is a genuine one and essentially represents Indian Post Payments Bank (IPBB) owned by Department of Postal Services, Government of India. The question is if this is a genuine entity then why the fuss is about?

SMS from DOPBNK – Is there some fraud or scam?

The short answer is No.

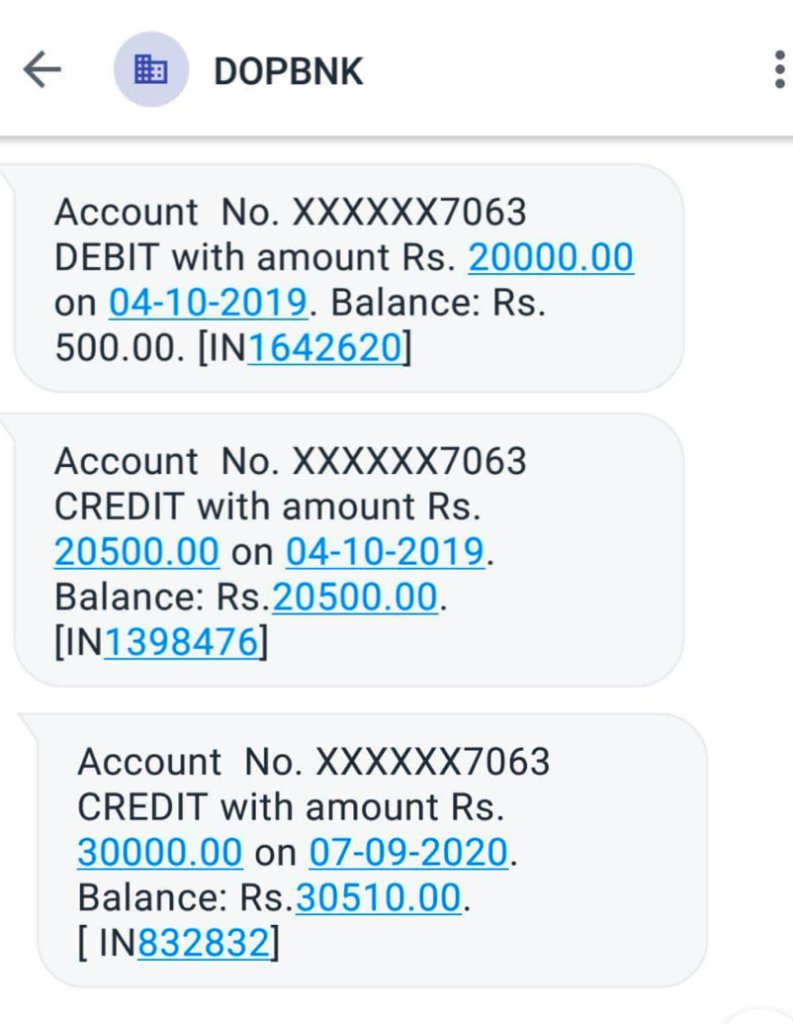

You may receive the SMS from following IDs ID-DOPBNK, VD-DOPBNK, IM-DOPBNK, VK-DOPBNK, TD-DOPBNK, etc. In most cases there is no problem and people receive genuine message about their transaction with the Postal bank. However there has been cases where people have received messages like in the picture below even when they had no account with the bank.

- Account No. XXXXXX0098 CREDIT with amount Rs. 3000.00 on 16-05-2021. Balance: Rs. 45000.00. [IN370978]

- Account No. XXXXXX0098 DEBIT with amount Rs. 3000.00 on 16-05-2021. Balance: Rs. 45000.00. [S370978]

If you do not have an account with the Postal bank, you should just ignore this. You may have received these messages due to wrong phone number linked to this number at the bank’s end. This is not going to harm you but is a problem for person whose account is wrongly linked. That person as and when realises that should go ahead and update his mobile number details in the Indian Post Payments Bank.

In case you have account with the bank, then these SMS from DOPBNK is just letting you know about your transactions and various alerts. If you are not happy with these alerts you can change this from account settings.

Do you Know about Hidden Charges in Banks?

Do you know you pay a few thousand rupees every year to hidden charges of banks. This could range from more known fines for not maintaining minimum balance amount to lesser know POSDEC charge of ICICI Bank. There could be charges for ATM usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and what you can do about it?

Indian Post Payments Bank (IPPB)

As mentioned Indian Post Payments Bank is owned by Postal department. It was setup in 2017 as a payments bank with the slogan of “Aapka Bank, Aapke Dwar”. It provides following services:

- Saving bank account

- Current bank account

- Domestic Money Transfer

- Bill Payments & Recharge

- Remittances & Fund Transfer

- Direct benefit Payments

IPPB Savings Bank Account: It’s relatively easy to open the savings bank account. You can have a maximum balance of Rs 2 lakhs at the end of the day. However, the interest rate offered is just 2.75%. You get RuPay based IPPB RuPay Virtual Debit Card which can be generated using the mobile banking App.

To conclude, the SMS from ID-DOPBNK, VD-DOPBNK, IM-DOPBNK, VK-DOPBNK, TD-DOPBNK, etc is genuine in most cases. In case you don’t have an account with Postal payment bank and have received the SMS, ignore it. This has happened mainly due to wrong mobile number updated in account.

Leave a Reply