Over the last 12 months, we’ve surveyed over 4,500 small business owners across the globe to find out how they’re managing cash flow amidst macroeconomic conditions such as high inflation and interest rates. The survey findings became a series of Money Matters reports that were released in Australia, Canada, New Zealand, Singapore, the United Kingdom and the United States.

Here are five interesting (and somewhat concerning) trends in these reports that compare and contrast the results across the six countries.

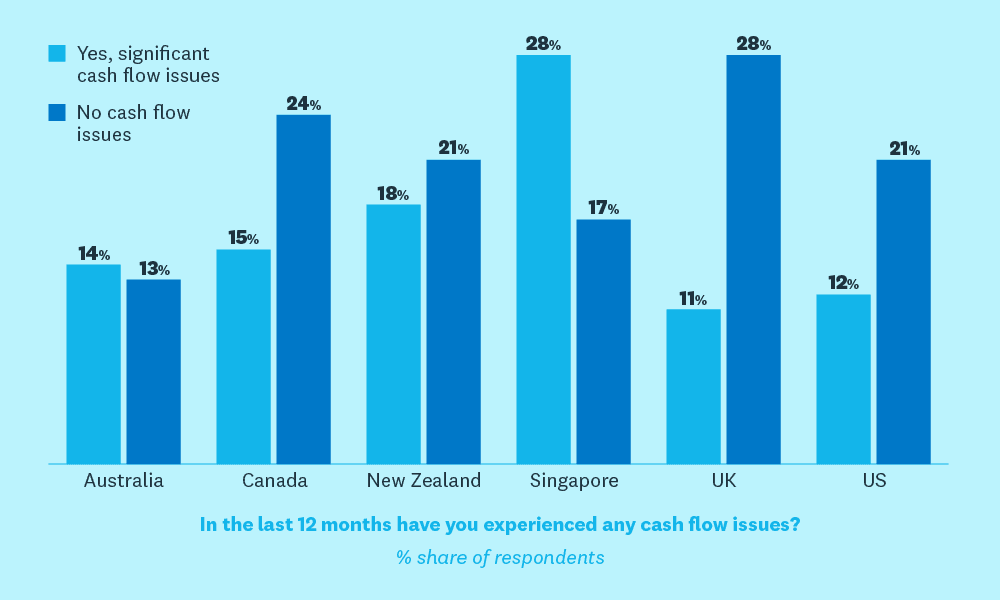

Most small businesses experienced cash flow issues in the past 12 months

In all the countries surveyed, most small businesses reported at least some cash flow issues in the past year – ranging from 72% of small businesses in the UK, to 87% in Australia. Singapore (28%) reported the highest share of respondents with significant cash flow issues and the UK (11%) had the smallest share reporting significant cash flow issues. In addition, Australia (13%) had the lowest share of small businesses that said they had not experienced cash flow issues over the year and the UK (28%) had the highest share.

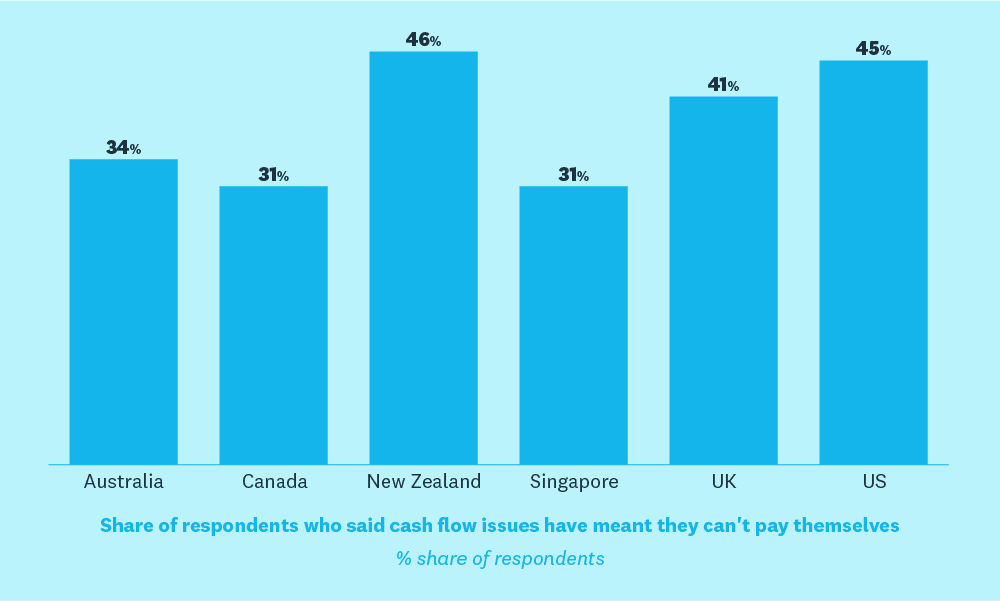

Across all countries, at least a third of small business owners have not paid themselves because of cash flow issues

