2022 was certainly a landmark year for Reckon. Our full-year results cap off a particularly strong 12-month period where Reckon cemented its position as a leading, innovative technology company that has the capability to deliver outstanding returns for shareholders, fund its growth through ongoing R&D spend and strengthen its balance sheet with a material reduction in net debt.

The sale of Accountants Group was of course a key achievement for Reckon and our efforts are now firmly focused on aggressively scaling up the operations of the Business Group, which delivers Accounting and Payroll software to SME’s and the Legal Group, which provides practice management solutions to legal firms, both of which traded well in 2022 and have excellent future prospects.

With more than 400,000 Australian workers now paid through Reckon software and a major market opportunity for its practice management software in the US legal sector, the Company has laid its foundation for long-term growth with a subscription-based revenue model.

Let’s unpack some of the highlights for the full 2022 year at Reckon…

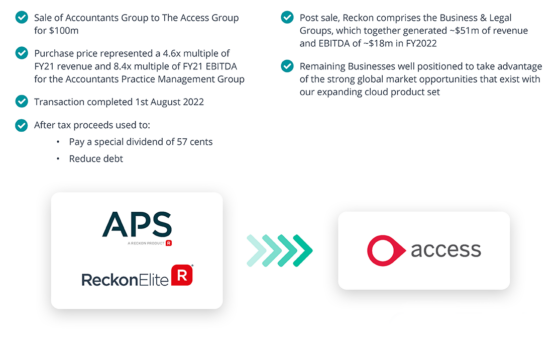

The $100 million sale of APS

One of the key highlights of the year, and a major shake up here at Reckon, was to successfully and profitably sell our Accountants Group, including the APS products suite, to Access Group in a deal worth $100 million.

This sale was designed to not only inject operating capital into the business, but to allow us to focus and invest more singularly in our high growth cloud accounting and payroll products as well pursue international legal product opportunities.

The sale also generated a special dividend for our investors.

Our focus has sharpened on two major markets

While Reckon was already tightly honed in on the small business market as well as the international legal practice management market (particularly in the US), we now find ourselves in a position to solely invest our resources in these spaces.

With cloud accounting, payroll, and legal practice management products and markets squarely in our remit, we envision high growth in these areas and increasingly sophisticated product suites.

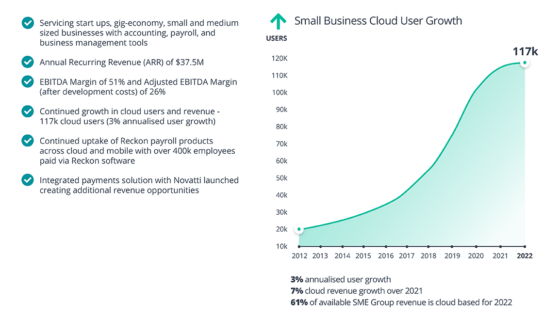

Strong growth in cloud software uptake

To add resonance to our refreshed focus on the cloud space and small business users, we’ve seen very strong growth in cloud software uptake.

In fact, we now have 117,000 cloud users of Reckon software across the group’s global customer base and more than 400,000 employees paid through our payroll solutions. With the global trend toward subscription-based cloud software offerings looking very positive, we’re confident of continual future growth in this area.

We achieved an 81% reduction in net debt

In no small part due to the sale of the Accountant’s Group, we saw a rapid reduction of net debt in 2022. We managed to reduce our previous year’s net debt of $14.7m down to our current level of $2.8m.

This reduction will grant us a strong position from which we can further invest in future growth, focus more on R&D, and contribute further resources to our key small business and legal markets.

We generated $51.2 million in revenue

In a sign of financial health and stability, with a solid trajectory, Reckon can report $51.2 million in revenue for 2022.

Summary

All in all, we feel confident that Reckon has delivered a very strong set of results for 2022. We successfully sold our Accountant’s Group for $100 million and delivered a special dividend for our investors.

We’ve now leveraged that opportunity and capital to focus our full attention and resources on our small business products and our international legal solution offerings.

Combining this honed purpose with a massive reduction in net debt and $51.2 million in revenue, we find ourselves in a very strong position to foster future growth and continue to serve the small business and international legal communities

Leave a Reply