If you run a small business, cash-based accounting is one of the easiest ways to manage finances — especially if you don’t have extensive experience with accounting. It basically works like this: you record revenue when cash comes in, and expenses when cash goes out.

Cash-based accounting software, then, is any solution built around this accounting approach.

Cash-based systems are typically easier to manage, less expensive, and a great choice for small businesses. They focus on the question: Where are our finances right now? As opposed to accrual-based or hybrid systems, which use accounts payable and receivable to record items before they clear.

Once you choose an accounting method, you’re pretty much stuck with it (unless you submit a written request to the IRS via Form 3115), so it’s important to also choose a software solution that accommodates your method.

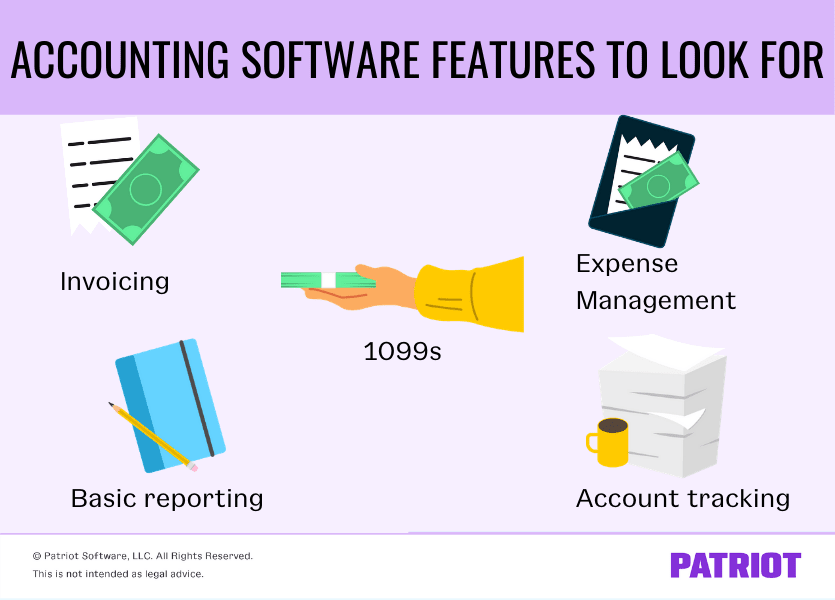

Most cash-based accounting software will provide some or all of the following features:

- Invoicing: Create customer invoices and export to PDF or other file formats; specify line items, prices, and sales tax rate; receive payments.

- Expense management: Pay vendors for products/services and track payment history.

- 1099s: Create and print 1099/1096 forms; process 1099-MISC payments (for independent contractors, rents, royalties, or attorneys).

- Basic reporting: Paid and unpaid invoices, payment history, tax document summaries, etc.

- Account tracking: Sync your software with bank accounts to record deposits, withdrawals, and track your balances.

During your accounting software comparison, use these features (and any others you may need) to screen products for your shortlist. After you’ve built a shortlist, run a few demos/free trials and compare pricing. Which solution offers the best value for its subscription price? Most importantly, which is the best fit for your accounting method?

Why it’s good for small businesses

Why use accounting software? Some small businesses tend to prefer cash-based accounting software because of its inherent simplicity.

If you’re looking for an easy way to track money as it flows in and out of your accounts, look no further. A cash-based system is like a sophisticated checkbook: you record payments and expenses, keep an eye on your balances, and let your accountant do the rest (tax reporting, financial projections, balance sheets, etc.). You don’t need some expensive, unwieldy piece of software designed for a multi-national corporation.

And don’t worry, you aren’t alone in loathing the tedious work of financial management: 46 percent of small business owners say bookkeeping is their least favorite task.

How is it different than accrual-based software?

Before you commit, it’s important to understand how cash-based systems differ from accrual-based and hybrid alternatives. Accrual-based accounting records income and expenses when they are earned or incurred, instead of waiting for cash to enter or leave the account. Thus, your “accounts payable” tell you how much to expect in upcoming expenses, and your “accounts receivable” how much to expect in revenue. Throw payroll, inventory, and reporting into the mix, and things can start to get confusing.

But the complexities of accrual-based accounting don’t necessarily mean cash-based accounting is the right choice for every small business. Each method has its pros and cons.

Cash accounting, for example, is said to be less reliable for calculating and projecting profits since it doesn’t record earned revenue until it’s actually paid in cash. The IRS also has some stipulations that prevent certain types of businesses from using cash accounting — such as C corporations, tax shelters, or businesses that keep an inventory of merchandise.

Cash Basis Accounting

| Pros | Cons |

|---|---|

| Easy to set up. | IRS requires form if you change accounting method. |

| Easy to track cash flow. | Harder to know your “bottom line.” |

| Income is taxable after it’s received. | Per IRS, certain businesses cannot use cash basis. |

Hybrid accounting software, as you might’ve guessed, combines aspects of both cash and accrual accounting in a single system. This is a less common route, but may be a valid option depending on the way you manage income, expenses, and inventory.

Closing thoughts

If you’re still confused about cash-based accounting software, just remember this: it’s a tool for managing money as it flows in and out of your business — no more, no less.

As a small business owner or sole proprietor, you don’t have a lot of money or time at your disposal, so you need to pick an affordable solution that’s easy to implement. Above all, your accounting software should match your preferred accounting method. Accounting software could be the answer to your cash-based accounting needs.

This article is a guest blog contributed by TechnologyAdvice.

This article has been updated from its original publication date of December 22, 2015.

This is not intended as legal advice; for more information, please click here.

Leave a Reply