Poor cash flow has impacted respondents in a variety of ways in the past year. One of the most alarming was the high proportion of respondents that said they had not been able to pay themselves. Indeed, this was the top impact in New Zealand (46%), US (45%), UK (41%) and Canada (31%). Not being able to be paid will clearly have a flow-on impact on the personal finances of small business owners.

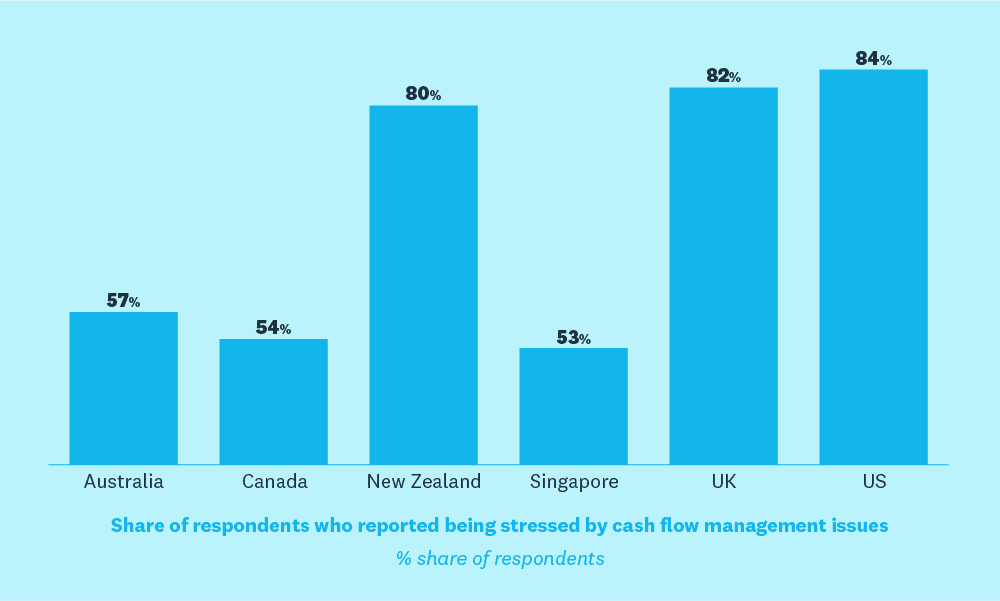

Cash flow management causes elevated stress levels but at two different levels

This survey also explored the non-financial impacts of cash flow issues on those who reported at least some cash flow impacts. Stress was the top non-financial impact reported in each country but there were two distinct groups of results. The most stressed countries were the United States (84%), the United Kingdom (82%) and New Zealand (80%). The other group of three countries also had similar results, but at a lower level – Australia (57%), Canada (54%) and Singapore (53%).

“Having less cash flow indicates that the business is struggling which may result in me becoming unemployed. I’ve spent nights worrying and stressing how I can provide for my child and keep on top of personal finances as well as my business.” Anonymous survey respondent

