The workplace, self-directed and retail wealth management giant that Morgan Stanley amassed through acquisitions in the past two years is humming to the tune of record revenue.

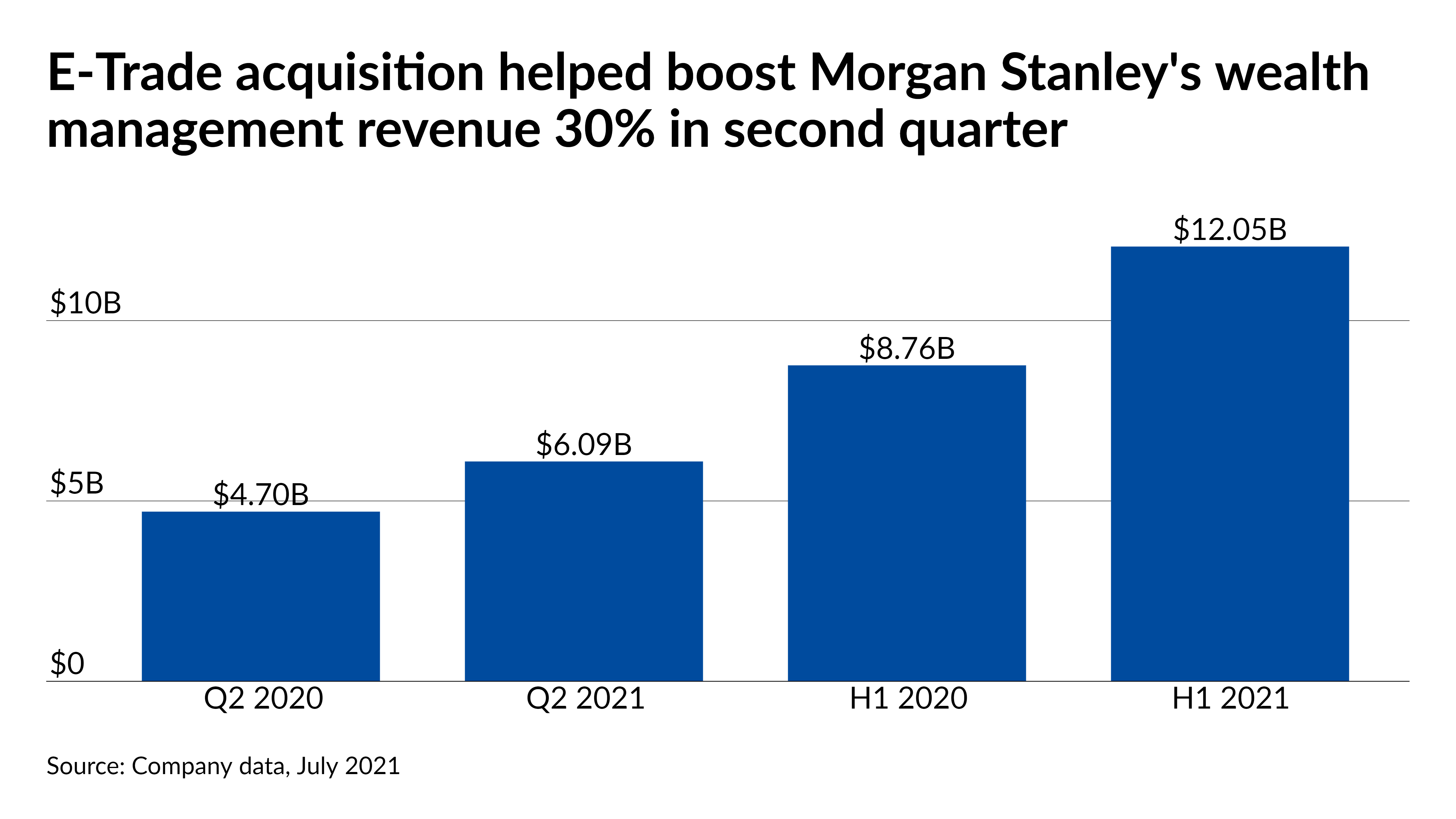

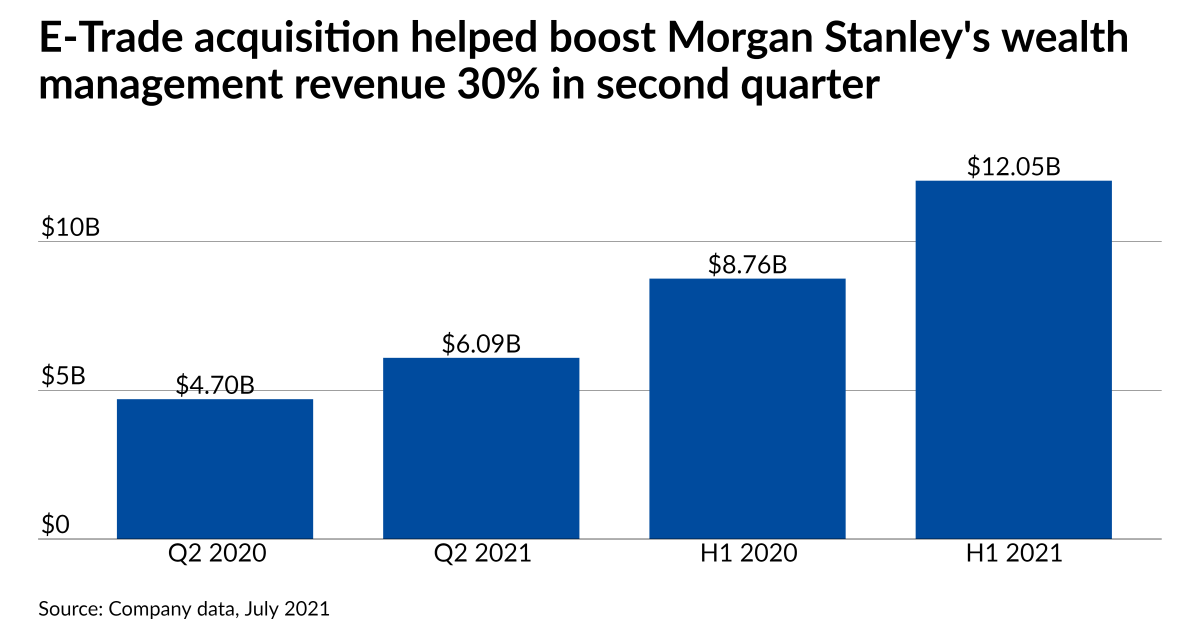

After supplementing its existing wealth management unit with the purchases of employee stock and retirement plan firm Solium in 2019 and self-directed investing service E-Trade last year, the wirehouse generated $6.10 billion in quarterly revenue, according to Morgan Stanley’s July 15 second-quarter earnings statement.

The significant uptick in business and net new assets prompted CEO James Gorman to claim in an earnings call with analysts that the three-pronged wealth unit is “creating — not to be arrogant about it — a new mouse trap.”

- For the first half of the year, Morgan Stanley’s wealth revenue has surged from the first six months of 2020 by 38% to $12.05 billion. Net income is up by even more, 46%, at $2.51 billion. Citing a pretax margin for the quarter of 26.8%, or 27.8% without expenses relating to acquisition integrations, the company says the results stem from higher asset management fees, record bank lending of $114.7 billion and strong net new assets.

- Incoming flows reached $71.2 billion, including $33.7 billion into fee-based advisory accounts, by the end of the second quarter. The unit has $4.55 trillion in client assets, which Gorman noted was only about $500 billion 12 or 14 years earlier. While the company stopped disclosing its count of financial advisors at the beginning of the year, he said Morgan Stanley’s attrition and hiring numbers are “fantastic” for the firm.

