IIFL Home Loan, the Housing Finance company from IIFL Group has come out with IIFL Home Loan NCD (Tranche 1) offering 10% and opens for subscription from July 6, 2021. It is technology driven HFC with focus on low & middle income group in suburbs of Tier 1, Tier 2 and Tier 3 cities.

IIFL Home Loan NCD – Significant Points:

- Offer Period: July 6 to 28, 2021

- Annual Interest Rates for Retail Investors: 10%

- Price of each bond: Rs 1,000

- Minimum Investment: 10 Bonds (Rs 10,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Credit Rating: CRISIL AA/ Outlook STABLE and Brickwork AA+/ Outlook Negative

- NCD Size: Base issue size of ₹100 crore, with an option to retain oversubscription up to ₹900 crore aggregating up to ₹1,000 crores

- Date of Allocation: August 4, 2021

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE & NSE and will entail capital gains tax on exit through secondary market

Learn All about NCDs

NCDs or non-convertible debentures or more popularly known as Bonds are a bit complex investment products. You must understand the product, risk involved, the taxation on interest received and when you sale it. We have done a separate post regarding this titled – Know all about NCDs.

Also you can keep track of upcoming NCD issues here.

IIFL Home Loan NCD – Investment Options:

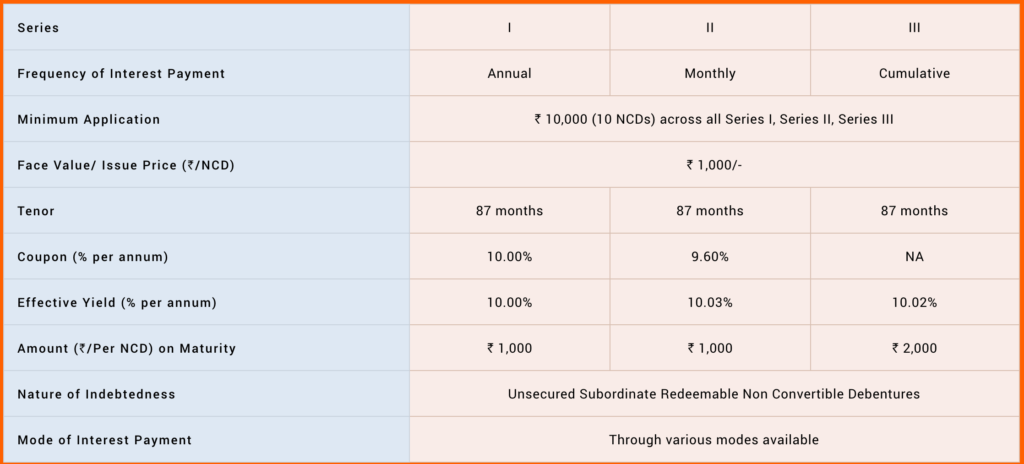

There are 3 options of investment in IIFL Home Loan NCD.

IIFL Home Loan NCD – Who can Apply?

This issue is open to all Indian residents, HUFs and Institutions.

- Category I – Institutional Investors – 10% of the issue is reserved

- Category II – Non-Institutional Investors, Corporates – 10% of the issue is reserved

- Category III – HNIs – 40% of the issue is reserved

- Category IV – Retail Individual Investors – 40% of the issue is reserved

However NRIs cannot apply for this NCD.

IIFL Home Loan NCD Review

Why you should invest in IIFL Home Loan NCD?

- AA Credit rating means low likely hood of credit default

- The interest rates are 4% – 5% higher than your regular Bank FDs

- No TDS as it would be only issued in Demat Form

- Increase profits and loan portfolio year over year

Why you should not invest in IIFL Home Loan NCD?

- There have been issues with some well rated companies like DHFL, IL&FS where rating agencies suddenly downgrade the rating. This risk always existed but it has come to forefront in last few months

- The NCD is “subordinated unsecured debt“. This means that this is not backed by any asset of the company & hence the higher interest rate to cover for higher risk. In case company goes to liquidation, there are going to be others in the queue that will have to be paid off in full before you get anything.

- NPAs have increase in last 2 years, which may be a concern especially after COVID.

How to Apply for IIFL Home Loan NCD?

You can apply online by ASBA facility provided by banks. It’s the easiest way to apply and also avoids a lot of hassle in terms of KYC and paper work.

How to apply for NCD through ASBA?

If you want to apply to NCDs, ASBA is the best way to do so. It’s easy, secure and the money leaves the account only when the bonds are allocated. We have covered step by step process for ASBA in SBI in the post. You have ASBA facility in most big banks.

In case you don’t want to do it online, you can download the application form from company site or Financial Institutions and submit to collection centers.

Recommendation:

- My recommendation is to keep away or invest small part of your Fixed Income investment in IIFL Home Loan NCD Issue (only if you understand the risk)

- You should always have diversified portfolio be it fixed deposit, NCD or equity investment

- Its good idea to remain invested till maturity because liquidity on exchanges are low and hence you would get lower than market value

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

IIFL Home Loan NCD FAQs

✅ How to apply for IIFL Home Loan NCD?

You can apply online by ASBA facility provided by most banks. It’s the easiest way to apply and also avoids a lot of hassle in terms of KYC and paper work. In case you don’t want to do it online, you can download the application form from company site or Financial Institutions and submit to collection centers.

✅ Is IIFL Home Loan NCD Secure?

✅ What is tax on IIFL Home Loan NCD?

For Tax Purpose NCDs are treated similar to Fixed Deposits. The interest earned is added to your income as “income from other sources” and taxed accordingly.

In case the NCD is sold before maturity on stock exchanges, it would lead to Capital Gains and taxed according to the holding period.

-If the NCD was sold within 12 months of allotment, it leads to Short Term Capital Gains and

-if the selling period is more than 12 months its Long Term Capital Gains

-Short Term Capital Gains would be added to income and taxed accordingly

-Long term capital Gains would be taxed at the flat rate of 10% (u/s 112 of IT Act)

✅ Is IIFL Home Loan NCD safe to invest?

The credit rating for IIFL Home Loan NCD is AA+. This is investment grade and less likely to default on principal or interest payment. Do remember that these ratings are as of today and these may change depending on company’s performance and external situations. So investors need to track the company closely.

Leave a Reply