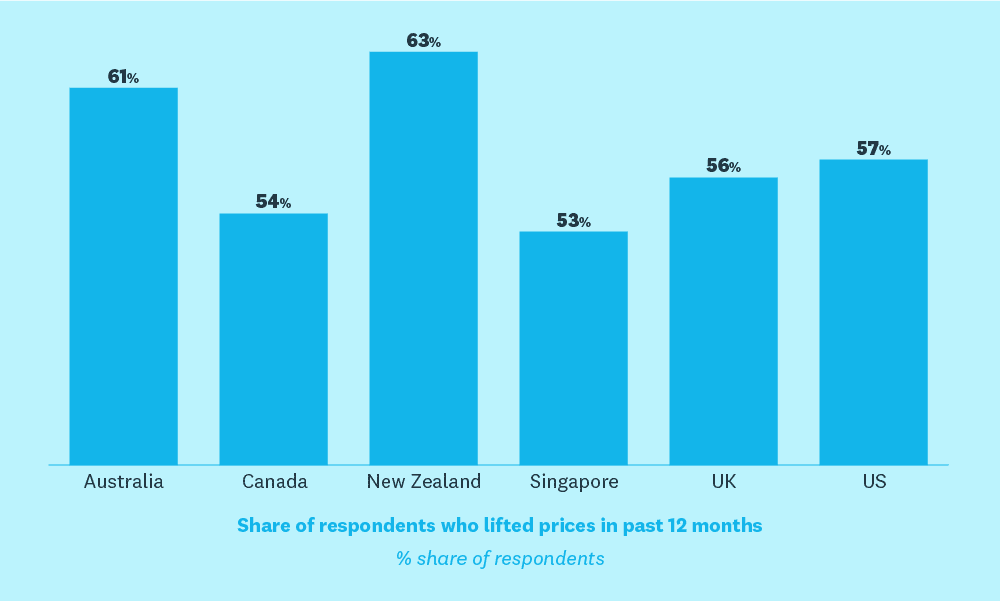

Small businesses have lifted prices a median of 6-8% in the past year

One way to improve cash flow is to lift prices and, in each country, more than half the respondents said they had done this in the past year. The largest proportion was in New Zealand (63%) and the smallest was in Singapore (53%).

The survey also asked by how much prices had been raised, with the median result (for those who lifted prices) being 6-8% in all the countries.

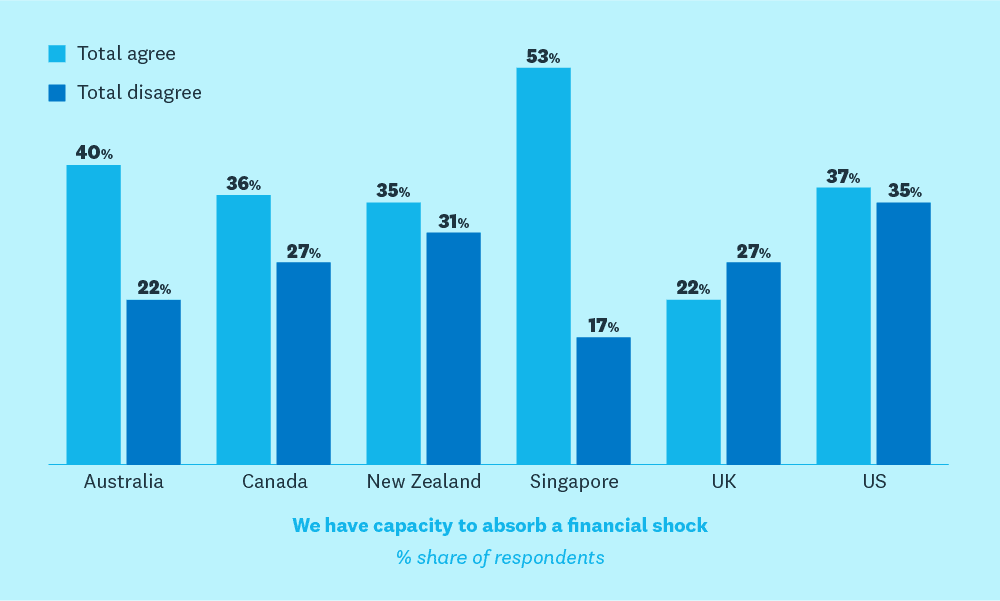

Small business in UK least likely to have capacity to absorb a financial shock

However, the results became interesting when we asked respondents if they thought they would be able to handle a financial shock.

In the UK only 22% of respondents said they had capacity to absorb a financial shock, the lowest response out of all countries surveyed. However, the UK was also the only country where more respondents disagreed with the statement (27%) than agreed, i.e. more people thought they couldn’t manage if there was a financial shock than could.

At the other end of the scale, over half (53%) of respondents running small businesses in Singapore agreed that they had capacity to absorb a financial shock. This was well above the next nearest country, Australia (40%).

This result seems counterintuitive to the earlier question, where Singapore small businesses reported the highest share of significant cash flow issues and the UK the lowest.

These are just five trends that we’ve identified but you can take a deep dive into all the individual Money Matters reports yourself and look for more similarities and differences in the experiences of small business.

In addition, our reports look at different tools to help you manage your cash flow, from talking to your accountant and bookkeeper about pricing strategies, to products that Xero offers to support small businesses globally. These include online invoice payments, eInvoicing, Xero Analytics Plus and now bill payments in the UK.

The post Five cash flow trends impacting small businesses appeared first on Xero Blog.

Leave a Reply