- “We’re creating an advisor channel, which actually has deep organic growth flavors in it,” Gorman told analysts, according to a transcript by Seeking Alpha. “We’re getting tremendous asset growth. And then you combine that with having the direct platform, and then combine that with having the workplace platform. You’ve got three legitimate channels pouring assets into the house. And it wasn’t so long ago that if we did 10 billion a quarter, we thought, ‘We’re pretty good.’”

- The organic growth and acquisitions do carry a cost for the firm: Compensation and benefits expenses rose 20% in the second quarter to $3.28 billion and non-compensation charges including $46 million relating to integration costs grew by 46% to $1.18 billion. Incremental expenses relating to E-Trade drove the substantial increase in non-compensation expenses, according to the company, which also agreed to spin off the E-Trade custodian unit, E-Trade Advisor Services, for $55 million in April. The small custodian has more than $23 billion in assets from 200 RIAs, and the deal with Axos Clearing, a subsidiary of online bank Axos Financial, is expected to close this quarter.

- After the Solium deal in 2019, Morgan Stanley launched an equity compensation service called Shareworks. While Gorman noted that Solium was an expensive purchase at around a half a billion dollars, he said he believed it will pay off over time by enabling the firm to convert workplace clients into working with E-Trade or Morgan Stanley. “Every now and then in business, you look and you sort of see a wave coming, and you catch the wave, and it’s a beautiful thing,” Gorman said. “The whole workplace space, to me, is the next major growth area in financial services.”

Leave a Reply